Asian local bonds have outshone global peers over the past five years

From 2018 through 2022, financial markets around the world had to endure a prolonged trade war between the US and China, a global COVID-19 pandemic, rising inflation, elevated oil prices and widespread geopolitical upheavals—namely the Russian invasion of Ukraine.

Another key stress factor global markets had to withstand since early 2022 was the aggressive monetary tightening by the US Federal Reserve (Fed) and other major central banks, many of which have implemented a series of interest rate hikes to quell decades-high inflation.

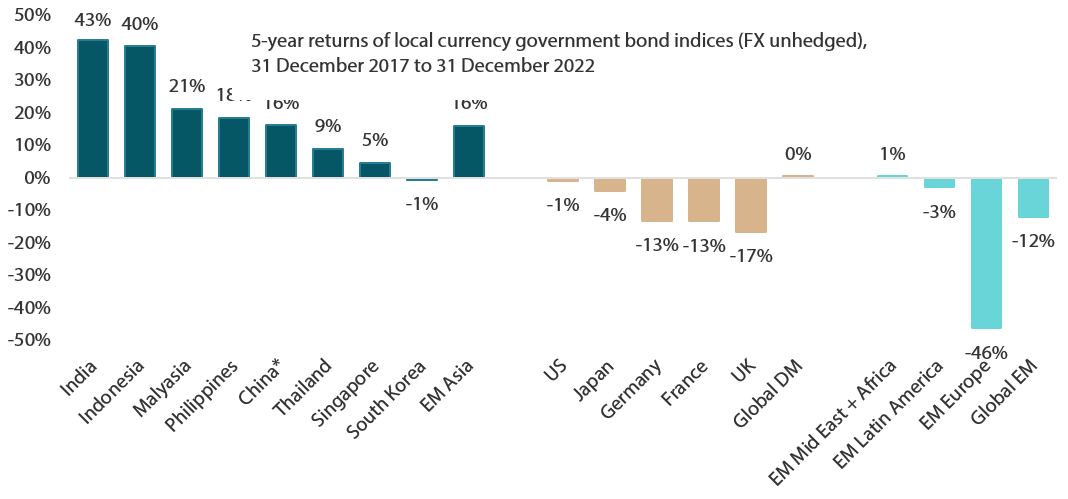

Still, Asian local bonds (also known as Asian local currency bonds, as they are denominated in the currencies of their home countries) have shown great resilience under such trying times. As a group, these regional bonds have outperformed their global peers by a big margin over the past five years (see Chart 1).

Local government bonds of India and Indonesia, for instance, turned in impressive gains of more than 43% and 40%, respectively, in local currency terms through 2018-2022, whereas those of Malaysia, the Philippines, China and Thailand all marked decent returns ranging from 9% to 21%. Conversely, most government bonds of the US, Europe and Latin America generated losses in local currency terms over the corresponding five-year period.

Backed by strong fundamentals and high-quality yields (as most Asian local currency government bonds have investment grade credit ratings) coupled with lower foreign ownership (compared to five years ago) and the potential appreciation of local currencies versus the greenback, Asian local bonds currently look attractive as a fixed income asset class.

In our view, regional local bonds will continue to perform well for the rest of 2023 and beyond as inflation rates in the region trend lower and Asian central banks refrain from further interest rate hikes. Moreover, we believe that the Fed, which recently hiked rates by 25 basis points (bps) at its Federal Open Market Committee (FOMC) meeting on 22 March, is near the end of its rate hike cycle. At the moment, given the ongoing global banking crisis, the market is pricing in less than a 50% chance of the Fed hiking rates at its next FOMC meeting in May.

In addition, there are other supportive factors that are expected to increase the appeal of Asian local bonds, namely the post-pandemic narrowing of Asia’s budget deficits, which will lead to lower issuance of local currency bonds, and the possible inclusion of these regional bonds in established global fixed income indices.

Chart 1: Asian local bonds outshine global peers

Source: Markit iBoxx, JP Morgan, Bloomberg

For individual countries, we use Markit iBoxxGlobal Government Bond Indices as proxies except India, which uses iBoxxAsia India Government Index. For emerging markets composite indices, we use JPM GBI-EM Index and its sub-indices. For Global developed markets, we use JPM Global Bond Index (GBI) as proxy. *China bond index’s inception was February 2019 and it has less than five years of track record.

Budget deficits of Asian countries set to narrow

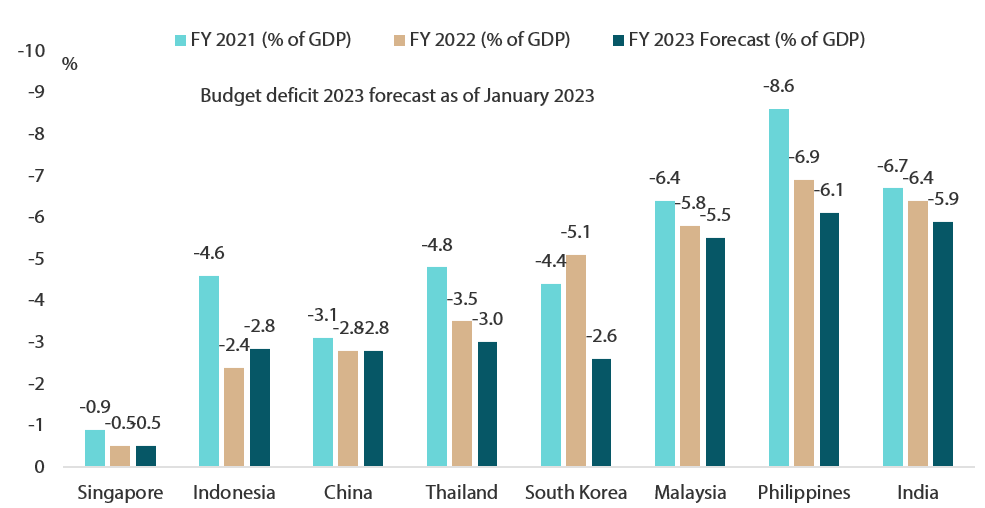

As Asian fixed income investors, we are especially watchful of the fiscal stance of countries within in the region. During the COVID-19 pandemic, notably in 2020 and 2021, almost all Asian countries experienced increases in their fiscal deficits as they were implementing expansionary fiscal stimulus to support their respective economies during periods of lockdowns and social restrictions, which had a negative effect on business and economic activities.

With the region’s economies reopening amid a return to normalcy following the pandemic, various countries in Asia are now adhering to stricter fiscal discipline and have started to trim their fiscal deficits, which are forecasted to narrow this year (see Chart 2).

Chart 2: Asia‘s budget deficits are likely to narrow going forward

Source: MOF India, Moody’s, official sources, Bloomberg, January 2023

Note: India’s data comes from MOF India and Philippine’s budget deficit forecast is from Fitch.

A case in point is Indonesia, which has managed to narrow its fiscal deficit substantially, from -4.6% of GDP in 2021 to -2.4% in 2022. Moreover, for 2023 the Indonesian government has set a budget deficit target of 2.85% of GDP, below its statutory limit of 3%.

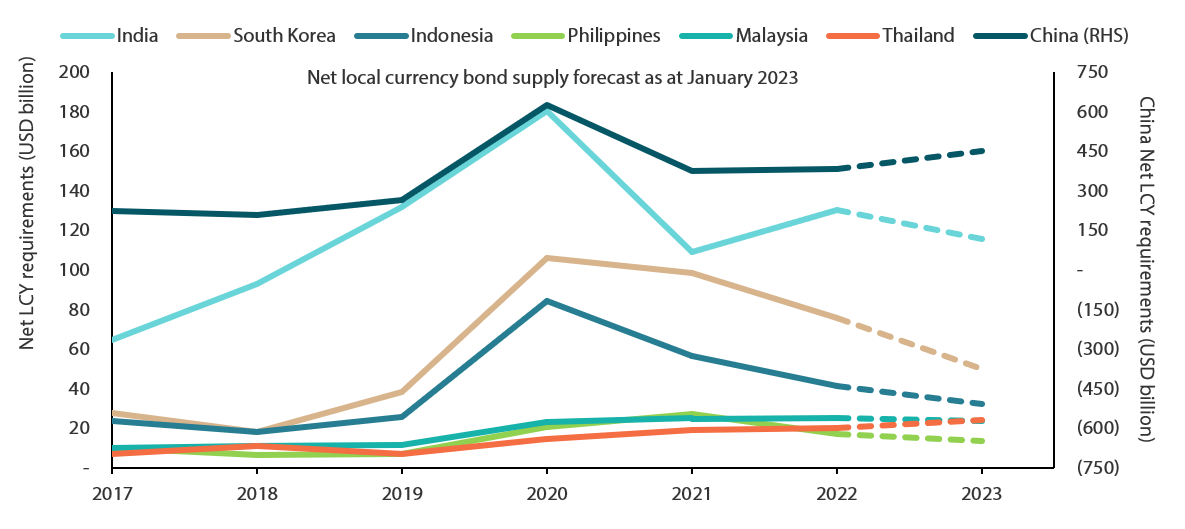

But what implications will a reduction in the fiscal deficits of Asian economies have on regional local bonds? To start with, we expect lower fiscal deficits to ease the financing pressure faced by Asian governments and, as such, lead to a lower issuance of local currency bonds. A cutback in net issuance or supply of Asian local bonds is generally supportive of bond prices. We expect the net local currency government bond supply of most Asian countries to be lower in 2023, as compared to 2022 (see Chart 3), creating less downside price pressure for regional local bonds over the next few quarters.

Chart 3: Net issuance of Asia local currency bonds projected to be lower in 2023

Source: ANZ, January2023

Ample room for inflows into regional bonds

Since March 2022, when the Fed started to embark on an aggressive tightening of monetary policy with a series of outsized rate hikes to tame rising inflation, we have seen an outflow of funds from Asia, with the move exacerbated by the strengthening of the US dollar.

However, in our view the aggressive rate hike cycle by the US central bank may not persist, given the ongoing banking crisis in the US and Europe. In addition, we believe that the Fed is now nearing the end of its tightening cycle as red-hot inflation in the US cools. Indeed, US annual inflation, as measured by the headline consumer price index (CPI), has been coming down since June 2022. For instance, the latest US annual inflation rate slowed for an eighth consecutive month to 6% in February 2023, the lowest since September 2021.

Likewise, the magnitude of the Fed’s interest rate increases has gradually shrunk since mid-2022, from a series of 75 bps hikes in June, July, September and November to 25-bps hikes in February and March 2023. At the moment, the Fed has to intricately balance the taming of inflation with its effort to avert a full-scale turmoil in the banking system.

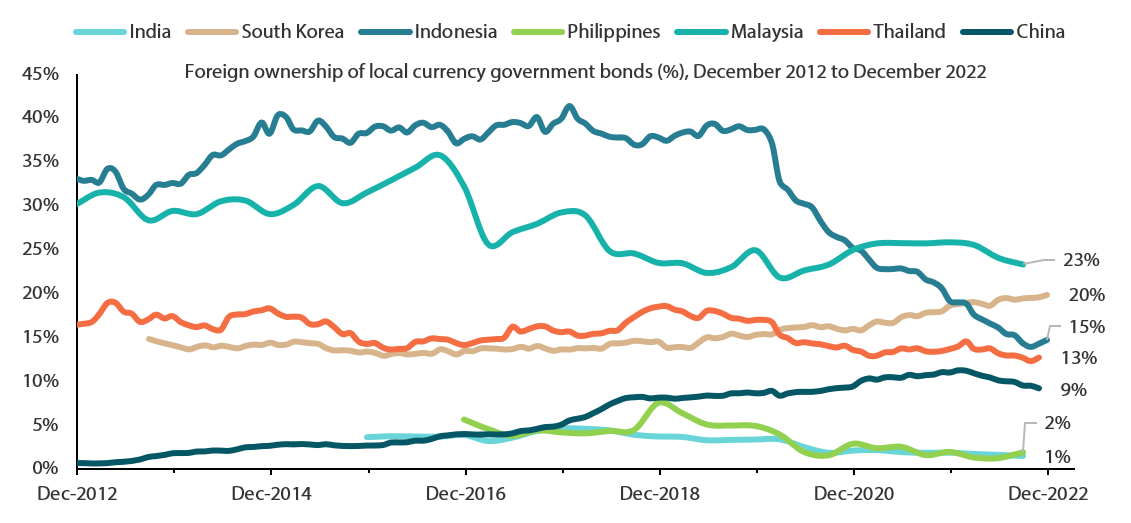

In the coming months, a possible pause in the Fed’s tightening cycle amid a slowdown by the world’s largest economy may help to stabilise the global rates market, resulting in an improvement in risk appetite. This could potentially prompt foreign funds to return to Asia as the greenback weakens. We believe that such developments will support Asian currencies and regional bonds. As at the end of 2022, foreign investors’ positioning in Asian local bonds (see Chart 4) was light relative to previous years. But once the environment turns more conducive for regional bonds, we expect inflows to Asia to resume.

Another factor that could spur more inflows of foreign funds into regional bonds in the near future is the possible inclusion of some Asian government bonds in established global fixed income indices. South Korea is seeking the inclusion of its government bonds to the FTSE World Government Bond Index (WGBI); similarly, India is pursuing the inclusion of its government bonds in the Bloomberg Barclays Global Aggregate Index and the JPMorgan Government Bond Index-Emerging Markets Global Diversified Index.

Chart 4: Foreign holdings in Asian local currency government bonds remain low

Source: ANZ, January2023

Regional central banks seen halting rate hikes as inflation in Asia eases

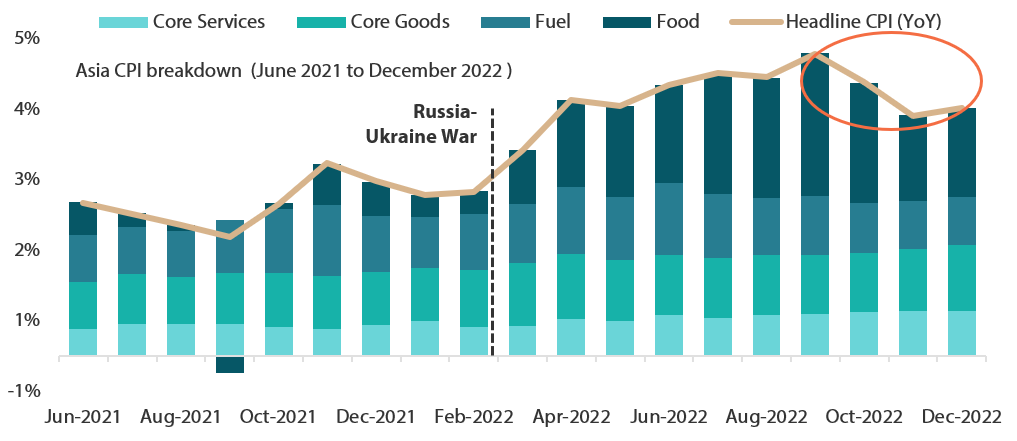

Russia’s invasion of Ukraine in February 2022 and the subsequent sanctions against Moscow by many developed countries have led to a diminished supply of major food staples, such as wheat and vegetable oils. As a result, Asia’s inflation, which is largely driven by the volatile food component, rose steeply in the first three quarters of 2022. Although global food prices remain elevated amid the ongoing war in Ukraine, price pressure has eased of late, especially in the fourth quarter of 2022, as new supply chains were established.

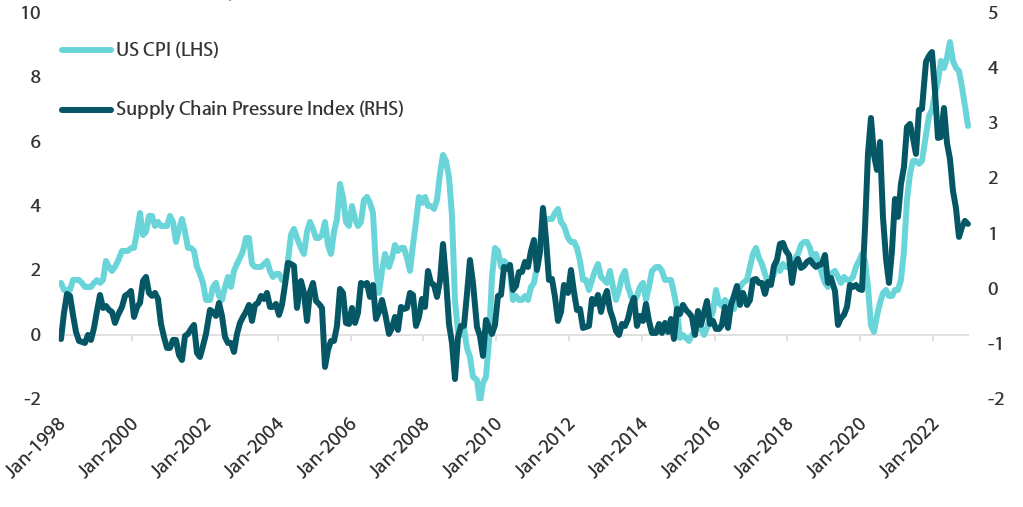

All in all, the pressure in the global supply chain is easing (see Chart 5). We see easing pressure leading to a decline in global inflation, especially in US CPI, as suggested by a recent research paper by economists from the Federal Reserve Bank of New York (New York Fed), which projects annual US CPI normalising to 3.8% within 12 months. Global supply factors are measured by the New York Fed’s Global Supply Chain Pressure Index (GSCPI), which uses various global price indicators, including the producer price index and the CPI of the US and the EU. The New York Fed’s academic projection of a substantial easing of US CPI in 2023 to below 4%, which is a level consistent with a soft-landing scenario, is based on the assumption that the GSCPI normalises to its historical average over 12 months.

Chart 5: Global supply chain pressure is easing

Source: Bloomberg, January 2023

At the same time, the cost-push pressure (namely the food price component) that drove Asian inflation is coming down and softening Asia’s inflation outlook (see Chart 6). As inflation in the region ebbs (as evidenced in the February CPI of countries such as South Korea, Thailand, China, India, Singapore and the Philippines), Asian central banks are likely to slow the pace of monetary policy tightening. As of March 2023, several regional central banks, such as those of South Korea, Indonesia and Malaysia, have already suspended rate hikes as inflation in their countries has eased.

Chart 6: Price pressure that drove inflation in Asia is easing

Source: Morgan Stanley, January 2023

Note: Asia includes China, Hong Kong, India, Indonesia, South Korea, Malaysia, Philippines, Taiwan, Australia and Japan. Singapore and Thailand are excluded due to a lack of data.

Moreover, the purchasing managers’ indexes of many Asian countries are falling in line with the global trend, whereas Asia’s exports, which are still largely dependent on demand from the US and the EU, have also started to come off as growth in developed countries slows. That said, a potential recovery of exports to China may offset the slowdown. But given the overall weaker growth outlook, we expect most of Asia’s central banks to pause hiking rates. In our view, Asian central banks—cognisant of the slower economic growth outlook—are likely to be less hawkish in their monetary policy stance and will be more inclined to keep interest rates accommodative, all of which should bode well for regional bonds.

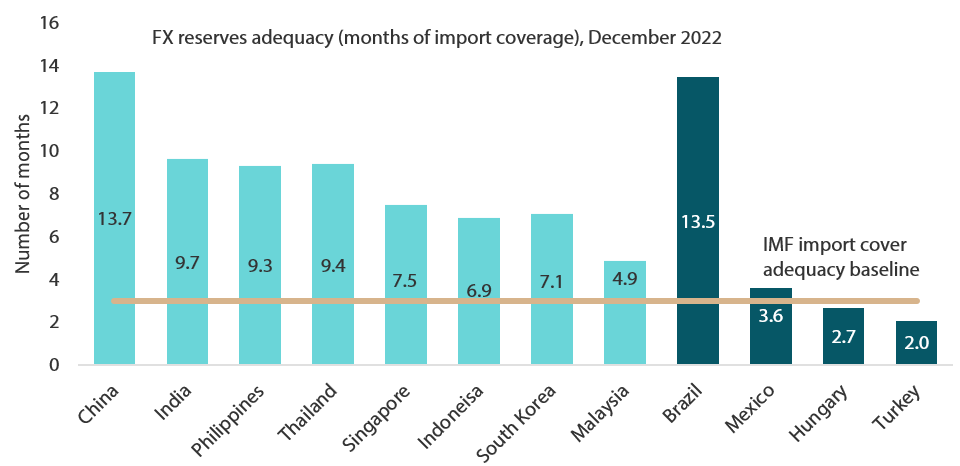

Asia’s FX reserves remain adequate; regional currencies look cheap

Asian foreign currency (FX) reserves have decreased over the past few months. They remain adequate, however, and are in accordance with the International Monetary Fund (IMF) rule of thumb from of having at least three months of imports being covered by FX reserves (see Chart 7). This underscores the sound fundamentals of Asian economies.

Chart 7: Asia's FX reserves remain adequate

Source: Bloomberg, IMF, January 2023

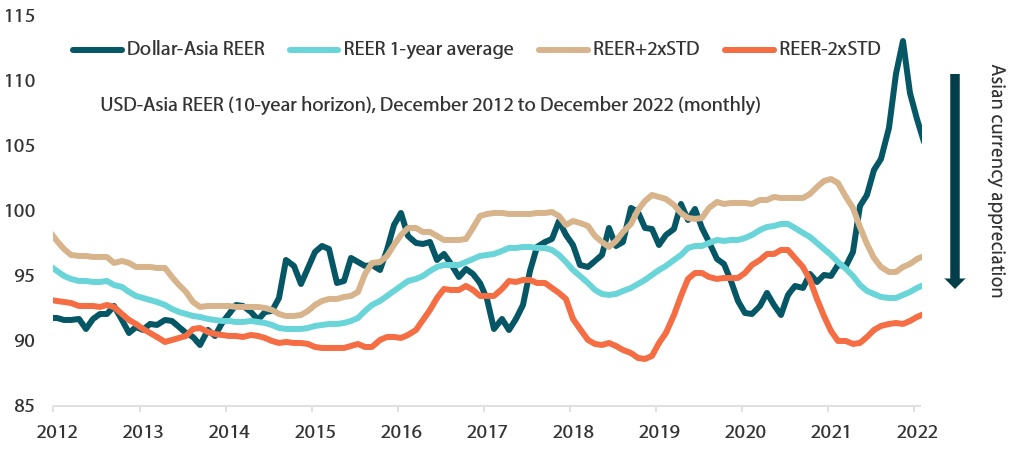

In addition, Asian currencies, as measured by the real effective exchange rate (REER), currently look cheap relative to their historical long-term averages. As regional currencies weakened against the US dollar (USD) in 2021 and 2022, the USD-Asia REER had recently exceeded two standard deviations from its long-term averages, making Asian currencies cheap from a long-term perspective (see Chart 8). In our view, the environment surrounding regional currencies is improving. As mentioned, we think that dollar strength will start to fade as the Fed may be nearing the end its tightening cycle, and Asian currencies will have ample room to appreciate versus the greenback. In terms of regional currencies, we favour the Thai baht, which is seen benefiting from increased tourism inflows and current account improvement. We also like the renminbi. China’s reopening and the imminent recovery in the world’s second largest economy are likely to spur the renminbi to appreciate against the greenback, in our view.

Chart 8: Asian currencies look cheap versus their long-term averages

Source: Citibank, Bloomberg, January 2023

Positive on the local bonds of Indonesia, India and South Korea

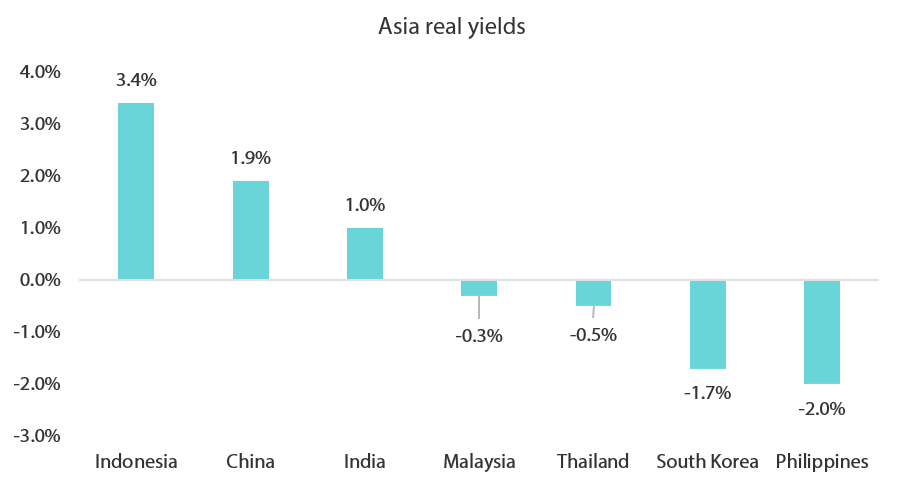

Within the region, we are most positive on the local currency bonds of Indonesia, India and South Korea. We expect Indonesian bonds to perform well on the back of strong foreign inflows—both portfolio fund flows and foreign direct investments (FDIs)—into the country. Indonesia is attracting considerable foreign investments on the back of its thriving electric vehicle supply chain ecosystem, which entails mining and the processing of metals all the way to the manufacturing of cathodes and battery cells. Strong FDIs into Indonesia are expected to support its economy and currency, as well as boost the appeal of its local currency government bonds, which also look attractive on a real yield (nominal yields minus core CPI) basis (see Chart 9).

Chart 9: Asian local currency bonds offer attractive real yields

Source: Bloomberg, January 2023

Local currency Indian bonds also look attractive from a real yield perspective and offer a good carry. Furthermore, we expect Indian bonds to receive a fillip when the Reserve Bank of India (RBI) ends its rate hike cycle in the near future. The RBI raised its benchmark repo rate by 25 bps to 6.5% in February. Like many other Asian central banks, the RBI is waiting for inflation to make a sustained decline before it stops hiking rates and revert to a more accommodative stance as the Indian economy slows.

Likewise, we expect South Korea’s local currency bonds to perform well. The Bank of Korea (BOK) was one of the first central banks in the world to hike interest rates to address soaring inflation; it embarked on its tightening cycle back in August 2021 and raised benchmark interest rates seven consecutive times. In February 2023, however, the BOK paused its rate hike cycle by keeping benchmark rate steady at 3.5%. We think that South Korea could be the first country in Asia to cut interest rates. The possibility of steady or declining rates coupled with the potential inclusion in the FTSE WGBI in the future will be supportive of South Korean local currency government bonds, in our view.

Summary on why Asian local bonds may outperform

On the whole, we expect Asian local bonds, which have outperformed their global peers over the past several years, to thrive in the remaining quarters of 2023 and beyond, supported by a conducive global environment of lower inflation, lower growth and steady interest rates.

At the same time, slower but still positive growth in Asian economies and a pause in regional central banks’ policy rate adjustments will benefit the Asian local bond market, in our view. We believe that Asian central banks are nearing the end of their rate hike cycles as inflation eases and growth prospects weaken. The prospect of stable or even falling interest rates in Asia bodes well for regional bonds.

Strong fundamentals, high-quality yields and low foreign ownership (and hence more room for fund flows recovery) are other factors that are supportive of Asian local bonds, which are also seen doing well as regional currencies strengthen versus the greenback.

Within the region, we favour Indonesian local bonds, which could benefit from strong inflows (both FDI and foreign portfolio fund flows) and fiscal consolidation. Indian bonds continue to offer good carry as the RBI looks to end their rate hike cycle, while South Korean bonds are also favoured to outperform on rate cut expectations over the longer term and their potential inclusion into bond indices.

There are risks that could alter our positive views on Asian local bonds, such as a resurgence in inflation, a big flare-up in global geopolitics and full-blown turmoil in the global banking sector, which undoubtedly will lead to widespread risk aversion in global financial markets. Those risks, while possible, are not likely to transpire in our base case scenarios, which by and large look conducive for Asian local bonds.