Summary

- We think that there could be some short-term rebound in China as valuations are in extreme oversold territory. However, for the rally to be more sustainable, we are monitoring for a few drivers, including supply-side measures that can resolve China’s main housing issues. India is on the opposite end of the spectrum, with positive sentiments all around, behind the country’s infrastructure investment push and rapid penetration of cheap smartphones and the internet.

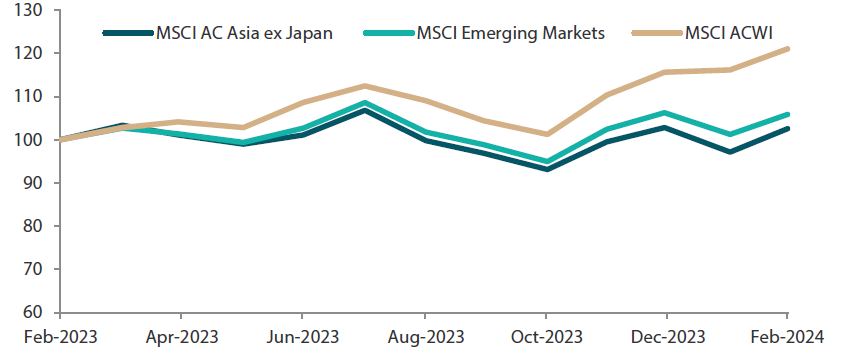

- For the month, the MSCI Asia Ex Japan Index climbed 5.6% in US dollar (USD) terms, propelled by Chinese markets that gained on supportive domestic policy measures. A rally in artificial intelligence (AI) stocks, as well as optimism about economic growth at a time of easing monetary policy helped to power global markets higher.

- China (+2.4%) and South Korea (+1.0%) led the region in February, while gains in Thailand (+0.7%) and Singapore (+0.9%) were more modest over the month.

- In the US, with excess savings nearly spent and fiscal thrust turning to drag, the current tight monetary environment could result in further disinflationary pressure. The resultant weaker US dollar and looser liquidity environment would be a boon for Asia, which still has plenty of room for rate cuts.

Market review

Asian markets climb higher in February

Asian markets climbed 5.6% in USD terms in February, according to the MSCI Asia Ex Japan Index, lifted as the Chinese markets gained on supportive domestic policy measures. A rally in AI stocks, including those of chipmaker Nvidia—whose shares erupted after earnings exceeded forecasts—as well as optimism about economic growth at a time of easing monetary policy helped to power global markets higher.

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Source: Bloomberg, 29 February 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

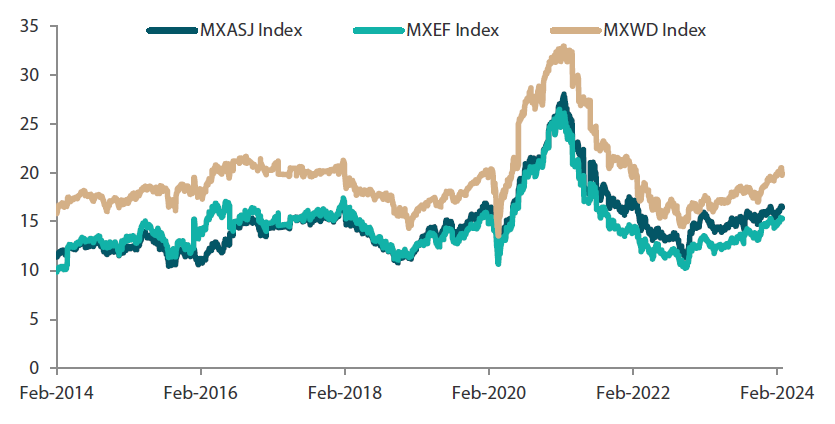

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 29 February 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

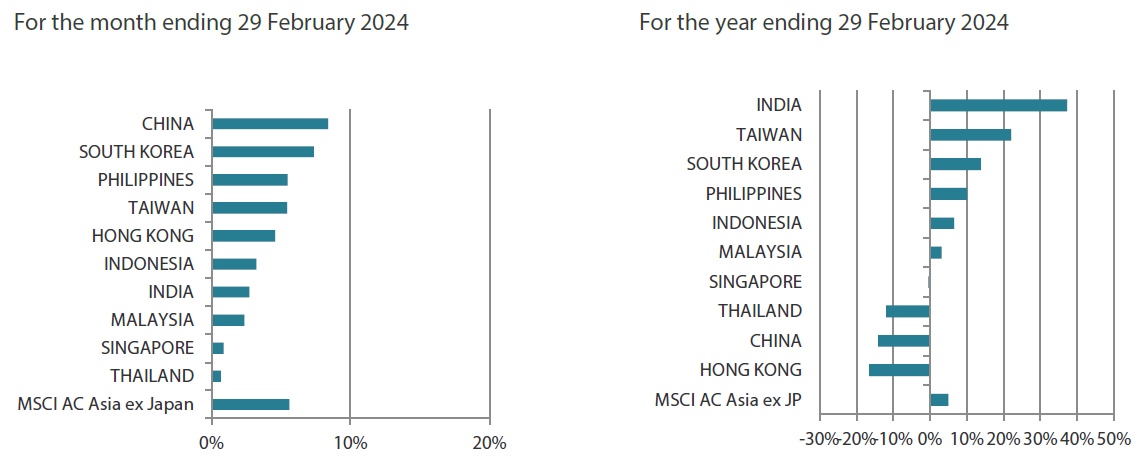

North Asian markets outperform, led by a rebounding China

North Asian equity markets outperformed, led by China which rose 8.4%. The Chinese markets recovered some ground, responding positively to the new domestic policy efforts aimed at shoring up ailing markets. Chinese lenders slashed their five-year loan prime rate—a benchmark for home loans—by 25 basis points (bps) to support China’s troubled property sector. The China Securities Regulatory Commission unveiled new trading curbs on short-selling, including barring brokerages from further expanding lending of stock certificates for that purpose. The Chinese cabinet also initiated a leadership reshuffle by replacing Yi Huiman, the chairman of the securities regulator, with Wu Qing. Central Huijin Investment, a Chinese sovereign fund that owns China's state-run banks, pledged more support including buying more exchange-traded funds. In Hong Kong, Financial Secretary Paul Chan scrapped property cooling measures to bolster the sector during his 2024 budget speech; Hong Kong stocks rose 4.6%.

The continued surge in AI demand drove the tech-heavy markets of South Korea (+7.4%) and Taiwan (+5.5%) higher over the month. South Korean authorities also unveiled a “Corporate Value-up Program” that seeks to incentivise companies that prioritise shareholder returns, similar to Japan’s corporate governance push last year. The Bank of Korea left the key interest rate steady at 3.5% in a sign of continued caution against inflationary pressures. Taiwan sees its economy rebounding this year and revised up its 2024 GDP growth forecast to 3.43% as exports recover.

Share prices in ASEAN rise as well

ASEAN markets also gained in February. In Indonesia (+3.2%), traders are betting on policy continuity after Prabowo Subianto declared victory in Indonesia’s presidential vote. The Philippines (+5.5%) saw its headline inflation fall sharply to 2.8% year-on-year (YoY) in January, the lowest figure in over three years, mainly due to lower food prices. In Malaysia (+2.4%), the ringgit extended its decline to the weakest level since the height of the Asian financial crisis, but Malaysia’s central bank has stepped up its rhetoric that it would “restrict excessive weakness in the ringgit”. Singapore (+0.9%) and Thailand (+0.7%) saw more muted gains during the month.

Appetite for Indian equities continues

Indian stocks continued to gain steam, rising 2.7% in February. The Reserve Bank of India kept the benchmark repurchase rate at 6.5%, retaining its “withdrawal of accommodation” policy stance. Retail inflation cooled to a three-month low of 5.1% in January primarily due to lower food prices. India then reported that its GDP expanded 8.4% YoY in the final three months of 2023, handily beating forecasts, helped by strong private-sector investment and a pick-up in services spending.

Chart 3: MSCI AC Asia ex Japan Index¹

Source: Bloomberg, 29 February 2024.

Market view

Focus on attractively-valued names with positive fundamental changes and strong sustainable returns

Despite the recent stronger economic data in the US, we continue to expect the Federal Reserve to begin cutting rates this year. With excess savings nearly spent and fiscal thrust turning to drag, we expect the current tight monetary environment resulting in further disinflationary pressure. The resultant weaker US dollar and looser liquidity environment would be a boon for Asia, which still has plenty of room for rate cuts. The question, however, remains whether China is able to engineer a soft landing for its housing sector and resolve the issue of uncompleted housing units. Whilst India has had decent returns, growth is keeping pace as its structural growth continues unabated. We remain steadfast in our bottom-up led investment philosophy and process, focusing on attractively-valued companies with positive fundamental changes and strong sustainable returns.

Prefer companies in the exporter and healthcare space due to a lack of visibility in the domestic economy

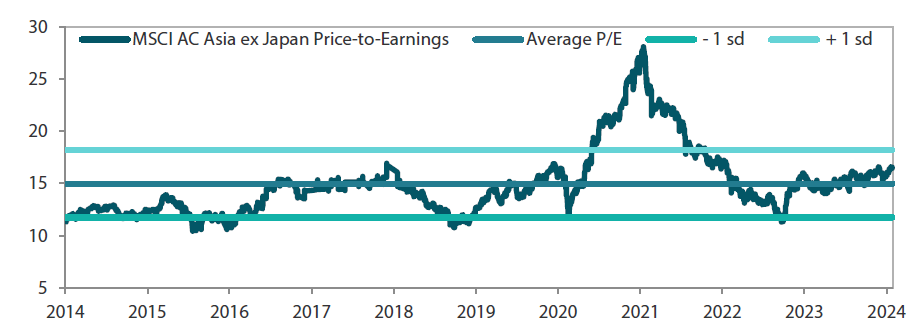

In China, we expect only a modest wave of counter-cyclical measures in the next few months. Despite investors’ concerns that the country’s deflationary pressure could become more entrenched, policymakers have been reluctant to act with any real urgency because headline growth in China is still within acceptable range. However, the risk is increasing that they could be behind the curve in arresting the decline in broader confidence in the economy. That said, with valuations in extreme oversold territory, there could be some short-term rebound. However, for the rally to be more sustainable, we are monitoring for a few drivers, such as supply-side measures that can resolve China’s main housing issues. Significant fiscal stimulus and changes in concerns about deflationary could also help turnaround sentiment. Longer term, there needs to be reforms in the local government and state-owned enterprises space. Due to the lack of visibility in the domestic economy, there is a preference for companies in the exporter and healthcare space, where there is less cyclicality and more idiosyncratic bottom-up alpha drivers.

Continue to favour Indian companies exposed to the improving domestic infrastructure

India is on the opposite end of the spectrum, with sentiment positive all around. Investments in the country’s unsatisfactory infrastructure has increased in recent years and is now paving the way for its manufacturing share of GDP to ramp up over the next few years. Concomitantly, its new economy space is also thriving as a result of the rapid penetration of cheap smartphones and internet, giving rise to fast-growing online platforms. To that end, we continue to favour companies exposed to the improving domestic infrastructure as well as online consolidators. ASEAN and Indonesia also enjoy similar dynamics but to a smaller extent. The good news in Indonesia is that following the latest election victory for Prabowo, we can expect the pro-growth reform policies during the Jokowi era to continue under the new regime.

The tech-centric markets of Taiwan and South Korea continue to ride the wave of structural AI demand while the tech cycle broadens out on the back of the nascent android and PC replacement cycles. South Korea, in particular, has an extra growth driver as the government attempts to follow Japan’s example of improving corporate governance in order to drive the rerating of cheaply-valued conglomerates.

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 29 February 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

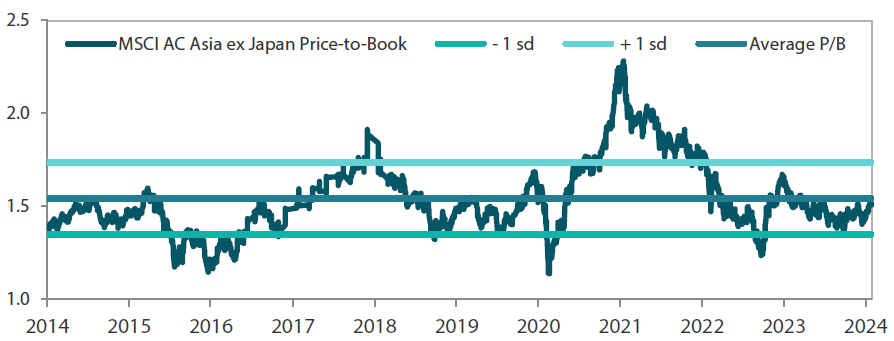

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 29 February 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

¹Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.