The Nikko AM Global Credit strategy is actively managed using fundamental top-down and bottom-up credit research to create diversified portfolios. The strategy draws on fundamental credit analysis as the primary contributor of returns and complements pure credit selection and credit allocations with other drivers, including currency and interest rates.

Our Philosophy

The investment team believes credit is most effectively managed within a global context, allowing fundamental research to determine asset allocation and security selection, tempered by awareness of the asymmetric risks of credit exposures.

Key Differentiators

- We do not have a home bias; our well-established fixed income teams located in Europe, Singapore, Japan and New Zealand allow the Global Credit team to develop a holistic and balanced view by drawing on local expertise and on-the-ground research from around the world.

- We employ a pragmatic approach and deploy our resources to areas where we see value.

- We are innovative. Credit research and Risk Management are supported by proprietary quantitative models which allow us to focus on alpha generating ideas.

- We are communicative. Regional teams communicate both formally and informally to share information and research. This additional insight allows the team to execute quickly once they have made a decision.

Insights

Collaboration

Diversity

Quality Research

Issue Selection

Interest Rate Forecasting

Currency Management

Holger joined Nikko AM in July 2015 to help develop the firm's Global Credit and Sustainable Investment capabilities. Prior to Nikko AM, Holger worked at Lazard Asset Management and held a variety of roles based in both Frankfurt and London, where he was Lead Portfolio Manager for Corporate Bonds. Before Lazard, he worked for Deka Investment Management where he was a Fund Manager/Analyst for Corporate Bonds. Holger began his career at DG Bank as a Fixed Income Trade & Sales assistant. He holds a Masters in Business Management and Economics from the Frankfurt School of Finance & Management and is a CFA® Charterholder.

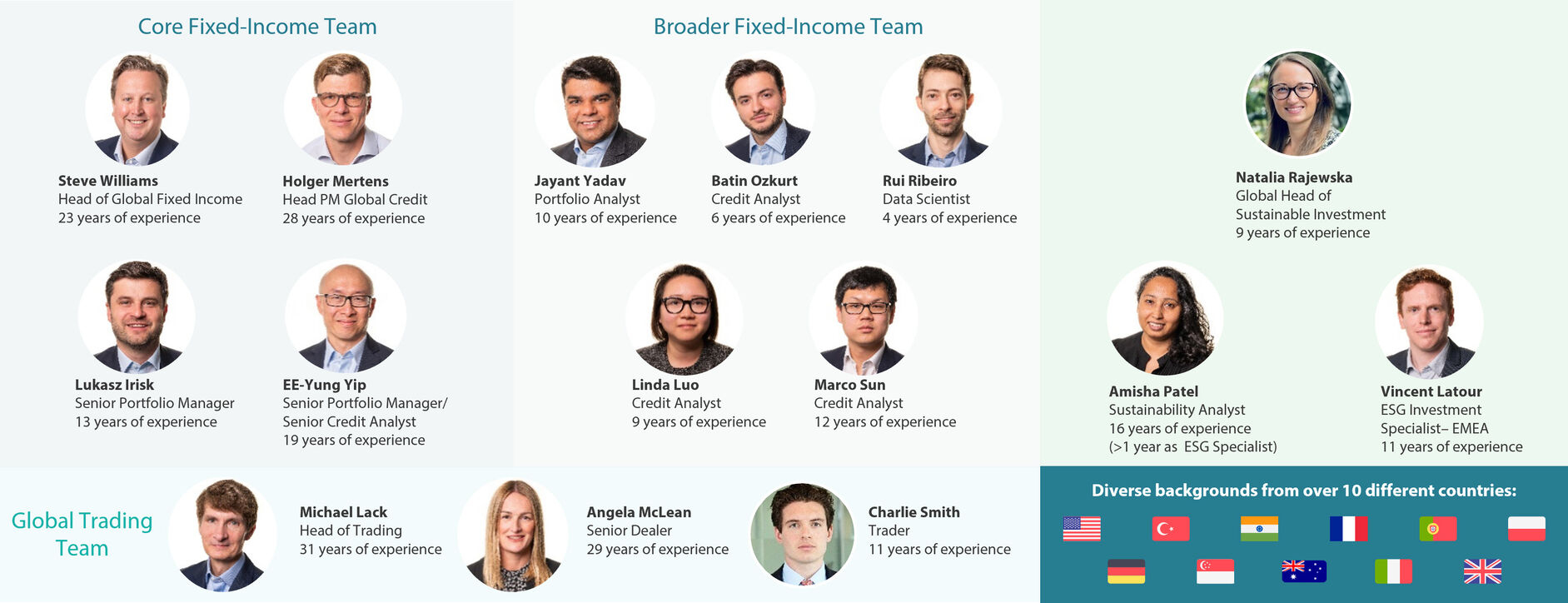

The Global Credit team is comprised of five investment professionals headed by Holger Mertens and supported by Steve Williams, Ee-Yung Yip, Marco Sun, Batin Ozkurt and Linda Luo. The team sits within the wider Global Fixed Income team based in London, and consists of 12 investment professionals with extensive investment management experience.

The London team has significantly broadened its capabilities over time to develop tailored solutions for global institutional clients. One of the team’s core differentiators is their fluid interaction and ability to execute decisions quickly across five categories: Global Credit, Currency, Core Markets, Emerging Markets and Research & Solutions. The diagram below illustrates the organisational structure of the London-based Global Fixed Income Team:

Global Credit also draws upon regional insights from Nikko AM’s credit specialists located in Europe, Singapore, New Zealand and Japan and there are 23 dedicated credit investment professionals in Nikko AM’s global investment network.

Global Credit Team

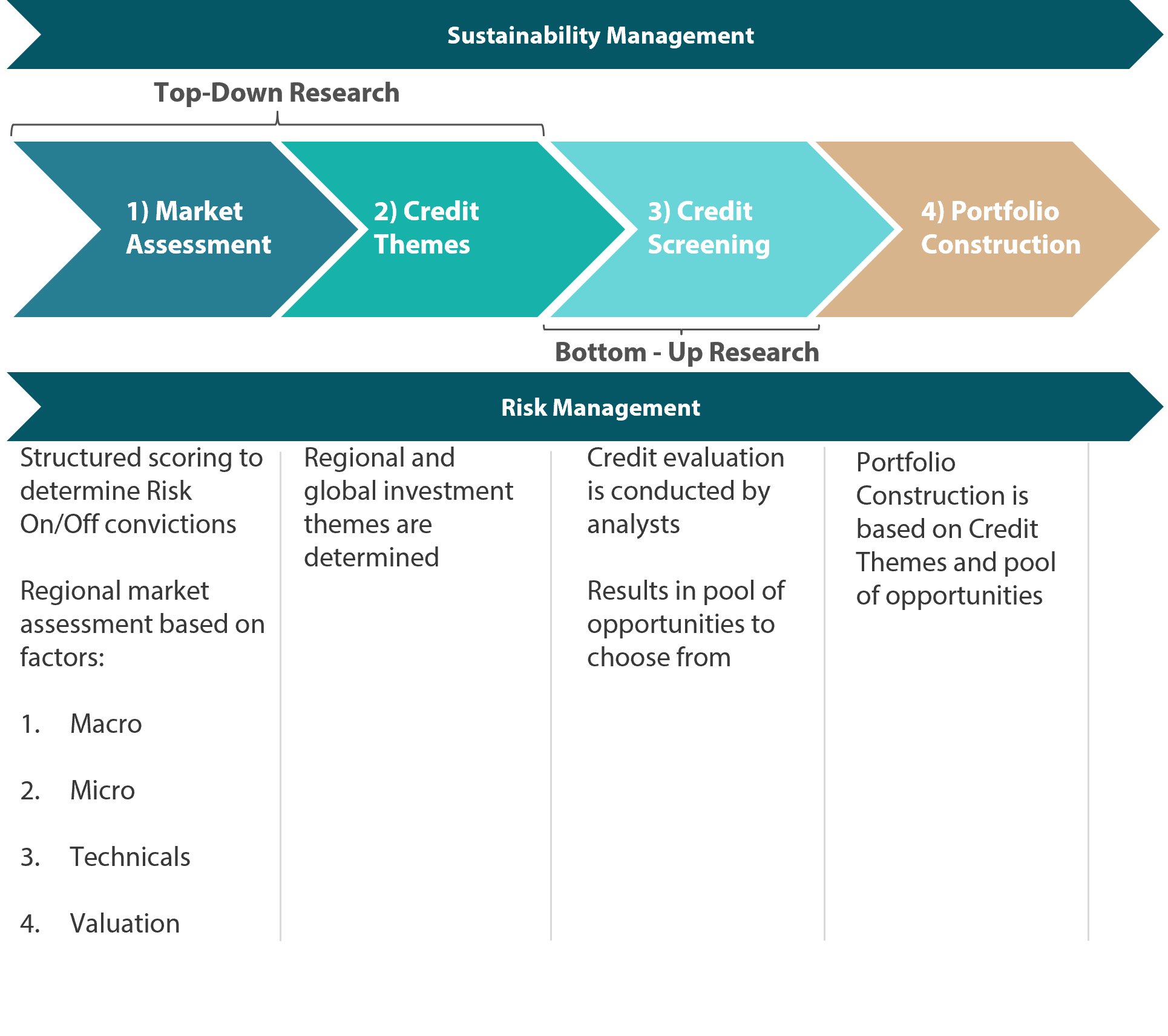

The investment process draws upon a global team of research analysts which follow a consistent investment process that incorporates quantitative and qualitative inputs from experienced investment professionals. The process is disciplined and transparent, which engages the team in a collaborative process to generate ideas and construct a high quality Global Credit portfolio.

The Nikko AM Global Credit Strategy was launched in August 2016 and is the flagship Global Credit strategy with wide investment powers permitting the Head Portfolio Manager to use discretion, showcasing Nikko AM’s broad credit capabilities. The portfolio is actively managed by Holger Mertens and his team using fundamental top-down and bottom-up credit research to create a diversified portfolio. The strategy aims to achieve a competitive absolute and relative return while managing risk. Key features of the strategy are detailed below:

- Draws on fundamental credit analysis as the primary contributor of returns

- Approach complements pure credit selection with other drivers, including currency and interest rates

- Average number of issues: 70-120

- Over a full credit cycle aims to achieve an above average annual return

- Targets 1.5% outperformance over the Bloomberg Barclays Global Aggregate Corporate Index

- Aims for absolute positive return of 4% over a longer term horizon

- Targets tracking error of 1-3%

- Maximum high yield exposure of 30%

- Risk divided into systematic and unsystematic components

The team continually reviews its product line to develop innovative strategies that are focused on higher yielding and higher credit quality solutions, which meet client needs for positive yields. Current AUM is approximately USD 8.5 billion.

“Building on our strong client relationships and extensive investment skills, the team has been able to tailor specialised investment solutions for our institutional clients”