Q1 2023 performance summary

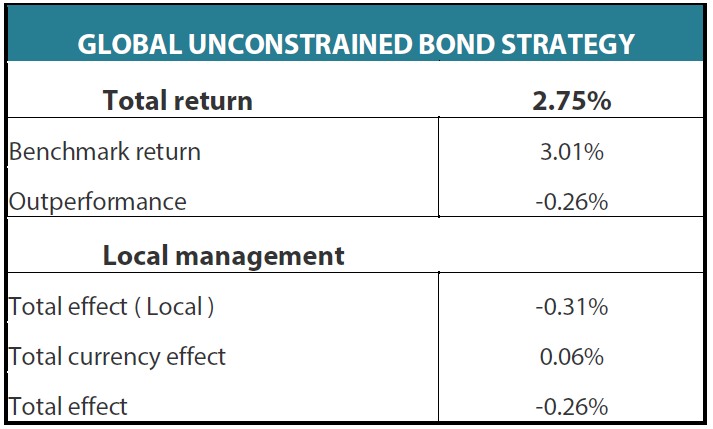

Despite the ongoing challenging global fixed-income environment, the strategy marked another quarter of solid performance. The gross NAV of the strategy gained 2.75% whilst the benchmark increased 3.01%, indicating a marginal underperformance of 26 basis points (bps). A strong rally in bond yields towards the end of the period and interest income earned on the bond holdings were the dominant factors behind the strategy’s positive performance during the quarter. Positive gains from favourable currency moves further complemented this, as despite the short-lived volatility caused by banking turmoil earlier in the period, risk sentiment towards high beta and higher carry foreign exchange (FX) was generally supportive.

Global Unconstrained Bond Strategy Q1 performance

Source: Nikko AM, as at 31 March 2023

Returns are based on Nikko AM Global’s (hereafter referred to as the “Firm”) Global Unconstrained Bond Strategy composite returns. The Firm claims compliance with the Global Investment Performance Standards (GIPS®). Returns are US Dollar based, and are calculated gross of management fees, performance fees and custodial fees but net of all trading commissions. The benchmark for this strategy is the Bloomberg Barclays Global Aggregate Bond Index. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Returns for calculation periods in excess of one year are annualised, but those for the periods of less than one year are not annualised. Numbers in the table may not sum to total due to rounding. Past performance does not guarantee future returns. GIPS is a registered trademark of the CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it..

Market and investment review

Following a sharp rise in market volatility in December 2022, risk sentiment recovered earlier this year, with equity and fixed-income markets rallying simultaneously. The Bank of Japan (BOJ) kept all parameters of its yield curve control toolkit unchanged, which triggered short-lived volatility in the Japanese government bond (JGB) space, as investors' expectations of a wider band around the 10-year tenor were subsequently repriced ahead of the 18 January meeting. In the FX space, the US dollar remained weak as strong risk sentiment favoured several high beta FX currencies, such as the Australian dollar, New Zealand dollar, and Canadian dollar.

However, the substantial risk sentiment and bond market rally observed earlier in the year did not last long. Higher-than-expected non-farm payrolls report in the US and higher-than-anticipated inflation in several developed countries led to a surge in global bond yields and a stronger dollar, dampening risk sentiment.

The final weeks of the review period were characterised by excessive volatility in the bond market following the collapse of a Silicon Valley bank in the US, followed by UBS taking over Credit Suisse in Europe. While the risk of spill-over into the broader financial sector appears contained, outflows of deposits to higher-yielding government money market funds in the US will likely reduce banks' lending to the real economy, which could exacerbate the tightening of financial conditions initiated by the US Federal Reserve (Fed) and other major central banks worldwide.

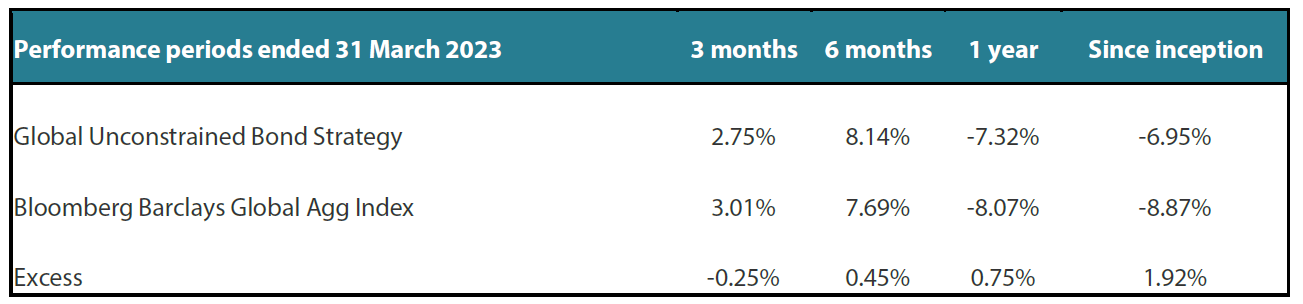

Gross annualised rolling returns since inception

Source: Nikko AM, as at 31 March 2023

Returns are based on Nikko AM Global’s (hereafter referred to as the “Firm”) Global Unconstrained Bond Strategy composite returns. The Firm claims compliance with the Global Investment Performance Standards (GIPS®). Returns are US Dollar based, and are calculated gross of management fees, performance fees and custodial fees but net of all trading commissions. The benchmark for this strategy is the Bloomberg Barclays Global Aggregate Bond Index. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Returns for calculation periods in excess of one year are annualised, but those for the periods of less than one year are not annualised. Numbers in the table may not sum to total due to rounding. Past performance does not guarantee future returns. GIPS is a registered trademark of the CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it..

Portfolio positioning

Within the fixed income portion of the strategy, a higher allocation to interest rate risk was beneficial for its performance. Bond yields have seen steady declines since their peak in October 2022, despite increased volatility during February. Declining commodity prices and, in turn, headline inflation across several jurisdictions supported our long duration call overall. The long duration conviction was expressed through several instruments. In the US, we maintained long positions in 2-year and 10-year bond futures, which proved to be key positive contributors to the strategy’s performance. A strong recovery in risk sentiment following the short-lived banking turmoil in the US and Europe also benefited spread performance, alongside the strategy’s strong duration performance. This resulted in a strong positive contribution from overweight allocations to government-related entities.

The performance of the broader global treasury component was somewhat more mixed. Declining US interest rates lent themselves to strong performance across several local bond markets in both emerging countries, such as South Africa and Mexico, and developed countries such as the UK.

However, the expectation of an early exit from Japan’s long-held ultra-accommodative policy stance was dampened by the BOJ’s unwavering support of the status quo at its March meeting, with focus on the imminent appointment of the new central bank governor. This led to a sharp rally in JGBs, negatively impacting the strategy’s performance via our short position in 10-year JGB futures and the underexposure to cash bonds.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.

In other futures positions, the team's view that the European Central Bank (ECB) was nearing the end of its hiking cycle was thwarted by the stickiness of core inflation. The central bank ramped up their hawkish rhetoric, leading to a loss in our long Euribor Sept23 futures position. The underperformance of the 2s10s flattener in Canada also detracted from performance, as the increasingly dovish central bank policy was met with persistently strong labour markets and resilient economic activity.

Within interest rate swaps, the received positions in 1-year Poland swaps and 3-year Hungarian swap markets returned strong positive gains as inflation stabilised, albeit at a high level. The Australian 1s12s flattener allocation benefited from the Reserve Bank of Australia’s (RBA’s) increased hawkish rhetoric, supported by the country's strong labour market, despite easing inflationary pressures. However, this was partially offset by underperformance in received positions in 2-year New Zealand, where the Reserve Bank of New Zealand (RBNZ) stayed on its hawkish path to bring inflation back to its target, at all costs, partially due to adverse weather conditions clouding near-term inflation dynamics for the country.

In terms of FX positioning, relative performance was marginally positive amid declining FX market volatility, driven by growing expectations that the Fed is nearing the peak in its tightening cycle. During the quarter, the US dollar generally traded weaker against the euro and several higher beta European currencies. Within the region, the Hungarian forint was the strongest performer, appreciating over 6% against the US dollar and outpacing the euro by over 5%, adding circa 12 bps to the strategy’s relative gain. Additionally, the strategy’s overweight allocation to the UK pound contributed a further 6 bps to relative gains, as the currency benefited from a strong recovery in risk sentiment in the latter part of the period, along with domestic activity and inflation data suggesting the need for further rate hikes in the UK. The Norwegian krone was a key outlier, depreciating significantly against both the dollar and euro. The Norwegian krone had a particularly weak month in February, with softer-than-expected inflation causing the short-term interest rate market to price in a near-end to the hiking cycle. The Norges Bank's FX purchases were also perceived to be larger than necessary given recent declines in energy prices and hence related government tax receipts. The weakness in the long Norwegian krone vs Canadian dollar position led to a near 15 bps drag on relative performance.

In other parts of the world, the recovery in risk sentiment and strong yield support, coupled with an improved political backdrop, saw the Mexican and Chilean pesos continue to post strong gains. With both currencies overweight in the strategy, the positive contribution was significant, adding a combined 30 bps to relative gains. In contrast, the South African rand saw a decline in the country's terms of trade (ToT), with weakness in bulk commodity prices, along with ongoing concerns regarding domestic electricity production, putting downward pressure on the currency during the period. Similar weakening pressures were observed among other commodity related currencies, including the Australian and New Zealand dollars, both of which declined over the period, costing around 11 bps of relative performance. More recently, activity data from China appears to confirm that the recovery following the lifting of COVID-related restrictions has largely centred around consumer spending, while industry performance has so far disappointed. This has led to a decline in several commodity prices, putting downward pressure on commodity-linked currencies via declining ToTs.

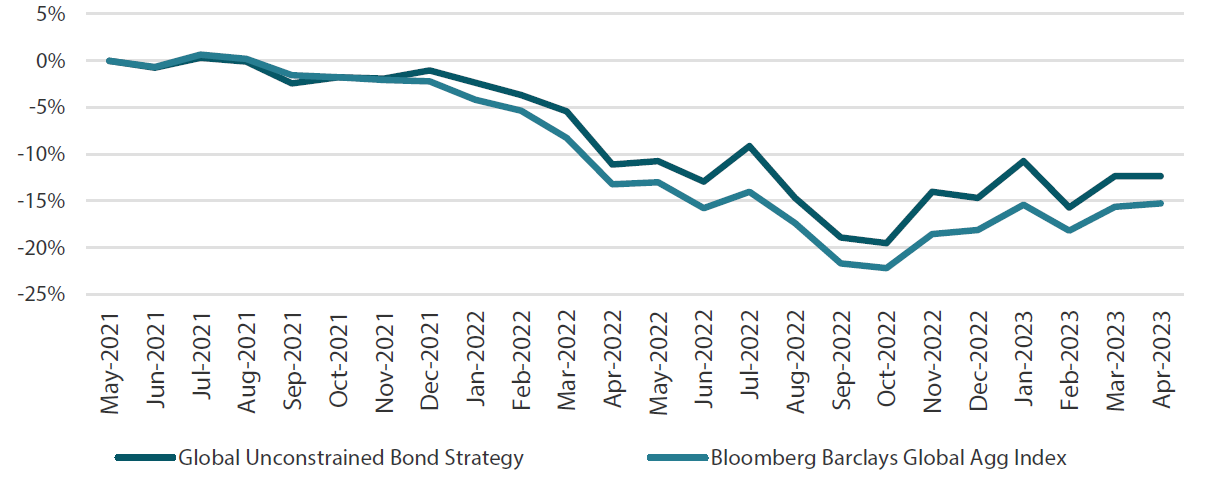

Gross cumulative returns since inception

Source: Nikko AM, as at 31 March 2023

Q2 2023 outlook

The team’s global inflation outlook remains largely unchanged from the previous quarters, and we continue to expect significant disinflation in the coming quarters with recent official inflation prints closely tracking the declines we have seen in leading indicators, such as business surveys and commodity prices. Yet, there remains a significant degree of uncertainty as to whether core inflation pressures will begin to decelerate to the same degree as headline inflation gauges, given the persistence of consumer demand, particularly in services. The US continues to lead the way in terms of disinflation in goods, due to both the prior strength of the dollar and greater energy independence, with gasoline prices having tracked oil prices significantly lower in recent months, while core consumer goods prices have seen relief from an ongoing easing in global supply chains. Services inflation, however, remains far more persistent with the labour market proving stubbornly tight, despite anecdotal reports of large-scale layoffs at major blue-chip companies, though we are now starting to see tentative signs of declining job vacancies and easing wage pressures. More recently we have seen how the Fed, by implementing the fastest rate hike cycle in four decades, has exposed vulnerabilities in the balance sheets of some US regional banks. The recent seizure of First Republic Bank by US regulators marks the second-largest bank failure in US history, following the collapse of Silicon Valley Bank and Signature Bank since March.

In Europe, goods inflation has proven far more unpredictable given the region’s greater dependency on energy supplies, driven by an urgent need to replace Russian natural gas supplies. Nevertheless, even here we have seen tightness in labour markets translate into higher services inflation as public sector workers have regained a degree of bargaining power following years of real wage declines. Yet, the front loading of energy supplies during the summer months, coupled with a mild winter and voluntary reductions in energy consumption have translated into significant declines in imported energy prices in recent months. This, coupled with government support packages, will cushion domestic consumption in the coming months and could allow many countries to avoid, a once seemingly inevitable, recession during 2023.

Despite the improving energy situation in Europe, the ECB has remained adamant in its goal to hike interest rates further, partially, in our view, due to the delay in commencing monetary policy normalisation—hence the lagged effects of previous rate hikes are yet to materialise in weaker demand indicators. Conversely the Fed is now witnessing the impact of its earlier, aggressive, interest rate hikes, most notably via stress in the regional bank and commercial property sector. The team believes the Fed has now reached the end of its hiking cycle, with an inverted yield curve continuing to flash a warning sign of an imminent recession. As a result, the team has maintained a significant exposure to US government bonds, principally via both 10-year and 2-year Treasury futures. More recently the team has reduced its underweight to Eurozone duration, principally via short term interest rate futures, as we expect the ECB to follow the Fed in ending its hiking cycle within a few months with a skew towards downside inflation risks translating into a lower terminal rate than both the ECBs forecast and current interest rate market expectations. Within European sovereign bonds we maintained a preference for Spain. Net supply is likely to remain elevated in 2023 for both France and Germany, with generous government support packages coupled with the ECB’s quantitative tightening programme likely to lead to underperformance, in our view. Elsewhere in government related bonds, we continue to see Danish covered bonds as an attractive relative value alternative to core Eurozone government bonds.

Outside of the US and Eurozone the team has also maintained its opportunistic approach to other developed rates markets. New Zealand still screens as the cheapest developed local rates market. Meanwhile, we are seeing significant weakness in the domestic property market which, in the team's opinion, is likely to result in a reversal of monetary policy tightening in the coming quarters as consumer spending is squeezed significantly. Meanwhile, in Australia the team are positioned for a flatter curve, yet with a net overweight duration bias as while the RBA’s earlier reduction in hiking magnitude proved premature the economy is facing similar challenges to many of its developed market counterparts, with high interest rate sensitivity in the property market. The team also has an overweight duration stance in the UK and Sweden, on similar grounds. In Canada, the team opportunistically reduced its overweight duration stance following a dovish pivot from the Bank of Canada, with relative valuations subsequently appearing rich relative to developed market counterparts.

Despite the strong performance in recent months the team still sees value in several emerging local rates markets given the pre-emptive tightening cycle of many emerging central banks. The team believes that short-term interest rate expectations in Poland and Hungary remain excessive given the domestic inflation outlook is set to improve sharply in the coming months. Value also persists in both South Africa and Mexico local government bonds given their domestic inflation outlooks remain benign relative to developed markets, yet both already trade at significantly higher real rates.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.

In currencies, given the end of the Fed’s hiking cycle has coincided with positive growth momentum from China’s abolishment of zero-COVID policy restrictions the team further reduced its US dollar exposure in favour of several China sensitive currencies including the New Zealand dollar, Australian dollar, Chilean peso and South African rand relative to the US and Canadian dollars. Within Europe, the team prefers more cyclical, and higher yielding, exposure such the Norwegian krone and Hungarian forint to the euro given the improving growth and inflation outlook. More recently the team also opportunistically added an overweight position in the UK pound relative to the euro as the divergence in monetary policy expectations reached extremes while the UK growth trajectory had begun to consistently beat overly pessimistic projections.

We have recently further reduced municipal spread risk, namely California, given strong outperformance relative to corporate credit.

Finally, within corporate credit market the team has maintained a preference for higher quality credit as lower rates volatility lends support to investment grade credit, yet earnings pressure is likely to weigh on lower quality names as default risk is likely to remain elevated for some time. Within investment grade corporate credit, the team also maintained a preference for European credit relative to US given concerns over the health of US regional banks. As such the team’s exposure to US investment grade credit has been more opportunistic, following a more systematic allocation. Towards the end of the quarter the team opportunistically added exposure to European financials via the iTraxx Senior Financials index as we believed the recent spread widening was excessive given limited contagion risks from US regional banks.