Summary

- US Treasury (UST) yields traded in a very tight range, with the yield curve ending flatter in July. The month opened to encouraging economic data released out of the US and China. However, there was heightened concern that the increasing spread of COVID-19 in the US had diminished its economy's momentum. Elevated tensions between the US and China, and the continued failure by the US Congress to reach a consensus on a new stimulus package also kept UST yields low. Overall, 2-year and 10-year UST yields ended the month at 0.107% and 0.529%, respectively, for declines of about 4.3 basis points (bps) and 12.8 bps from the prior month.

- Asian credits returned 2.20% in July, driven by a 26 bps tightening in credit spreads. Positive risk sentiment led high-yield (HY) credits to outperform, gaining 2.42%, with spreads contracting 50 bps. High-grade (HG) credits registered a total return of +2.13%, with spreads tightening 20 bps.

- In July, a total of 77 new issues amounting to US dollar (USD) 32.25 billion were raised in the primary market. Within the HG space, 38 new issues amounting to USD 19.56 billion were raised. Meanwhile, the HY space saw USD 12.69 billion being raised from 39 issues.

- Regional inflation prints remained low in June, although they did come off the levels seen in May. Monetary authorities in Indonesia and Malaysia trimmed their policy rates while Singapore and South Korea slipped into recession in the second quarter. Separately, China’s economy grew by 3.2% year-on-year (YoY) in the second quarter, rebounding from the first quarter's contraction as COVID-19 restrictions were relaxed, and the government rolled out stimulus measures to prop up the economy.

- We prefer Indonesian and Malaysian bonds, as we believe liquidity dynamics will drive near-term outperformance for these two spaces. On currencies, we expect the Singapore dollar (SGD), Chinese yuan (CNY) and South Korean won (KRW) to outperform.

- We expect Asian credit spreads to continue tightening slowly. That said, we will continue to monitor downside risks to this moderately constructive outlook, including the risk of a second COVID-19 wave leading to the re-imposition of activity restrictions. A more impactful escalation of geopolitical tensions between the US and China, such as the “Phase One” trade deal being derailed, also remains a persistent risk.

Asian rates and FX

Market review

UST yields end the month lower

UST yields traded in a very tight range, with the yield curve eventually ending flatter in July. The month opened to encouraging economic data out of the US and China, which fuelled hopes the world's two largest economies are on track to recover from damage caused by the COVID-19 outbreak. In particular, there was a big leap in US jobs growth and a firm gain in headline consumer price index (CPI) in the month of June. Meanwhile, China's second quarter gross domestic product (GDP) growth print suggested it was on course for a V-shaped recovery. However, as a handful of high frequency US economic numbers towards end-July began falling short of expectations, there was heightened concern that the increasing COVID-19 spread in the US has diminished its economy's momentum. Separately, elevated tensions between US and China, and the continued failure by the US Congress to reach a consensus on a new stimulus package also kept UST yields low. Towards month-end, the US Federal Reserve (Fed) pledged to keep rates low, and announced that it would extend its emergency lending programmes through the end of the year. Overall, 2-year and 10-year UST yields ended the month at 0.107% and 0.529%, respectively, for declines of about 4.3 basis points (bps) and 12.8 bps from the prior month.

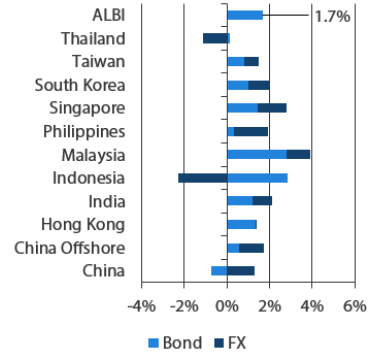

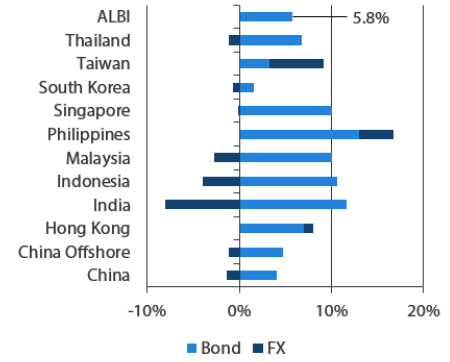

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 July 2020

For the year ending 31 July 2020

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 July 2020

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures accelerate in June

Regional headline CPI prints remained low in June, although they did come off the levels seen in May. South Korea's annual inflation printed flat, following negative growth a month earlier. In China, CPI inflation edged up in June, driven mainly by higher vegetable prices. China’s producer price index inflation also rebounded, reflecting higher oil and commodity prices as well as a low base. June's CPI inflation ticked higher in the Philippines, on the back of gains in food prices and the normalisation of transport costs with crude oil prices recovering. Elsewhere, consumer price inflation in both Malaysia and Thailand remained in negative territory for a fourth straight month in June, though the rates of -1.9% and -1.6% YoY, respectively, were significant recoveries from the readings in May.

Monetary authorities in Indonesia and Malaysia trim policy rates

Bank Negara Malaysia (BNM) and Bank Indonesia (BI) both reduced their policy rates by 25 bps, citing the need to continue supporting growth amid COVID-19. Both central banks now expect their respective second quarter GDP growth to have contracted, due primarily to large-scale social restrictions implemented by the governments. Notably, BI's policy statement sounded less dovish than at the previous meeting when the policy rate was also lowered by 25 bps. In particular, July's statement no longer explicitly mentioned that room for a further rate cut is available. In contrast, BNM maintained its dovish stance, leaving the door open to further monetary easing. It also added that it sees downside risks to growth in the event of a second wave of COVID-19 infection and a weaker-than-expected recovery in global growth.

China's second quarter growth registers 3.2% YoY; Singapore and Korea slips into recession

The Chinese economy grew by 3.2% YoY in the second quarter, rebounding from the first quarter's contraction as COVID-19 restrictions were relaxed, and the government rolled out stimulus measures to prop up the economy. Notably, the expansion was larger than the 2.4% rise markets had expected. In contrast, both the Singapore and South Korea economies plunged into recession in the second quarter. Singapore's advance estimates showed growth contracted 41.2% quarter-on-quarter (QoQ), as the extension of "circuit breaker" measures shuttered most businesses and external demand weakened. Similarly, South Korea's economy slumped 3.3% QoQ, following a 1.3% contraction in the prior quarter. A sharp decline in exports, slower growth in government spending and lower fixed investment growth were the primary drivers of the contraction in the second quarter growth.

Market outlook

Prefer Indonesian and Malaysian bonds

Economic data to be released for 2Q 2020 is likely to show record-setting deterioration, with a slight hint of this already seen in the 1Q 2020 numbers. GDP growth should then improve in 2H 2020 from the 2Q lows, although we expect the pace of recovery to vary. Meanwhile, decisive action by major central banks to inject liquidity and improve funding markets will continue to support the hunt for carry when risk sentiment stabilises. The US Fed has also reiterated that interest rates would be kept lower for longer, which will support capital flow into Asia.

Within the region, we believe that liquidity dynamics for Indonesian and Malaysian bonds will drive near-term outperformance for the two spaces. The burden sharing arrangement between BI and the Indonesian government has somewhat alleviated supply concerns, as net bond issuance is reduced. Officials have also given assurance that it is a one-off policy under an exceptional situation. Meanwhile, we see scope for BNM to increase monetary accommodation, which will be positive for Malaysian bonds. We note that foreign positioning for both spaces remains relatively light, and a return of offshore capital should bode well for the bonds.

That said, we will continue to monitor downside risks, particularly the risk of new waves of COVID-19 cases globally and re-emergence of geopolitical tensions between the US and China, which could dampen sentiment anew in the near-term. However, we note that actions by governments and central banks (particularly the Fed) are likely to prevent a steep decline in markets, should risk aversion prevail.

SGD, CNY and KRW expected to outperform

Unlike other regional central banks, the Monetary Authority of Singapore has continually reiterated its strong preference for stable monetary policy at the re-centred SGD Nominal Effective Exchange Rate levels, despite expectations that the output gap could turn even more negative. We believe this would support the outperformance of the SGD in the near term. We also have constructive views on the CNY and KRW. Our anticipation of better offshore portfolio inflows into Chinese securities markets and the combination of a weaker USD environment amid improving China macro data should continue to support CNY strength. Similarly, we believe the strong tech cycle would lift demand for South Korean exports and support the appreciation of the KRW.

Asian credits

Market review

Asian credits register gains in July

Asian credits returned 2.20% in July, driven by credit spreads tightening 26 bps. Positive risk sentiment led HY credits to outperform, gaining 2.42%, with spreads contracting 50 bps. HG credits registered a total return of +2.13%, with spreads tightening 20 bps.

The month opened to encouraging economic data released out of the US and China, which fuelled hopes that the world’s two largest economies are on track to recover from damage caused by the COVID-19 outbreak. China’s positive second quarter GDP growth print largely affirmed this improving trend. On the fiscal policy front, European Union (EU) leaders reached agreement on a landmark EUR 750 billion EU Recovery Fund that met market expectations on aspects such as overall size and split between grants and loans. Against this constructive market backdrop, Asian credit spreads tightened, largely disregarding the continued souring of US-China relations, as well as the surge in COVID-19 cases in the US and some large emerging market (EM) countries. Towards month-end, positive news on a potential COVID-19 vaccine, together with the US Fed’s announcement it will extend all of its emergency lending programmes until end of year, spurred risk sentiment further. Technicals also remained strong thoughout the month, with positive inflows into EM hard currency bond funds. By country, Indonesian credits outperformed, while Hong Kong credits underperformed. The formal adoption of the new national security law dampened investor sentiment for Hong Kong credits at the start of the month. Subsequently, a resurfacing of COVID-19 cases in Hong Kong also negatively affected demand in the space. That said, spreads nevertheless ended tighter in end-July.

Primary market activity remains active in July

The month saw a total of 77 new issues amounting to USD 32.25 billion being raised in the primary market. Within the HG space, 38 new issues amounting to USD 19.56 billion was raised, including the USD 1.45 billion two-tranche quasi-sovereign issue from China’s State Grid Overseas Investment, USD 1.6 billion two-tranche issue from ICBC Hong Kong and USD 1.2 billion two-tranche issue from China Construction Bank Hong Kong. Meanwhile, the HY space saw USD 12.69 billion being raised from 39 issues.

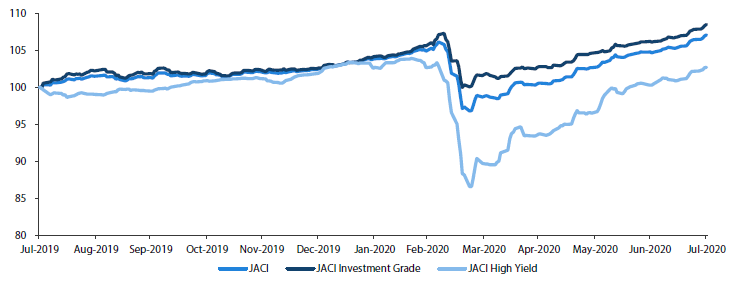

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 July 2019

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: Bloomberg, 31 July 2020

Market Outlook

Asian credit spreads to continue its slow grind tighter, though downside risks remain

Asian credit spreads are expected to continue tightening slowly. Most Asian economies have likely seen the worst of the economic downturn in Q2, and high-frequency indicators suggest a recovery is underway. The first half and second quarter earnings season for Asian banks and non-financial companies are about to kick off and are likely to reflect the severe impact of the COVID-related lockdowns. However, with the broader economic recovery, we should see better sequential results in the second half of the year, with negative rating migration and high-yield defaults higher but remaining manageable overall.

At the same time, we expect both developed and emerging market central banks to maintain their loose monetary policies, including supportive measures targeted at the credit market. Pro-active fiscal policy in many countries add to the support for broader economy and credit fundamentals. However, given the sharp rally in credit spreads in recent months, the pace of tightening should slow with more regular episodes of market pull-back as investor sentiment remains fragile due to the unprecedented nature of the economic shock.

We continue to monitor downside risks to this moderately constructive outlook, including the risk of a second COVID-19 wave leading to the recent re-imposition of activity restrictions such as in Hong Kong, Australia, and parts of the US. After the initial bounce following the economic reopening in May and June, the resurgence of new COVID-19 cases poses a downside risk to the anticipated economic recovery in the second half of the year. A more impactful escalation of geo-political tensions between the US and China, such as the “Phase One” trade deal being derailed, remains a persistent risk.