January 25, 2019

Nikko Asset Management Co., Ltd.

Takumi Shibata, Representative Director, President and CEO

Pursuing fiduciary principles and ensuring customer-first operations is the essence of the asset management business. At Nikko Asset Management (“Nikko AM”), we also aim to play a role in creating a sustainable society by continuing our efforts as a responsible institutional investor to position Environment, Society and Governance (“ESG”) assessments, as well as stewardship activities, at the heart of our investment process.

Stewardship responsibilities regarding the companies in which asset managers invest, including the exercise of voting rights, form an important part of this work. At Nikko AM, we not only do our utmost to fulfil our responsibilities in these areas, but have also established committees that provide monitoring and oversight of our activities as well as necessary advice from outside perspective that is fair and neutral.

By taking the initiative to create and put into practice our own ESG initiatives, we also aim to foster our own individual corporate culture and company values that truly serve the interests of customers and can be shared with them.

Having fully taken on board the import of the Financial Services Agency’s “Principles for Customer-oriented Business Conduct”, we constantly strive to apply the principles to all of our business activities, thus ensuring that they inform our future plans as well as our past and present efforts.

As described below, we engage in a variety of initiatives to achieve our goals, including our own ESG activities as a firm, efforts to serve the interests of our individual and corporate customers, general stewardship and ESG activities, and our long-standing governance initiatives.

1. ESG Initiatives as a Firm

As an asset manager engaged in ESG initiatives directed at investee companies, we also believe in the importance of implementing our own ESG activities as a firm.

This conviction led us to newly establish the Corporate Sustainability Department in September 2018 in order to enhance our commitment to ESG in our own business operations as well as our investment approach. Through the activities described below, we intend to continue working to serve the interests of all stakeholders with a connection to Nikko AM, from our customers and employees to our shareholders, in order to ensure that our firm is managed with a focus on long-term sustainability.

We strive to contribute to a sustainable environment through eco-friendly offices, employee-led eco-initiatives, and minimisation of our carbon footprint.

◆Tokyo Office

Tokyo Midtown’s green area (including 1,800 m2 of rooftop greenery) forms part of the green belt connecting Aoyama, Roppongi and Akasaka.

This “green network” breathes life into the city and eases the heat island effect, while absorbing approximately 1.65 tons of CO2 per day. The facility also closely monitors and actively works to minimise energy consumption, including through promoting natural lighting and using energy efficient lights and solar power, while also recycling rainwater and kitchen wastewater.

The office works to promote energy conservation, resource sharing, and recycling, while maximizing green purchasing and complying with all laws and regulations related to the environment.

And each office is individually also working on maximum energy efficiency and reduced environmental impact. Some examples are highlighted below.

◆Nikko AM “Environmental Policy”

Nikko AM will proactively take environmental preservation issues into consideration and contribute to its sustainable development in the course of business and office activities centering on the asset management businesses.

For this purpose, it hereby sets forth the following environmental policy, sets environmental objectives and targets and reviews the same on a regular basis, and continuously improves the environmental management system.

This environmental policy will be communicated to all employees, and each employee will incorporate consideration of environmental preservation issues into his or her activities.

1.Expansion of green investors

Since asset flows from socially responsible investing (SRI) funds make significant contributions to environmental preservation, Nikko AM will make efforts to expand the number of these investors (green investors).

2.Promotion of energy conservation and resource saving in office activities

Nikko AM will make efforts to promote energy conservation, resource saving and recycling of waste, while expanding green purchasing in its offices. Furthermore, it will comply with laws and regulations related to the environment and other requirements and prevent environmental pollution.

3.Enhancement of information disclosure

Nikko AM recognizes that the establishment and enhancement of information disclosure concerning the environment as a social system will have significant importance from the standpoint of environmental preservation. Based on this recognition, Nikko AM will make efforts to enhance disclosure by proactively announcing its efforts related to the environment such as the environmental policy.

Environmental performance of Nikko AM

| FY 2012 | FY 2013 | FY 2014 | FY 2015 | FY 2016 | FY 2017 | % change from the previous FY | ||

| Power usage | Thousand kWh | 1,068 | 1,025 | 1,026 | 1,071 | 1,029 | 1,057 | 2.7% |

| Total energy consumption | GJ | 13,928 | 13,280 | 13,317 | 14,022 | 13,441 | 13,807 | 2.7% |

| CO2 emissions | t-CO2 | 532 | 508 | 510 | 537 | 530 | 517 | -2.5% |

| Copy paper purchase per capita | Sheet | 660 | 628 | 627 | 672 | 614 | 548 | -10.7% |

| Stationery green purchasing ratio | % | 57.2 | 58.6 | 59.6 | 50.6 | 65.0 | 58.8 | -9.5% |

Scope: Head office building (Midtown)

CO2 emissions: Specified according to Tokyo Metropolitan Environmental Protection Ordinance Calculation formula of greenhouse gas emissions (The emission factor is the same as in FY 2014)

We strive to enhance social causes, both within the company by supporting a diverse and inclusive environment, and outside of the company through hands-on initiatives and charitable donations.

◆LGBT

Nikko AM is a member of LGBT Finance in Japan.

The Firm is highly committed to this effort which has both very visible grass root support and very engaged sponsorship from senior management.

◆Idea Generation Forum

Nikko AM promotes transparency and open discussion across the Firm, including on issues relating to our Social Policies. The original suggestion of an LGBT-focused effort originated in this forum, as did many other discussions that help the Firm continuously progress on its ESG journey.

◆Women's Group

Nikko AM was the first Japanese Asset Manager to be a signatory to the UN Women’s Empowerment Principles.

The Firm provides for a strong support system for women, which includes the use of flex time, careful consideration of career moves, a Women's support group, in both Japan and the international offices.

◆Charitable Donations and Activities

Employees support a global cause, while complementing this with existing local outreach and charities which focus on similar causes.

Nikko AM is focused on one centralised organisation as its global cause, and has formed a partnership with Japan for UNHCR, a national partner of the United Nations High Commissioner for Refugees. Nikko AM employees are able to make donations to Japan for UNHCR on the company intranet.

There are many local charitable support initiatives, which the Firm strongly encourages. They have an overarching theme (children/children and education) but will be selected by local employees. In Japan, the three chosen charities for 2017/2018 are Wheelchairs for Children Living Overseas, Fair Start Support (supporting children leaving welfare institutions) and Mirai No Mori (providing English language lessons and outdoor programmes to children in welfare institutions).

Our role as an asset manager is not only to seek improvements in the governance of the firms in which we invest but to continuously ensure that our own governance is at a world-class level. Our activities in this area, which are described below, stem from our conviction that the three pillars of governance are management governance, voting rights governance, and fund governance.

We position our governance activities among the most important of our corporate activities, and all of our efforts in regard to voting rights governance and fund governance—as well as the obvious example of management governance—are directly reported on to our Board of Directors. Furthermore, based on our conviction that the best governance can only be achieved with scrutiny from outside, we strive to maintain independent oversight by ensuring that our Board of Directors is chaired by an independent, outside director, and by appointing even more outside directors to our Board of Directors than the number required of listed firms. We also ensure strict independence in the governance of our voting rights activities and funds by entrusting it to committees that not only consist of a majority of outside members but have their chairs appointed from among those outside members.

(1) Management governance

As befits a firm entrusted with managing the assets of customers, our business operations are presided over by a senior management team that is well versed in asset management. Our approach to securing management talent is predicated on our strong belief that having such a team in place gives Nikko AM the strongest possible foundations.

Our appointment of Yoichiro Iwama as an outside director and Chairman of the Board of Directors in May 2018 helped to strengthen our governance by bringing in his independent perspective and extensive knowledge to benefit Nikko AM. Mr. Iwama’s participation has further invigorated our Board of Directors, enhanced the transparency of its decision-making process for important business management matters, and generated lively discussions on issues including how to enhance our asset management capabilities. By having debates and discussions based on the respective areas of experience and knowledge of our directors and outside directors, we constantly examine ways of refining our vision for the future of Nikko AM and differentiating it from competitors with a forward-looking perspective on the asset management industry as a whole.

As of January 2019, Nikko AM’s Board of Directors has five independent, outside directors (including the Chairman of the Board of Directors), four of whom are pure outsiders who have no capital relationships with the company. This ensures high levels of independence and transparency in our governance relative to our industry peers.

(2) Voting rights governance

We established the Stewardship and Voting Rights Policy Oversight Committee in June 2016 as a way of improving transparency in our stewardship activities such as engaging with firms and exercising voting rights as well as strengthening our governance. Drawing the majority of its members from outside the company, the committee is the first such third-party body to be established at a Japanese asset management company. It holds meetings once a quarter in principle and provides a venue for outside committee members to have lively discussions on how Nikko AM exercises its voting rights. The committee has held a total of 12 meetings so far. Please refer to the Appendix (PDF) for details of its activities.

(3) Fund governance

We established the Fund Advisory Board, whose members are also mostly from outside Nikko AM, in September 2017. The Fund Advisory Board meets every quarter in principle. The board has met a total of three times since January 2018 and its outside members participate in debates at its meetings. Please refer to the Appendix (PDF) for details of its activities.

2. Activities for individual and corporate clients

(1) Activities for individual clients

As an asset management company, our paramount mission is to be useful to our customers in their medium-to long-term asset building. Realizing this mission is not just a case of delivering strong investment management outcomes, however. We also need to put a great deal of effort into every aspect of our services, including understandably and simply imparting accurate knowledge of investment management and the products we offer, proactively delivering timely and appropriate information on market trends from a neutral standpoint to help customers make investment decisions, providing products that are suitable for medium-to long-term investment that serves customer needs, and helping customers to manage risks.

Our initiatives in this area, together with the results we have delivered to date, are detailed below.

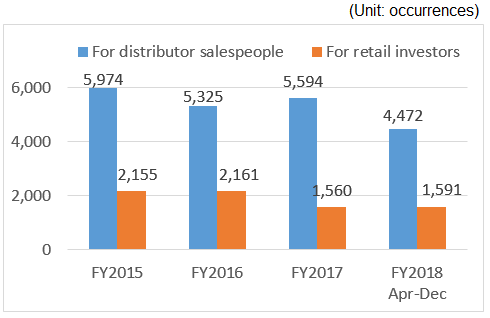

① Number of seminars held

② Information provision under Nikko AM Academy brand

| Main investment information sources provided as series | Frequency | Additional information |

| Rakuyomi | Twice weekly | 141 released in 2018 |

| Koyomi | Monthly | |

| Gokuyomi | Monthly | |

| Market 5 Minutes | Monthly | |

| Weekly Market | Weekly | |

| Data Watch | Weekly | |

| Follow-up Memo | Irregular | 14 released in 2018 |

| Global REIT Weekly | Weekly | |

| Monthly Market | Monthly | |

| JAPAN in Motion | Monthly | |

| Nikko AM Newsletter | Irregular | 8 released in 2018 |

| CHINA INSIGHT | Irregular | 7 released in 2018 |

| KAMIYAMA Reports | Irregular | 33 released in 2018 |

| KAMIYAMA Seconds! | Irregular | 44 released in 2018 |

| Why should we invest? | Irregular | 11 released in 2018 |

| Robotics Report | Twice monthly | |

| What Nikko AM wants you to know about healthy money management | Irregular | 1 released in 2018 |

③ Average holding periods of top ten funds for AUM

| Rank | Fund name | Expected average holding period (years) | AUM (JPY 100M) | Fund investment universe/type |

| 1 | Nikko LaSalle Global REIT Fund (Monthly Dividend Payment Type) | 2.79 | 4,825 | Foreign REIT/active |

| 2 | Global Robotics Equity Fund (Semi-annual Settlement Type) | 6.04 | 4,021 | Foreign equity/active |

| 3 | Global Robotics Equity Fund (Annual Settlement Type) | 3.27 | 3,861 | Foreign equity/active |

| 4 | Nikko Triple Fund (Property Bond Equity) Monthly Dividend Payment Type | 9.07 | 3,497 | Balanced |

| 5 | Smart Five (Monthly Settlement Type) | 13.89 | 2,872 | Balanced |

| 6 | Nikko Index Fund 225 | 3.02 | 2,093 | Japanese equity/passive |

| 7 | Global Fintech Equity Fund | 1.98 | 1,786 | Foreign equity/active |

| 8 | Nikko Developed Countries High Yielding Bond Open (Monthly Dividend Payment Type) | 4.18 | 1,459 | Foreign bond/active |

| 9 | Global Fintech Equity Fund (Semi-annual Settlement Type) | 6.97 | 951 | Foreign equity/active |

| 10 | Japan Robotics Equity Fund (Annual Settlement Type) | 2.33 | 732 | Japanese equity/active |

* Expected average holding period is theoretical calculated by "annual average AUM ÷ annualized redemption amount" (calculation period is year 2018). The figure is different from the actual average holding period of the investor.

* Funds with very small redemption amount compared with the subscription amounts or AUM may result in longer period than the actual holding period.

* AUM as of 2018/12/28. Top 10 AUM funds excluding ETF and MRF.

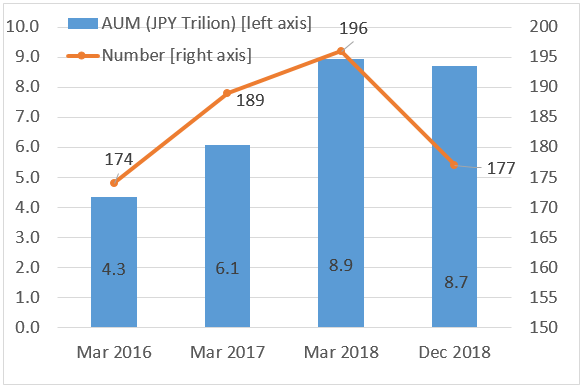

④ AUM and number of asset-building funds (annual or semi-annual annual account settlement)

Main publicly offered funds capable of stably delivering medium- and long-term returns that we deem suitable for customers' asset-building needs

| Fund investment target | Fund name | Distribution frequency | AUM (JPY 100M) |

| Japanese Equities/Active | Japan Robotics Equity Fund | Annual, semiannual | 970 |

| Nikko Japan Open | Annual | 332 | |

| Nikko DC J Growth | Annual | 217 | |

| Foreign Equities/Active | Global Robotics Equity Fund | Annual, semiannual | 8,384 |

| Global Fintech Equity Fund | Annual, semiannual | 2,929 | |

| Foreign Bonds/Active | Nikko Developed Countries High Yielding Bond Open (Growth Type) | Annual | 103 |

| Balanced | Smart Five (Annual Settlement Type) | Annual | 341 |

| Fine Blend (Growth Type) | Annual | 142 | |

| Nikko GW7 Eggs | Annual | 535 | |

| Nikko Triple Fund (Property Bond Equity) Growth Type | Annual | 87 | |

| Global Three Times Triple Fund (Annual Settlement Type) | Annual | 2 |

* AUM as of end Dec 2018. Aggregate value is shown for series funds. AUM is in descending order by fund investment destination.

* For fund with multiple settlement types, hyperlink is set to the fund with the largest AUM.

⑤ Initiatives for cumulative investment including cumulative Nippon Individual Savings Accounts

Our efforts to meet cumulative investment needs are not just confined to cumulative NISA, however, as we are also working to promote the use of defined contribution plans, individual-type defined contribution pension plans and general account for such purposes. With these products, we are advocating long-term, cumulative and diversified investments to those who wish to build up their assets. We also provide assistance to distributors for cumulative investment initiatives by not only providing products but also creating and offering a variety of support tools.

Having completed the registration of one of our funds for eligibility in the cumulative NISA system, we are now preparing to obtain the same registration for multiple Exchange Traded Fund (“ETF”) products.

We also held a “Product Strategy Seminar” for distributors in July 2018, at which we emphasized the effectiveness of cumulative investment in enhancing returns for investors.

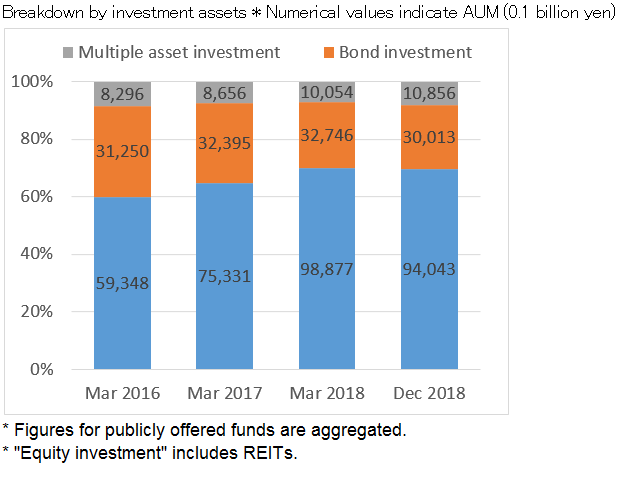

⑥ AUM and Performance of Japan-domiciled publicly offered funds

Out of the total assets in the publicly offered funds that we manage on behalf of our customers (as of December-end 2018), equity investment funds accounted for 70%, bond investment funds (including MRFs) accounted for 22%, and multiple asset investment funds/other funds accounted for 8% of the total.

Equity investment funds: largest returns in past three years

| Rank | Fund name | Launch date | AUM (JPY 100M) | Return (inc. dividends) (%) | |||

| Since launch | 5 years | 3 years | 1 year | ||||

| 1 | Nikko Growing Venture Fund | Jul-03 | 236 | 316% | 123% | 99% | -14% |

| 2 | Japanese Emerging Equity Open | Dec-96 | 194 | 353% | 91% | 55% | -14% |

| 3 | Natural Resources Equity Fund Currency Selection Series <Brazilian Real Course> (Monthly Dividend Payment Type) | Nov-09 | 288 | -31% | -36% | 20% | -30% |

| 4 | Natural Resources Fund (Equity and Currency) Brazilian Real Course | Jul-09 | 149 | -25% | -36% | 20% | -30% |

| 5 | Global Robotics Equity Fund (Annual Settlement Type) | Aug-15 | 3,861 | 23% | - | 17% | -19% |

| 6 | Global Robotics Equity Fund (Semi-annual Settlement Type) | Aug-15 | 4,021 | 23% | - | 17% | -19% |

| 7 | Index Fund Emerging Equity | Apr-08 | 134 | 17% | 9% | 15% | -18% |

| 8 | Listed Index Fund J-REIT (Tokyo Stock Exchange REIT Index) Bi-Monthly Dividend Payment Type | Oct-08 | 2,252 | 251% | 38% | 13% | 11% |

| 9 | Nikko Index Fund J-REIT | Oct-04 | 239 | 107% | 36% | 12% | 10% |

| 10 | Listed Index Fund 225 | Jul-01 | 26,131 | 103% | 33% | 11% | -11% |

| (Reference index: Japanese equity) TOPIX | 15% | -3% | -18% | ||||

| (Reference index: foreign equity) MSCI All Country World Index (ex. Japan, no hedge, JPY-based) | 17% | 3% | -14% | ||||

* Publicly offered open-end funds(incl ETFs). AUMs are as of end-December 2018. Funds with AUMs below JPY 10 billion are excluded.

Bond investment funds: largest returns in past three years

| Rank | Fund name | Launch date | AUM (JPY 100M) | Return (inc. dividends) (%) | |||

| Since launch | 5 years | 3 years | 1 year | ||||

| 1 | Emerging High Yield Bond Fund Brazilian Real Course | Dec-10 | 125 | 21% | 5% | 27% | -20% |

| 2 | Nikko PIMCO High Income Sovereign Fund Monthly Dividend Payment Type (US Dollar course) | Sep-03 | 184 | 122% | 22% | 11% | -6% |

| 3 | Listed Index Fund Emerging Bond | Jan-12 | 170 | 34% | -1% | 3% | -8% |

| 4 | Nikko World Bank Bond Fund (Monthly Dividend Payment Type) | Jun-07 | 167 | -13% | -13% | -2% | -7% |

| 5 | Asia Corporate Bond Fund B Course (No Currency Hedge) | Nov-12 | 241 | 52% | 19% | -2% | -4% |

| (Reference index) FTSE World Government Bond Index (ex. Japan, no hedge, JPY-based) | 9% | -2% | -4% | ||||

* Publicly offered open-end funds(incl ETFs). AUMs are as of end-December 2018. Funds with AUMs below JPY 10 billion are excluded.

Multiple asset investment funds/other funds: largest returns in past three years

| Rank | Fund name | Launch date | AUM (JPY 100M) | Return (inc. dividends) (%) | |||

| Since launch | 5 years | 3 years | 1 year | ||||

| 1 | Nikko Ashmore Emerging Markets Tri-Asset Fund Monthly Dividend Payment Type (Brazilian Real Course) | Feb-10 | 164 | 31% | 12% | 29% | -18% |

| 2 | Nikko Triple Fund (Property Bond Equity) Monthly Dividend Payment Type | Aug-03 | 3,497 | 98% | 17% | 7% | -3% |

| 3 | Nikko Japan Trend Select(Hyper Wave) | Jan-95 | 123 | -62% | 40% | 7% | -23% |

| 4 | Smart Five (Monthly Settlement Type) | Jul-13 | 2,872 | 20% | 16% | 7% | -4% |

| 5 | Smart Five (Annual Settlement Type) | Jul-13 | 341 | 20% | 16% | 7% | -4% |

* Publicly offered open-end funds(incl ETFs). AUMs are as of end-December 2018. Funds with AUMs below JPY 10 billion are excluded.

Top 10 funds in performance for the past one year

| Rank | Fund name | Launch date | AUM (JPY 100M) | Return (inc. dividends) (%) | |||

| Since launch | 5 years | 3 years | 1 year | ||||

| 1 | Listed Index Fund J-REIT (Tokyo Stock Exchange REIT Index) Bi-Monthly Dividend Payment Type | Oct-08 | 2,252 | 251% | 38% | 13% | 11% |

| 2 | Nikko Index Fund J-REIT | Oct-04 | 239 | 107% | 36% | 12% | 10% |

| 3 | No-Load J-REIT Focus (Monthly Dividend Payment Type) | Jul-13 | 3 | 56% | 39% | 11% | 9% |

| 4 | Nikko Japan Trend Select(Reverse Trend Open) | Jan-95 | 27 | -59% | -40% | -22% | 6% |

| 5 | No-Load JGB Focus (Monthly Dividend Payment Type) | Feb-11 | 7 | 26% | 15% | 6% | 1% |

| 6 | Nikko Index Fund Japanese Fixed Income (DC) | Nov-03 | 26 | 27% | 8% | 3% | 1% |

| 7 | Nikko DC Index Fund Japanese Bond (IRA) | Dec-01 | 4 | 23% | 7% | 3% | 1% |

| 8 | Index Fund Japanese Fixed Income (Annual Settlement Type) | Oct-01 | 89 | 23% | 7% | 3% | 0% |

| 9 | Nikko PIMCO High Income Sovereign Fund Monthly Dividend Payment Type (Mexico Peso course) | Jan-13 | 11 | 4% | -4% | 9% | 0% |

| 10 | Japan Public Bond Fund 2023 | Jan-14 | 2 | 5% | - | 1% | 0% |

* Publicly offered open-end funds(incl ETFs). AUMs are as of end-December 2018. Funds with AUMs below JPY 10 billion are excluded.

⑦Fund Efficiency Initiatives

Our belief is that it is imperative for asset managers to constantly develop and manage more attractive and effective products for investors. We strive to achieve this goal through constant efforts to enhance our fund lineups and expand AUM. However, it is also true that some of our funds have small AUMs. Funds with smaller AUMs cost more to manage than other funds and are less likely to realize the investment policies set out in their investment prospectuses or trust deeds, making it harder to deliver the sustained medium- and long-term investment performances that customers expect.

At Nikko AM, we address this by not only terminating smaller funds once they reach maturity but also terminating them early by shortening their trust periods based on legally stipulated procedures.

We carried out early terminations of 22 funds between January and December of 2018, having gained the understanding of the funds’ beneficiaries.

These efforts are essential ways for us to maintain the strength of our funds’ product attributes and to deliver strong investment performances. We firmly believe that devoting our human resources to a carefully selected lineup of funds is the key to delivering medium- and long-term profits to investors.

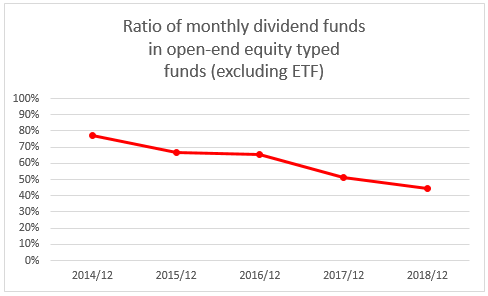

⑧ Change in distribution pattern for medium- and long-term investment: Japan-domiciled publicly offered funds

Procedures for selecting Nikko AM’s key funds

- Rank Nikko AM’s publicly offered funds (excluding money funds, ETFs and index funds) as of October-end 2018).

- If there are multiple series funds among the top funds for AUM, use the funds with the largest AUMs.

- For the relevant period, we selected the 18 funds in the below chart as Nikko AM’s key funds (excluding funds that have less than one year track record) as of November-end 2018.

| Fund name | AUM(JPY100M) As of end Dec 2018 |

Launch date | Risk/Return Abbreviated name on profile | |

| 1 | Nikko LaSalle Global REIT Fund (Monthly Dividend Payment Type) | 4,825 | Mar-04 | LaSalle Global REIT Fund (Monthly Dividend) |

| 2 | Global Robotics Equity Fund (Semi-annual Settlement Type) | 4,021 | Aug-15 | Global Robotics (Semi-annual) |

| 3 | Nikko Triple Fund (Property Bond Equity) Monthly Dividend Payment Type | 3,497 | Aug-03 | Nikko Triple Fund (Monthly Dividend) |

| 4 | Smart Five (Monthly Settlement Type) | 2,872 | Jul-13 | Smart Five (Monthly Settlement) |

| 5 | Global Fintech Equity Fund | 1,786 | Dec-16 | Global Fintech |

| 6 | Nikko Developed Countries High Yielding Bond Open (Monthly Dividend Payment Type) | 1,459 | Aug-03 | Developed Countries High Yielding Bond Open (Monthly Dividend) |

| 7 | Japan Robotics Equity Fund (Annual Settlement Type) | 732 | Jan-16 | Japan Robotics (Annual) |

| 8 | Greater China Equity Fund (Monthly Dividend Payment Type) | 557 | Oct-10 | Greater China Equity |

| 9 | Nikko GW7 Eggs | 536 | Feb-03 | Nikko GW7 Eggs |

| 10 | Nikko Five Continents Bond Fund (Monthly Dividend Payment Type) | 533 | Jun-06 | Five Continents Bond Fund (Monthly Dividend) |

| 11 | Shenzhen Innovation Equity Fund (Annual Settlement Type) | 440 | Nov-17 | *Graph not shown because the investment period is less than 2 years |

| 12 | Nikko AMP Global REIT Fund Monthly Dividend Payment Type A (No Hedge) | 378 | Jan-04 | AMP Global REIT Fund (Monthly Dividend) A Course (No Hedge) |

| 13 | New Silk Road Economies Fund | 362 | Sep-17 | *Graph not shown because the investment period is less than 2 years |

| 14 | Nikko PIMCO High Income Sovereign Fund Monthly Dividend Payment Type (US Dollar course)(Note1) | - | Sep-03 | PIMCO High Income Sovereign Fund Monthly Dividend (USD course) |

| 15 | Nikko Japan Open | 333 | Aug-98 | Nikko Japan Open |

| 16 | Nikko World Triple Fund (Property Bond Equity) Monthly Dividend Payment Type | 304 | Sep-05 | Nikko World Triple Fund (Monthly Dividend) |

| 17 | Natural Resources Equity Fund Currency Selection Series <US Dollar Course> (Monthly Dividend Payment Type) (Note2) | - | Sep-13 | Natural Resources (USD Course) |

| 18 | Nikko Profit Return Growth Stock Open | 267 | Jun-91 | J-Growth |

Note 1: For Nikko PIMCO High Income Sovereign Fund, risk-return figures for the USD course (converted to JPY), a major fund in the same strategy, were used.

*As the USD course is not the largest fund of the same strategy, AUM is blanked to prevent confusion.

Note 2: For Natural Resources Equity Fund, risk-return figures for the USD course (converted to JPY), a major fund in the same strategy, were used.

*As the USD course is not the largest fund of the same strategy, AUM is blanked to prevent confusion.

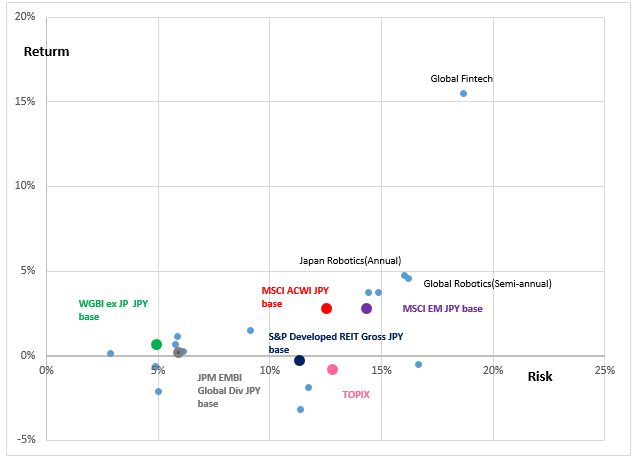

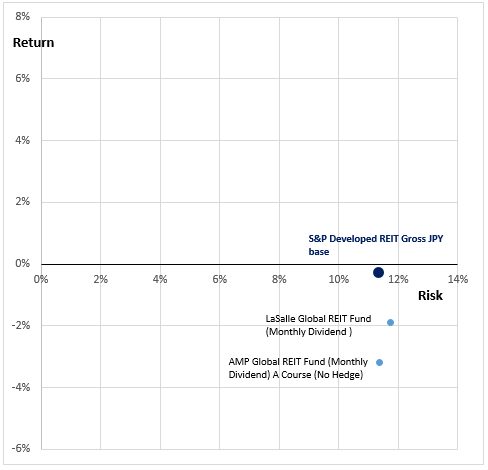

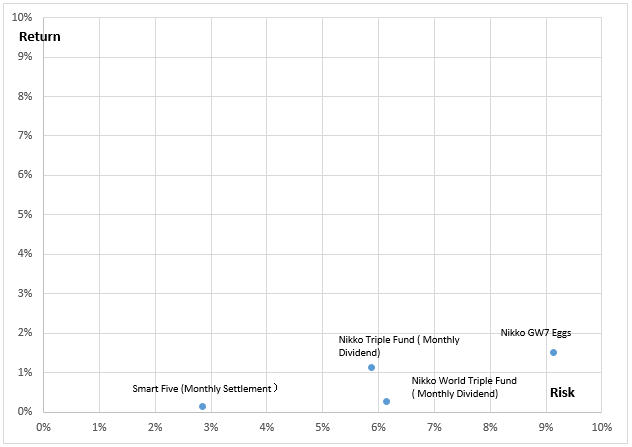

⑨ Risk/return profile of major funds in past two years (as of December-end 2018)

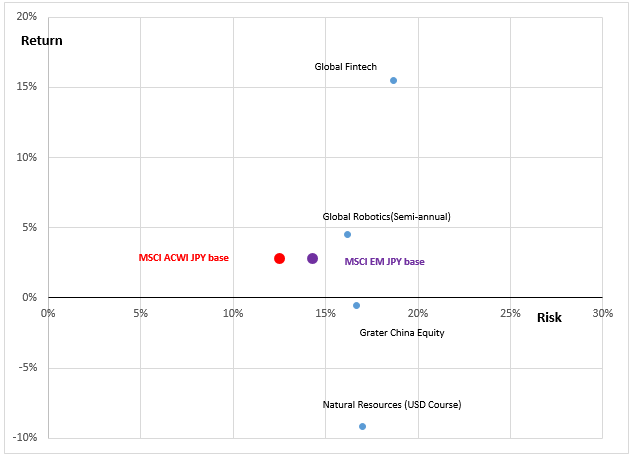

⑩ Risk/return profile of major foreign equity funds in past two years (as of December-end 2018)

Note: For Natural Resources Equity Fund, risk-return figures for the USD course (converted to JPY), a major fund in the same strategy, were used.

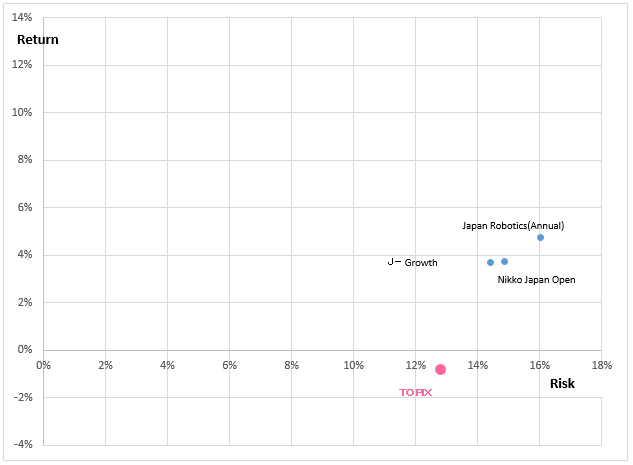

⑪ Risk/return profile of major Japanese equity funds in past two years (as of December-end 2018)

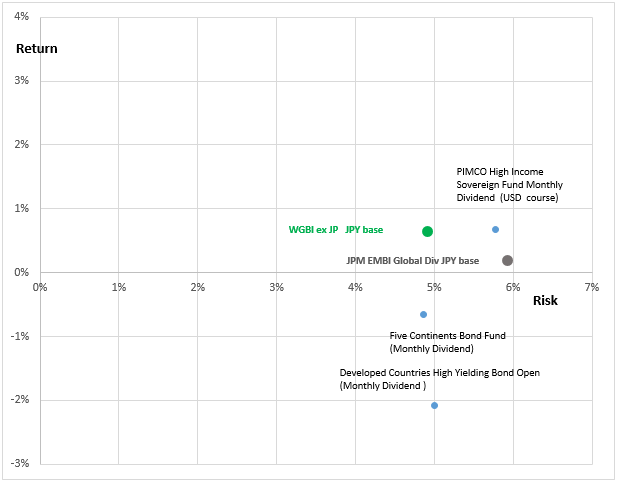

⑫ Risk/return profile of major foreign bond funds in past two years (as of December-end 2018)

Note: For Nikko PIMCO High Income Sovereign Fund, risk-return figures for the USD course (converted to JPY), a major fund in the same strategy, were used.

⑬ Risk/return profile of major global REIT funds in past two years (as of December-end 2018)

⑭ Risk/return profile of major balanced funds in past two years (as of December-end 2018)

⑮ Sharpe ratios of major funds in past three years (as of December-end 2018)

| Dec-18 | A | B | A/B | |||

| Fund name | AUM (JPY 100M) | Launch date | Excess Return (Annualized) | Standard Deviation | Sharpe Ratio | |

| 1 | Nikko LaSalle Global REIT Fund (Monthly Dividend Payment Type) | 4,825 | Mar-04 | -2.18% | 13.60% | -0.16 |

| 2 | Global Robotics Equity Fund (Semi-annual Settlement Type) | 4,021 | Aug-15 | 5.47% | 17.50% | 0.31 |

| 3 | Nikko Triple Fund (Property Bond Equity) Monthly Dividend Payment Type | 3,497 | Aug-03 | 2.47% | 7.05% | 0.35 |

| 4 | Smart Five (Monthly Settlement Type) | 2,872 | Jul-13 | 2.36% | 3.79% | 0.62 |

| 5 | Nikko Developed Countries High Yielding Bond Open (Monthly Dividend Payment Type) | 1,459 | Aug-03 | -2.76% | 6.77% | -0.41 |

| 6 | Greater China Equity Fund (Monthly Dividend Payment Type) | 557 | Oct-10 | -5.56% | 19.08% | -0.29 |

| 7 | Nikko GW7 Eggs | 536 | Feb-03 | 0.80% | 11.16% | 0.07 |

| 8 | Nikko Five Continents Bond Fund (Monthly Dividend Payment Type) | 533 | Jun-06 | -1.38% | 6.94% | -0.20 |

| 9 | Nikko AMP Global REIT Fund Monthly Dividend Payment Type A (No Hedge) | 378 | Jan-04 | -4.81% | 13.67% | -0.35 |

| 10 | Nikko PIMCO High Income Sovereign Fund Monthly Dividend Payment Type (US Dollar course)(Note3) | - | Sep-03 | 3.56% | 7.43% | 0.48 |

| 11 | Nikko Japan Open | 333 | Aug-98 | 1.91% | 15.81% | 0.12 |

| 12 | Nikko World Triple Fund (Property Bond Equity) Monthly Dividend Payment Type | 304 | Sep-05 | 0.72% | 7.61% | 0.09 |

| 13 | Natural Resources Equity Fund Currency Selection Series <US Dollar Course> (Monthly Dividend Payment Type) (Note2) | - | Sep-13 | 0.76% | 19.41% | 0.04 |

| 14 | Nikko Profit Return Growth Stock Open | 267 | Jun-91 | 1.89% | 15.60% | 0.12 |

Note 1: LIBOR1M was used for the risk-free rate.

Note 2: For Natural Resources Equity Fund, risk-return figures for the USD course (converted to JPY), a major fund in the same strategy, were used.

*As the USD course is not the largest fund of the same strategy, AUM is blanked to prevent confusion.

Note 3: For Nikko PIMCO High Income Sovereign Fund, risk-return figures for the USD course (converted to JPY), a major fund in the same strategy, were used.

*As the USD course is not the largest fund of the same strategy, AUM is blanked to prevent confusion.

⑯ Sharpe ratios of major funds in past one year (as of December-end 2018)

| Dec-18 | A | B | A/B | |||

| Fund name | AUM (JPY 100M) | Launch date | Excess Return | Standard Deviation | Sharpe Ratio | |

| 1 | Nikko LaSalle Global REIT Fund (Monthly Dividend Payment Type) | 4,825 | Mar-04 | -6.29% | 14.86% | -0.42 |

| 2 | Global Robotics Equity Fund (Semi-annual Settlement Type) | 4,021 | Aug-15 | -18.60% | 19.45% | -0.96 |

| 3 | Nikko Triple Fund (Property Bond Equity) Monthly Dividend Payment Type | 3,497 | Aug-03 | -3.40% | 7.61% | -0.45 |

| 4 | Smart Five (Monthly Settlement Type) | 2,872 | Jul-13 | -3.80% | 2.93% | -1.29 |

| 5 | Global Fintech Equity Fund | 1,786 | Dec-16 | -8.84% | 24.02% | -0.37 |

| 6 | Nikko Developed Countries High Yielding Bond Open (Monthly Dividend Payment Type) | 1,459 | Aug-03 | -6.15% | 4.98% | -1.24 |

| 7 | Japan Robotics Equity Fund (Annual Settlement Type) | 732 | Jan-16 | -19.28% | 18.78% | -1.03 |

| 8 | Greater China Equity Fund (Monthly Dividend Payment Type) | 557 | Oct-10 | -26.11% | 19.30% | -1.35 |

| 9 | Nikko GW7 Eggs | 536 | Feb-03 | -11.40% | 11.20% | -1.02 |

| 10 | Nikko Five Continents Bond Fund (Monthly Dividend Payment Type) | 533 | Jun-06 | -4.58% | 5.65% | -0.81 |

| 11 | Shenzhen Innovation Equity Fund (Annual Settlement Type) | 440 | Nov-17 | -34.90% | 17.11% | -2.04 |

| 12 | Nikko AMP Global REIT Fund Monthly Dividend Payment Type A (No Hedge) | 378 | Jan-04 | -9.66% | 14.28% | -0.68 |

| 13 | New Silk Road Economies Fund | 362 | Sep-17 | -22.52% | 14.53% | -1.55 |

| 14 | Nikko PIMCO High Income Sovereign Fund Monthly Dividend Payment Type (US Dollar course) (Note3) | - | Sep-03 | -5.66% | 6.91% | -0.82 |

| 15 | Nikko Japan Open | 333 | Aug-98 | -19.02% | 17.54% | -1.08 |

| 16 | Nikko World Triple Fund (Property Bond Equity) Monthly Dividend Payment Type | 304 | Sep-05 | -5.32% | 7.93% | -0.67 |

| 17 | Natural Resources Equity Fund Currency Selection Series <US Dollar Course> (Monthly Dividend Payment Type) (Note2) | - | Sep-13 | -18.48% | 19.04% | -0.97 |

| 18 | Nikko Profit Return Growth Stock Open | 267 | Jun-91 | -17.54% | 16.84% | -1.04 |

Note 1: LIBOR1M was used for the risk-free rate.

Note 2: For Natural Resources Equity Fund, risk-return figures for the USD course (converted to JPY), a major fund in the same strategy, were used.

*As the USD course is not the largest fund of the same strategy, AUM is blanked to prevent confusion.

Note 3: For Nikko PIMCO High Income Sovereign Fund, risk-return figures for the USD course (converted to JPY), a major fund in the same strategy, were used.

*As the USD course is not the largest fund of the same strategy, AUM is blanked to prevent confusion.

⑰ Investor returns of major funds (periods since launch)

| Fund name | Investor Return (Annualized) | NAV Return(Annualized) |

| Nikko LaSalle Global REIT Fund (Monthly Dividend Payment Type) | 9.30% | 4.19% |

| Global Robotics Equity Fund (Annual Settlement Type) | 5.60% | 6.53% |

| Global Robotics Equity Fund (Semi-annual Settlement Type) | -1.48% | 6.47% |

| Nikko Triple Fund (Property Bond Equity) Monthly Dividend Payment Type | 0.81% | 4.61% |

| Smart Five (Monthly Settlement Type) | 0.10% | 3.52% |

| Global Fintech Equity Fund | 3.59% | 14.30% |

| Global Fintech Equity Fund (Semi-annual Settlement Type) | -19.90% | 0.79% |

| Nikko Developed Countries High Yielding Bond Open (Monthly Dividend Payment Type) | 3.33% | 3.80% |

| Japan Robotics Equity Fund (Annual Settlement Type) | -4.96% | 7.00% |

| Japan Robotics Equity Fund (Semi-annual Settlement Type) | -7.84% | 6.98% |

| Greater China Equity Fund (Monthly Dividend Payment Type) | -8.48% | 2.60% |

| Nikko GW7 Eggs | 0.22% | 5.23% |

| Nikko Five Continents Bond Fund (Monthly Dividend Payment Type) | -0.01% | 2.65% |

| Shenzhen Innovation Equity Fund (Annual Settlement Type) | -40.13% | -32.89% |

| New Silk Road Economies Fund | -14.91% | -13.41% |

| Nikko AMP Global REIT Fund Monthly Dividend Payment Type A (No Hedge) | 7.72% | 5.30% |

| Nikko Japan Open | -4.33% | 2.25% |

| Natural Resources Equity Fund Currency Selection Series <Brazilian Real Course> (Monthly Dividend Payment Type) | -3.07% | -4.09% |

| Nikko PIMCO High Income Sovereign Fund Monthly Dividend Payment Type (Turkey Lira course) | -0.19% | 1.28% |

| Nikko World Triple Fund (Property Bond Equity) Monthly Dividend Payment Type | -5.26% | 3.55% |

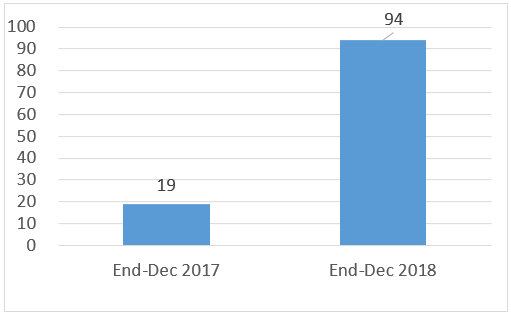

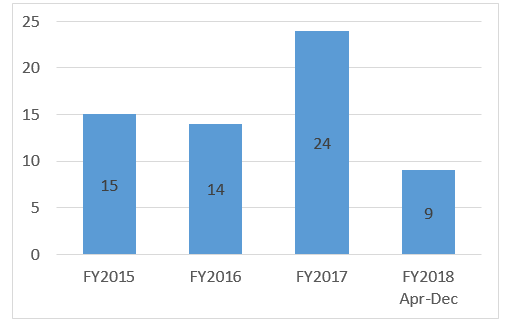

(2) Activities for corporate clients

① Number of accounts utilizing risk management tool for institutional investors

② Number of fund awards won

* Aggregation of awards from R&I Fund Awards, Fund of the Year (Morning Star) and Lipper Fund Awards.

3. Stewardship activities

We believe that it is one of our key responsibilities as an asset manager to help the companies in which we invest to improve the value they offer to investors by vigorously pursuing our stewardship activities including the exercise of voting rights. We constantly work to ensure that our activities are sustained and steadily improved upon. At the same time, we incorporate the concept of ESG into all of our investment management processes and perform assessments of the corporate value of firms—including their non-financial information—in order to promote medium- and long-term improvements as well as sustainable growth, and this approach is useful in our investment decision-making process. We also organized the ESG Global Steering Committee in order to further expand the global reach of our ESG efforts. Comprised of leaders in our investment management operations in Japan and overseas, the committee deliberates over matters such as ESG initiatives, ways of putting them into practice, and new approaches.

Our initiatives and results to date in the above-mentioned areas are as follows.

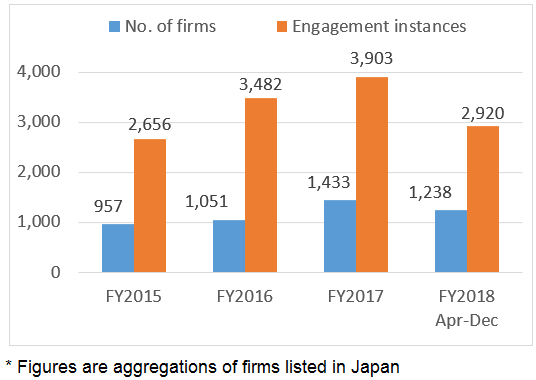

① Engagement results

These initiatives have further improved our ability to engage with firms and exercise our voting rights in order to help maximize the corporate value of firms. In 2018 (Apr-Dec) we engaged with 1,238 firms, and in the same period the number of instances of engagement we had was 2,920.

② Voting track record

1. Company-generated proposals

| Proposal | July 2017 - June 2018 | ||||

| Yea | Nay | Subtotal | Nay ratio | ||

| Proposal on company | Election/dismissal of directors | 14,183 | 2,934 | 17,117 | 17.1% |

| (Reference) Number of companies | 1,252 | 832 | 2,084 | 39.9% | |

| Election/dismissal of corporate auditors | 1,568 | 162 | 1,730 | 9.4% | |

| (Reference) Number of companies | 893 | 135 | 1,028 | 13.1% | |

| Selection of accounting auditors | 40 | 0 | 40 | 0.0% | |

| Proposal on executive remuneration | Executive remuneration | 422 | 3 | 425 | 0.7% |

| Retirement benefit payments | 162 | 26 | 188 | 13.8% | |

| Proposal on capital policy (Except proposals concerning the articles of incorporation) | Appropriation of surpluses | 1,374 | 135 | 1,509 | 8.9% |

| Restructuring | 43 | 11 | 54 | 20.4% | |

| Introduction, update, abolition of takeover defense measures | 0 | 62 | 62 | 100.0% | |

| Other proposals on capital policy | 387 | 78 | 465 | 16.8% | |

| Partial revision to articles of incorporation | 510 | 41 | 551 | 7.4% | |

| Other | 0 | 1 | 1 | 100.0% | |

| Total | 18,689 | 3,453 | 22,142 | 15.6% | |

2. Shareholder proposals

| Proposal | July 2017 - June 2018 | ||||

| Yea | Nay | Subtotal | Nay ratio | ||

| Proposal on company | Election/dismissal of directors | 5 | 41 | 46 | 10.9% |

| (Reference) Number of companies | 2 | 15 | 17 | 11.8% | |

| Election/dismissal of corporate auditors | 0 | 0 | 0 | 0.0% | |

| (Reference) Number of companies | 0 | 0 | 0 | 0.0% | |

| Selection of accounting auditors | 0 | 0 | 0 | 0.0% | |

| Proposal on executive remuneration | Executive remuneration | 0 | 7 | 7 | 0.0% |

| Retirement benefit payments | 0 | 0 | 0 | 0.0% | |

| Proposal on capital policy (Except proposals concerning the articles of incorporation) | Appropriation of surpluses | 6 | 5 | 11 | 54.5% |

| Restructuring | 0 | 0 | 0 | 0.0% | |

| Introduction, update, abolition of takeover defense measures | 2 | 0 | 2 | 100.0% | |

| Other proposals on capital policy | 0 | 0 | 0 | 0.0% | |

| Partial revision to articles of incorporation | 0 | 0 | 0 | 0.0% | |

| Other | 12 | 86 | 98 | 12.2% | |

| Total | 25 | 139 | 164 | 15.2% | |

③ ESG initiatives

Since launching the Nikko Eco Fund in 1999, which invests in environmentally friendly firms and is Japan’s first Socially Responsible Investing (“SRI”) fund, we have incorporated ESG factors in all of our investment management processes based on our understanding that they contribute to medium- and long-term corporate value. We also constantly introduce new initiatives in order to put our EGS activities into practice more effectively. Since August 2013, we have been applying the principle of Creating Shared Value (“CSV”; the practice of creating value for society and firms by aligning efforts to solve societal issues with corporate interests and pursuing both goals simultaneously) by having our analysts formulate unique CSV scores that incorporate comprehensive assessments of firms’ financial standings, market competitiveness levels and ESG initiatives, and use them in their stock selections. We currently formulate scores for 600 stocks listed on the Tokyo Stock Exchange from a medium- to long-term perspective. We have already built up a track record of over five years of assessment and engagement based on our analysts’ close engagement with the 600 firms whose CSV scores we assess and their daily work to improve corporate value including ESG.

Our other initiatives are as described below.

Principles of Responsible Investing (PRI) ratings from assessment institutions

| 2018 | 2017 | 2016 | ||

| Approach to responsible investing (overall assessment) | A+ | A+ | A+ | |

| Incorporation of responsible investing in listed stocks | A+ | A+ | A | |

| Active ownership in listed stocks | Engagement | A+ | A+ | A |

| Exercise of voting rights | A+ | A+ | A+ | |

Funds focused on Socially Responsible Investing (SRI)

| Investment target | Fund name | AUM (JPY 100M) |

| Japanese Equities | Nikko Eco Fund | 74 |

| Nikko DC Eco Fund | 6 | |

| Foreign Bonds | Nikko World Bank Bond Fund (Monthly Dividend Payment Type) | 167 |

| SMBC Nikko World Bank Bond Fund | 19 | |

| World Bank Green Bond Fund | 38 |

* AUMs are as of December-end 2017. * Open-end, publicly offered funds.

[In conclusion]

Engagement regarding fiduciary principles and ESG principles are continuous efforts that will never come to an end, and all officers and employees at Nikko AM will continue making their utmost efforts to put the principles into practice. We will continually provide updates on those efforts.

Furthermore, we intend to take our role a step further by switching the focus of our role in fulfilling our fiduciary duties from protecting the interests of customers to promoting the interests of customers.

Engagement Regarding Fiduciary/ESG Principles (May 1, 2017)Engagement Regarding Fiduciary/ESG Principles (January 26, 2018)