Summary

- The US Treasury (UST) yield curve steepened in August. Yields initially traded in a tight range but experienced an abrupt rise mid-month, pushed higher by the uptick in the US July inflation readings and the US Treasury's outsized refunding announcement. Expectations of rising inflation caused longer-term rates to ratchet higher. Overall, 2-year and 10-year UST yields ended the month at 0.132% and 0.706%, respectively, about 2.5 basis points (bps) and 17.7 bps higher than July.

- Asian credits returned 0.40% in August. Although credit spreads tightened by 9 bps in the month, overall gains were tempered by the sell-off in USTs. There was a relatively elevated supply of new issuances in the month, with a total of 51 new issues amounting to US dollar (USD) 20.02 billion being raised in the primary market.

- Within the region, inflation prints remained low in July, although most did edge up from June levels. Regional monetary authorities left their policy rates unchanged. Separately, economic activity in the region saw a significant slump in the second quarter, reflecting weak external demand and the impact from lockdown measures that were introduced to help limit the spread of COVID-19.

- We maintain our preference for Indonesian bonds due to the country's low inflation, attractive carry and flush onshore liquidity. On currencies, we expect the Singapore dollar (SGD) and Chinese yuan (CNY) to outperform.

- We expect Asian credit spreads to continue tightening slowly. That said, we will continue to monitor downside risks, which include a more severe resurgence of COVID-19 and the economic recovery stalling after the strong initial bounce amid still-cautious consumer sentiment. An escalation of geopolitical tensions between the US and China, especially with the US election season now in full swing, also remains a persistent risk.

Asian rates and FX

Market review

The UST yield curve steepens in August

Yields initially traded in a tight range but experienced an abrupt rise mid-month, pushed higher by the uptick in US July inflation readings and the US Treasury's outsized refunding announcement. Yields slipped back down thereafter, following domestic data that pointed to a deceleration in US economic recovery. Towards the month-end, Federal Reserve (Fed) Chairman Jerome Powell announced a major shift in the central bank's approach to achieve maximum employment and its inflation goal, as it formally adopted an average inflation targeting policy. Consequently, expectations of rising inflation on the horizon caused longer-term rates to ratchet higher. Throughout the month, a failure by the Republicans and Democrats to reach a legislative consensus regarding further fiscal stimulus capped UST yields. Overall, 2-year and 10-year UST yields ended the month at 0.132% and 0.706%, respectively, about 2.5 bps and 17.7 bps higher than July.

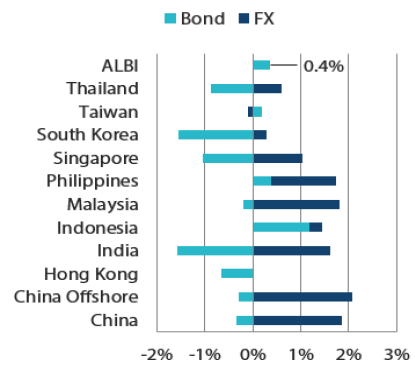

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 August 2020

For the year ending 31 August 2020

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 August 2020

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflation readings pick up slightly in July

Regional headline consumer price index (CPI) prints remained low in July, although most did edge up from June levels. The CPI inflation in Thailand registered the smallest decline in four months as food prices increased and domestic activity resumed. In the Philippines, headline inflation inched up to 2.7% on the back of higher transport and utility costs. Rising food and energy prices pushed China's CPI index to 2.7% in July. Meanwhile, Malaysia's headline CPI fell for the fifth month in a row, falling 1.3% year-on-year (YoY) after declining 1.9% in the prior month. India's headline CPI stood out, rising sharply above expectations to 6.9% YoY in July after climbing 6.2% in June, driven by a resurgence of both food and core inflationary pressures.

Monetary authorities leave policy rates unchanged

Regional central banks left their policy rates steady in August. According to Thailand's Monetary Policy Committee (MPC), fiscal policy should play a greater role for now. Subsequent minutes of the MPC meeting revealed that the committee preferred to "preserve the limited policy space in order to act at the appropriate and most effective timing", as it believes economic activity would take a minimum of two years to return to pre-pandemic levels. In Indonesia, the central bank also left rates unchanged, despite low inflation and a weak growth outlook, citing the need for FX stability. Meanwhile, as a result of recent elevated inflationary pressures, the Reserve Bank of India voted unanimously to maintain its accommodative stance, but it kept policy rates on hold for now. Elsewhere, monetary authorities in South Korea and the Philippines also opted to leave their respective policy rates unchanged; the Bangko Sentral ng Pilipinas described its decision to hold pat as a "prudent pause" that allows previous measures it implemented to work their way through the economy.

Regional Gross Domestic Product (GDP) growth plunges in the second quarter

Economic activity in the region slumped significantly in the second quarter, reflecting weak external demand and the impact from lockdown measures that were introduced to help limit the spread of COVID-19. Singapore's economy entered a technical recession, with growth contracting 13.2% YoY in the period, on the back of meaningful slowdowns in the construction and services sectors. A collapse in domestic demand prompted GDP growth in Indonesia to fall 5.3% YoY and below the Ministry of Finance's forecast range of -3.5 to -5.1%. In India, GDP growth shrunk by 23.9% YoY in the second quarter—the steepest pace of contraction on record. Elsewhere, Malaysia and the Philippines suffered steep GDP contractions of 17.1% and 16.5% YoY, respectively, as private consumption plummeted. Meanwhile, the recession in Thailand deepened, with GDP growth deteriorating to -12.2% YoY in the second quarter.

Market Outlook

Indonesian bonds favoured

The Fed's formal adoption of an average inflation targeting policy has resulted in a steepening in the UST yield curve, and regional yield curves have followed suit. We expect this bear steepening trend to gain traction moving forward. Consequently, we deem it prudent to remain defensive in duration positioning for now. Within the region, we continue to favour Indonesian bonds because of the country's low inflation, attractive carry and flush onshore liquidity as Bank Indonesia manages the open market operation rates lower.

SGD and CNY expected to outperform

We see further scope for regional currencies to appreciate against the USD. This appreciation bias, in our view, will be supported by the Fed's policy shift that suggests current ultra-low rates in the US are likely to stay lower for longer. In addition, the improvement in risk sentiment and impending economic recovery in the region should help push regional currencies higher.

Unlike other regional central banks, the Monetary Authority of Singapore has reiterated its strong preference for stable monetary policy at the re-centred SGD nominal effective exchange rate levels, despite expectations that the output gap could turn even more negative. We believe this would support the outperformance of the SGD in the near-term. Moreover, we see scope for further gains in the SGD as regional trade recovers and broad USD weakness persists. We also expect the CNY to outperform regional peers. Our anticipation of better offshore portfolio inflows into Chinese securities markets and the combination of a weaker USD environment amid improving China macro data should continue to support the CNY.

Asian credits

Market review

Asian credits end higher in August

Asian credits returned 0.40% in August. Although credit spreads tightened by 9 bps in the month, overall gains were tempered by the sell-off in USTs. Consequently, high-yield (HY) credits outperformed, gaining 2.15% with spreads contracting 41 bps. High-grade (HG) credits ended the month weaker, registering a total return of -0.10%, despite spreads tightening by 7 bps.

Asian credits had a strong start in August. An improvement in risk sentiment, prompted by better-than-expected economic data released from US and China, caused a meaningful tightening in spreads. Meanwhile, the markets mostly ignored the continued escalation in US-China tensions. That said, select credits, particularly within the Chinese technology space, experienced some widening in spreads on concerns that new measures announced by the Trump administration against the sector would negatively impact their operations. Towards the latter half of the month, the tone in the Asian credit market softened slightly, and the earlier tightening in spreads partially reversed as a result. The rise in cautious sentiment was triggered in part by the lack of fresh fiscal stimulus from the US and economic data implying some deceleration in the global economic recovery. The Chinese central bank also published policy notes that cooled down expectations for further monetary easing, while guidelines for bond sales of Chinese property developers were tightened. Additionally, the heavier-than-usual supply from the Asian credit primary market weighed on secondary performance, despite continued net inflows into Emerging Market (EM) hard currency bond funds.

As widely expected, 2Q and 1H 2020 earnings of financials and non-financial corporates across Asia were generally softer on a year-on-year basis, due to the direct and indirect impact of economic disruptions caused by the COVID-19 pandemic. The pressure on earnings and credit metrics was felt more acutely in sectors such as retail and consumer, oil & gas, transportation and banks, while sectors such as telecommunications, media and technology (TMT) and utilities showed greater resilience. Bank earnings were weaker across the region, with delayed impact from loan moratoriums expected to further pressure the banks’ asset quality. That said, Asian banks are generally well capitalised, have good and stable access to funding and possess ample liquidity to weather the deterioration in asset quality, in our view. China real estate developers reported resilient 1H 2020 results, with most still registering growth in revenues and earnings and enjoying relatively stable credit metrics. Overall, the extent of credit rating downgrades across sectors directly resulting from these weaker earnings results have not been significant.

Against this backdrop, all major country segments, save for South Korea and the Philippines, saw spreads tighten in August. The meaningful narrowing in Indian credit spreads was driven mainly by financials, as regulations turned supportive for the sector. Towards the month-end, Standard & Poor’s announced negative ratings actions across a number of Thai banks, which caused some widening pressure on spreads of subordinated debt issued by the banks.

Primary market activity remains active in August

The month saw a relatively elevated supply of new issuances, with a total of 51 new issues amounting to USD 20.02 billion being raised in the primary market. Historically, August has been a slow month for new issues due to the summer break and black-out period for issuers. Within the HG space, 28 new issues amounting to USD 12.8 billion were raised, including the USD 1.2 billion two-tranche issue from CMB International Leasing, USD 1.2 billion issue from Hong Kong’s MTRC Corp, and USD 1.0 billion issue from Malaysian telco operator Axiata. Meanwhile, the HY space saw USD 7.22 billion being raised from 23 issues, including the USD 1.4 billion issue from Vedanta Resources.

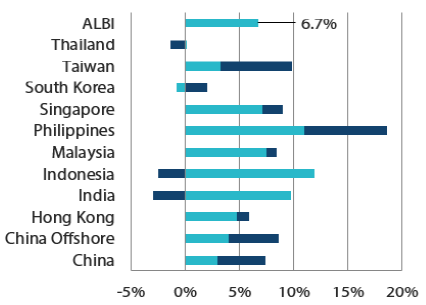

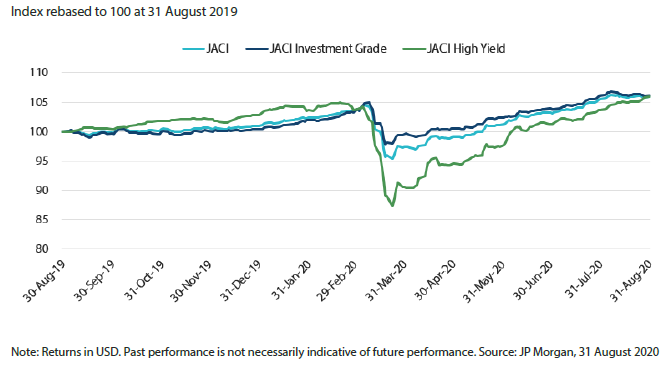

Chart 2: JP Morgan Asia Credit Index (JACI)

Market outlook

Asian credit spreads to continue tightening slowly, though downside risks remain

Asian credit spreads are expected to continue tightening slowly. Most Asian economies have likely seen the worst of the economic downturn in Q2, and high-frequency indicators suggest a recovery is underway. As expected, the first half and second quarter earnings season for Asian banks and non-financial companies reflected the severe impact of the COVID-related lockdowns. However, with the broader economic recovery, we should see better sequential results in the second half of the year, with negative rating migration and high-yield defaults higher but remaining manageable overall.

At the same time, we expect both developed and EM central banks to maintain their loose monetary policies, including supportive measures targeted at the credit market. Proactive fiscal policies in many countries add to the support for broader economy and credit fundamentals. Further progress on potential vaccines and better treatment for COVID-19 also lend support to the positive backdrop. However, given the sharp rally in credit spreads in recent months, the pace of tightening should slow with more regular episodes of market pull-backs as investor sentiment remains fragile due to the unprecedented nature of the economic shock.

We continue to monitor downside risks to this moderately constructive outlook, including the risk of a more severe resurgence of COVID-19 and the economic recovery stalling after the strong initial bounce amid still-cautious consumer sentiment. An escalation of geopolitical tensions between the US and China, especially with the US election season now in full swing, also remains a persistent risk.