Summary

- Despite short-term negatives, we believe that China continues to offer ample long-term growth opportunities as the country pivots towards advanced manufacturing and technology. Elsewhere, some of the best growth stories globally could be found in India and Indonesia, while Taiwan and South Korea are expected to continue benefitting from a modest upcycle as the semiconductor industry recovers.

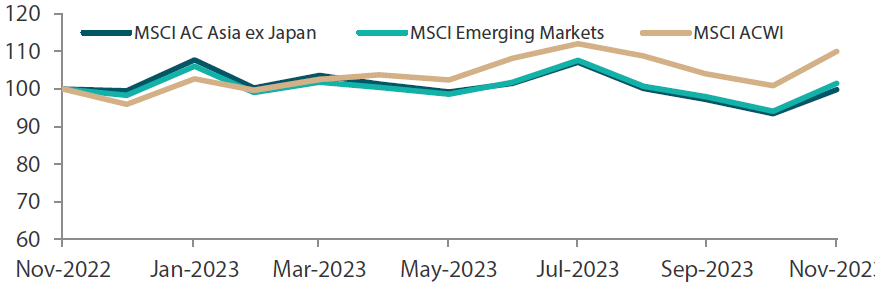

- For the month, the MSCI AC Asia ex Japan Index surged 6.9% in US dollar (USD) terms, fuelled by inflation and economic data suggesting that the US Federal Reserve (Fed) can pull off a soft landing and that the central bank’s rate hike cycle has peaked.

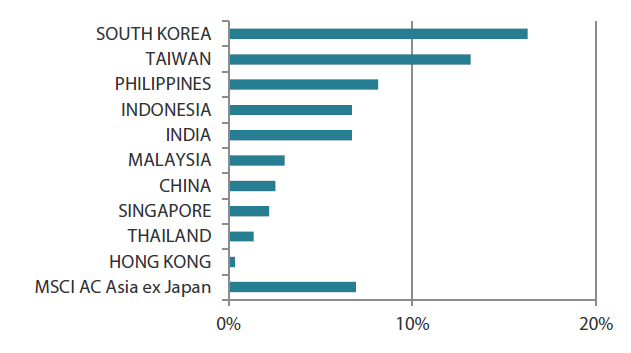

- South Korea (+16.2%), Taiwan (+13.2%) and the Philippines (+8.1%) led the gains in November, whereas Hong Kong (+0.5%) and Thailand (+1.3%) were the notable laggards.

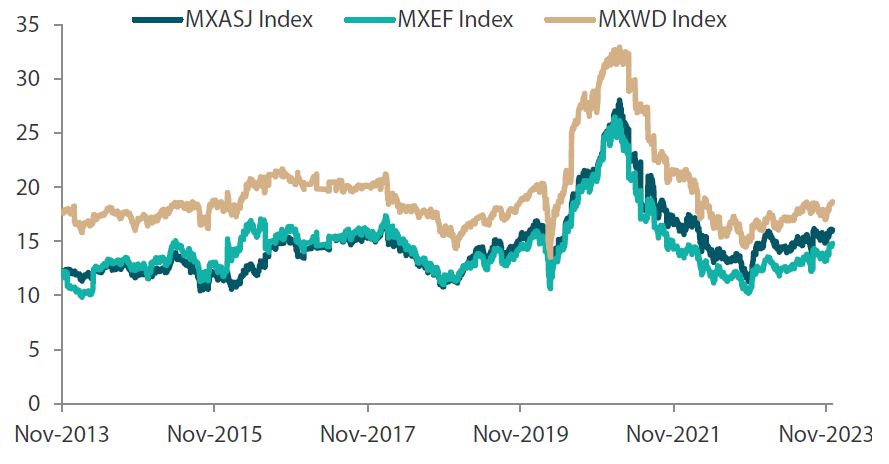

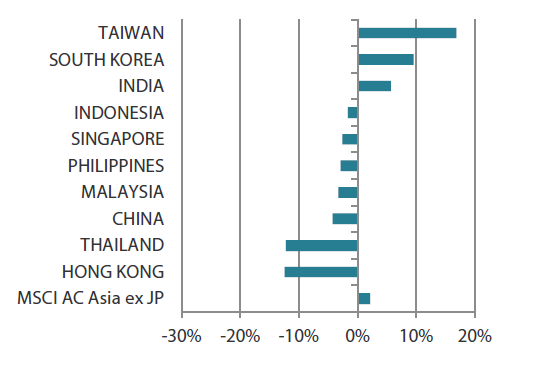

- With valuation dispersions again back to all-time highs, we contend that the risk-reward related to Asia and the emerging markets looks more favourable when viewed from a long-term perspective.

Market review

Asian markets make a strong rebound

In a stunning turnaround from October, regional equities, as measured the MSCI Asia Ex Japan Index, surged 6.9% in USD terms in November, in line with big gains in the US. The equity rally was fuelled by inflation and economic data suggesting that the Fed can pull off a soft landing and that the central bank’s rate hike cycle has peaked.

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Source: Bloomberg, 30 November 2023. Returns are in USD. Past performance is not necessarily indicative of future performance.

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 30 November 2023. Returns are in USD. Past performance is not necessarily indicative of future performance.

South Korea and Taiwan lead gains, Hong Kong lags regional markets

China stocks rose 2.5% in November, supported by new government support for the country’s ailing property sector and hopes of better US-China relations, after the recent meeting between US President Joe Biden and Chinese President Xi Jinping in San Francisco. In Hong Kong, stocks turned in marginal gains of 0.3%, weighed down by lingering concerns about China’s weak housing market and its slowing economy. China’s official manufacturing purchasing managers’ index contracted more than expected in November, adding to signs of a faltering recovery in the world’s second largest economy. During the month, Beijing handpicked 50 Chinese real estate developers, including the distressed Country Garden Holdings, to be eligible for a range of financing. However, the move failed to spark a sustained rally in Hong Kong and China stocks.

Elsewhere, the technology(tech)-centric markets of South Korea (+16.2%) and Taiwan (+13.2%) surged in November, driven by the strong rebound in global tech stocks. Prospects of improving earnings as an artificial intelligence (AI) boom spurs a recovery in the global semiconductor sector also buoyed Taiwan and South Korea index heavyweights Taiwan Semiconductor Manufacturing Company and Samsung Electronics.

In South Korea, stocks were given an extra boost after the country re-imposed a full ban on short selling. Meanwhile, the Bank of Korea kept its base rate unchanged at 3.5% during its November meeting. In Taiwan, its economy grew 2.32% year-on-year (YoY) in the third quarter of 2023 (3Q23), up from a 1.41% rise in the previous quarter.

The Philippines and Indonesia deliver sizable gains, while Thailand ekes out marginal returns

In the ASEAN region, the Philippines (+8.1%) and Indonesia (+6.7%) were the best performing markets in November, whereas Malaysia (+3.0%), Singapore (+2.2%) and Thailand (+1.3%) turned in relatively subdued gains. The Philippines saw its economy grow at a forecast-beating 5.9% in 3Q23, largely driven by government spending. Annual inflation also came in at 4.9% in October, sharply slower than anticipated. Third-quarter economic growth in Malaysia also accelerated to 3.3% YoY, behind higher consumer spending and growth in the services and construction sectors. During the month, the central bank of Indonesia kept the benchmark interest rate unchanged at 6% to support the rupiah amidst global uncertainties. Singapore's manufacturing output grew 7.4% YoY in October, posting the first expansion in over a year. Thailand was the region’s most notable laggard, as its economy slowed for a second straight quarter, expanding by 1.5% YoY. Thailand also experienced deflation for the first time in over two years as consumer prices fell 0.31% YoY in October.

Indian equities track regional gains

For the month, Indian stocks rose 6.7%, tracking regional gains, as annual retail inflation eased to 4.87% in October on lower food prices. Furthermore, India’s GDP rose 7.6% YoY in the July-September quarter as manufacturing surged and the government boosted spending before election.

Chart 3: MSCI AC Asia ex Japan Index1

| For the month ending 30 November 2023 | For the year ending 30 November 2023 | |

|

|

Source: Bloomberg, 30 November 2023.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Asia’s risk-reward looks more favourable when viewed from a long-term perspective

As 2023 winds down, the market is now confronted with a couple of potential inflection points, namely the prospect of peak rates beginning and China’s economy bottoming. Suffice to say, we have had several false dawns in these areas that disappointed optimists. Yet, it is also equally true that pessimists are less downbeat, with negative factors increasingly being discounted. As economic data in the developed world and China suggest that we are increasingly nearer to the respective inflection points, in our view the most important questions for 2024 are how long the Fed will keep rates high and when China will begin to reflate. With valuation dispersions again back to all-time highs, we contend that the risk-reward related to Asia and the emerging markets looks more favourable when viewed from a long-term perspective.

Long-term opportunities seemingly abound as China pivots towards advanced manufacturing and tech

In China, it is clear that policy has already inflected since the politburo meeting in the summer of 2023, which prioritised stabilising growth and risk management in troubled areas. The Chinese government has since made several significant steps towards stabilising the property sector, but important supply-side measures are still much needed. While it will take a monumental effort for China to reduce its reliance on property, we do not think the task it faces is insurmountable. Our sense is that the government is keen to spend its way out of trouble in the housing sector, but it absolutely does not want to see another big housing cycle kicking off. Time and patience will be needed for the Chinese government to stabilise and reform the sector, which will go a long way in boosting broader economic sentiment. China is determined to pivot towards advanced manufacturing and tech in the longer term, centring on automation, robotics, renewable tech and healthcare. These will be the areas we will be focusing on and we see substantial growth potential for the country and opportunities for investors.

India and Indonesia seen thriving on the back of positive changes

While there are understandable concerns about China, we should not overlook the bright opportunities that other parts of Asia offer. We continue to highlight that some of the best growth stories globally remain in the heart of Asia—namely India and ASEAN. These are regions where we see structural reforms and countries positioning themselves for greater supply chain relocation investments. A burgeoning infrastructure and capital expenditure cycle is blossoming on the back of these positive changes. Our base case remains that the national elections in India and Indonesia in 2024 will pave the way for further positive reforms and developments in these regions. While we are cognisant about pockets of overexuberance in local markets, we continue to favour areas we find the most attractively-priced sustainable returns and positive fundamental change—namely financials, property and consumption.

Taiwan and South Korea may benefit from a modest upcycle as the semiconductor industry recovers

In the tech sector, there are increasing signs that the semiconductor industry is bottoming out. Better-than-expected smartphone and personal computer demand in China coupled with thinned-out inventory levels suggest that tech heavyweights in Taiwan and South Korea could benefit from a modest upcycle. We expect longer-term tailwinds in the form of a global AI boom-driven hardware “build-out” (construction of hardware) trend to continue driving the sector.

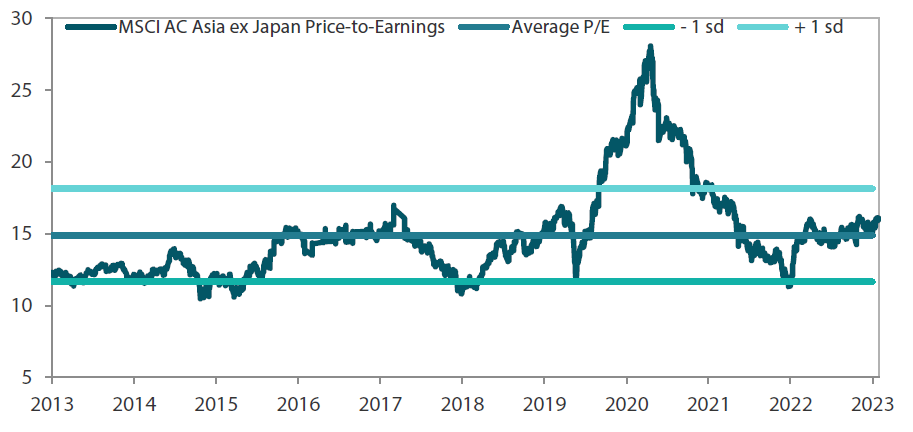

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 30 November 2023. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

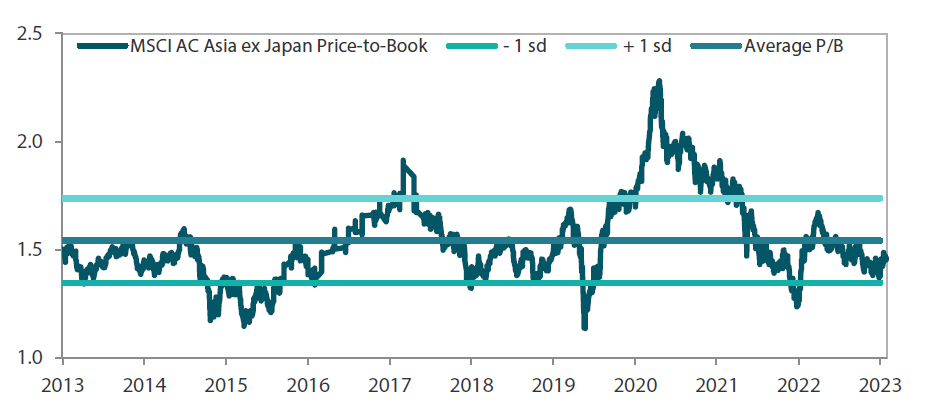

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 30 November 2023. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.