Key Takeout

- We see DeepSeek’s breakthrough as an accelerant of existing trends and the next stages of broader AI adoption and implementation of applications.

- Companies engaged in content production, autonomous driving, robotics and industry-specific software as a service (SaaS) may see the greatest potential for monetisation.

- Beyond monetisation, scope for efficiency gains will also become much more prevalent in certain industries.

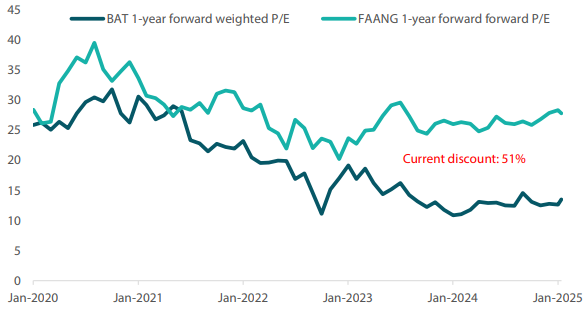

- Markets have been significantly discounting China’s digital majors, known as “BAT”, compared to the broader US industry represented by “FAANG”, and in terms of valuation they are approximately half the price.

- Geopolitical tensions and data privacy concerns are key risks to monitor.

DeepSeek: an AI industry upstart

Not too long ago, the term artificial intelligence (AI) was found only in the realm of science fiction novels. It was featured prominently in works such as Phillip K. Dick's “Do Androids Dream of Electric Sheep?” which the cult movie classic “Blade Runner” was based on, and Isaac Asimov's “I, Robot”, which also inspired a movie of the same name. Fast forward to today, and the term has since become synonymous with all things digital. It encompasses everything from the smart robot vacuum cleaner assiduously hoovering up all the dirt on your home floor, to the virtual assistant on your smartphone answering all the queries you throw at it.

Looking at the multibillion-dollar industry that has coalesced to allow these applications to proliferate in all aspects of daily life, we would assume that massive capital expenditure and time are needed to develop infrastructure and train AI programmes. However, a small, independent research laboratory based in Hangzhou, China, appears to be challenging this conventional wisdom. Founded by entrepreneur Liang Wenfeng, the AI startup's DeepSeek chatbot has roiled the tech world. DeepSeek has performed nearly as well, if not better, than AI models from Microsoft-backed OpenAI's ChatGPT, Meta's Llama and Amazon-backed Anthropic's Claude. What is truly surprising, however, is that the company claimed to have spent less than US dollar (USD) 6 million to build its AI model—approximately ten times less than the amount Meta spent on its product—and achieved this feat in just two short months.

Conventional wisdom dictates that companies use Nvidia's expensive, cutting edge H200 or B200 graphical processing units (GPUs) to train their AI models for optimal results. Prevailing sanctions prohibit US companies from selling advanced computer chips to mainland China; however, the programmers of DeepSeek were apparently able to produce results with the older H800 GPUs by wringing out every last bit of performance from them. The revelation shocked the tech industry and sparked a selloff in the shares of semiconductor firms including Nvidia, Broadcom and Micron.

In our view, these developments could lead to changes in the way AI models are trained, particularly from a cost and efficiency perspective. DeepSeek's innovation in the field has established that the “mixture of experts” 1 (MoE) approach, which requires less computing power and time, coupled with the “reward system” 2 are as effective as the more resource-intensive chain-of-thought 3 reasoning approach.

Falling costs will mean lower barriers to entry, allowing more companies to partake in AI development and grow the ecosystem at a more rapid pace. Additionally, open source AI models, like DeepSeek's, which make the programme's source code available for public use and modification, have now been proven to perform just as well, if not better, to proprietary models from Big Tech. We believe the trend towards using open source inference models with narrower parameters will persist. As a result, we expect to see broader adoption and implementation of AI applications across both corporate and government sectors in the days ahead. We had previously touched on the subject of AI models improving in terms of efficiency and cost-effectiveness in our article A Fundamental Change for AI?

Although semiconductor firms such as Nvidia were sold down on fears that their chips might face lower demand, we believe it would be premature to write them off. DeepSeek's AI model training is still based on Nvidia's GPUs and their CUDA software, albeit on older hardware. Hence, we still expect healthy demand for such chips as the training of AI models continues to intensify.

China's underrated tech sector

From our perspective, the markets may have been discounting China's tech sector, represented by Baidu, Alibaba and Tencent (BAT), in comparison to the broader US industry represented by Facebook, Amazon, Apple, Netflix and Google (FAANG). It is only recently that the markets have started to recognise the potential value of Chinese tech startups, like DeepSeek, which have the prowess to compete on the global stage. Valuation-wise, we have observed that US FAANG firms are approximately twice as expensive as their BAT Chinese counterparts.

Chart 1: BAT stocks at a significant discount compared to FAANG stocks

Source: Goldman Sachs, February 2025

Meanwhile, competition within China's domestic market is already intensifying as AI models from Chinese firms such as Baidu, Zhipu and Bytedance's Doubao are being launched. Tech giant Alibaba is even claiming that its Qwen 2.5 version AI model is superior to DeepSeek's V3 AI model. We expect these developments to eventually enable users to switch models in their applications at a low cost. As a case in point, we are now seeing international firms like Perplexity, a San Francisco-based developer of a conversational search engine, incorporate and offer DeepSeek's AI models on their platforms.

These events are in line with what we had discussed in the Asian equity outlook 2025, where we explored the implications of generative AI transitioning to the next level of development following massive capital expenditure.

Roadblocks to further AI adoption

A major obstacle standing in the way of broader AI usage in light of DeepSeek's claimed breakthrough is the escalation of US-China geopolitical tensions. A technological arms race between the world's two largest economies will certainly hinder any progress in building an ecosystem that would propel AI applications to the forefront of worldwide adoption. There are already news reports that US officials are investigating how DeepSeek was able to procure Nvidia-made AI chips in spite of the ban, and US government workers are prohibited from using the application due to national security concerns.

Should the US further tighten export controls to stem the flow of AI chips and technology to China, we believe that it would affect the speed of future AI model training there as domestic supply is currently unable to make up the shortfall. We therefore believe that chip independence should remain a priority for China in order for the country to continue its advancements in the AI field.

Data privacy is another significant concern. The integration of AI into all aspects of the internet makes it even more challenging to regulate the personal information we allow to be collected online, given the data-intensive nature of such systems.

Then, there is the issue of AI “hallucinations” where generative AI chatbots produce misleading or entirely wrong information due to incorrect or skewed data that the AI model is trained on. This problem reflects an old adage from Computer Science 101: “garbage in, garbage out”. However, as AI technology matures, this risk is decreasing as improved data, better architecture, reinforced learning and guardrail filters improve the user experience.

Finally, there is the million-dollar question of how AI can be monetised to help enterprises address business pain points. We believe that companies engaged in content production, autonomous driving, robotics and industry-specific SaaS stand to benefit the most from the greater adoption of AI models. Beyond the monetisation question, AI-enhanced efficiency in areas such as automation, robotics, inventory management, cyber security and targeted advertising are significant benefits that no CEOs of large corporations can afford to ignore. In our view, the fields highlighted here have the most potential for robust, sustainable returns.

Full steam ahead for AI

The speed at which AI applications are becoming part and parcel of daily life is breathtaking, with DeepSeek's apparent breakthrough merely accelerating an inevitable, fundamental change in the field. We firmly believe these breakthroughs are the key components needed for sustainable, long-term returns.

We also are firm believers in the Jevons Paradox, an economic theory that suggests that as technological advancements increase the efficiency with which a resource is used, the overall consumption of that resource actually increases rather than decreases. We have seen this with improvements in fuel efficiency resulting in more people driving, in turn increasing total global fuel consumption. A similar phenomenon was seen during the Industrial Revolution as an improvement in the efficiency of steam engines did not reduce coal consumption but led to a boom in coal demand. We believe that the AI industry is highly likely to follow a similar pattern, leading to even greater long-term demand for AI-related applications.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.

1 A machine learning approach that divides an AI model into separate sub-networks (or “experts”).

2 A method in which AI algorithms are trained to make decisions by being rewarded or punished for their actions.

3 An approach allowing models to break down complex problems into simpler steps that can be solved individually.