Investment Philosophy

Dividends serve as indicators that encapsulate company fundamentals such as earnings potential, financial strength, and management strategy. Dividend yield is therefore an effective factor for long term investment. The strategy’s focus is not solely on the current level of dividend yield but also on dividend growth potential. Through bottom-up research, the investment team evaluates a company's competitiveness, cash generation potential and business strategy. The strategy aims to deliver stable total returns from both income and capital gains.

Focus on dividend yield and dividend growth potential

The Strategy invests in competitive companies paying high dividends. Competitive companies have cash generating ability - the question is how the cash is utilized. Superior management teams balance investments and shareholder returns to create a virtuous cycle of cash flow generation.

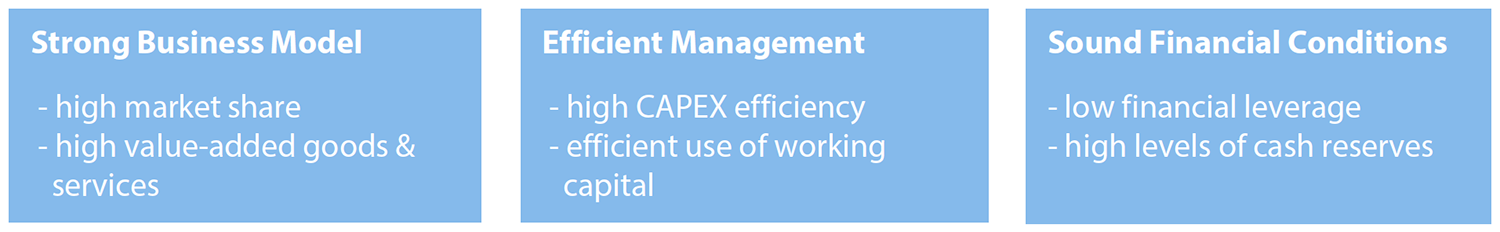

When assessing a stock’s dividend growth potential, the focus is on a company’s ability to generate cash, the source of dividend payouts. Some key attributes the investment team looks for are a strong business model, efficient management, and sound financial conditions. A strong emphasis is placed on direct contact with company management. Through interactions with the senior management, the investment team seeks to determine the company’s competitive edge, generation and uses of cash, and stance towards shareholder returns.

Established investment team with robust research platform

Toshinori Kobayashi is the team leader of the Research Active Management Team and lead portfolio manager for the strategy. He has over 25 years’ industry experience with extensive background in value, growth, small cap, and thematic portfolios.

He is supported by Nikko AM’s robust equity research platform. The centralised research effort, consisting of a team of experienced analysts, has strength across all sectors, market caps and styles and a strategist with over 30 years’ industry experience.

Key Characteristics

Screening by dividend yield

The investment universe is put through a dividend yield screen, based on the 12-month forward dividend yield. The universe is narrowed down to stocks with above-average dividend yield. This step typically narrows the range to 400 – 500 stocks.

Narrowing via bottom-up research

Among the stocks that currently have high dividend yield, potential investments are further narrowed down via bottom-up corporate research. The aim is to identify companies with potential to grow dividends and sustain a high level of dividends.

The focus of the research is in identifying high quality companies that are competitive and have the ability to generate cash flow. The following are examples of key attributes that the investment team looks for:

Portfolio characteristics

- Approximately 50 stocks

- High dividend

- High quality bias e.g. high ROE, low leverage

- Low valuation bias e.g. low PER

- No bias towards low growth or utility stocks (despite common perception that high dividend portfolios have large exposure to such names)

- Low beta and volatility

Investment Process