Global equity investment philosophy

Our philosophy is centred on the search for “Future Quality” in a company. Future Quality companies are those that we believe will attain and sustain high returns on investment. ESG considerations are integral to Future Quality investing as good companies make for good investment. The four pillars we use to assess the Future Quality characteristics of an investment are:

Franchise - does the company have a sustainable competitive advantage?

Management - does the company make sound strategic and capital allocation decisions?

Balance Sheet - is growth appropriately financed?

Valuation - are the company’s prospects under-appreciated by the market?

We believe that investing in Future Quality companies will lead to outperformance over the full market cycle. Our strategy is based on fundamental, bottom-up research therefore sector and country allocations are a function of stock selection. The Global Equity strategy is a concentrated, high conviction portfolio with a high active share ratio.

Market outlook

We will use this month’s outlook to reappraise our conviction positions coming into 2023.

- Energy transition and healthcare innovation will lead the market over the coming years

- Technology will not

Clearly, neither of these positions have benefitted our clients year to date and that makes for uncomfortable levels of underperformance. Are we wrong, or just early?

Regarding technology (and the closely correlated parts of communication services), which are more than 25% of the ACWI benchmark combined, it is worth considering the starting point for their year-to-date outperformance. Though inflated valuation multiples and unrealistic earnings expectations had us substantially underweight these stocks, it is fair to say that both sectors were weaker than we had expected in Q4 2022—as interest rate expectations were ratcheted higher amid persistently strong inflation numbers. With the benefit of hindsight, this created a deeply oversold condition coming into 2023.

Whilst inflation has continued to run hot, developments in Silicon Valley and the broader banking sector have changed investor sensitivities to this markedly in Q1 2023. Real world financial conditions have tightened, and this has benefitted “Big Tech” in two ways: their relative scale and liquidity has become more prized and valuation multiples have been under less pressure on the belief that peak interest rates are closer at hand.

As shown in Chart 1 below, this allowed the technology sector to meaningfully decouple from other cyclical sectors in March.

Chart 1: Technology has decoupled from other cyclical sectors

Source: Bloomberg as at 31 March 2023

We think it probably makes sense to believe that peak rates are close at hand.

We are not sure that there is much to be gained by meaningfully increasing the defensiveness of the portfolio at this stage, with many investors already positioned for the US recession that the inverted US yield curve is once again predicting.

Instead, we continue to focus on looking for what happens after the slowdown. Rather than asking who enjoyed rising returns in the last decade, where will these be seen in the future? Despite our relative optimism on markets, we remain underweight tech and communication services. It is hard to have a pronounced cyclical recovery, in our view, without a preceding contraction and tech spending and digital advertising have arguably yet to see this to any meaningful extent. We are not sure where the incremental demand comes from in many of these areas. After a decade of boom times and although AI may be a ray of hope, we doubt spending here will be large enough to counter the headwinds in other areas.

By way of contrast, energy spending has been depressed for much of the last 10 years and travel-related demand was effectively zeroed by COVID-19. Both areas remain well represented within our portfolio—through stocks such as Schlumberger N.V., KBR, Inc., Samsonite International S.A. and Booking Holdings Inc.

Turning to our other main problem child in recent months—healthcare—we have had too much of it and the wrong stocks year to date. If 2022 was all about defensive value (Big Pharma, managed care and distributors), 2023 has seen a significant reversal, with healthcare equipment (medtech) leading. The case for a rebound here looks solid as surgical procedure demand rises with COVID-related headwinds dissipating. This has worked to the benefit of Masimo Corporation, Koninklijke Philips N.V. and within the portfolio but not (yet?) for other stocks with similar exposures, such as Encompass Health Corporation and AdaptHealth Corporation. We expect the picture for these stocks to improve from here as uncertainties around reimbursement (Encompass Health Corporation) and management execution (AdaptHealth Corporation) start to clear. Adapt’s biggest suppliers (including Abbott) continue to enjoy strong demand, and Adapt “just” have to deliver this growth in a more cost contained manner.

Patience is also required with our holdings in Life Sciences and Tools (Danaher Corporation & Bio-Techne Corporation). Abbott Laboratories' large diagnostics business has seen them tarred with the same brush too. For a long time, the fate of these stocks has been closely correlated with that of tech (which makes some sense, as both rely on customer funding and confidence).

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.

Whilst confidence has seemingly been restored in tech spending, the overhang created by bumper life sciences spending during COVID-19 times means that it may take longer for these companies to perform (Chart 2). When it does, Danaher Corporation may once again be capable of delivering organic revenue growth of 7-8% (with growth at Bio-Techne Corporation considerably faster). We are not deluding ourselves that demand here has no sensitivity to events in Silicon Valley or thinking that delivering life-saving science somehow makes them bullet proof. We are, however, convinced that demand growth will come through and become increasingly evident in the second half of 2023 (just as other parts of the economy potentially start to slow).

Chart 2: Life science companies vs. technology

Source: Bloomberg as at 30 April 2023

In conclusion, at times of stress, we believe that it makes sense for investors to reach for something that has recently provided comfort. Our view is that that is exactly what we have seen in Q1, as banking stock volatility (to which we had no direct exposure) has led investors back into the technology sector. Q1 is now behind us though and is often a time of the year characterised by mean reversion such as we saw in 2022.The worst thing that we could do is to overreact to the underperformance that our clients have endured in Q1— especially when we fundamentally believe that market leadership in the coming years will look very different to that seen in the years of abundant liquidity. In addition to the industry-specific themes noted above, we are also becoming more confident that emerging markets (EM) will fare relatively well in the coming years and we have been adding to the fund’s exposure there. In our view, EM current accounts are in better shape than in previous cycles, they are less exposed to a potential unwinding in private equity markets and their demographics remain supportive.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.

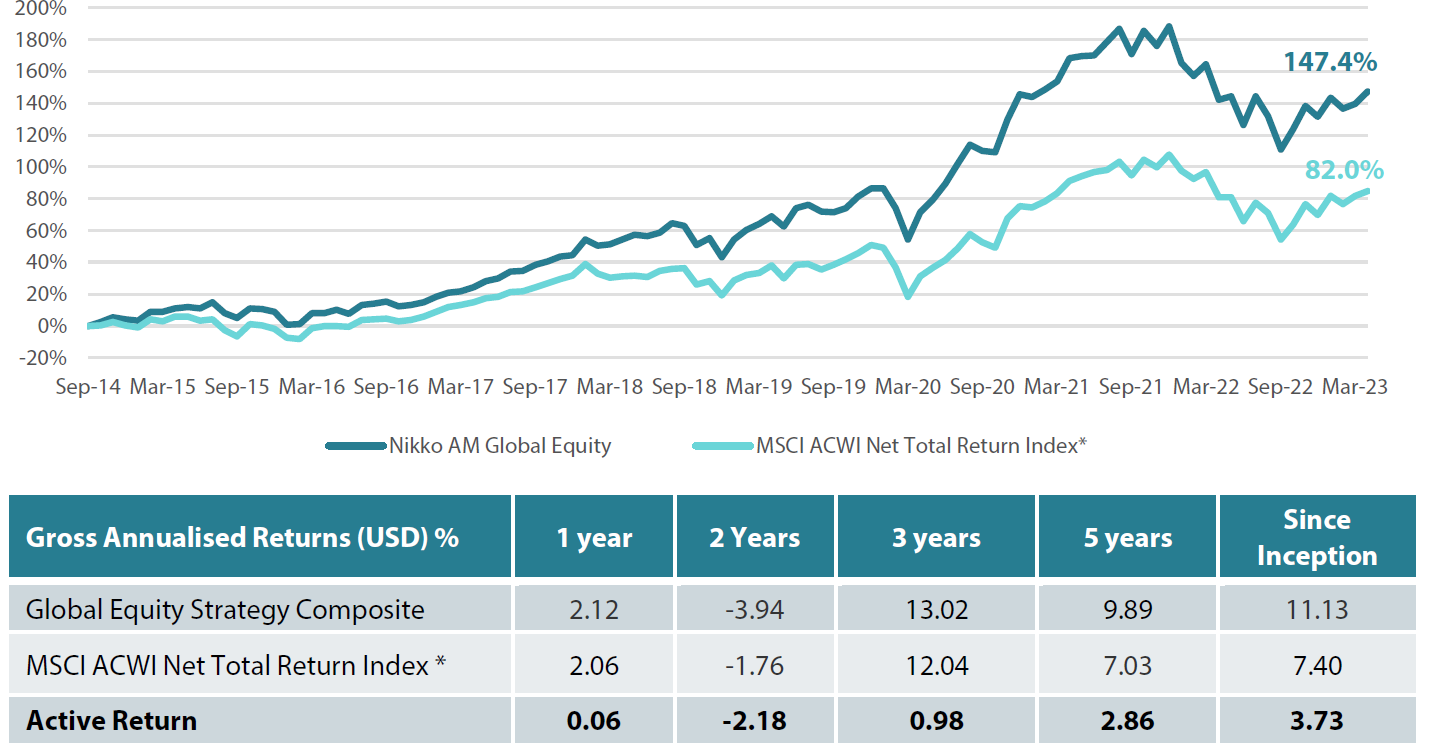

Global Equity strategy composite performance to April 2023

Cumulative Returns October 2014 to April2023

Past performance is not a guide to future returns.

*The benchmark for this composite is MSCI ACWI Net Total Return Index. The benchmark was the MSCI ACWI ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014.

Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it.. Data as of 30 April 2023.

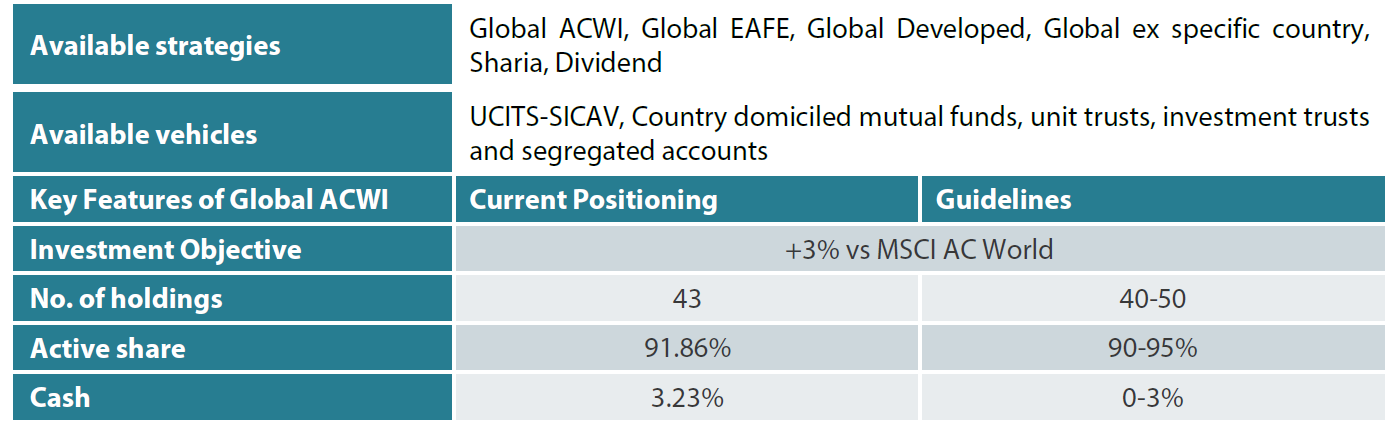

Nikko AM Global Equity: Capability profile and available vehicles (as at April 2023)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy’s risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon.

Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

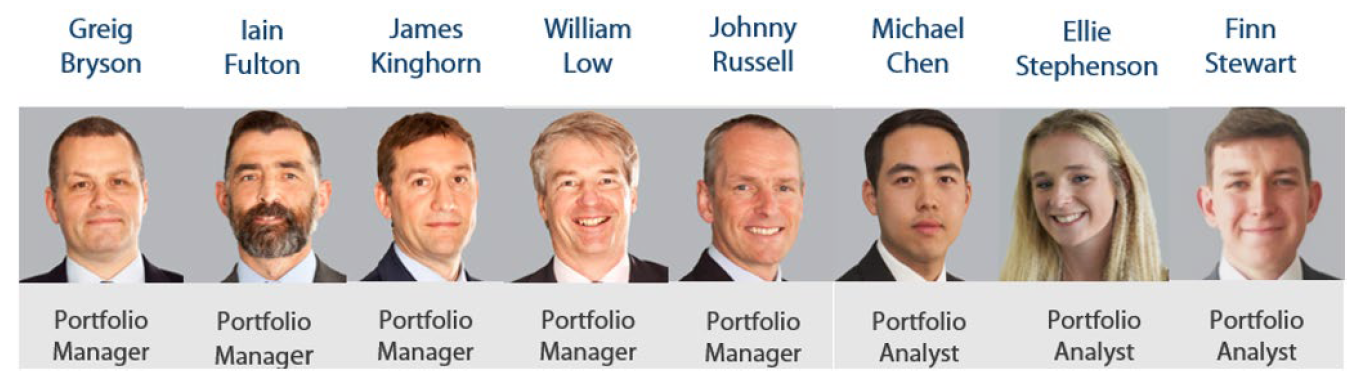

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

There are four key areas that make our strategy different:

- a focus on Future Quality companies – a different and clear philosophy

- a distinctive team culture – a tight-knit team with a process built on openness and respect

- unique execution, including rigorous team challenge of every idea

- differentiated portfolios, with a strong track record in stock-picking and ESG integration

Future Quality companies

We believe that companies with superior long-term returns on investment will deliver better performance. We call these Future Quality companies, and it is only these companies that make it into client portfolios. We search for Future Quality through analysis and financial modelling of companies that we expect to deliver over the next five years, and beyond. This approach is supported by academic evidence that businesses with high and improving returns on invested capital provide superior compound performance over the long term. With this investment time horizon, the sustainability of returns is a crucial ingredient of our Future Quality approach. We have found that companies developing solutions to ESG issues and management teams providing value to all stakeholders are more likely to be successful at sustaining high returns on invested capital over the long-term.

Distinctive team structure and culture

We believe that our collective knowledge and experience are powerful tools for delivering investment performance. Since 2011, we have operated a team-based approach to uncovering Future Quality investment ideas and have fostered a strong group dynamic. Individually, each Portfolio Manager is an expert investor with a broad skillset and experience of many market cycles.

We work in a flat structure, where all our Portfolio Managers have a dual role that combines investment analysis and investment management responsibilities. With individual analytical coverage split along industry lines, each Portfolio Manager is a specialist in the stocks and sectors they cover.

We all actively challenge the ideas and analysis of colleagues throughout the investment process, in an open atmosphere of vigorous and constructive debate. Portfolio Analysts work alongside Portfolio Managers, typically researching thematic trends that could influence and uncover future investment opportunities.

We take collective responsibility for approving stocks for the portfolio, and therefore there is joint accountability for performance. As such, it is in everyone’s interest to ensure that the investment analysis is thorough and that no stone is left unturned in the search for Future Quality.

We believe that the broad experience of our Portfolio Managers and distinctive team-based approach that sees everyone contributing to the strategy, increases the probability of successfully uncovering Future Quality.

Unique execution

Our tight-knit team approach and flat structure enable us to execute in a transparent way, including a rigorous team challenge of every idea. By using our strict Future Quality standards, we can identify long-term winners from the broader universe, to narrow down a comprehensive watch list and around 100 deep dive researched ideas. This is within a unique framework of individual accountability for the underlying analysis and company research, combined with the collective challenging of assumptions at the team level. Our proprietary ranking tool creates a disciplined process to compare and rank attractive opportunities and ensures that at the portfolio construction phase, only our best-ranked ideas receive the most committed weights in client portfolios. We believe our culture is key, and the collective ownership of our research process brings the best portfolio outcomes for clients.

Differentiated portfolios

We deliver a high-conviction Global Equity strategy for clients that is not constrained by benchmarks. As such, Future Quality can be sourced from listed businesses across any geography or sector. And, in a world awash with investment prospects, our disciplined, accountable and transparent process helps us to focus solely on building portfolios from companies that best meet our specific Future Quality criteria.

In terms of balancing risk and reward, our track record shows that we consistently deliver attractive returns on a lower risk-adjusted basis compared with peers and the global reference benchmark. The high active share and concentrated number of holdings help ensure that our Future Quality stock-selection process delivers differentiated portfolios.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the strategy will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.

UN SDG Risk: In the event the degree of positive impact towards the UN SDGs of a company and/or its technology changes resulting in the Investment Manager having to sell the security, neither the Sub-Fund, the Investment Manager, Management Company nor the Investment Adviser accepts liability in relation to such change.

Sustainability risk: The risk arising from any environmental, social or governance events or conditions that, were they to occur, could cause material negative impact on the value of the investment.

Specific sustainability risk can vary for each product and asset class and include but are not limited to: Transition Risk, Physical Risk, Social Risk and Governance Risk.