Summary

- Markets continued to be supported by easing financial conditions, but they remain volatile amid the easing of trade tensions and geopolitical changes in the Middle East. Despite this smidge of uncertainty over the near-term outlook, we believe that Asian markets can still offer attractive returns.

- One of the key drivers of optimism in Chinese equities is the country’s favourable liquidity environment, which could prompt domestic institutions to redirect their capital to equity markets for more attractive returns. Elsewhere, India remains a compelling long-term investment opportunity despite short-term challenges; pro-growth consumption policies and structural reforms will likely support Indian corporate recovery.

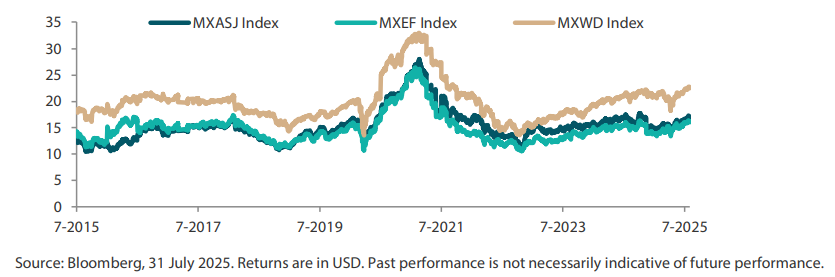

- Global market sentiment was broadly positive amid resilient economic data and cooling trade tensions. Top-performing Asian markets included Thailand (+14.3%), Taiwan (+5.4%), China and Hong Kong (both +4.8%) while India (-5.1%) and the Philippines (-4.4%) underperformed.

- The stock markets of South Korea and Taiwan are well positioned to benefit from structural spending in artificial intelligence (AI) capital expenditure (capex). In ASEAN, amid uncertainties regarding structural reforms and political issues, we prefer Singapore for its stable politics and tech-driven economic growth.

Market review

Asian markets rise to kick off the second half of 2025

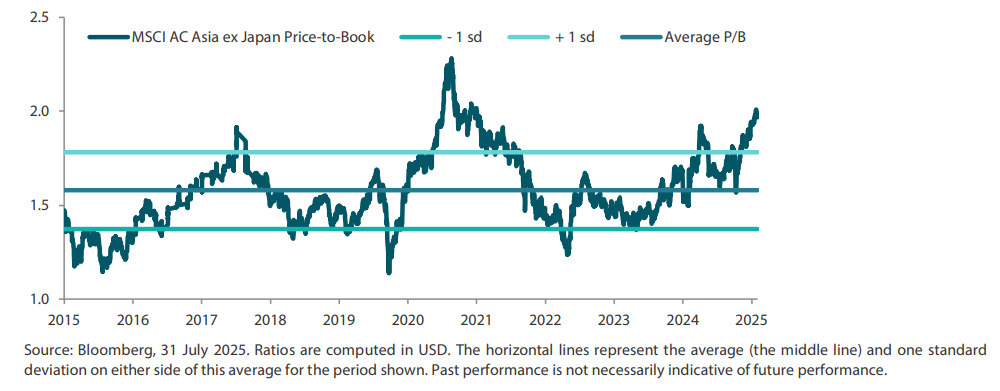

July wasn’t exactly the most action-packed month, but investors were likely content to see the broader market retain its steady momentum. Asian markets have mostly continued to demonstrate resilience, with the MSCI Asia Ex Japan Index posting a gain of 2.6% US dollar (USD) terms in July. We did see some action on the tariff front, with US President Donald Trump saying that Washington has brokered trade agreements with several countries, although little—and nothing legally binding—is set in stone. The return of the AI theme has been another positive.

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

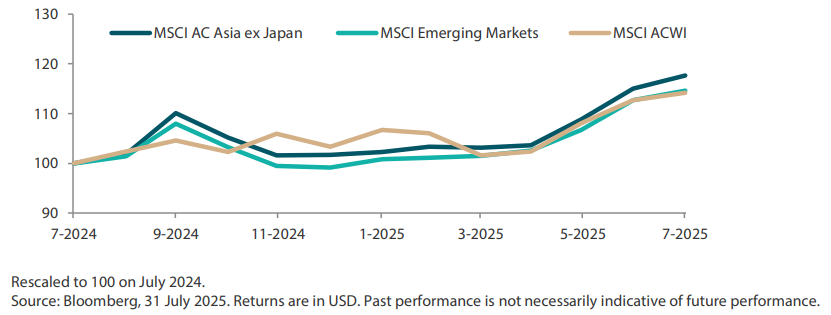

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

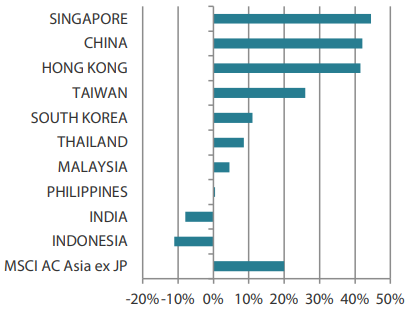

Thailand leads the pack; India takes the wooden spoon

After a difficult first half of the year, Thailand staged a remarkable turnaround in July, as relatively low valuations attracted foreign fund inflows. Market sentiment was also lifted after Thailand and Cambodia agreed to an "unconditional ceasefire" to end a five-day military conflict stemming from a longstanding border dispute.

Stellar earnings reports amid optimism over robust demand for AI technologies propelled Taiwanese names. Index heavyweight Taiwan Semiconductor, the world’s largest contract chipmaker, saw its market value surpassing USD 1 trillion for the first time.

Chinese and Hong Kong markets also ended the month firmly in positive territory. The US-China Stockholm talks concluded without a resolution to avert tariffs from soaring back to ultra-high levels between the world’s two largest economies. However, both sides could agree to another extension of the tariff pause. China’s Politburo held its mid-year meeting, but Chinese leaders refrained from rolling out more major stimulus for now. Instead, China’s top policymaking body reiterated its intention to address excess capacity in some key industries.

Elsewhere, India fell behind other Asian peers as weak earnings, foreign outflows and steep valuations weighed on sentiment. Trump added further pressure by imposing a 25% tariff and threatened further penalties due to the country’s energy purchases from Russia.

Chart 3: MSCI AC Asia ex Japan Index¹

For the month ending 31 July 2025

For the year ending 31 July 2025

Source: Bloomberg, 31 July 2025.

1 Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Favourable liquidity environment should support investor sentiment in China

Markets continue to be supported by easing financial conditions, but they remain volatile amid shifting trade conditions and geopolitical changes in the Middle East. While there have been progress in trade negotiations and ceasefires to some conflicts, the broader outlook remains uncertain.

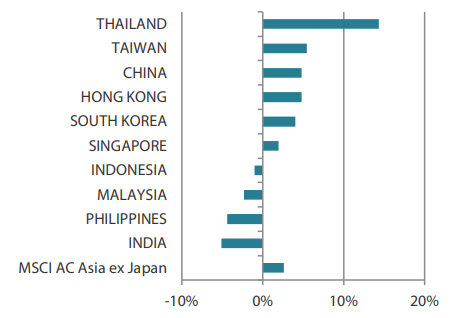

In China, equity optimism continues to be underpinned by a favourable liquidity environment. Low government bond yields reflect this and could prompt domestic institutions to redirect their capital into equities for better returns. China’s securities regulator is also encouraging more investments in the equity market by allowing state-owned insurers to invest 30% of new policy premiums to the domestic A-share market. Additionally, there are signs of improvement in US-China tariff tensions, exemplified by the trade deal framework struck between the two countries in late June.

Long-term outlook for India remains compelling

We believe that India remains a strong long-term investment opportunity despite the near-term challenges it faces. Pro-growth consumption policies and structural reforms are expected to support corporate recovery. We view India’s recent market pullback as a healthy occurrence, potentially providing investors with opportunities to invest in some high-quality companies at much more reasonable valuations. While we still maintain a cautious view on India in the short term, we see value in select Indian large-cap names with strong fundamentals.

Strong AI capex to benefit South Korea, Taiwan markets; ASEAN’s long-term potential remains promising

South Korea has performed well year-to-date, supported by strong corporate earnings and its “Value-up” program. Fiscal and monetary easing have also provided additional tailwinds for the market. South Korean companies continue to expand globally and offer attractive valuations. Alongside Taiwan, these markets are well positioned to benefit from the structural surge in AI-related capex.

In ASEAN, where markets continue to be plagued by structural reform delays and political uncertainty, Singapore remains the preferred market, as it benefits from stable politics and tech-driven economic growth. That said, we continue to believe in the region’s long-term structural transformation potential.

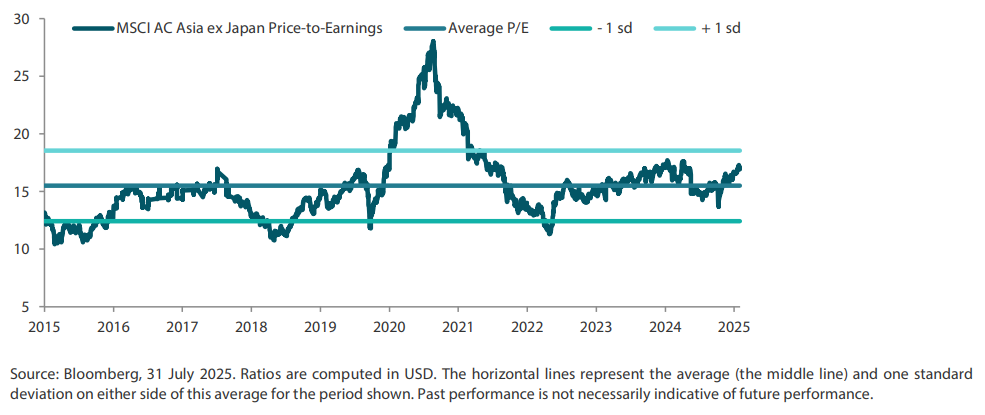

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Chart 5: MSCI AC Asia ex Japan price-to-book