Source: Shutterstock

The changing seasons are nature’s way of reminding us that time moves on. And it is the same in the Russell household, where my youngest is approaching 18 and his late weekend nights are his way of telling me change is arriving in our home too. There is a dawning that I am heading into a new stage of life. It is exciting, but after 20 years of bringing up a family, I also admit to being a little scared of what the next chapter will bring. In markets we often get obsessed with short-term changes but it can be the slow structural moves—such as a child leaving the home—which can have a more profound longer-term impact.

Bear markets exist for a purpose. They expose the heavy misallocation of capital that in this bear market happened because finance was too easy. While capital is now more rationed, energy too can no longer be taken for granted. Of course management teams of energy companies have been aware of this for some time, as they have witnessed their own cost of capital rise as the shale revolution unwound and climate change took hold.

In bear markets time horizons are compressed and dreams are often shelved as rising costs force management teams to make difficult choices. These choices impact different stakeholders, often over different time horizons, which explains why companies adopting a stakeholder approach with purpose could be better equipped to navigate their way through difficult times and eventually, when the next bull market begins, may be better placed to solve the significant challenges facing society over the coming decades.

Choice One: Energy affordability versus long-term energy transition

Energy markets and policies have changed as a result of Russia’s invasion of Ukraine, not just for the time being, but likely for decades to come. The environmental case for clean energy needed no reinforcement, but the economic arguments in favour of cost-competitive and affordable clean technologies are now stronger—and so too is the energy security case. But solving for clean, secure and affordable energy is not straight forward.

Energy is an input to making substantively everything in the modern world. So when we have shortages—as we do now—the rising costs of everything acts like a tax on consumption. Primary energy costs at the start of the last century were about 4% of the global GDP. Today, primary energy accounts for about 12% of total GDP, which is similar to that achieved in the two oil shocks in the 1970s.1

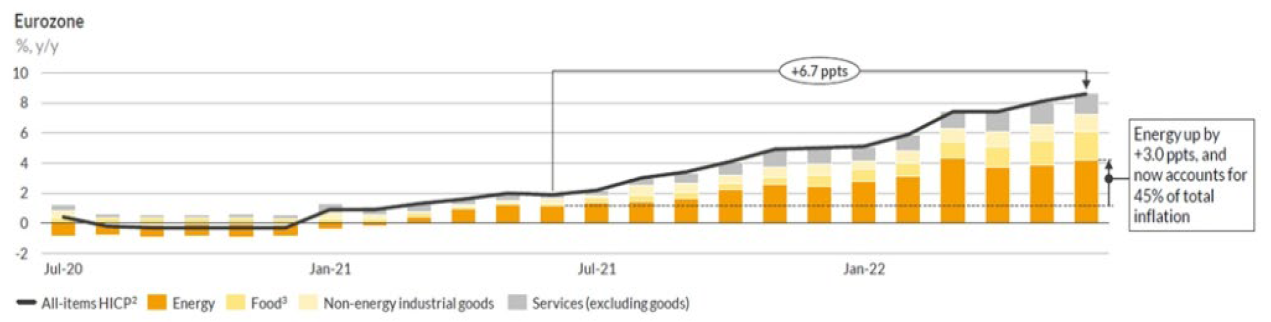

Direct energy makes up about 45% of European inflation (Chart 1). However, we also know that 10%–15% of all primary energy goes into making food for the world’s population—which adds to the inflationary pressure. If other associated links to energy are added, we can estimate that approximately 75%2 of inflation is driven directly and indirectly by energy costs. Our current energy crisis is a core element of today’s inflation and until we solve energy’s supply problems, we expect inflation to remain stubbornly above most central banks’ 2% targets.

Chart 1: Headline inflation rate with component contributions - Eurozone

Source: Aurora Energy Research, GOV.UK, Eurostat, U.S. Bureau of Labor Statistics, MarketWatch

Today, for every US dollar (USD) spent globally on fossil fuels, USD 1.5 is spent on clean energy technologies. But by 2030, under the net-zero emissions by 2050 scenario, every dollar spent on fossil fuels will be outmatched by USD 5 on clean energy supply and another USD 4 on efficiency and end-uses.3

If clean energy investment does not accelerate, higher investment in oil and gas will be needed to avoid further fuel price volatility, while also putting the 1.5 degrees Celsius goal in jeopardy. But if we accelerate clean energy today at the expense of fossil fuels, we will only exacerbate our energy shortages, given the short-term draw on valuable energy sources made by solar and wind. These are long-term versus short-term choices that even the experts have difficulty reconciling (Exhibit 1):

Exhibit 1: IEA illustrates the challenge between short-term affordability and long-term energy transition

International Energy Agency (IEA) executive director Fatih Birol: “If governments are serious about the climate crisis, there can be no new investments in oil, gas and coal, from now – from this year”. (“No new oil, gas or coal development if world is to reach net zero by 2050, says world energy body”, The Guardian, 18 May 2021)

IEA’s 2022 outlook: “Ahuge increase inenergy investmentis essentialto reducethe risksoffutureprice spikes and volatility, and to get on track for net zero emissions by 2050… an average of almost USD 650 billion per year ‘will be’ spent on upstream oil and natural gas investment to 2030, a rise of more than 50% compared with recent years”. (IEA “World Energy Outlook 2022”, November 2022)

The most suitable near-term solutions include projects with short lead times that bring oil and gas to market quickly, but also includes areas such as capturing some of the 260 billion cubic metres of gas that is wasted each year through flaring and methane leaks4 to the atmosphere—a key driver of our investment in Emerson.

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.

1Thunder Said Energy, “Energy Shortage: fear in a handful of dust?”, November 2022

2Nikko AM estimates

3IEA, “World Energy Outlook 2022”, November 2022

4IEA, “World Energy Outlook 2022”, November 2022

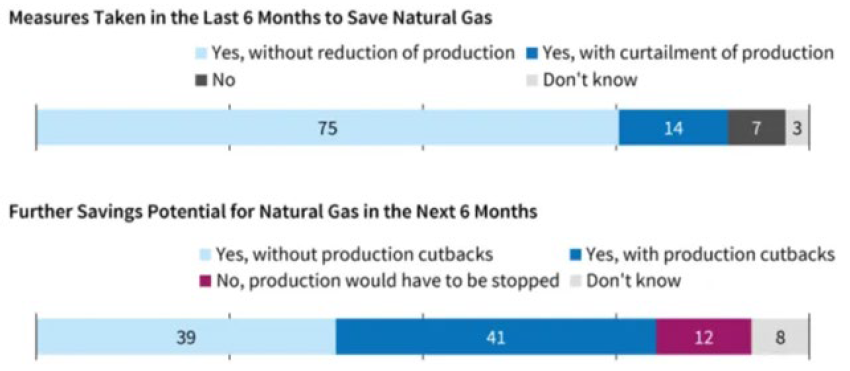

Demand efficiency and productivity could also be key and in this field, there has been significant progress. A recent German IFO survey suggested that most companies—in this case 75% of those that use gas as a primary energy source in their production—have found ways to reduce gas usage in the last six months while still meeting production targets (Chart 2).

Chart 2: Reduction of natural gas consumption in the production process (%)

Source: IFO Business survey, October 2022

In fact energy efficiency is the number one place to look for solutions to this energy crisis. While energy costs soar, CEOs are expected to look at ways to make their businesses more resilient and reduce their energy burden. Paybacks on energy efficient investments will be very high, in our view, and are unlikely to be shelved if and when a recession starts. We see this providing tailwinds for long-term holding companies such as Schneider and opportunities within the energy services companies, where cash flow returns could accelerate to double-digit levels. This is certainly a significant part of the reason for our more recent investments in Worley & Schlumberger

Choice two: ESG recession versus stakeholder capitalism

Recent market history suggests that commodity prices will correct with a recession and if central banks have their way, a recession is exactly what we may get. Our own experience tells us that we should prepare for where the cuts might be. Some are obvious—such as advertising and marketing. These cuts have already started as can be seen by the demise of Google or Meta. For many others their earnings recession is just starting.

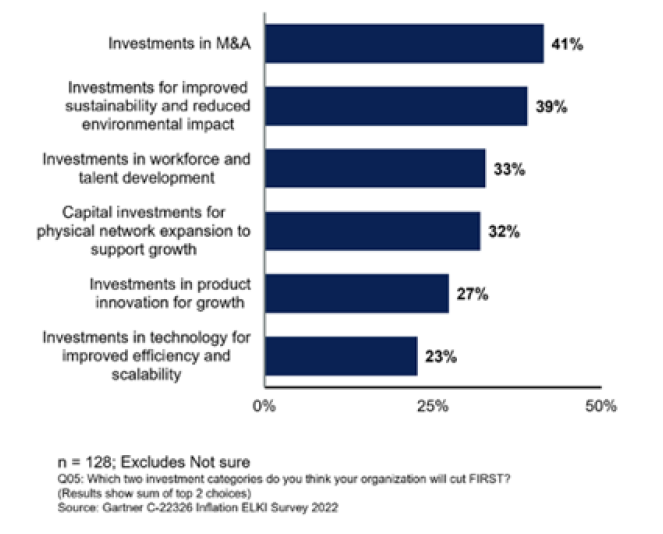

Corporates are also expected to cut capital projects and the following June 2022 Gartner poll provides some insight into where these might be (Chart 3). The results are not surprising—but significant reductions in investment for improved sustainability and environmental impact is worth raising.

Chart 3: Investment categories to be cut first—surveys

Source: Gartner, July 2022

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.

While corporates may sharpen the knife on sustainability, what is surprising to many is the backbone behind policy changes in Europe and the US (among others) which instead of accelerating fossil energy supply, are expanding incentives and targets for alternatives, such as wind, solar and hydrogen. The REPowerEU Plan was launched by the European Commission earlier in 2022 to reduce the European Union’s (EU) dependence on Russian fossil fuels in a direct response to the Ukraine invasion. The plan calls for the EU to consume 20 million tonnes (mT) of hydrogen by 2030, instead of the 5mT target previously quoted in the Fit For 55 policy announced just a few months before, as an example. If we feared a clash between decarbonisation and short-term energy needs, decarbonisation seems to remain society’s number one target.

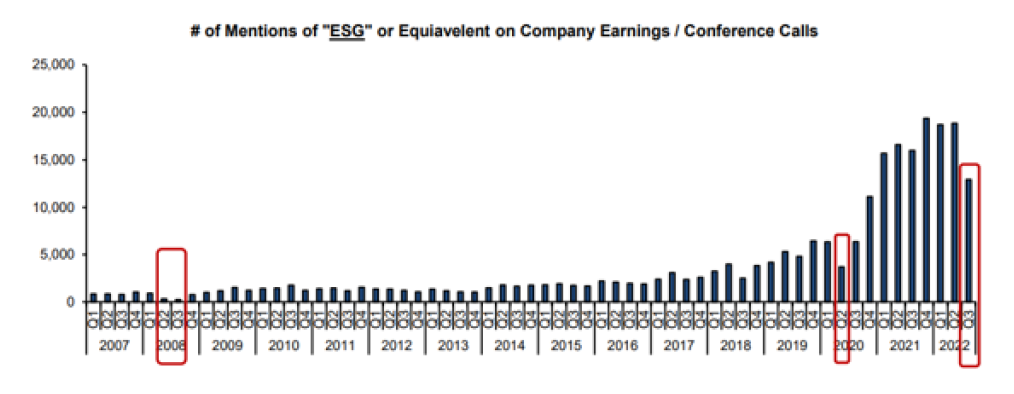

The bull market for ESG data and integration has been stratospheric. Changing demographics, rising inequality, the rise in the importance of externalities such as nature and increased influence of the state through regulation all have a part to play. But as was the case in prior recessions, we should expect ESG to be less of a focus for management teams as they divert their attention to short-term challenges or for some simply staying afloat (Chart 4). In our view, expensive virtue signalling does not perform well during recessions (e.g. Tesla).

Chart 4: Long-term bull market for ESG—with a few blips

Source: Bernstein research and Bloomberg, October 2022

In terms of energy shortages, we may play out the 1970s again. We also appear to have returned to that decade to question the role of shareholder primacy, with both business leaders and politicians (e.g. business round tables and the Davos Manifesto), suggesting we are on the verge of a fundamental reshaping of society. This slow, structural change is of course not new and ESG is a key cog if stakeholder capitalism is to work.

Given the shift to stakeholder capitalism is such an ideological shift, it shouldn’t surprise anyone that we are now seeing an ESG backlash, the most vigorous of which is targeted at greenwashing. Survey evidence around sustainability suggests trust is low. For example, three out of four institutional investors do not trust companies to achieve their sustainability targets and commitments.5 And of course, the measurement of ESG data is fraught with difficulty; while credit ratings correlate 99%, the correlation of external ESG ratings ranges between 38% and 71%.6 For some, ESG is leading to a significant misallocation of capital and is morally bankrupt. 7 8The situation has prompted some regulators, such those in the predominantly Republican US states, to try and alter the direction of travel and ban ESG investing altogether.

Yet, many companies today are making major decisions, such as discontinuing operations in Russia and protecting employees in at-risk countries. They also continue to commit to science-based targets and to define and execute plans for realising these commitments. This indicates that ESG considerations are becoming more—not less— important in companies’ long term decision making.

In fact, at Nikko Asset Management we believe companies should adopt a stakeholder approach. Companies must approach externalities as a core strategic challenge, not only to help future-proof their organisations but to deliver meaningful impact over the long term. Some companies that have already built purpose into their business models and are demonstrating they benefit multiple stakeholders are already showing success, such as Microsoft or lesser known companies, such as Compass Group.

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.

5Edelman, “2021 Trust Barometer Special report: Institutional investors”, November 2021

6Florian Berg, Julian Kölbel and Roberto Rigobon, “Aggregate confusion: The divergence of ESG ratings”, Review of Finance, forthcoming, updated

26 April 2022

7Bérengère Sim, “Ukraine war ‘bankrupts’ ESG case, says BlackRock’s former sustainable investing boss”, Financial News, 14 March 2022

8Steve Johnson, “ESG outperformance narrative ‘is flawed,’ new research shows”, Financial Times, 3 May 2021

In recent years, boards of directors have become increasingly focused on corporate purpose. This is partly driven by a sense that purpose drives corporate culture, helps attract and retain talent and is increasingly a differentiator when it comes to customers and suppliers.

External pressure on corporate boards to define purpose better has come from investors, who are themselves being asked to justify their own investments on the basis of ESG as well as financial considerations.

A single, clearly marked path that every business should follow does not exist. Strong corporate leaders recognise that social expectations constantly evolve and we believe that it is the company’s purpose that guides management, fund managers and owners through difficult times.

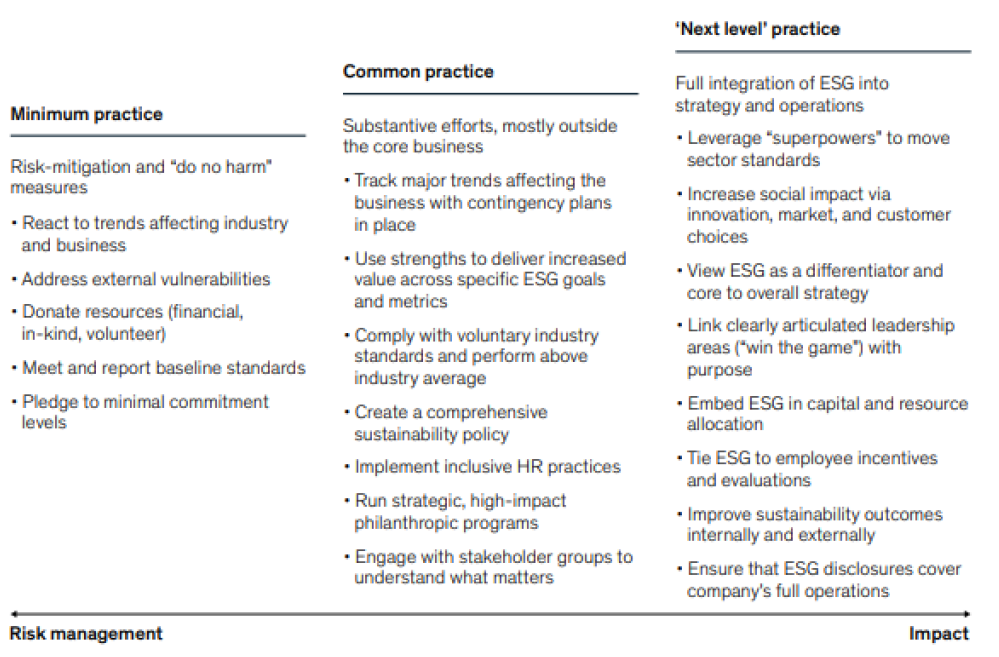

A recent Mckinsey study developed a framework for summarising key ESG approaches. This highlights characteristics of those at the forefront of stakeholder capitalism, fully integrating ESG into strategy and operations—listed as “Next Level Practices”. Companies adopting stakeholder capitalism are seen to be enhancing their company’s competitive positioning. They have purpose and can articulate why stakeholder capitalism is creating a competitive edge (Exhibit 2).

Exhibit 2: Corporate approach to ESG and stakeholder capitalism

Source: “How to Make ESG Real”, McKinsey, August 2022

They are a more attractive place to work for their employees—retention rates are higher than peers—successfully fighting the war for talent, while some are discovering new solutions needed to solve many of our current problems, such as climate change.

We can already see success in many of our own holdings—such as Danaher, Sony or John Deere to name a few. These companies are creating their very own superpowers, enhancing their franchise and management qualities and creating value (Exhibit 3).

Exhibit 3: Examples of Future Quality purpose statement

“Helping realize life’s potential” (Danaher)

“Fill the world with emotion, through the power of creativity and technology”. (Sony)

“We must act with urgency today to make the lives of our customers, workforce, and all those we serve better tomorrow”. (John Deere)

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.

Our own experience is supported by academic research. Work by Ariel Babcock et al. titled “Walking the Talk: Valuing a multi-stakeholder strategy” links the importance of stakeholders and stronger operating performance across a number of metrics.9

These management teams are committed, empathetic and demonstrate with full and transparent disclosure of data that they are on a journey of continuous improvement. They invest with a long term investment horizon and are prepared to make difficult decisions, some with potential trade-offs across different time periods. But when backed by a clear purpose statement that creates value for all key stakeholders, these management teams can “walk the talk”.

Remuneration and incentive schemes are linked to measurable ESG targets and integrated reporting—such as diversity targets or emission reduction targets. And they are preparing themselves for further regulation such as the introduction of separate ESG reporting under what is known as “Double Materiality”.

Conclusion

In conclusion clean, secure and affordable energy is likely to be one of the major challenges of this decade. Given we need abundant energy to complete the energy transition, we believe fossil fuel companies that are actively enabling transition to low carbon society can be part of the solution. They often understand how to deliver global energy at scale and have the balance sheets capable of enabling the transition to clean energy.

We also believe companies adopting a stakeholder approach will be better equipped to solve the significant challenges facing society over the coming years, and that a clearly defined purpose will help guide management teams through the challenges and choices they will have to make.

After all, it is the choices made today that will define the Future Quality returns of tomorrow.

9Ariel Babcock et al., “Walking the talk: Valuing a multi-stakeholder strategy”, FCLTGlobal, 17 January 2022

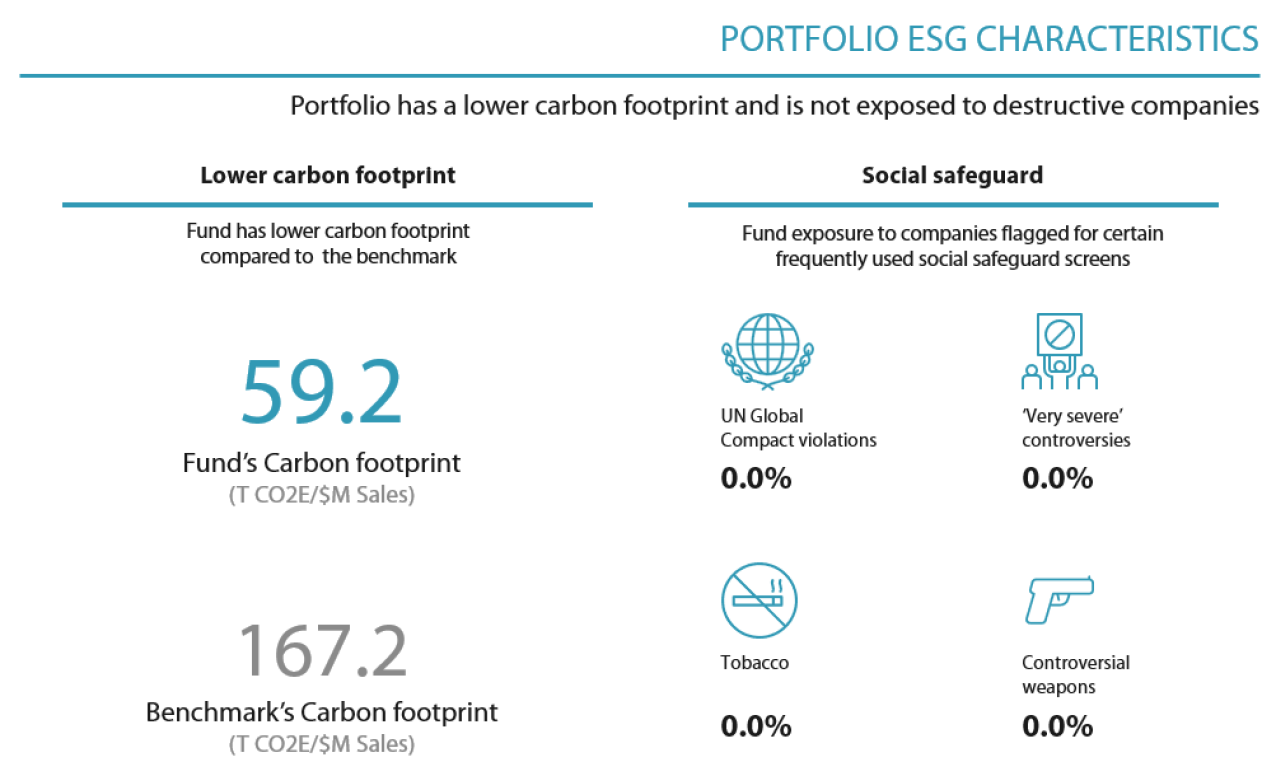

Source: MSCI ESG Research, September 2022* Underlying score is the MSCI ESG Quality Score. Carbon Footprint is Weighted Average Carbon Intensity Fund is a representative account of the Nikko AM Global Equity Strategy. Benchmark is the MSCI ACWI.

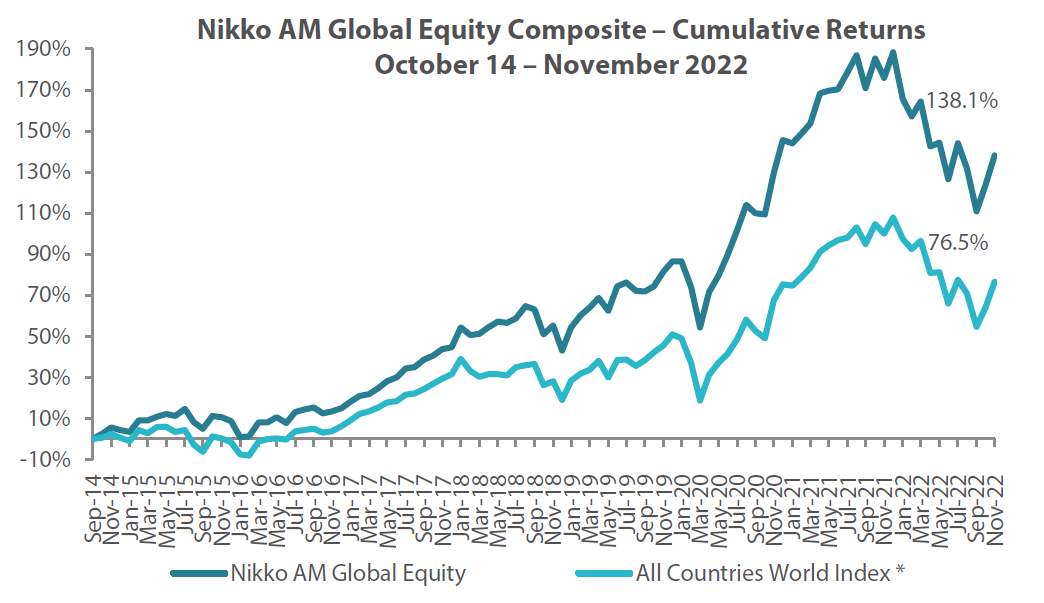

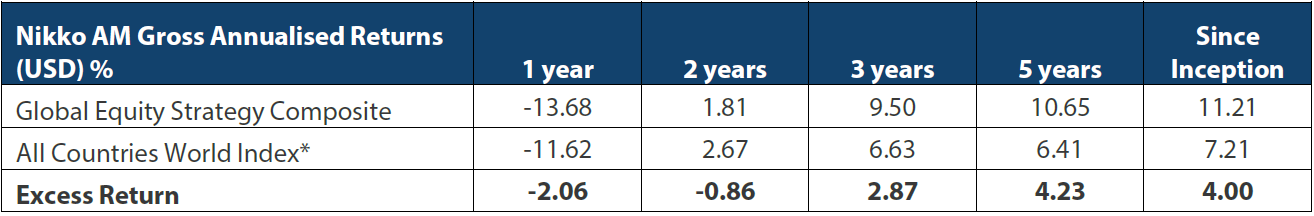

Global Equity strategy composite performance to November 2022

*The benchmark for this composite is MSCI All Countries World Index. The benchmark was the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Any comparison to reference index or benchmark may have material inherent limitations and therefore should not be relied upon. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it.. Data as of 30 November 2022.

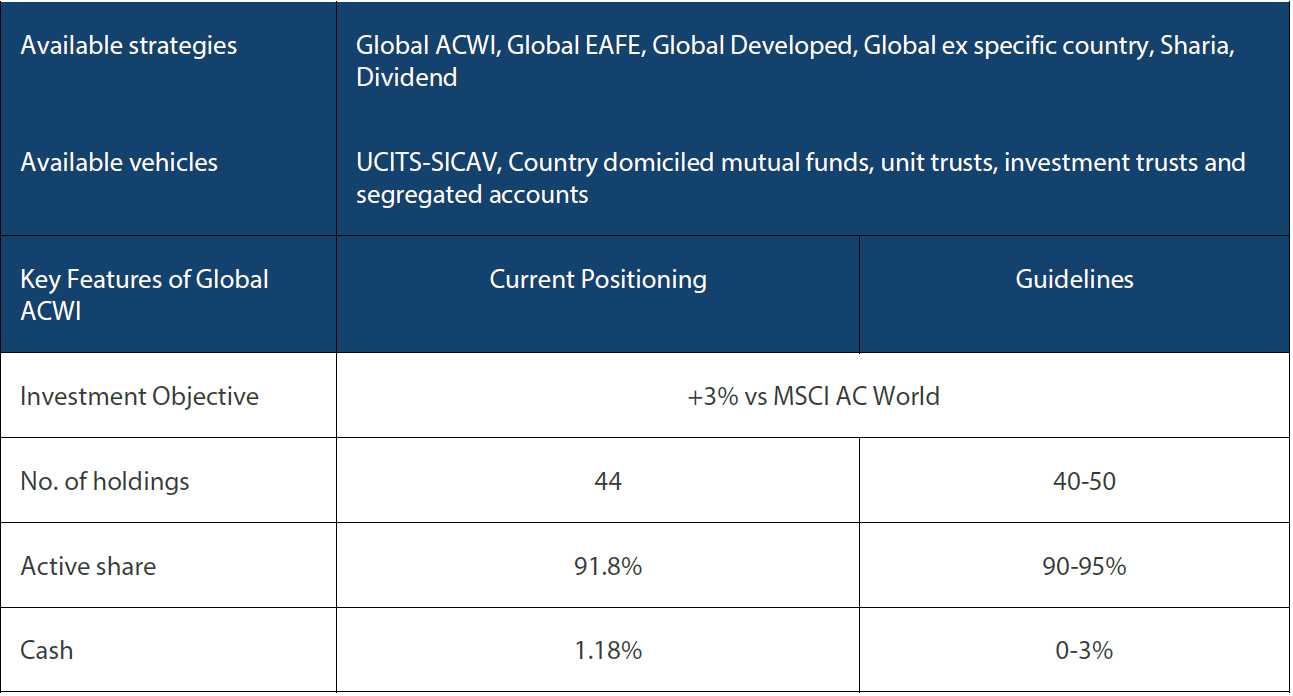

Nikko AM Global Equity: Capability profile and available funds (as at November 2022)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy’s risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon.

Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

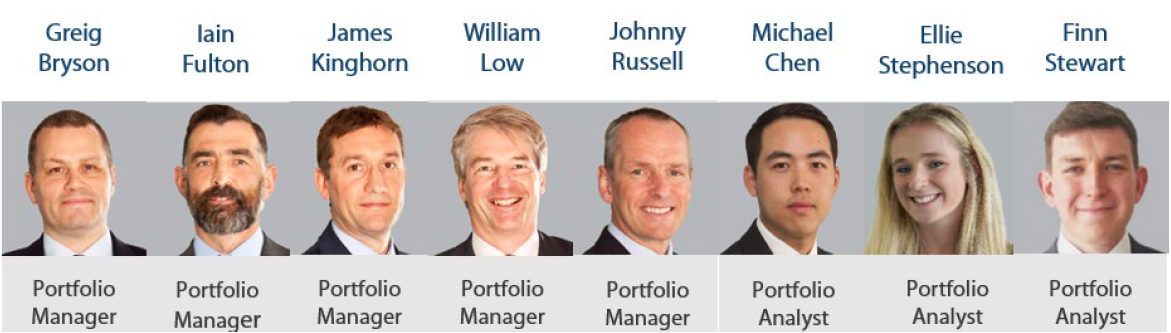

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 25 years’ industry experience and have worked together as a Global Equity team for eight years. In 2019, two portfolio analysts, Michael Chen and Ellie Stephenson joined the team followed by Finn Stewart in 2022, they are the first in a new generation of talent on the path to becoming portfolio managers. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of Future Quality companies will lead to outperformance over the long term. They define Future Quality as a business that can generate sustained growth in cash flow and improving returns on investment. They believe the rewards are greatest where these qualities are sustainable and the valuation is attractive. This concept underpins everything the team does.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 186.3 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 30 September 2022.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.