Summary

- In China, we await confirmation of real, positive fundamental change before increasing our confidence towards the country, and we maintain a highly selective approach. Elsewhere, a combination of artificial intelligence (AI)-induced excitement and positive structural reforms has driven Asian markets higher, particularly in Taiwan, South Korea and India.

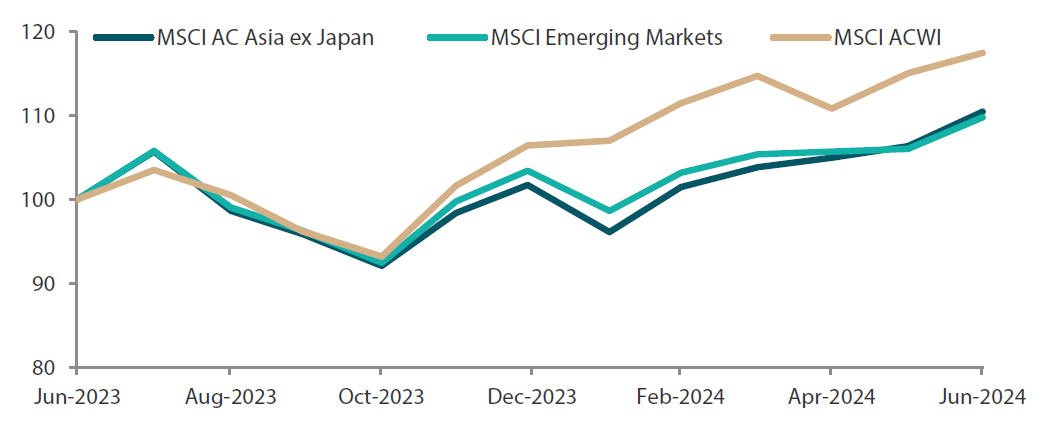

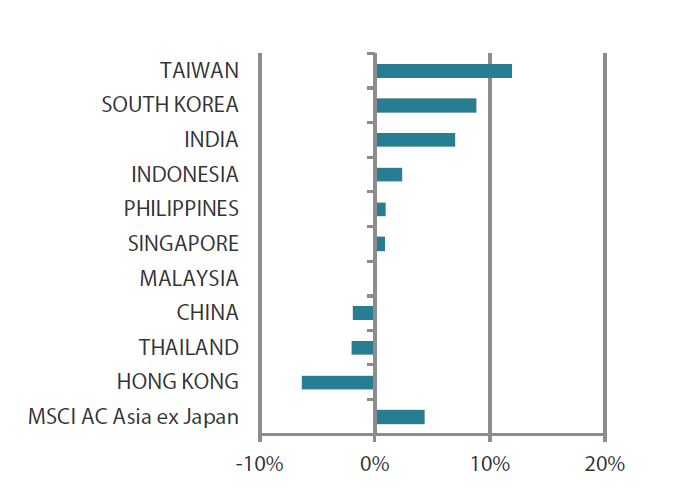

- In June, the MSCI AC Asia ex Japan Index advanced 4.3% in US dollar (USD) terms. Taiwan (+11.9%) and South Korea (+8.8%) led the region, while Hong Kong (-6.4%) and Thailand (-2.0%) were the laggards. Investors continued to monitor the June Federal Open Market Committee (FOMC) meeting and US inflation data. Price increases were held in check, and the US Federal Reserve (Fed) kept rates on hold, pencilling in one interest-rate cut for this year.

- Change remains the sole constant in Asian markets. Despite accelerated easing in China, concerns persist in the property market, which remains the focal point for confidence, consumption and broader markets. While slower growth expectations for China are now universally accepted, the path forward remains uncertain. In India, we continue to find significant positive fundamental change and sustainable returns on offer, and the challenge is finding those at the right price.

Market review

Another positive month for Asian markets

The June FOMC meeting and US inflation reading were once again front and centre in the minds of investors. Price increases were held in check, with headline inflation for May coming in at 3.3% year-over-year (YoY). The Fed kept rates on hold and pencilled in one interest-rate cut for this year. Enthusiasm over AI technology also continued to boost markets, led by Nvidia’s relentless rally. Asian markets were largely higher, except for losses in Hong Kong, Thailand and China. The MSCI Asia Ex Japan Index ended the month 4.3% higher in USD terms.

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Source: Bloomberg, 30 June 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

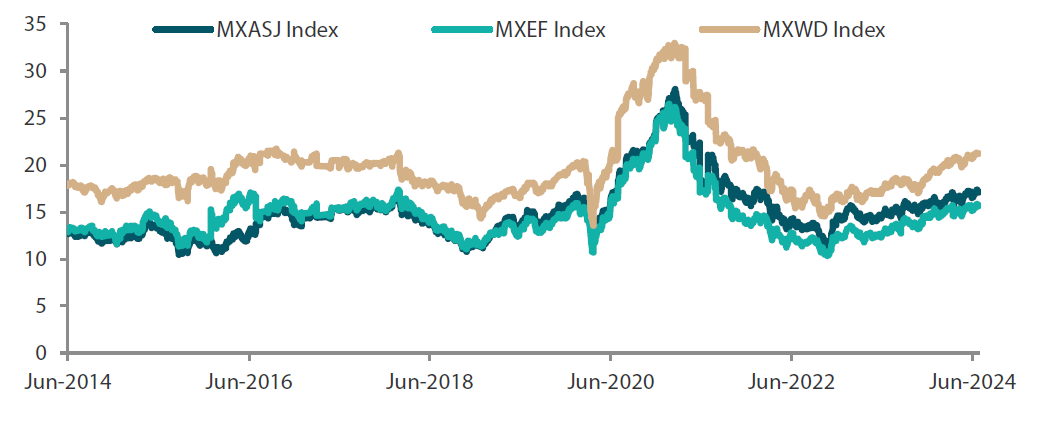

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 30 June 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

Tech powerhouses lead the charge; Chinese stocks buck the uptrend

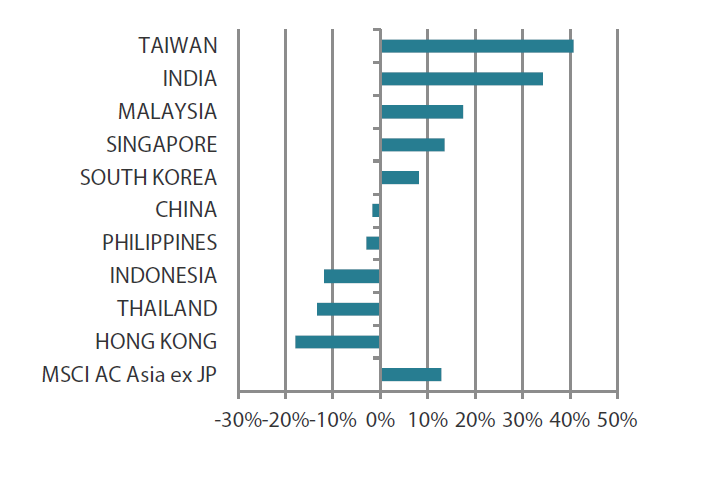

Tech powerhouses Taiwan (+11.9%) and South Korea (+8.8%) led gains in Asia during the month. Pushed by global demand for AI and high-performance computing devices, Taiwan’s industrial activity recovery continued to gain momentum. Industrial production growth jumped to 16.1% YoY in May, and Taiwan’s exports rose by 3.5%. To safeguard its position in the global semiconductor market, South Korea will begin awarding aid to chipmakers from July, kicking off a USD 19 billion package of financial support for its chip industry, with measures including preferential loans and investment capital. South Korea has also decided to extend a market-wide ban on short selling of stocks in the domestic market through the first quarter of 2025. Furthermore, policymakers have discussed tax reforms, which would be a big positive for boosting corporate value and shareholder returns.

In China (-1.9%), economic data for May was mixed. Retail sales grew at a faster-than-expected pace of 3.7%YoY, while industrial output increased 5.6% YoY, missing forecasts. Exports held up, expanding by 7.6% YoY. China's consumer inflation held steady in May, rising 0.3% YoY. Persistent trade tensions kept sentiment in check, with the European Union (EU) investigating Chinese subsidies for electric vehicles (EVs). The EU has threatened to impose extra tariffs, potentially as high as 38%, on EV imports from China. Though frictions remain, China and the EU have agreed to hold further talks on these tariffs. Separately, traders are seeking clues on major policy shifts that may be unveiled at China’s Third Plenary Session being held mid-July. Sentiment also remained subdued in Hong Kong (-6.4%) amid concerns about growth prospects.

ASEAN markets underperform the broader region

In ASEAN, monetary authorities in Thailand (-2.0%), Indonesia (+2.3%) and the Philippines (+0.9%) left interest rates unchanged in June. Bank Indonesia kept its interest rate unchanged at 6.25%; the Bank of Thailand maintained its policy rate at 2.5% despite public calls by the government to reduce borrowing costs; and the Bangko Sentral ng Pilipinas held its benchmark interest rate steady at 6.5% to support the Philippine peso. Singapore’s (+0.8%) manufacturing sector continued to recover, with manufacturing output back in positive territory, rising 2.9% YoY in May.

Indian equities gain despite BJP losing its majority

Indian stocks surged 7.0% in June. Narendra Modi was sworn in as India’s prime minister for a third straight term, extending his leadership for another five years despite an electoral setback that saw the Modi-led Bharatiya Janata Party (BJP) fail to gain the simple majority on its own. Investor sentiment was dented after the surprise election result. However, investors bought into the sell-off and Indian stocks bounced back. Meanwhile, India’s retail inflation slowed to a 12-month low of 4.75% YoY in May, and the Reserve Bank of India (RBI) maintained its policy interest rates at 6.5% and its "withdrawal of accommodation" stance.

Chart 3: MSCI AC Asia ex Japan Index1

For the month ending 30 June 2024

| For the year ending 30 June 2024

|

Source: Bloomberg, 30 June 2024.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market view

Await confirmation of real, positive fundamental change before committing further capital in China

Change remains the sole constant in Asian markets. Despite accelerated easing in China, concerns persist in the property market, which remains the focal point for confidence, consumption and broader markets. While the acceptance of slower growth is now universal, the path forward still remains uncertain. The Third Plenum in July is likely to serve as the next major milestone for clues regarding future policy direction in China. Market expectations friendly measures are relatively low, and valuations in local equity markets remain exceptionally cheap. We await confirmation of real, positive fundamental change before we further increase our confidence towards the country, and we maintain a highly selective approach.

Still positive on the overall India story

In India, the shock loss of majority in the election for Prime Minister Modi and the BJP is, in our view, both a victory for democracy and an opportunity for more balanced growth. We say a victory for democracy because there was a growing risk that Modi’s third term would become increasingly nationalistic with an ever-increasing majority. This has now been checked. Votes were lost on key welfare issues of employment, income, inflation and health; if anything, this likely leads to reduced emphasis on the corporate sector and increased focus on basic needs and consumption. This does not de-rail the India story, which is built on long lasting reforms, productivity gains and its geopolitical positioning. As always, we find a lot of positive fundamental change and sustainable returns on offer in India, and the challenge is finding those at the right price. We have recently been enhancing our favourable view of consumption and financials at the expense of healthcare.

Taiwan and South Korea buoyed by strategic positioning in supplying AI’s infrastructure build-out

Elsewhere, due to their strategic positioning in supplying AI’s infrastructure build-out, stocks from Taiwan and South Korea have emerged as some of the biggest gainers in Asia. While we observe this trend extending to downstream technology products and user applications, we cannot help but draw parallels with the internet era in terms of the market’s eagerness to extrapolate future infrastructure capacity expansion. We remain vigilant for any signs of overextension and have shifted our focus toward downstream consumer technology and software. Additionally, we are making a deeper assessment of how AI is likely to transform labour-intensive business models. In South Korea, we will be watching July’s parliamentary sessions; any momentum in tax reform—a key deliverable if the country’s shareholder-friendly “value-up” program—is expected to have significant impact.

For the first time in years, we are focused on individual Malaysian stocks within ASEAN. This shift is due to a combination of the country’s stability, better top-down policy making and bottom-up fundamental change in the technology sector as Malaysia continues to move up the value chain in Southeast Asia. We have tempered our view on Indonesia owing to the long period between the national election and inauguration, a much tighter liquidity environment domestically and a weakening Indonesian rupiah.

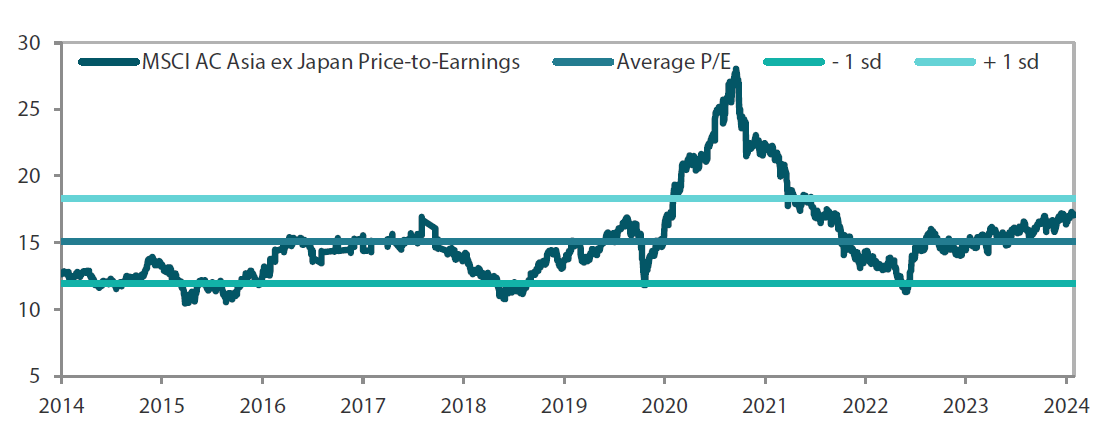

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 30 June 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

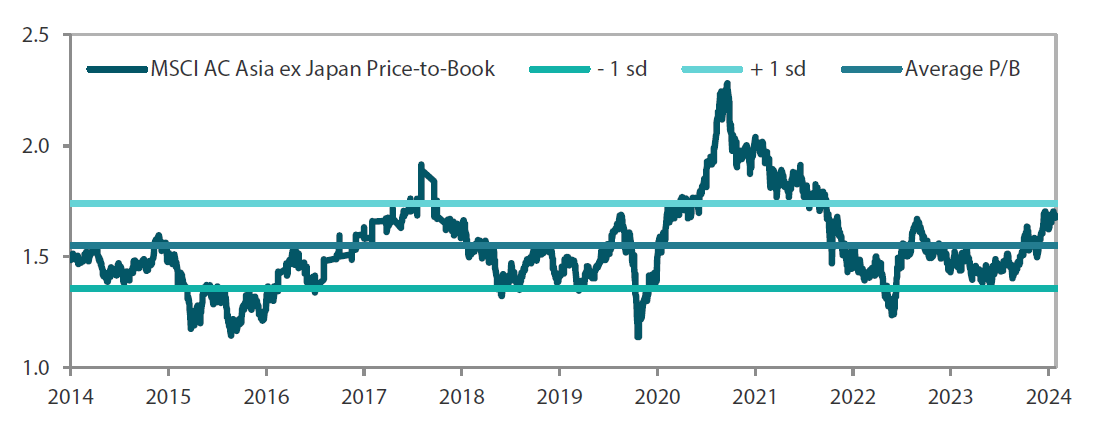

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 30 June 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.