Summary

- Despite concerns about Donald Trump's impact on emerging markets, historical data shows that during his first term as US president, China, South Korea and Taiwan outperformed the S&P 500—although they are the most trade-sensitive equity markets. The lesson here is to keep an open mind and that there can be more meaningful fundamental changes at play than just Trump's bluster.

- We believe that Asian markets can still offer attractive returns despite ongoing geopolitical uncertainties. We would look to domestic policies across heavyweight economies like India and China as key fundamental change drivers for the year ahead. In our view, investors should focus on companies capable of harnessing these changes for sustainable growth in 2025 and beyond.

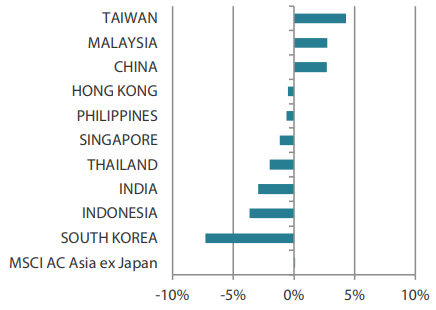

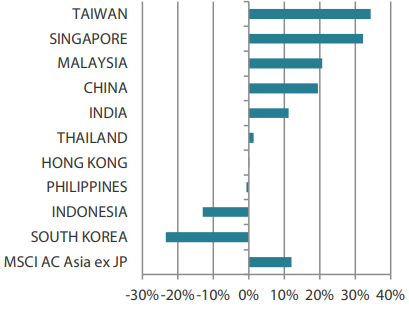

- Asian markets ended an otherwise stellar 2024 on a low note due to a reconsideration of interest rates, lingering concerns about Trump's protectionist policy and worries about the health of the Chinese economy. The MSCI AC Asia ex Japan Index returned 0.1% in US dollar (USD) terms in December. Taiwan (+4.3%), Malaysia (+2.7%) and China (+2.7%) were the best-performing markets while South Korea (-7.3%) and Indonesia (-3.7%) were the biggest laggards.

- Given the unpredictability associated with Trump's leadership, Chinese equities already reflect a higher risk premium for trade disruptions. We believe that investing in companies with strong management and adaptability is crucial for mitigating risks and seizing opportunities. In China, opportunities can be found in self-sufficient industries and those that have consolidated. Elsewhere, we believe India remains a compelling long-term investment case despite short-term reservations regarding rich valuations. South Korea's recent political turmoil also presents opportunities to focus on high-quality companies at lower valuations.

Market review

Lacklustre December in an otherwise strong 2024 for Asian markets

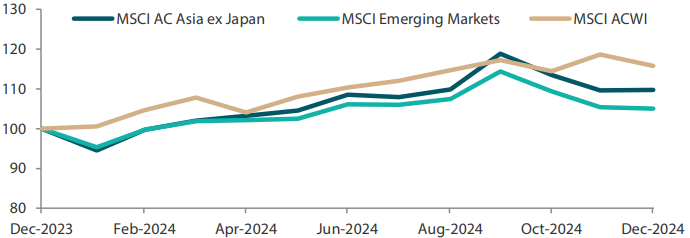

Asian markets stumbled to the finish line in 2024, reflecting the lingering uncertainties investors face, which include Trump's protectionist stance, the outlook for central bank policies and the health of the Chinese economy. Following a sluggish November, the MSCI Asia Ex Japan Index grinded out a 0.1% gain in US dollar terms in December. Still, the region wrapped up the year with a 12% gain.

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Rescaled to 100 on December 2023.

Source: Bloomberg, 31 December 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 December 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

China proposes loose monetary policy; Taiwan tops Asian indices in 2024

In North Asia, Chinese shares advanced 2.7%. China's Politburo, led by President Xi Jinping, vowed to adopt a “moderately loose” stance on monetary policies while promising to ramp up fiscal measures in 2025. There will be a greater focus on spurring consumption to support the economy, ahead of growth headwinds from looming US tariffs. In terms of economic data, China's factory activity expanded for a third straight month in December; however, retail sales, export and import figures all fell short of expectations. Meanwhile, Hong Kong shares edged down 0.5%.

Taiwan cemented its position as Asia's best-performing market in 2024 (+34.4%), following a 4.3% rise in December. Tech stocks had helped lift Taiwan throughout the year amid robust demand for artificial intelligence (AI)-related hardware and application. Notably, shares of index heavyweight TSMC touched a record high in December. Separately, the central bank of Taiwan held its key discount rate steady at 2% during its quarterly board meeting. Elsewhere, the South Korean stock market remained in a slump, after turning in a 7.3% loss over the month, weighed down by domestic political drama. Earlier in December, President Yoon Suk Yeol dramatically declared martial law before reversing the decision hours later, which was then swiftly followed by a motion to impeach him. Han Duck-soo, who then took over as acting president, was also impeached, plunging the country deeper into political chaos.

ASEAN markets conclude the year mostly on a negative note

ASEAN markets were largely in the red with the exception of Malaysia, which added 2.7%. ASEAN markets gave back some recent gains following the Federal Reserve boards more hawkish tone in its December meeting, indicating less cuts than previously anticipated by markets.

In the Philippines (-0.6%), the Bangko Sentral ng Pilipinas cut its policy rate by 25 basis points (bps) and signalled its intention to press on with a measured approach to easing. Its counterparts in Thailand (-2.0%) and Indonesia (-3.7%) also delivered their latest policy decisions—both kept interest rates on hold at 2.25% and 6.00% respectively. Singapore's (-1.2%) core inflation continued its decline in November to a three-year low of 1.9% YoY, mainly due to a moderation in food and services inflation.

The RBI cuts CRR requirement for banks, leaves repo rate unchanged

Indian equities dipped 2.9%, amid worries about the economy losing momentum on factors such as weakening private consumption and reduced government spending; amid reservations about rich valuations, there are also concerns about corporate earnings growth slowing.

Slowing economic growth may mean that the Reserve Bank of India (RBI) could face pressure to ease. For now, the RBI maintained its key repo rate at 6.5% in December, but it cut the cash reserve ratio (CRR) by 50 bps to 4% to boost liquidity into the banking system. India's retail inflation eased to 5.48% in November, after breaching the RBI's 6% upper tolerance band in October.

Chart 3: MSCI AC Asia ex Japan Index 1

For the month ending 31 December 2024

For the year ending 31 December 2024

Source: Bloomberg, 31 December 2024.

1

Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Drive towards self-sufficiency and industry consolidation in China provide investment opportunities

After three years of tightening monetary policy, global central banks have started to ease, benefiting investment opportunities, particularly in twin deficit economies such as India and parts of ASEAN. However, this environment may be complicated by the unpredictable nature of Trump's return to power, which could increase market volatility due to his protectionist policies. Rate cut expectations are already being dialled back.

Despite concerns about Trump's impact on emerging markets, historical data shows that during his first term, China, South Korea and Taiwan outperformed the S&P 500—despite being the most trade-sensitive equity markets. This time around, Chinese equities already reflect a higher risk premium for trade disruptions. We believe that investing in companies with strong management and adaptability is crucial for mitigating risks and seizing opportunities. In China, opportunities can be found in self-sufficient industries and those that have consolidated. Supply chain diversification is essential, especially in regions with minimal trade balances with the US.

Longer-term India growth story remains intact despite rich valuations

India remains a compelling long-term investment opportunity despite short-term reservations regarding rich valuations. Fortunately for patient investors, opportunities at more reasonable prices are emerging.

In the meantime, India faces near-term challenges which may slow growth in some sectors. These challenges include Prime Minister Modi's coalition government potentially struggling to implement significant reforms and proactive regulation by the RBI and the Securities and Exchange Board of India. It is also worth noting that the digitisation of the Indian economy profoundly impacts long-established traditional distribution channels and brand moats—elements that have benefited several companies for decades.

Capturing opportunities amid South Korean political woes

South Korea's recent political turmoil, characterised by leadership instability and public protests, has led to increased volatility in its equity market. Investors are cautious as political uncertainty affects economic policies and investor confidence, resulting in fluctuating stock prices and a slowdown in capital inflows. Most South Korean presidents have historically been impeached or incarcerated, but some of the country's companies continue to grow globally and deliver good returns. The political turmoil presents an opportunity to select high-quality companies at lower valuations.

Buoyed by expectations of lower rates, ASEAN has outperformed the US and Asia ex-Japan markets since mid-2024 and trails China only narrowly. Despite likely inflationary policies under Trump's second term, we believe that the US monetary easing cycle will continue into 2025. This would be supportive for ASEAN markets, especially those with positive domestic fundamental change, namely Malaysia, Singapore and the Philippines, in our opinion. Under the Trump administration, we anticipate an added boost for "China plus one", as manufacturers—including those from China—continue to seek low-cost and low-tariff production locations.

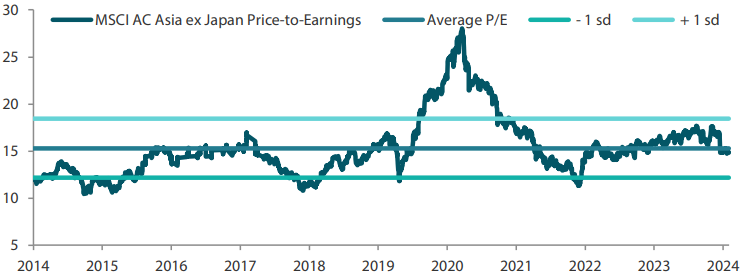

Asian markets still offer attractive returns

While geopolitical uncertainties persist, we believe that Asian markets can still offer attractive returns. A sustained shift towards lower interest rates could benefit economies like India and China if accompanied by supportive policies and structural reforms. Investors should focus on companies capable of harnessing these changes for sustainable growth in 2025 and beyond.

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 December 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

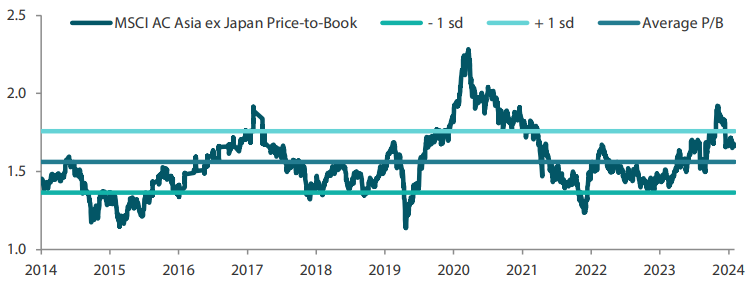

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 December 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.