Summary

- As the developed world continues to struggle with inflation and a lack of growth, Asia stands out as the bright spot, with inflation well in check and monetary cycles peaking ahead of the West. Growth in Asia is also expected to outperform the West over the next few years, reversing a decade-long trend of developed world growth outperformance.

- For the month, the MSCI AC Asia ex Japan Index fell 1.8% in US dollar terms. Regional equities slipped in May, pressured by China’s weakening post-COVID recovery momentum and its growing frictions with the US.

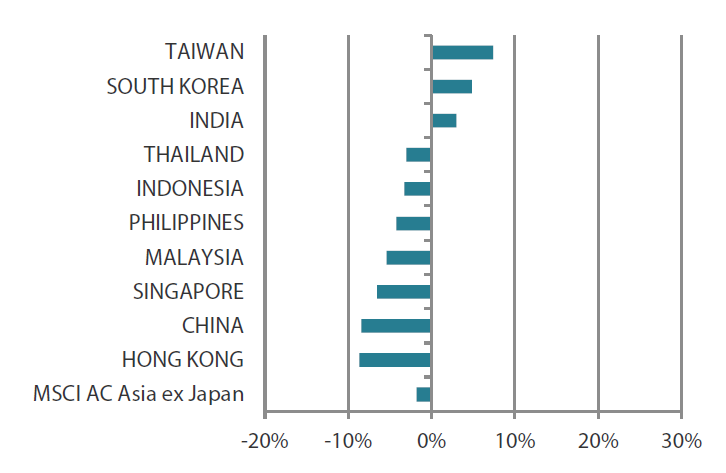

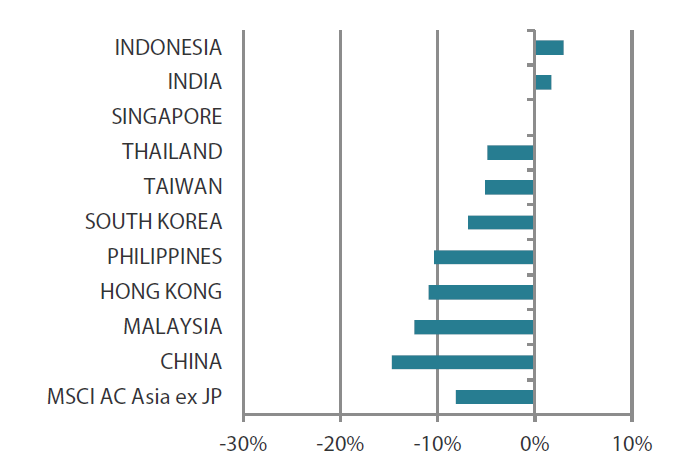

- In North Asia, China (-8.4%) and Hong Kong (-8.7%) led the losses, whereas the technology-centric markets of Taiwan (+7.3%) and South Korea (+4.8%) rose. In the ASEAN region, all markets fell. Elsewhere, India (+2.9%) turned in decent gains.

- For China, we retain a positive view on areas of consumption, in particular local brand leaders, and on areas of healthcare, software and select industrials. We hold a favourable view of high-quality banks and companies leveraged to domestic consumption and the capital expenditure (capex) cycle in India and Indonesia.

Market review

Asian markets fall on concerns about the Chinese economy

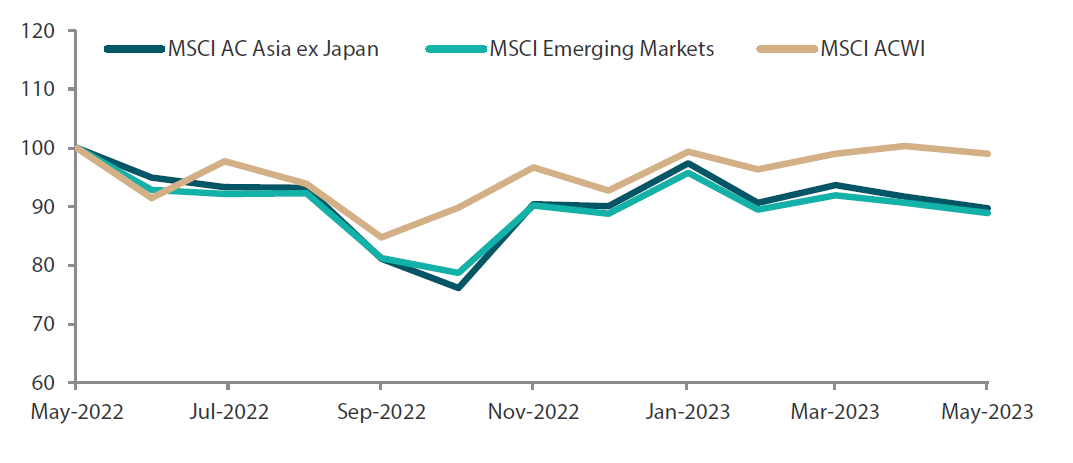

Regional equities slipped in May, with the MSCI AC Asia ex Japan Index returning -1.8% in US dollar (USD) terms, pressured by China’s weakening post-COVID recovery momentum and its growing frictions with the US. Global markets generally traded cautiously during the month as investors carefully watched the negotiations to raise the US debt ceiling to avert a default.

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Source: Bloomberg, 31 May 2023. Returns are in USD. Past performance is not necessarily indicative of future performance.

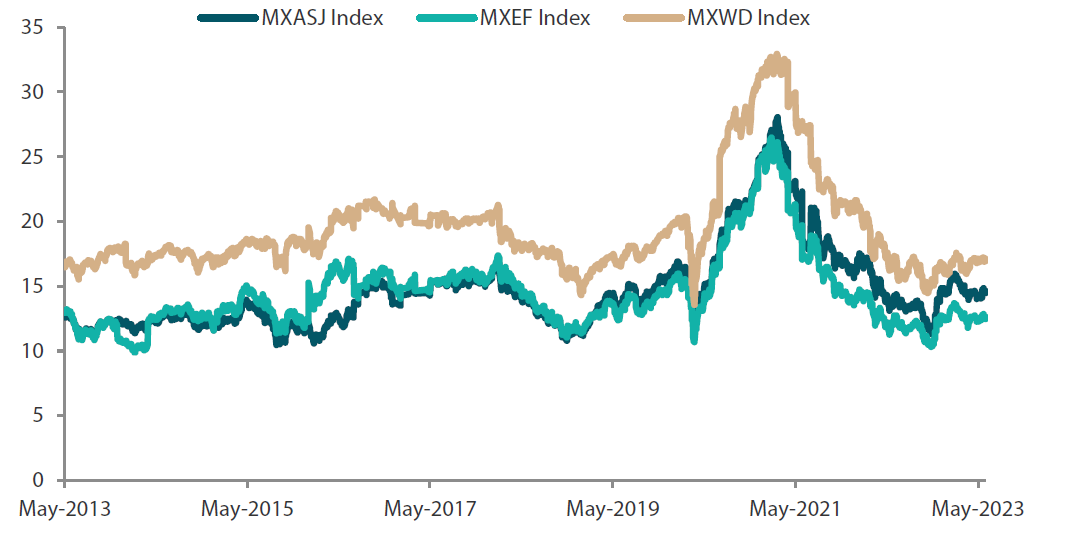

Chart 2: MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index price-to-earnings

Source: Bloomberg, 31 May 2023. Returns are in USD. Past performance is not necessarily indicative of future performance.

China and Hong Kong lead the losses in North Asia, South Korea and Taiwan rise

In North Asia, stocks of China (-8.4%) and Hong Kong (-8.7%) tumbled for the month due to growing concerns that the recovery in the world’s second largest economy is losing steam, as suggested by a slew of recent weaker-than-expected economic data. Most of the recently released Chinese data, including manufacturing purchasing managers’ indexes, industrial production, retail sales, fixed asset investment and others all came in below market expectations.

Rising tensions between Washington and Beijing also hurt sentiment towards Chinese equities. During the month, China—in a retaliatory move towards the US—banned the sales of US memory chipmaker Micron Technology’s products to Chinese companies, fanning more discord among the two countries. The People’s Bank of China, though under pressure to cut the reserve requirement ratio to support the flagging Chinese economy, kept its key lending rates unchanged.

The technology-centric equity markets of Taiwan (+7.3%) and South Korea (+4.8%), however, surged in May, boosted by a strong rebound in global technology (tech) stocks and hopes of turnaround in the semiconductor market as demand for chips used in artificial intelligence (AI) systems soared. Beijing’s ban on Micron Technology also propelled a rally in the leading Asian chipmakers, such as Samsung Electronics which lifted the South Korean stock market during the month. In other developments, the Bank of Korea held its benchmark interest rate steady for the third consecutive time in May as inflation in the country eased. South Korea’s consumer price index (CPI) rose 3.7% year-on-year (YoY) in April, while Taiwan’s CPI for April was at 2.35% YoY (unchanged from the previous month). Meanwhile, both countries continued to see a slump in export numbers.

All ASEAN markets turn in losses

All the equity markets in the ASEAN region slumped in May. Singapore (-6.5%) and Malaysia (-5.4%) led the losses, while the Philippines (-4.3%), Indonesia (-3.4%) and Thailand (-3.0%) performed relatively better.

The Singapore economy grew by 0.4% YoY in the first quarter of 2023 (1Q23), weighed down by the manufacturing and finance sectors. In Malaysia, its central bank unexpectedly raised its benchmark interest rate by a quarter point in early May, while the Philippines moved to pause its most aggressive tightening cycle in years, keeping its benchmark interest rate steady at 6.25%. Indonesia’s economy expanded 5.03% YoY in 1Q23 on the back of strong domestic consumption, despite exports taking a knock from weaker commodity prices and global demand. Thailand chose a new government, which delivered a sharp rebuke to the military's grip on politics. However, investors may have to wait until at least late July for the actual government formation.

Indian equities register decent gains

For the month, the Indian equity market advanced 2.9%, led by financial and consumer stocks. India’s economy is proving to be unexpectedly resilient to higher rates, with GDP expanding 6.1% YoY in the January–March quarter, powered by government manufacturing subsidies and stronger service sector exports. The country’s inflation rate remained within the Reserve Bank of India’s tolerance range, having eased sharply to 4.7% YoY in April (from 5.7% in March) due to a steep decline in food prices.

Chart 3: MSCI AC Asia ex Japan Index1

| For the month ending 31 May 2023 | For the year ending 31 May 2023 | |

|

|

Source: Bloomberg, 31 May 2023.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.

Market outlook

Asia stands out as the bright spot

As the developed world continues to struggle with inflation and a lack of growth, Asia stands out as the bright spot, with inflation well in check and monetary cycles peaking ahead of the West. Growth in Asia is also expected to outperform the West over the next few years, reversing a decade-long trend of developed world growth outperformance. Moreover, consumption is expected to grow structurally on the back of a burgeoning middle class and large savings pool. We see innovation in the healthcare, environmental tech and industrial tech space continuing to give rise to a large pool of high-quality companies with high sustainable returns and positive fundamental changes. Cheaper valuations now mean these companies are more attractive than ever.

Favouring consumption, healthcare, software and select industrials in China

It is becoming evident that the economic recovery in China is going to be more gradual than the market had expected. In contrast to the pandemic recovery in the US, Chinese consumers did not benefit from a fiscal wealth transfer and the country is still in the midst of moderating excesses in the property and financial markets. Cognisant of the inflationary consequences of the aggressive fiscal policy in the US, the Chinese government is adopting a policy approach characterised by pro-business pragmaticism; it is seemingly determined not to repeat the same mistakes, preferring to think long term. While this approach is positive for the long-term sustainability of the Chinese economy, the trade-off is a weaker near-term recovery. What is certain, however, is that Chinese consumers will play a much more important role within the economy as the country rebalances towards consumption. We retain a positive view on areas of consumption, in particular local brand leaders, and on areas of healthcare, software and select industrials.

Structural reforms and capex cycle boosting the appeal of India and Indonesia

In the long run, the outlook remains rosy for countries like India and Indonesia, both of which are able to supply cheap skilled workers needed by the world. Structural reforms boosting productivity have been ongoing as companies move their supply chain to India as a result of “China Plus One” strategies. For India, hope continues to build for a capex cycle alongside a long housing upcycle. Early indications are positive as gross fixed capital formation has begun to move up as a percentage of nominal GDP, and new project announcements in the private sector have continued to grow. Corporate balance sheets are also at the healthiest level in more than 15 years. The aforementioned factors continue to drive our favourable view of high-quality banks and companies leveraged to domestic consumption and capex cycle in India and Indonesia.

Staying selective in South Korea and Taiwan

Notwithstanding our constructive long-term view on innovation tech leaders in South Korea and Taiwan, we remain selective in this space due to uncertain Western demand in consumer tech as economic growth in the West slows.

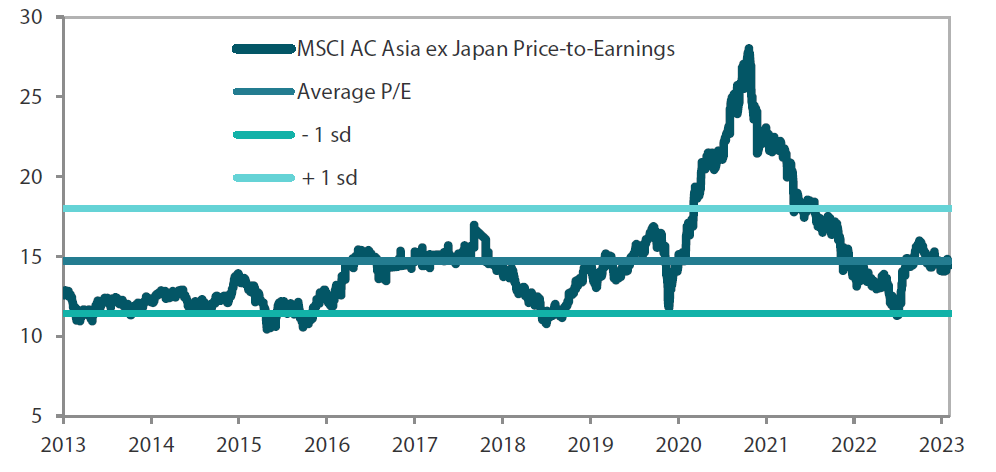

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 May 2023. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

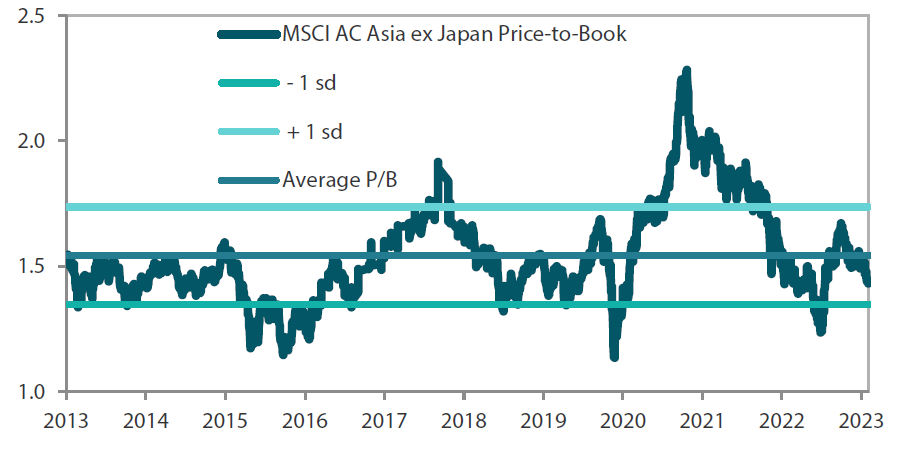

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 May 2023. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.