Investment Philosophy

We seek to identify undervalued companies capable of achieving high sustainable returns and benefiting from

positive fundamental change to capture superior returns in Asia; one of the most dynamic and fast changing

regions in the world.

We seek to identify undervalued companies capable of achieving high sustainable returns and benefiting from

positive fundamental change to capture superior returns in Asia; one of the most dynamic and fast changing

regions in the world.

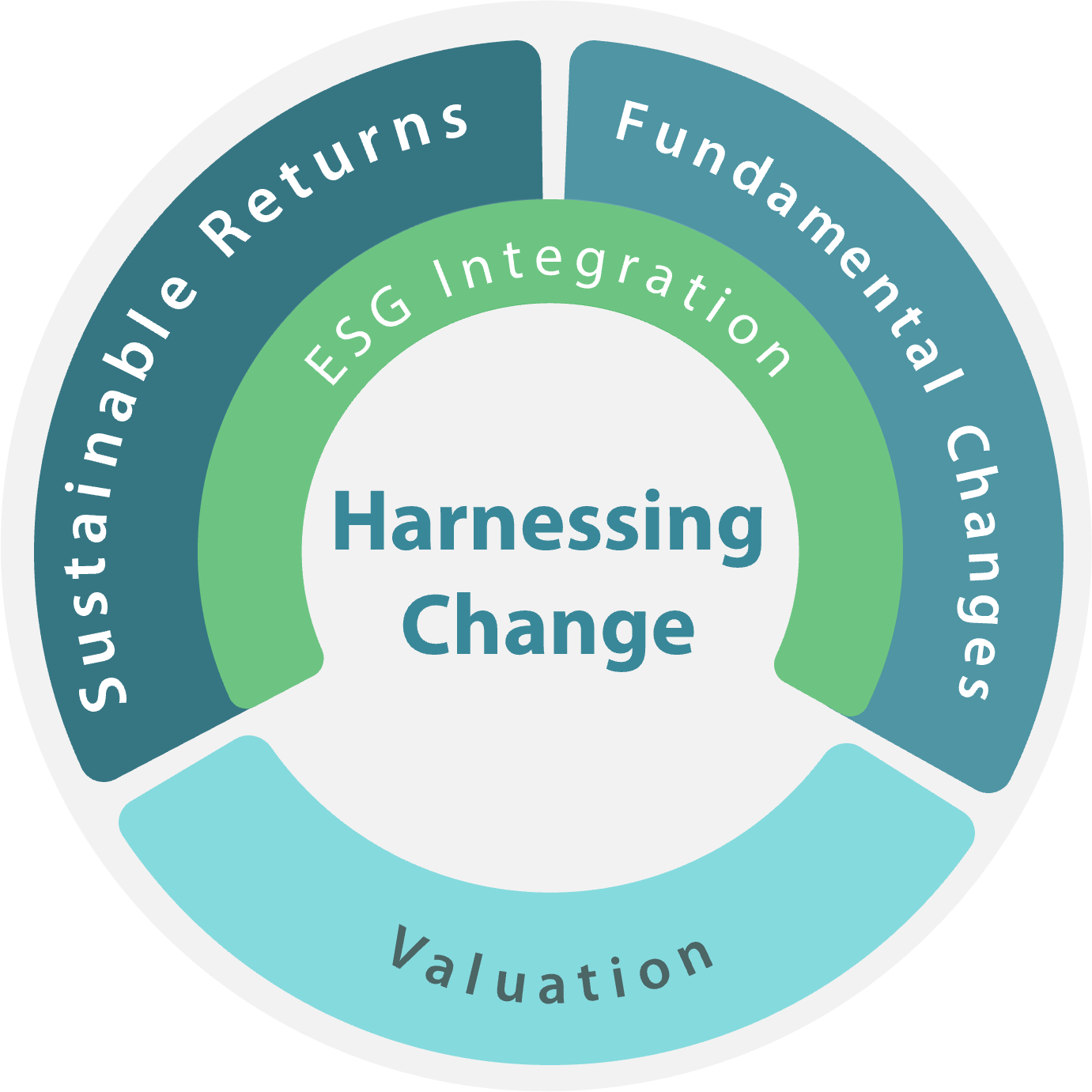

We believe that strong or improving Environmental, Social, and Governance (ESG) performance is essential for

generating higher sustainable returns.

We term the above as “Harnessing Change”.

We aim to have a balanced portfolio with the largest representation of stocks with

undervalued high sustainable returns and positive fundamental change, with ESG Risks and Returns analysis

integrated throughout.

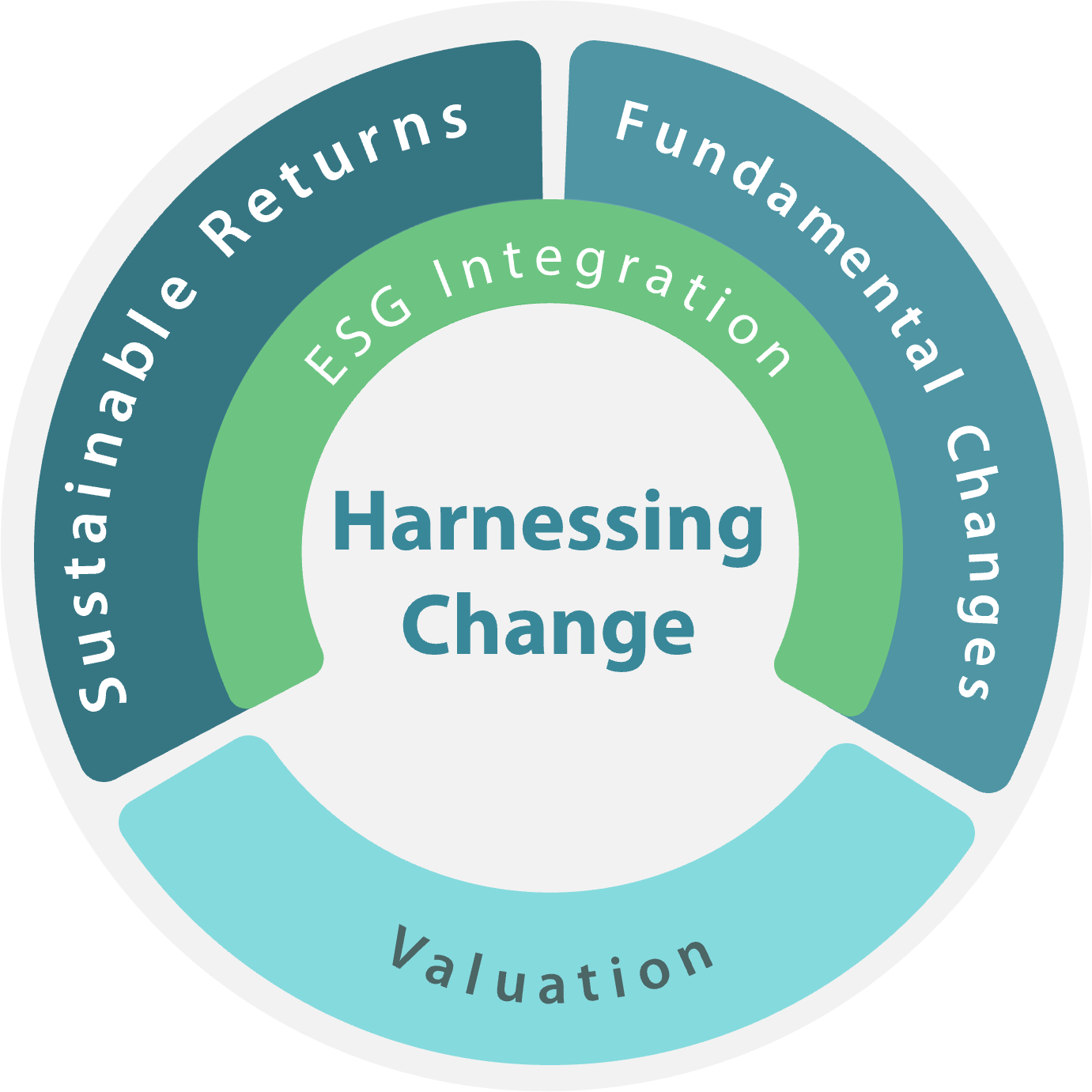

We believe that strong or improving Environmental, Social, and Governance (ESG) performance is essential for

generating higher sustainable returns.

We term the above as “Harnessing Change”.

We aim to have a balanced portfolio with the largest representation of stocks with

undervalued high sustainable returns and positive fundamental change, with ESG Risks and Returns analysis

integrated throughout.

Asia – The Continent of Great Opportunity

A dynamic market transforming itself at an unprecedented speed. Capturing value from diverse Asian opportunities requires deep understanding and cultural awareness.

[> 85% of global Semiconductor Foundry4 | > 85% Electric Vehicle Battery5 | > 85% Solar (Polys, Modules, Cells)6]

- 1Source: Bloomberg, Feb 2023

- 2Source: World Data Lab, September 2021

- 3Source: S&P Global – Market Intelligence, November 2022

- 4Source: Statista, https://www.statista.com/statistics/867223/worldwide-semiconductor-foundries-by-market-share/, September 2022

- 5Source: Bloomberg NEF, June 2022

- 6Source: Bloomberg NEF, May 2022

Unique and Dynamic Team

A unique and dynamic market requires a team approach of the same character.

We rely on the individual creativity and unique backgrounds of our team to produce varied, often unexpected insights into these sizable, fast-paced markets

Relying on input from experts on the ground to generate the building blocks of the best investment ideas

An environment of trust, cohesion, and respect is the foundation for challenging, and subsequently integrating individual insights into a broader, coherent picture

The Asian Equity Team

- Over 15 investment professionals based in Singapore and Hong Kong

- 18 years of average industry experience

- 10 primary nationalities

- All major Asian languages spoken

- Diversity across cognition, culture and demographics

- Mutual Respect, the foundation of our collaboration

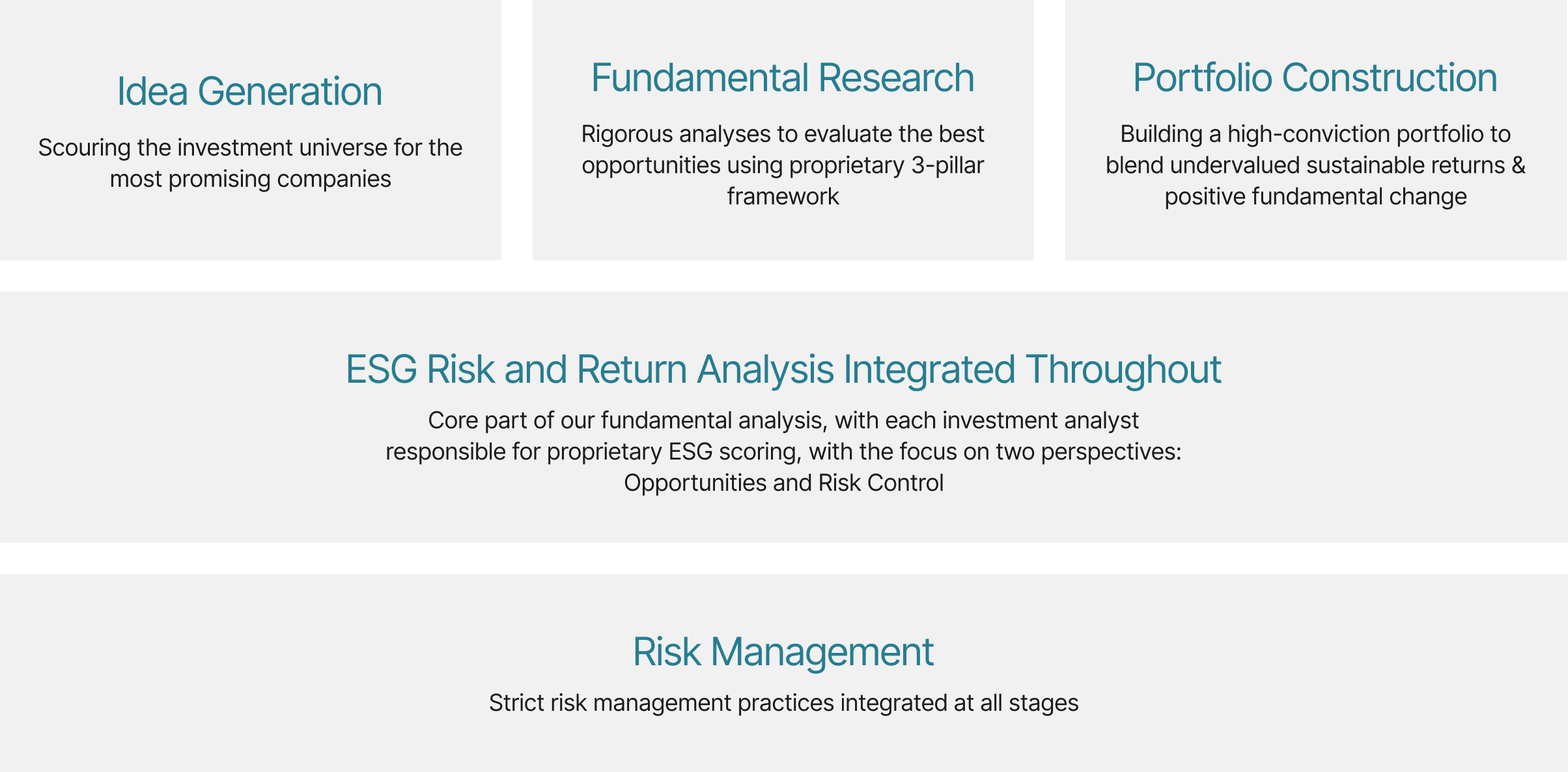

Investment Process

Tailored for the complexities of Asian markets and fundamental change.

ESG Implementation

ESG Risk and return analysis is integrated across the entire investment process, supported with the following ESG beliefs:

- Strong or improving ESG is essential for higher sustainable returns

- Focus on what’s material for Asia

- Investment analyst led assessment works best

Key Characteristics