Summary

- DeepSeek had the world talking in January. We believe the introduction of this low-cost artificial intelligence (AI) model may cause a recalibration of capital expenditures. Moreover, DeepSeek's introduction has initiated a shift towards a more cost efficient, scalable, and accessible AI landscape. It also presents the opportunity for more Chinese companies to adopt cutting-edge technologies without prohibitive capital allocation towards AI projects

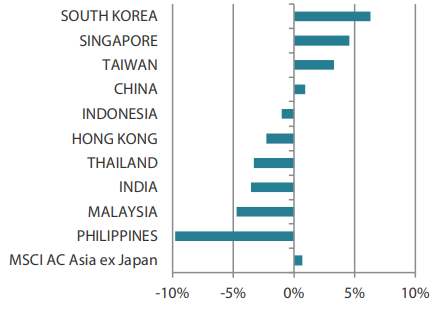

- There was caution over the pace of the US Federal Reserve (Fed)'s easing cycle. US President Donald Trump threatening to impose tariffs across the board on all goods entering the US was also a source of concern. Investors also monitored news about DeepSeek, the AI application from a small Chinese start-up firm. DeepSeek performed nearly on par with OpenAI and similar products from US Big Tech companies, but at a fraction of the capital expenditure needed to train and develop these systems. South Korea (+6.3%) and Singapore (+4.6%) outperformed the region while the Philippines (-9.8%) and Malaysia (-4.7%) lagged.

- Chinese equities already reflect a higher risk premium for trade disruptions with Trump back in the White House for his second term. We continue to believe that focusing on companies with strong management and adaptability is crucial for mitigating risks and seizing opportunities. Elsewhere, we see India as undergoing a healthy correction, which hopefully opens up more opportunities at much more reasonable valuations. Similarly, South Korea's recent political turmoil also presents opportunities to select quality companies at lower valuations.

Market review

Markets end a bumpy January with muted gains

Asian equities gained modestly in the first month of 2025. The Fed opted to keep interest rates unchanged at the end of January amid concerns over what it described as elevated inflation levels, and there was some caution prior to the Fed's meeting. Another cause for worry was the start of Trump's second presidential term. His threat to impose tariffs across the board on all goods entering the US—a measure intended to bring jobs and manufacturing back to the country—stirred caution. Investors were also jittery following the emergence of DeepSeek. The MSCI Asia Ex Japan Index edged up 0.7% in US dollar (USD) terms in January.

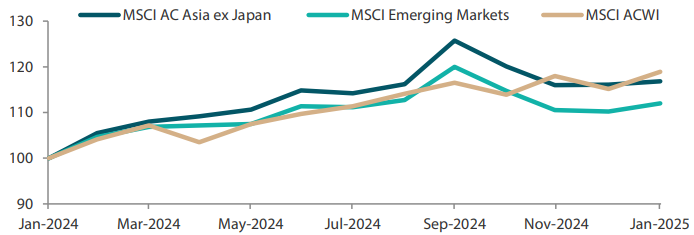

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Rescaled to 100 on January 2024.

Source: Bloomberg, 31 January 2025. Returns are in USD. Past performance is not necessarily indicative of future performance.

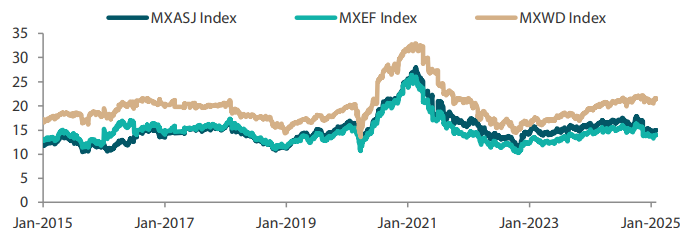

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 January 2025. Returns are in USD. Past performance is not necessarily indicative of future performance.

South Korean sentiment bullish on government stimulus plans; AI demand lifts Taiwan

South Korea (+6.3%) led the way in January, with sentiment boosted as the authorities looked to introduce measures to reinforce the flagging economy, support local businesses and increase exports. A total of 26 large public institutions plan to invest USD 45 billion on initiatives to sustain the housing market, upgrade infrastructure and stimulate growth. These measures were initiated in response to South Korea's gross domestic product (GDP) in the fourth quarter of 2024 (4Q24) falling short of forecasts. South Korea has been roiled by political turmoil as impeached President Yoon Suk Yeol was arrested and charged with insurrection over his failed martial law declaration in December 2024.

Elsewhere, tech-heavy Taiwan (+3.3%) was buoyed by continued optimism towards the global proliferation of AI applications. Its economy grew in 4Q24, albeit at a slower-than-expected pace. Taiwan's December export orders exceeded expectations, led by electronics, information and communication products.

In other North Asian markets, China (+0.9%) gained following news that growth for 2024 was in line with official targets. The economy expanded by 5.4% in 4Q24, lifting full-year growth to 5% as the country posted a record trade surplus of USD 990 trillion. The People's Bank of China also pumped USD 234 billion into the financial system via outright reverse repurchase agreements to stabilise the local currency. Meanwhile, Hong Kong shares declined 2.3% amid Trump's renewed threats to impose more duties on Chinese goods.

Singapore stocks shine in ASEAN

Singapore (+4.6%) was the sole bright spot in ASEAN. Its market advanced as Singapore's central bank eased monetary policy for the first time in four years amid an increase in global trade disputes with Trump back in office. December exports surpassed forecasts due to robust electronics shipments to other parts of Asia.

The potential imposition of more US tariffs cast a shadow over the rest of ASEAN. Indonesia lost 1.0%, Thailand fell 3.3%, Malaysia shed 4.7% and the Philippines retreated 9.8%. The economies of Malaysia and the Philippines both saw weaker-than-expected growth in 4Q24 amid geopolitical uncertainty. In Indonesia, the central bank cut interest rates by 25 basis points (bps) to support economic growth and revised down the country's 2025 growth outlook. The local currency has been pressured by a strong US dollar, which has gained on the prospect of the Fed ending its easing cycle sooner than anticipated.

Indian market extends its monthly losing streak on slowing growth

The Indian equity market continued declining, shedding 3.6% in January on pessimism over its slowing economy. In response, the central bank plans to inject over USD 11 billion in liquidity into the financial system via open market operation purchases of government securities, a 56-day variable rate repo auction and a dollar/rupee buy-sell swap auction. The manufacturing purchasing managers index for December 2024 dropped to a 12-month low as growth in production and new business orders softened.

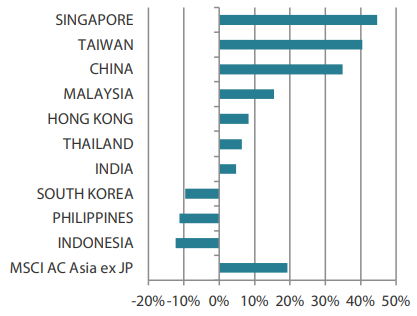

Chart 3: MSCI AC Asia ex Japan Index 1

For the month ending 31 January 2025

For the year ending 31 January 2025

Source: Bloomberg, 31 January 2025.

1 Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Trump's tariff threats priced into Chinese equities

Market volatility has increased at the start of the year due to the unpredictable nature of Trump's protectionist policies and the possibility of tariff-induced trade wars. Despite concerns about the impact of such punitive measures on emerging markets, historical data shows that during Trump's first term, China outperformed the S&P 500 and other beneficiaries of the "China plus one" strategy. Currently, Chinese equities already reflect a higher risk premium for trade disruptions. In this climate, we believe that focusing on companies with sound management and adaptability is crucial for mitigating risks and seizing opportunities. In China, opportunities can be found in self-sufficiency and industries that have consolidated, where pricing power is improving. We are also keeping close watch on China's counteracting policies this year, as consumption could play a much more significant role in propping up growth.

The rapid rise in popularity of DeepSeek, which develops open-weight large language models (LLMs), also significantly contributed to market volatility. The introduction of the low-cost AI model may cause a recalibration of capital expenditures and has initiated a shift towards a more cost efficient, scalable, and accessible AI landscape. It also presents the opportunity for more Chinese companies to adopt cutting-edge technologies without prohibitive capital allocation towards AI projects.

Eyeing quality names amid Indian market correction

We believe that India remains a compelling long-term investment opportunity despite its short-term challenges. The Indian rupee is expected to further weaken after hitting a new low earlier this year on expectations of interest rate cuts to lift economic growth. Supportive consumption policies and structural reforms may enable Indian companies to recover in the year ahead. We see the current correction as a healthy occurrence that hopefully presents investors with opportunities to focus on high quality companies at much more reasonable valuations.

Korean market volatility similarly presents opportunity to focus on quality stocks

South Korea's recent political turmoil, characterised by leadership instability and public protests, has led to increased volatility in its equity market and sidelined its “Value-Up” programme. Investors are cautious as political uncertainty affects economic policies and investor confidence, resulting in fluctuating stock prices and a slowdown in capital inflows. Many South Korean presidents have historically been impeached or incarcerated. However, some South Korean companies still continue to grow globally and deliver good returns. The political turmoil presents an opportunity to select good companies at lower valuations. Together with Taiwan, these economies and their stock markets are among the most sensitive to trade disruption, and we have observed several portfolio companies already adapting to limit those risks.

ASEAN economies poised to benefit from “China plus one” diversification strategy

Buoyed by expectations of lower rates and structural reforms, ASEAN has outperformed the US and Asia ex-Japan markets since mid-2024 and trails China only narrowly. While easing interest rates would be a large tailwind, there is enough fundamental change that we find attractive regardless of the direction of interest rates. Under the Trump administration, we anticipate added impetus for "China plus one", as manufacturers—including those from China—continue to seek low-cost and low-tariff production locations. We believe that this trend will continue to benefit most ASEAN countries. China, as a counterweight to US policy, may also guide and encourage its private companies to increase outward direct investment, aiming to improve trade relations with its neighbours.

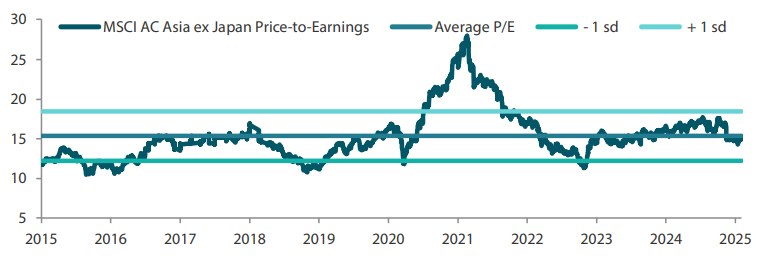

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 January 2025. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

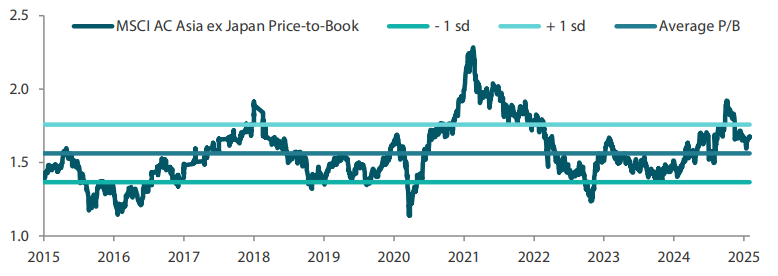

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 January 2025. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.