Short but scary global recession

Reflecting back, our mid-June meeting’s overall macro theme “Stagflation Lite,” which entailed G-3 GDP somewhat worse than consensus, but skirting recession in the US (but not the Eurozone), coupled with central banks being more hawkish than consensus, seems to have been very predictive. Our “more enthusiastic” stance on global equities (after being unenthusiastic in March), excluding Europe, was initially very correct, but ended mostly disappointing, especially in USD terms. MSCI US ended with only about a 2% total return from our meeting date, after peaking at 17% in mid-August, while Japan and Developed Pacific ex-Japan fell about 6% in USD terms and Europe fell about 10%. Japan actually rose slightly in yen terms, but Europe fell about 3% in euro terms; Meanwhile, our negative stance on global bonds was proven correct in both local currency and USD terms, with the latter falling about 7%, much worse the MSCI World’s -1.4% (that peaked at nearly 15%), so our preference for equities over bonds certainly proved predictive.

As for macro and other market reflections, GDP consensus for CY22 is now moderately below what it was in June for the US, while the Eurozone (dubiously so, in our view) and Japan (due to a surprisingly strong CY2Q) are slightly above such. Meanwhile, that for China has fallen sharply, greatly due to lockdowns and the continued multi-faceted problems linked to the declining property market, which had major global effects, particularly on commodities. Lastly, the Ukrainian crisis has clearly hurt the entire global economy and was worse than we predicted. Our bond yield forecasts were too low, and thus the USD appreciated much more than we expected. Our forecast that G-3 central banks would be more hawkish than consensus was accurate, but they, except the BOJ so far, have been even more so than we expected. Our meeting’s call for moderately higher commodity prices was incorrect, greatly due to China’s lockdowns. Our less cautious stance on geopolitics was also too optimistic, although outside of the Ukraine crisis, “cooler heads” seem to have prevailed.

Looking forward in obviously murky conditions, on 29 September, out of the seven macro-economic scenarios presented, our committee narrowly decided on a scenario of a short but scary global recession. Thus, there is major downside risk for markets and economies in the 4Q, in our view, but followed with major upside as commodity prices fall further and central banks relent. Given this scenario, we expect corporate results and guidance in the upcoming earnings season to be even more cautious, with global demand decelerating while margins are being squeezed by higher labour and other input costs. Supply chain disruptions, though lessening, should continue to burden profitability too. We have said for years that no one should doubt the ability of US corporations, in particular, to boost profits, but the quarters ahead should be especially challenging. Investor sentiment, meanwhile, will likely turn very negative in the 4Q, especially as we expect the Ukraine conflict to cause major economic dislocations, especially for Europe, but to turn the corner in the 1Q. Thus, our fixed income and equity teams delivered targets of very weak global equities in aggregate for the next three months (although we expect Japan to stay positive due to re-opening tourism, low interest rates, low oil prices, low equity valuations and benefitting from the prior, but increasingly stabilised, weak yen), but to regain their losses in the 1Q. We expect stability for global bonds in USD terms in the 4Q followed by a rally in the 1Q. We expect commodity prices to decline in the 4Q, but basically stabilise at those levels in the 1Q and the following quarters.

Our new scenario predicts that globally, GDP will underperform consensus in the 4Q, but outperform in the 1Q, with the US up 0.0% on a Half on Half Seasonally Adjusted Annualised Rate (HoH SAAR, as used in all references below) in the 4Q22-1Q23 period and 1.8% in the 2Q23-3Q23 period (vs. consensus of 1.2% and 1.2%, respectively, as we measure from a few top economists). Eurozone GDP will continue to be hurt the most by the Ukraine crisis, showing -1.4% in the 4Q22-1Q23 period and 1.5% in the 2Q23-3Q23 period (vs. consensus of -0.7% and 1.0%, respectively). Meanwhile, although a slow global economy will be a headwind, Japan’s economy should benefit from re-opening and many other factors, growing 0.4% in the 4Q22-1Q23 period and 1.6% in the 2Q23-3Q23 period (vs. consensus of 2.0% and 1.2%, respectively).

On China’s economy, we continue to expect that it will be able to wade through its current troubles, although it should continue to be quite rocky at times. The recent lockdowns negatively affected both domestic and global growth, especially when considering supply chain disruptions, but the reverse of such should occur now, especially in the 4Q. Thereafter, however, there remain many problems. We continue to note that major shifts in economic policy often cause problems and the property market’s weakness is causing broadly negative effects in both the economy and financial system (which is extremely opaque and complicated, yet crucially important). It seems rather clear that property prices will be very challenged ahead, especially if empty apartments are increasingly sold on the secondary market. The government is aware of these various problems and is reducing regulatory pressure somewhat and trying to patch-up various crisis points, but it will likely maintain the course away from a property-driven nation towards a technology-driven one. Unlike some sceptics, we expect a moderate loosening of zero-covid rules after Xi is re-elected, with an additional push and incentives for immunisation. In sum, we forecast its GDP to grow 5.0% HoH SAAR in the 4Q22-1Q23 period (due to the post-lockdown rebound) and 5.7 in the 2Q23-3Q23 period (vs. consensus of 6.7% and 4.2%, respectively).

For full year 2022 GDP growth, the US, the Eurozone, Japan and China, at 1.5%, 2.8%, 1.5% and 2.5% respectively, should moderately underperform consensus of 1.7%, 3.1%, 1.7% and 3.0%, and one should note that these numbers are boosted by low base effects (especially Europe), so they are weaker than they appear. For 2023, we expect average growth at 0.9%, 0.3%, 1.2% and 4.3% respectively, moderately underperforming consensus of 1.1%, 0.5%, 1.6% and 4.6%. Indeed, this is not a major rebound as the unplanned restructuring of the global economy, with its increasing de-globalisation and the shift to sustainability, particularly in the energy sector, is causing major problems with inefficiencies and productivity. Moreover, one major risk factor is if labour strikes accelerate further globally, especially in Europe, from their present levels. Suffering lower lifestyles for geopolitical reasons may be tolerated more than in the past, but some countries in which socialism is highly prevalent, especially in Europe, will face a populace that will force corporations to share the burden with higher salaries, coupled with various negative government mandates, that will lower their corporate profits. Economic growth is obviously hurt by strikes, as well. However, in our view, once recession hits and commodity prices fall further, hopefully causing consumer prices to fall more broadly, labour will likely become less adversary, which is what central banks desire above all.

Geopolitics will no longer be ignored

Whereas in the past the problems were fleeting, geopolitical risk should now remain something that markets will not ignore. Not only will the Ukraine conflict continue to be a major problem, North Korea, China and the Middle East need watching. On Ukraine, although fighting might lessen ahead, a peace treaty is very unlikely. We expect that grey-zone warfare with Ukrainian forces and with the rest of the world, including hacking, will continue to disrupt markets, economies (especially as Ukraine and Russia are such large commodity producers that affect supply chains and inflation) and investor confidence. Meanwhile, relations between the West and China remain very tense, although neither side seems willing to cross any red lines, while China’s support of Russia has the potential to cause major economic disruptions with the West. Increased fears about Taiwan certainly should not be ignored either. Meanwhile, the Middle East remains on tenterhooks, especially whether the Iran deal will be completed, although we believe there is a good chance that it will be after the US elections, as the Iranians seem eager for such, and besides capping Iran’s nuclear ambition, the US’s overwhelming incentive is to boost Iranian oil output, especially after the petroleum reserves can no longer be tapped.

As for US political risk, the country remains mired in conflict. Social issues will also likely provoke more civil unrest, especially leading up to November’s election, after which the outlook points to complete political stalemate. If, as seems likely, the Republicans win one or both houses, investigations into Democrats, including President Biden, will likely prove unsettling. The net result of all of this, should make risk markets and business leaders wary.

Our detailed forecasts:

Central banks: Relent to cutting after mid 1Q

We expect the Fed to hike 125 bps in the 4Q, 25 in the 1Q (in line with consensus), but then cut 50 in the 2Q and 3Q, which is much more dovish than consensus. As for the ECB, we expect it to hike 125 bps in the 4Q, 25 in the 1Q and then cut 50 in the 2Q and 3Q. Meanwhile, the BOJ will only likely tinker with hawkishness in the 4Q, perhaps by making negative rates virtually inapplicable. In sum, this forecast is dovish after January, which should provide major relief for equity and bond markets. Furthermore, central banks will proceed with QT and also reduce their balance sheets by winding down special pandemic-related lending programs.

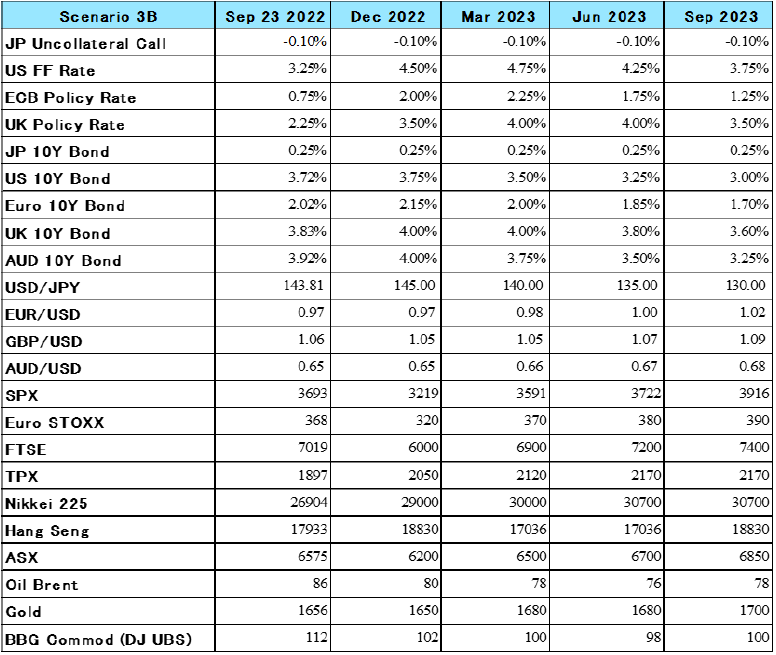

G-3 bond yields stable 4Q, then decline; USD weakens

For bonds globally, relatively weak economic growth, scary risk markets and the continuing decline in inflation should greatly help, but Fed QT and the absence of ECB purchases (followed by beginning QT in the 2Q), certainly will prove challenging. Central banks are likely expecting that money market and bond fund inflows will surge in the 4Q to provide buying power. Many bond investors, given their disposition, will likely assume that inflation will decelerate further in the intermediate term, and will worry about virus scares, especially disappointing economic data points, geopolitical flare-ups and problems during China’s economic transition. For US 10-year Treasuries, our target for end-December is 3.75%, while those for 10-year bunds and 10-year JGBs are 2.15% and 0.25%, respectively, falling (except for JGBs) to 3.50%, 2.00% in March, respectively, and further in the following quarters. Regarding forex, we expect the USD to stabilise at 145 vs. the yen in December and then fall to 140 in March (and further thereafter), with the EUR at 0.97 and 0.98 for those periods.

As a side note, we do not believe the UK’s problems will metastasize globally into a loss of confidence in sovereign debt, as its fiscal tax cuts are unique proposals and the method of proposing such was ham-fisted. The BOE will also continue via emergency purchases to quell margin calls on gilt derivatives, allowing this financial excess to be unwound and adjusted to the current rate structure. Also, after further turmoil, we expect the Truss government to greatly relent on tax cuts, especially for the wealthy, and the BOE to perform an outsized hike, but as mentioned previously, we do not think this provides an example for the rest of the world. It is scary enough, however, to keep the pressure on governments not to advocate much further fiscal stimulus, especially if deemed permanent in nature. This is not to say that the UK economy won’t suffer in the intermediate term from its major imbalances and decreasing international investor confidence in its path ahead. It is particularly notable that the normal “things will stabilise” response from both UK and global economists and pundits has been reversed into open ridicule of the government and financial system, at least for now. Lastly, its political backdrop will likely get very unruly in the months ahead, as well, with strikes a major concern.

As a side note, one should note that fixed mortgage rates have soared globally, presenting a major headwind to the crucially important (in many ways) residential and commercial property markets. Outside the US, especially in the UK, anyone with a variable mortgage rate will suffer major cost increases that will likely lead to a decent amount of defaults and continually declining home prices. Also, overdue residential rent cases in the US are surging and many will likely leave their current apartments, leaving landlords and any securities based on housing (with a similar situation for commercial properties) vulnerable to shocks.

This all implies that the FTSE WGBI (index of global bonds) should produce in USD terms a -0.9% unannualised return from our base date of 23 September through December but improve to 0.5% at March-end and 9.3% by September. Thus, we are fairly neutral for the next five months, but have a very enthusiastic stance thereafter. For yen-based investors, however, this index in yen terms should return 0.0%, -2.2% and -1.2% through those respective periods, with JGBs returning 0.1%, 0.2% and 0.3%, respectively, so offshore bonds should not be preferred to JGBs due to yen strength after year-end.

The Brent oil price will likely decline further, in our view, in the 4Q due to the global recession, but after central banks relent, it should basically stabilise thereafter. Of course, the Iran question looms large, both geopolitically and as regards global oil supply, but we think there is a good chance that a deal will help supply. In sum, we expect Brent to hit USD 80 in December and USD 78 in March and next September.

After another month-on-month surge in the upcoming August core CPI, we expect major moderation, well below consensus, ahead. For the US headline CPI, we expect 3.8% and 2.0% in March and September 2023, respectively, vs. consensus of 5.4% and 2.9%. For the US core CPI, we expect 4.3% and 2.0% for these periods vs. consensus of 5.0% and 3.3%. On a 6-month annualised rate, which the Fed is supposedly carefully watching, core CPI will be 2.0% in March and next September, in our view, and average about 0.17% monthly after October, which should be a long enough streak of low readings by mid 1Q for the Fed to get comfortable, especially if housing rents in the current marketplace decline markedly. Indeed, these rates will undershoot the Fed’s target, assuming that the PCE deflators are a bit lower than the CPI. As for the details, housing rent will likely, due to the lagged effect of repricing of new contracts, march upward, though to a lesser degree (and medical costs could also remain sticky), but food, gasoline, airfares, new and used cars, apparel, home furnishings and many services prices should soften soon due to the strong USD and lower recessionary demand. Eurozone and Japanese CPIs should decelerate greatly ahead too.

Global equities sink, ex Japan, in 4Q but rebound nicely thereafter

The MSCI World Index ticked down from our base date through our meeting date this week, vs. our +3% forecast, so we were clearly should have been less unenthusiastic, although we were certainly looking bright after the 15% gain in mid-August. A significant global recession ahead is not the only problem, as it could get especially scary due to credit market conniptions after all the excesses of the past few years. Very few “accidents” have occurred so far, whether in the derivatives markets, leveraged loan syndications, securitized real estate investments, junk-rated firm collapses, personal loan defaults or other aspects, but we expect quite many to appear soon globally. Furthermore ,even among stable firms, we expect corporations globally to report earnings (and guide) negatively during the 3Q season for rather obvious reasons. Geopolitical events could also get scary at times, and hurt market sentiment and proper economic functioning. After the 4Q scare, however, prospects should stabilise with central banks relenting, and then markedly improve, although not to optimistic levels.

In sum, we shift to a negative view on global equities for the 4Q, but are much more positive thereafter. Aggregating our national forecasts from our base date, we forecast that the MSCI World Total Return Index in USD terms will be -10.7% through December, but -0.1% through March and +10.2% by next September (-10.0%, -2.7% and -0.4% in yen terms). In USD terms through December, we expect 12% declines in Europe and US, but for Japan to rise 8% and Hong Kong, after its major 3Q downturn, to rebound 6% based on China’s improvement.

In the US, the SPX’s PER on its CY22 EPS estimate remains around 16, which is reasonably fair, especially if bond yields stabilise and buybacks remain strong, but earnings reports and guidance ahead will likely be shocking, especially to short-term investors and algorithm models. Credit scares will be numerous too. But we expect after a 12% decline in the 4Q that lower inflation, a more balanced labour market and cooled financial conditions indices will cause the Fed to relent. In sum, we expect the SPX to fall to 3,219 (-12.3% total unannualised total return from our base date) at end-December, but rebound to 3,591 in March and 3,916 at end-September (7.9% return), with yen-based returns of -11.6%, -4.4% and -2.5%, respectively.

European equities in the 3Q finally underperformed the US in USD terms, and fell even more than we expected. The Euro Stoxx PER, at 10.7 times CY22 EPS current estimates is well below its historical average, but as mentioned above, earnings forecasts and investor sentiment, along with the economy, should be quite negative, even as the ECB has to hike to prevent inflation and indirectly, labour strikes. Thus, we expect the Euro Stoxx index to fall to 320 at end-December and FTSE to 6,000, which translates to a total return of -12.5% (unannualised from our base date) for MSCI Europe through then in USD terms. However, we expect improvement thereafter, with a rebound in MSCI Europe’s return, at 2.5%, through March and 14.9% through next September, greatly aided by a rebound in the euro. This may sound too optimistic, but actually it leaves the Euro Stoxx index about 7% below its August peak and 20% below its 2021 peak, and at a low PER multiple, although such will likely be justified by the region’s loss of competitiveness and productivity due to its forced economic re-jiggering.

Japanese equities since our last meeting fell in USD terms much more than the US, which was highly disappointing. Equities in yen terms were basically flat, but the yen has been quite weak, mostly due to higher US interest rates occurring while the BOJ rightly insisted that sustainable inflation in Japan was not likely yet, and, thus, did not tighten its policies. Given the full re-opening of the economy (and gradual reopening of international tourism) in the 4Q, consumer optimism is rebounding and the auto sector, which is a major portion of the stock market and economy, should rebound. Unfortunately, the tech sector, in particular the electronic components and production equipment for such, in which Japan excels, has entered a downturn, primarily as excess demand during the pandemic is reversed. Corporate earnings have, overall, continued to rebound as the weaker yen heretofore has increased profitability and competitiveness, especially as 3-6 month forex hedges roll off. Meanwhile, Japan has low political risk and structural reform is continuing, especially in digitalization and alternative energy. Japan’s low exposure to Russia is fortunate, and fortunately it secured its natural gas supplies from Sakhalin, and the country, will continue to benefit from lower global commodity prices. Global economic recession will definitely hurt, but China, to which Japan is quite highly exposed, should rebound from lockdowns. TOPIX’s PER fell to 11.7 times its CY22 EPS consensus estimate, which is very low, especially as CY22 earnings estimates in aggregate should remain firm. Also to support the market are share buybacks that are on a record-breaking pace, and the market’s dividend yield, which at 2.6% remains extremely attractive vs. bonds. Thus, we forecast TOPIX at 2,050 at end-December, 2,120 in March and 2,170 next September for total unannualised returns of 7.9% in USD terms (8.7% in yen terms), 16.1% (13.0% in yen terms) and 29.3% (16.9% in yen terms), respectively, from our base date through those periods. As for the Nikkei, it should hit 29,000, 30,000 and 30,700, respectively. These returns are obviously very attractive for both domestic and global investors.

Developed Pacific-ex Japan MSCI: Australia will be hurt by lower commodity prices and weak global economic growth in this scenario, but some of the burden will be alleviated by the rebound in China and after mid-1Q, by central bank cuts and better than expected global growth. China needs increased coal supplies because it is worried about energy costs and is willing to slow its transition to green energy. Hong Kong’s stock market, which is dominated by PRC firms, has been extremely weak, but should rebound along with China’s prospects and the revival of tourism. A weakened local property market certainly does not help, but easing central bank policy should allow for a rebound in property and equity sentiment in 2023. We expect the region’s MSCI index returns in USD terms (total unannualised) at -0.9% through December, +0.7% through March and +12.2% through next September.

Investment strategy concluding view

Our scenario is fairly ugly for the 4Q, but has a strong silver lining thereafter. We are not optimistic about the global economy and investor returns reverting to normal for an extended period, but there should be clear intermediate term relief and pockets of strong outperformance due to idiosyncratic advantages. Notably, Japan should be globally overweighed for both stocks and bonds and Japanese investors should strongly concentrate on the domestic market in the year ahead. Of course, there will be underperformers too, and there is a plethora of risks that must be navigated, some the most challenging in post-War history. Thus, for the 4Q, bonds should outperform struggling equity markets, but we are fairly bullish, for the reasons stated above, thereafter. As always, there remains a significant chance of alternate scenarios, for which we have different market and economic targets, and institutional investors are welcome to contact us for such.