Q1 performance summary

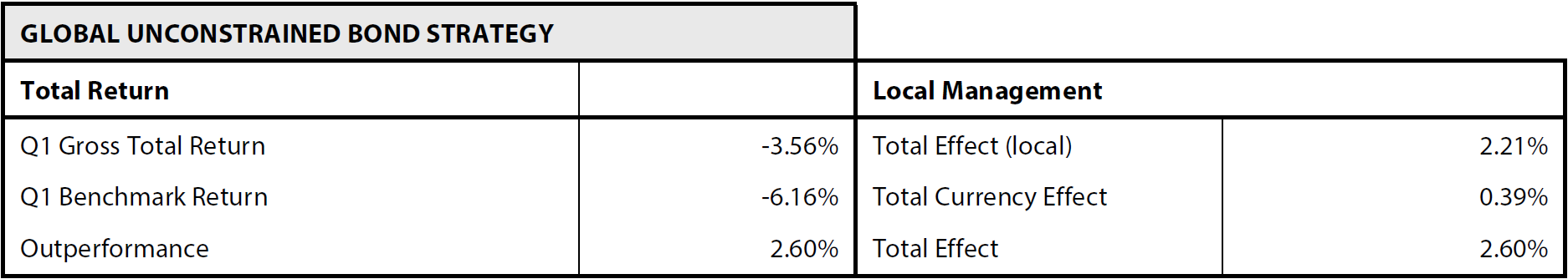

During the first quarter of the year, the representative account of the Global Unconstrained Bond Strategy returned a very strong relative gain of +2.60%. The total return was negative 3.56% versus the benchmark performance of negative 6.16%. The bulk of the relative performance came from the local price effect, 2.21%, while currency views returned an additional 0.39%. Q1 marks one of the largest drawdowns since the inception of the Global Aggregate index (1992). Additionally, if you used the ICE BAML US Treasury Index as a benchmark you will have not seen a drawdown like this since the early 1980s.

Global Unconstrained Bond Strategy Q1 performance

Source Nikko AM, As at 31 March 2022

Source Nikko AM, As at 31 March 2022

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Returns are based on a representative account of the Global Unconstrained Bond strategy. The benchmark for this strategy is the Bloomberg Barclays Global Aggregate Bond Index The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Returns for calculation periods in excess of one year are annualised, but those for the periods of less than one year are not annualised. Numbers in the table may not sum to total due to rounding. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Past performance does not guarantee future returns. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it..

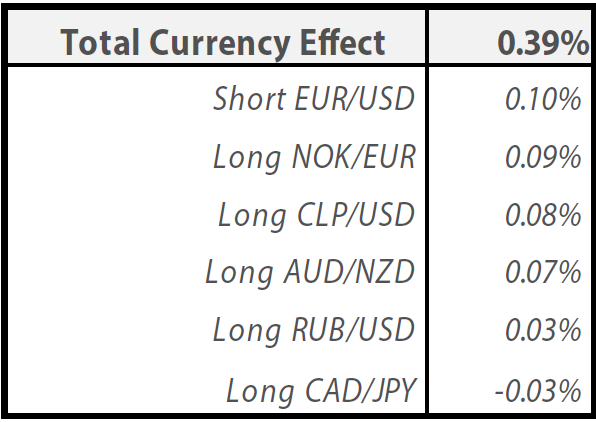

In FX positioning, the Global Fixed Income Team (“the team”) preferred a higher allocation to the US dollar, particularly versus the euro, based on the investment theme of monetary policy divergence between the Federal Reserve (Fed) and the European Central Bank (ECB) which added 10 basis points (bps) to the relative gains. Meanwhile, overweight exposure to several commodity-linked currencies such as the Norwegian krone and Chilean peso contributed a further 17 bps. In the Antipodean region, the team favoured an allocation to the Australian dollar versus the New Zealand dollar in anticipation of a hawkish turn by the Reserve Bank of Australia (RBA), and corresponding repricing of interest rate expectations at the short end of the curve, which was set to benefit the former versus the latter. This trade added a further 7 bps to relative gains.

Total currency effect on relative performance

The numerous delivery riders across Shenzhen play a crucial role in the city’s digital economy.

Source Nikko AM, As at 31 March 2022

The numerous delivery riders across Shenzhen play a crucial role in the city’s digital economy.

Source Nikko AM, As at 31 March 2022

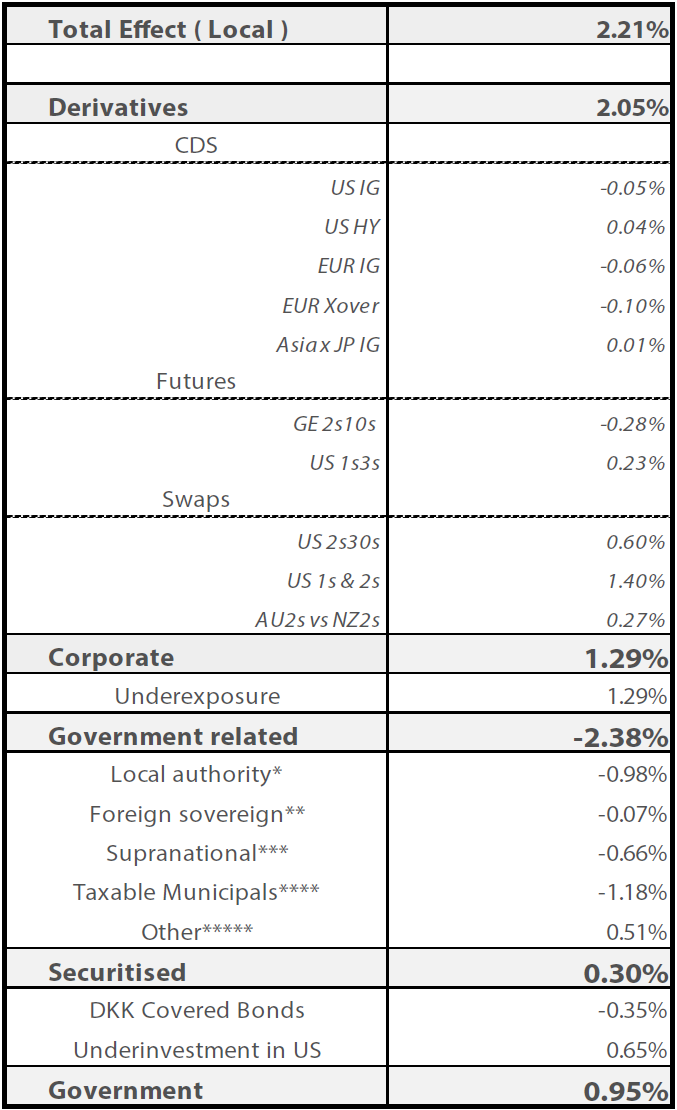

Government bond markets came under heavy pressure during Q1 as short-term interest rates began to price an increased probability of imminent interest rate hikes, particularly by the Fed, and by other key developed market central banks. The team exploited these moves in interest rates by implementing a 2-year/30-year flattener position in the US, in addition to markedly reducing duration on a portfolio level, by shorting the 2-year and 1-year parts of the US swap curve. These two strategies contributed over 200 bps of relative performance during Q1. Additionally, underinvestment in corporate as well as government bonds benefited the strategy’s relative performance. However, a higher allocation to government-related and municipal sectors partially offset those gains.

Total effect in detail

* Canadian provinces, New Zealand local government funding agency

** EM external debt*** Asia, EBRD, IFC

**** State of California & New York

*****Underexposure to EUR/GBP/AUD denominated issues

Source Nikko AM, As at 31 March 2022. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Returns are based on a representative account of the Global Unconstrained Bond strategy. The benchmark for this strategy is the Bloomberg Barclays Global Aggregate Bond Index The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Returns for calculation periods in excess of one year are annualised, but those for the periods of less than one year are not annualised. Numbers in the table may not sum to total due to rounding. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Past performance does not guarantee future returns. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it..

Q2 outlook and positioning

Following the sharp move higher of government bond yields in recent months and the associated flattening of yield curves, the team now believes that global government bond yields are likely to stabilise in the coming months and accordingly have reduced the underweight portfolio duration in the strategy. The team view is that inflation has peaked on an annualised basis. However, in some developed markets risks persist due to lingering supply chain disruptions and tight labour markets in western advanced economies, particularly in the US. Valuations now look attractive for government bonds as real yields have turned positive for longer maturities while expectations of monetary policy tightening appear somewhat extended relative to previous hiking cycles. Additionally, there are seasonal factors that will likely be supportive for global bonds in the coming months with the summer months in the northern hemisphere typically associated with a relative preference for safe-haven assets as well as the potential for fresh rebalancing flows from institutional investors such as US and UK defined benefit pension funds as well as Japanese institutions.

The team maintained its view of a relative repricing of interest rate expectations in Australia, expressed via a relative 2-year swap position paying Australian rates versus receiving New Zealand rates. The Reserve Bank of New Zealand have already initiated rate hikes and there remains significant scope for the RBA to signal and implement further policy tightening thereby reducing the current rate differential between the two countries, which are on a broadly similar economic trajectory.

The team has also taken the view that the current interest rate hike expectations for the Eurozone appear to be overpriced with too much policy tightening anticipated by the market. We have entered a convergence trade between the ECB and the Bank of England (BOE) via paying euro rates versus receiving UK rates, given the recent incrementally dovish shift from both central banks. Expectations for the ECB to continue hiking through 2023 may prove too optimistic given the stagflationary environment on the continent, and associated risk of a recession in the coming quarters, even though the ECB will likely initiate rate hikes in Q3, as expected. As such the team continues to expect an underperformance of the euro whilst recently upgrading its view on the UK pound as the BOE may need to respond more aggressively to increased price pressures should an anticipated slowdown in demand not materialise.

The team has also maintained a positive view on a number of commodity currencies, aside from the Australian dollar, including the Norwegian krone and Canadian dollar, with notably hawkish central banks providing additional support above and beyond the significant terms of trade improvement from the supply-driven surge in global commodity prices. In contrast the team has turned more cautious on the Chinese renminbi as the government’s unyielding COVID restrictions are hampering economic growth with consumer demand likely to suffer while industrial activity is inhibited. As such we believe that additional policy easing is likely with the People’s Bank of China focusing on a weaker currency to restore competitiveness.

Additionally, given the sharp underperformance of Swedish rates in recent weeks, as the Riksbank have belatedly acknowledged the persistence of price pressures in the economy and pivoted towards a more hawkish path for interest rates, the team also believes that the expectations are somewhat optimistic given that Sweden is exposed to similar economic risks as the Eurozone. Given that Swedish mortgage bond spreads over their respective government bonds are also now comparable to Danish mortgage bonds the team decided to express this relatively more constructive Swedish rates view via Swedish mortgage bonds.

Finally, in credit markets the team believes that despite improved valuations, credit markets in Europe remain vulnerable to a further deterioration in economic growth, coupled with the obvious technical headwind of an end to ECB’s corporate sector purchase programme in the coming months. Meanwhile, the team believes that US credit markets are relatively more attractive given the underlying economic resilience, with corporates better positioned to pass on higher input prices to consumers. High yield spreads look particularly compelling at circa 400 bps, with the team biased to increase its exposure if spreads widen again as concerns over a more aggressive hiking cycle from the Fed could linger.

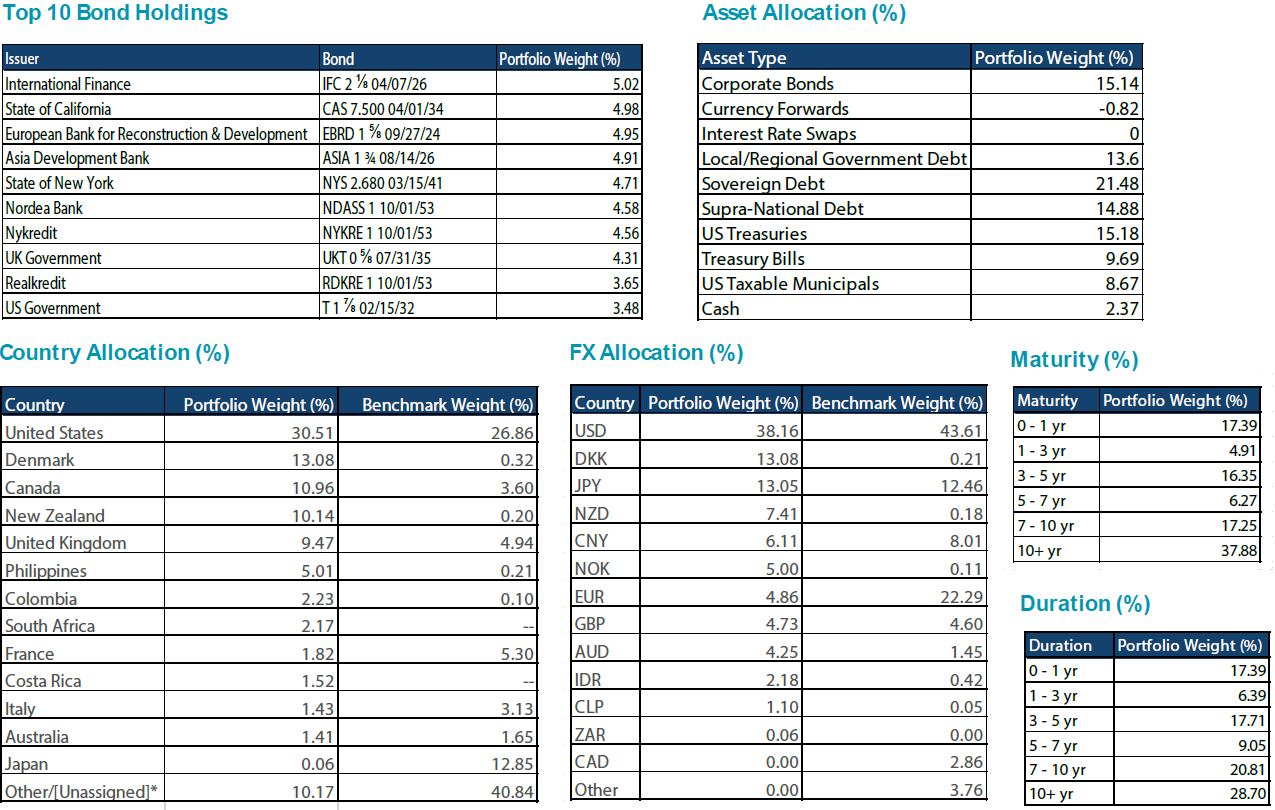

Current portfolio

Source Nikko AM, As at 31 March 2022

Source Nikko AM, As at 31 March 2022

Please note: Other/[Unassigned}* includes portfolio weight’s CDS positioning.

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standard (GIPS®). The data above is based on the representative account of the Global Unconstrained Bond strategy. The representative benchmark for this composite is the Bloomberg Barclays Global Aggregate Bond Index. Past performance does not guarantee future returns. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it..

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.