Key Takeaways

- A stable political backdrop is just one of several key considerations supportive of investors increasing their exposure to Japanese equities, in our view.

- We believe that reforms to both its corporate governance structure and the configuration of its stock market have made Japan a more attractive investment destination for global investors.

- The removal of COVID-19 inbound travel restrictions is expected to provide Japan with an additional economic boost, with tourism further benefitting from the yen’s relative weakness.

Political stability and geopolitical positioning

We believe that there are three key considerations that are supportive of investors increasing their short- and long-term exposure to Japan, the world’s third-largest economy. To start, Japan’s political stability is the envy of much of the rest of the world. In an era of increased polarisation, Japan’s political environment is known for its stability and policy continuity. The ruling Liberal Democratic Party (LDP) and its junior coalition partner Komeito control both houses of parliament, and in last year’s Upper House election the LDP won a landslide victory. This climate of “no surprises” has helped create a favourable environment for businesses and long-term investors.

And of course, Japan has a unique geopolitical position as the only Asian member of the G7 group of countries. Other Asian countries depend on Japan for its technology and materials, but Japan also benefits from its strategic location as a gateway to emerging Asia, making it an attractive investment destination for companies seeking regional expansion and for investors seeking exposure to emerging growth. Being less exposed to the same level of risks as emerging markets means Japan is an investment destination that can offer the best of developed and emerging worlds.

Corporate governance strength

Second, one of the key drivers of success within the Japanese market has been its corporate governance reforms since 2014. The 2014 introduction of the Stewardship Code was a watershed moment for changing how investors interact with corporations. Japan’s Corporate Governance Code was introduced shortly after in 2015, with further revisions in 2018 and 2021. Key provisions included companies increasing the number of independent directors, full disclosure of policies and voluntary measurable targets to appoint more women and non-Japanese professionals.

Moreover, corporate accountability has become a growing theme in Japan, with shareholders ensuring companies in Japan are held accountable for their actions. An example of this involves Canon, one of Japan’s most famous global brands and a leading maker of digital cameras and industrial equipment using semiconductors.

Canon’s CEO, Fujio Mitarai, is a well-known leader in corporate Japan and has been in the role for almost two decades, but in 2022 his re-election agenda was almost voted down at a shareholders meeting. Why? Because shareholders now have the power to say no. They were able to make their voices heard and told Canon they were unhappy with the fact that it did not have a female on its board. In the end, Mitarai scraped through with just over 50% of shareholder support.

So, shareholders are gaining more power and becoming much more vocal, which is an important aspect of the improved corporate governance backdrop. In particular, the number of activist shareholder proposals has steadily increased since the introduction of the Corporate Governance Code, underlining how far Japan has come already.

Some global investors might still question whether corporate culture changes within Japan are happening quickly enough. But it is worth remembering that Japan is a country that places a great emphasis on social stability. Rather than making drastic moves, restructuring takes place carefully and over time. But when taken from a top-down view, the changes implemented over the last decade have been hugely significant.

Stock market reforms

It is important to also recognise the way that the Tokyo Stock Exchange has played a role in ensuring Japanese-listed companies become more accountable. In April 2022, the Tokyo Stock Exchange underwent a significant restructuring. Its five segments (First Section, Second Section, Mothers, JASDAQ Standard and JASDAQ Growth) were restructured into three (Prime Market, Standard and Growth). The result is that companies face far more stringent listing criteria and must meet specific corporate governance standards or risk being demoted or delisted.

These Tokyo Stock Exchange reforms are starting to accelerate. In March 2023, it took an unprecedented move by calling on companies listed on Prime and Standard markets to draft specific plans that focus on enhancing shareholder value. It called for companies to look into their financial strategy, their share price, their valuation and, specifically, their cost of capital, to ensure everything was satisfactory. This will not be a one-off event, in our view, as the bourse is expected to ensure companies engage with shareholders to continue to improve their financial strategy on an ongoing basis.

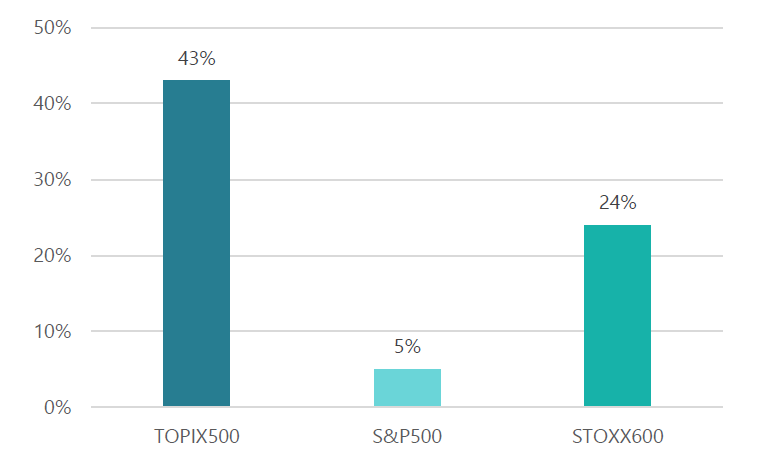

And from a valuation perspective, Japanese companies have plenty to offer investors. As Chart 1 shows, of the 500 largest companies in the TOPIX Index (which consists of around 2,000 stocks), the number of companies trading below book value is 43%, which is significantly higher than the number of below-book value companies in the US’s S&P 500 (just 5%) and Europe’s STOXX600 (24%). In other words, Japanese stocks look significantly undervalued and there is a lot of value to be unlocked in the Japanese equity market.

Chart 1: Percentage of companies trading below book value (Japan, US, Europe)

Source: Tokyo Stock Exchange as at December 2022

COVID recovery and inbound tourism

Third, it is important to consider where Japan is regarding the return to inbound tourism. The Japanese government removed all of its travel restrictions between March and April of this year, and this included the last remaining restrictions on Chinese tourists entering Japan. Before COVID, Japan had 32 million visitors per year, of which a third came from China. In fact, approximately 40% of inbound spending was made by Chinese tourists. In 2019, inbound tourist spending accounted for 0.8% of GDP1. For a country with annual GDP growth of 1.7% in 2022, this represents a significant contribution to Japan’s overall economy.

Japan’s government had been quite conservative in its approach to reopening its borders to visitors, especially considering the importance of national and local elections over the past year. This was understandable given Japan’s senior citizens make up a large proportion of the electorate and have the most to fear from the spread of COVID. However, with those elections now in the past, the government clearly recognises it can be a little more progressive in its approach to travel restrictions and tourism. Now, there’s every likelihood more Chinese tourists will return to Japan.

At a real-world level, Japan is a country that tourists want to return to, and when they get to Japan, they find their money is going further, which will increase inbound tourism spending.

And visitors of note are indeed returning. Warren Buffet was in Japan in April, when he announced his firm Berkshire Hathaway was increasing its allocation to its Japanese holdings and he also indicated he wanted to increase his broader Japanese equities exposure, which we view as highly encouraging.

It is also worth keeping in mind the undervaluation of Japan’s currency. In The Economist’s Big Mac Index, a Big Mac in the UK costs 3.79 pounds(GBP), whereas in Japan it costs 410 Japanese yen, which is equivalent to just GBP 2.31. Goods and services (and fast food) are clearly cheap in Japan right now, and this is largely down to the divergence in monetary policies between its central bank and those of the rest of the developed world; while other countries are raising interest rates and tightening monetary policy, Japan has been able to maintain an ultra-loose policy.

So, considering things from a political, corporate governance, and international tourism and trade perspective, there are plenty of compelling reasons for global investors to take a closer look at Japanese equities.

1Ministry of Land, Infrastructure, Transport and Tourism (Kanko Hakusho).

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.