There has been remarkable progress in electric vehicle (EV) technology and its acceptance globally. The shift to EVs is becoming more noticeable and investment managers are now incorporating this theme within their investment portfolios. At Nikko AM, we believe that Chinese EVs are set to lead the world in this area as technological innovation, demand, government policy and consumer behaviour have put China ahead of Europe and the US. China is positioned in a way which will allow this trend to continue, and we believe China will retain its first place position to lead the global EV race.

Electric vehicles and future mobility

EVs are powered by electric power rather than traditional internal combustion engines (ICEs). Consequently, EVs are more environmentally friendly as they do not use fossil fuels; furthermore, they have lower running costs as they have fewer moving parts compared to ICEs, thus requiring less maintenance.

The EV industry is very different from the more traditional automotive industry because it is so new. Until recently, there was little or no interest in EVs but now all the largest auto manufacturers in the world are developing their EV capabilities.

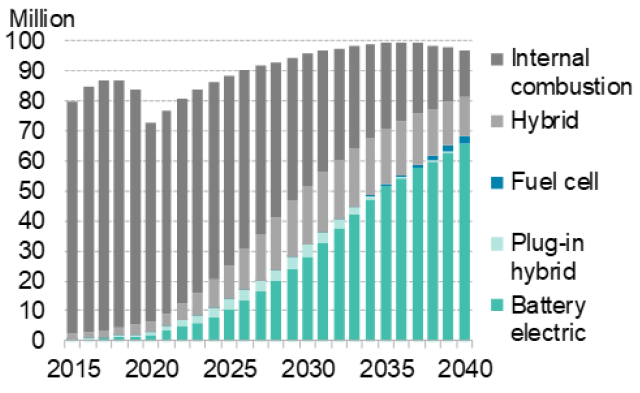

The growing interest in the EV industry means that at some point the majority of cars running on fossil fuels will be phased out.

Chart 1: Global passenger vehicles sales outlook by drivetrain – economic transition scenario

Source: BloombergNEF

Source: BloombergNEF

This disruption comes with these consequences:

- A rise in demand for materials and components such as lithium and batteries

- An increasing need for progressive global infrastructure to support a future where EVs are the main source of transportation

- The development of smarter mobility technology

The last point above stresses a broader concept of “Future Mobility” (FM). This covers the future of transport and can range from EVs to autonomous vehicles, the sharing economy (e-hailing services, distributed energy storage and intelligent transport systems) and more.

As with any disruptive innovation, the shift from ICEs to EVs brings along investment opportunities. A combination of various advancements in technologies including internet connectivity, battery storage capacity and artificial intelligence has steered this new EV and FM era in the global transport industry which is now one of the world’s fastest growing and most innovative industries.

Source: Shutterstock

Source: Shutterstock

What’s fuelling the growth?

Globally, there is growing pressure to combat climate change and hence a move to invest more in EVs as countries shift away from fossil fuels. The US has become more serious, with President Joe Biden renewing the country’s commitment to fighting climate change with a goal to reach net zero emissions by 2050 and invest further in green infrastructure. We have seen the UK introduce rules on banning the production of diesel and petrol engines by 2030, Europe implement stricter emissions standards and China enact a phenomenal amount of government-led policy to electrify its transport sector.

EV growth is taking longer to gain traction in South and Southeast Asia. Policy support in these areas is more partial and the availability of lower cost ICE cars make it difficult for EVs to compete on a price basis. However, despite the slightly slower start rate, the demand and pace for adoption of EVs is forecast to increase and follow similar trends as the rest of the world, just at a slightly later date.

Aside from Tesla, we have seen the world’s largest car manufacturers adapt to this technological revolution. In the US, General Motors is aiming to become the largest EV automaker in North America. Volkswagen has entered the race aggressively and expects 70% of the cars it sells in Europe to be fully electric models by 2030. And in China, we have seen the growth of hundreds of start-ups.

The EV industry has been recognised by investors as an area of substantial growth. For that reason, many portfolio managers are beginning to incorporate EV as a theme within their portfolios. Warren Buffett’s investment in Chinese car manufacturer BYD has also drawn investor attention to this particular area.

Source: Shutterstock

Source: Shutterstock

How does the EV market in China differ?

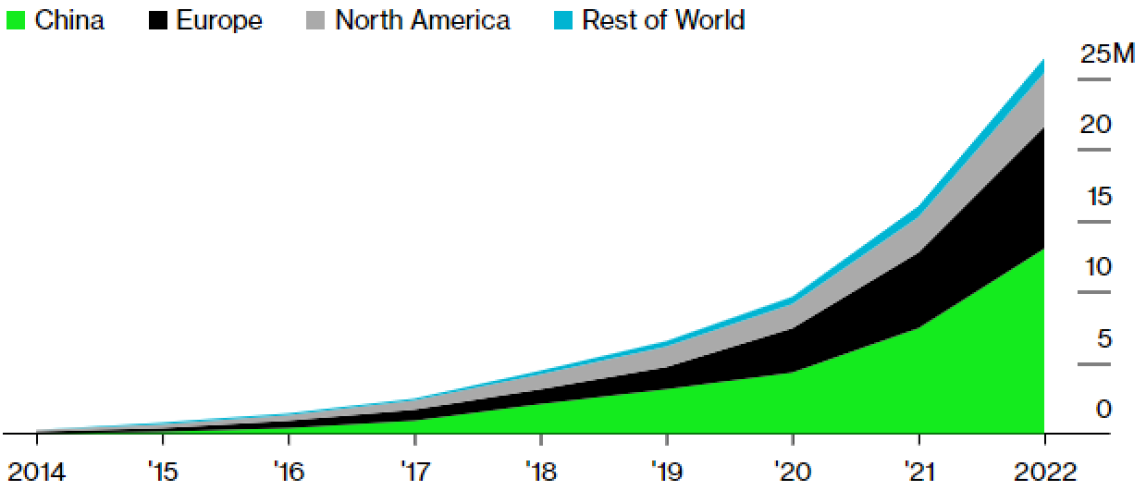

China and Europe are fuelling the adoption of EVs and China accounts for 46% of the total sales to date, followed by Europe at 34% and North America at 15%.

Chart 2: Global EV fleet by region

Source: Bloomberg as at 8 April 2022

Source: Bloomberg as at 8 April 2022

Includes battery electric and plug-in hybrid passenger vehicles. 2022 is based on BloombergNEF forecast. European data includes EEA + UK.

China’s role in the EV market differs from other regions primarily due to government policy. China’s government has driven innovation in the EV industry, and it has been very aggressive when it comes to domestic investing. China has a serious air pollution problem and it is also the largest importer of oil in the world. The country wants to be carbon neutral by 2060 and one way it aims to achieve this is by encouraging the population to adopt EVs. The government’s 5-year automotive plan aims for 20% of all vehicle sales to be new energy vehicles (NEV) by 2025. We think that this is achievable since NEV sales already totalled three million, or 14.8% of all car sales, in 2021 and the sales growth of NEVs far outstrips that of ICE vehicles. According to projections by the Society of Automotive Engineering of China, the country’s NEV sales are forecast to hit 40% of all car sales in 2030. Manufacturers are also being fined unless they produce a certain quota of EVs in a year. Therefore, more and more analysts are beginning to believe that China is going to be the leader in the EV market.

China positioned to dominate the EV race

China has also been at the forefront for introduction and implementation of electric vehicle infrastructure. Now exceeding half a million, there are more charging stations in China than in any other country. Therefore, EV buyers know that their vehicles can be charged during commutes which is not often the case in other parts of the world. There are 1,800 chargers in Shenzhen alone—a level of concentration not seen anywhere else globally. In Beijing, access to the city centre is only permitted if you have an electric car. EV purchases are also subsidised across the country, while ICE vehicles incur a number of fines.

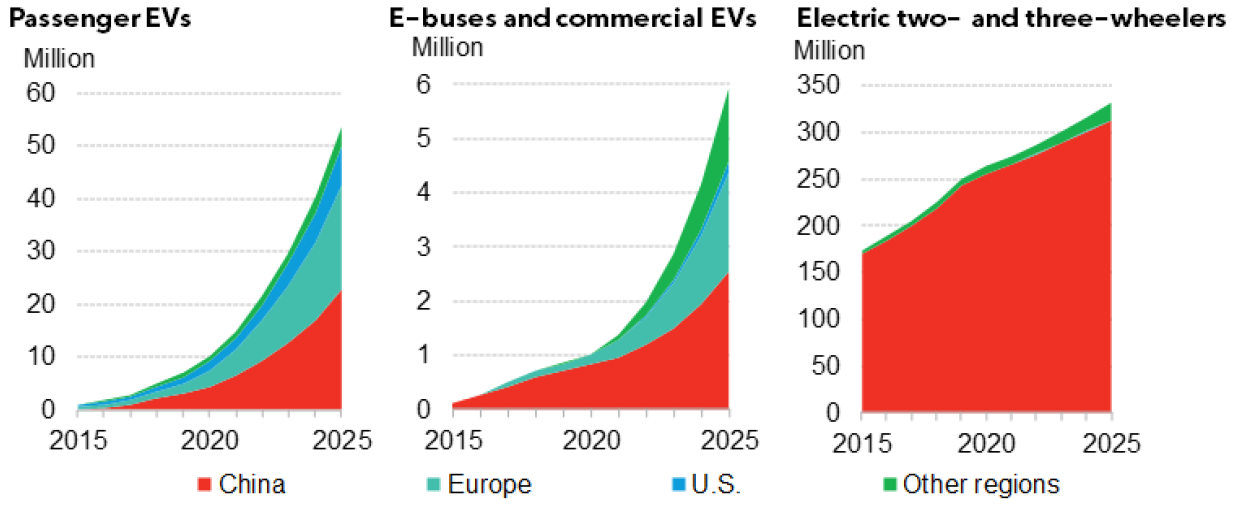

Chart 3: Global EV fleet by segment and market

Source: BloombergNEF

Source: BloombergNEF

Subsidies are only one factor putting China in front, although they are due to be completely phased out by the end of this year. In 2020 and 2021 there has been growth in Chinese start-ups such as NIO and Xpeng, which have now become multi-billion dollar companies. The number of start-ups in China is now in the hundreds and these companies are focussing on both lower-priced shorter range vehicles and luxury vehicles. These car manufacturers are seen as pure players (those investing substantial amounts of money into the EV sector alone) producing attractive-looking and reliable cars. This is driving a change in consumer behaviour. Earlier buyers may have purchased EVs due to subsidies but more consumers are now deliberately choosing EVs.

In 2020, one million more EVs were sold in China than in the US. Part of this can be explained by consumer behaviour. Chinese consumers are willing to buy small, economical EVs but US motorists still prefer gas-guzzling trucks. Although Ford, Chevrolet and Dodge have started to work on their EV line up, the US will need a lot more policy and regulation changes in order to encourage consumers to purchase EVs. As a result, we believe that many US manufacturers will lag behind their Chinese counterparts in the EV space as they continue to focus on manufacturing ICE vehicles. With a low penetration rate (total NEVs on the road/total existing vehicles) at less than 3% at the end of 2021, we believe that there is ample room for growth in China’s NEV market.

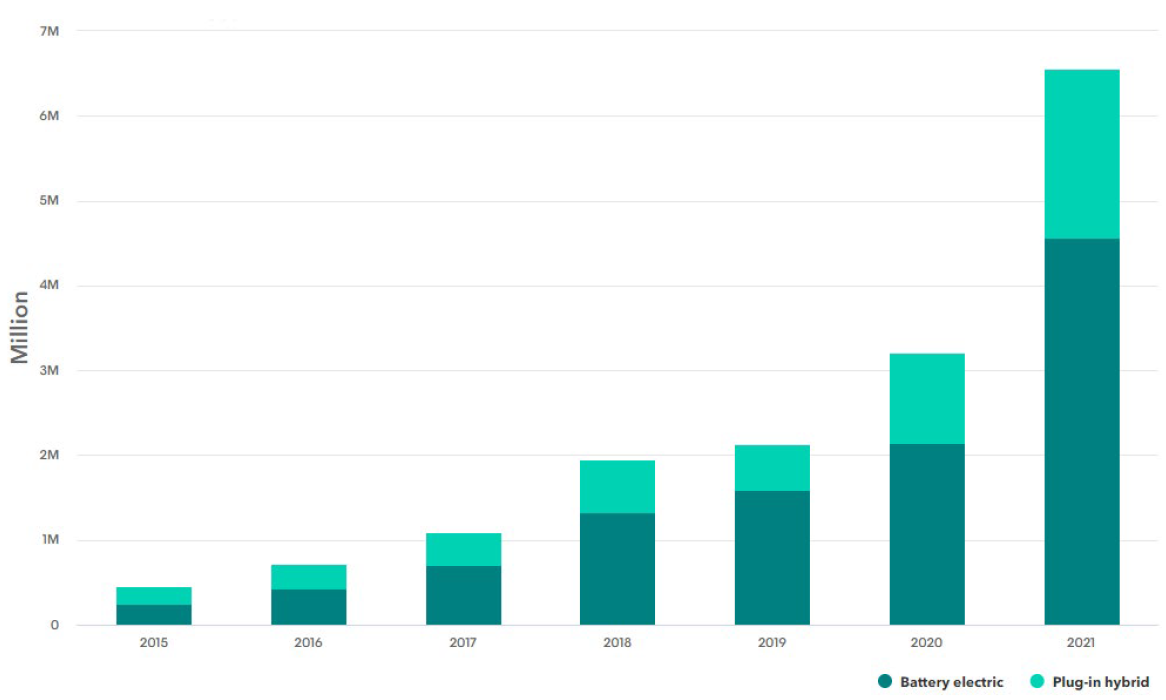

Chart 4: Global passenger EV sales by type

Source: BloombergNEF

Source: BloombergNEF

Cost is one of the biggest factors when it comes to purchasing an EV and a significant portion of that cost is attributed to the battery. Battery production is centred in China, seen as the leader in battery manufacturing capabilities. China already controls many of the chemicals required for battery production which puts the country in a great position for the coming years. The graph above illustrates how battery powered electric vehicle sales are accelerating ahead of plug-in hybrids. BloombergNEF expects this gap to widen further in the years ahead.

China is also a leader in another interesting innovation: battery technology solutions. The aforementioned start-up NIO has recognised that much of the population in densely populated cities will be unable to charge their vehicles as residences are concentrated in multi storey buildings. Therefore, NIO introduced the concept of battery swapping, a system in which drivers who cannot charge their cars at home are able to do a quick battery swap during their usual commutes.

According to Organisation Internationale des Constructeurs d'Automobiles (OICA), the total number of ICE and EVs sold globally in 2021 was around 82 million. China accounted for the largest amount of vehicle sales and is estimated to be the largest automobile market globally. We continue to believe that China’s brands will make up the majority of EV and FM global sales in the future given this volume of consumer sales and the innovation, infrastructure and government-led subsidies mentioned above.

EV valuations and performance

Everyone seems to have a view on Tesla: it is a stock which has most investors polarised. Tesla’s sheer market cap valuation makes it challenging for many investors to justify the company’s position in their portfolios. Despite dwarfing the major global car manufacturers, its current global sales remain at just a fraction. This disconnect is prompting investors to search for other areas of the market where valuations are not so outrageously high.

Currently, the top six EV companies by market cap are divided equally by US and Chinese names.

Table 1: Largest six EV companies by market cap

Source: companiesmarketcap.com as at 27 May 2022

Source: companiesmarketcap.com as at 27 May 2022

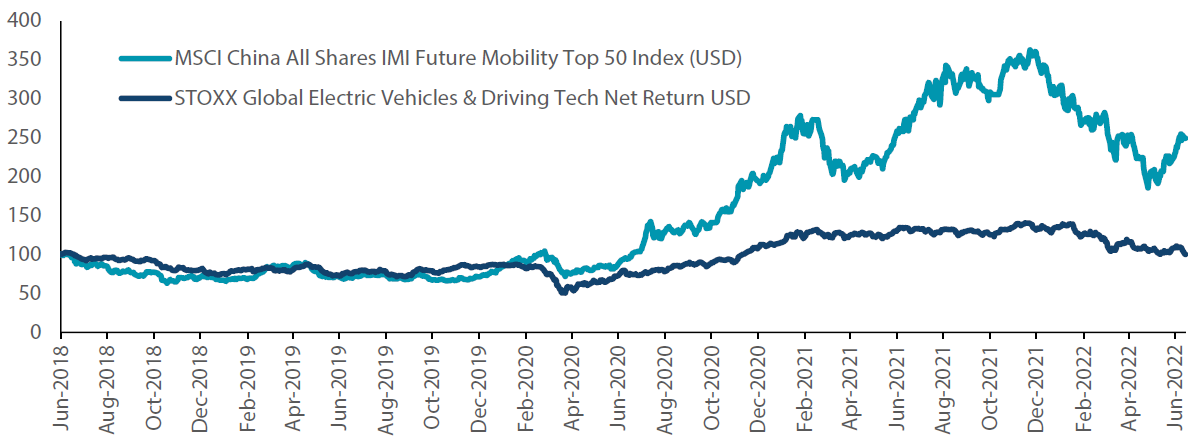

It is worth noting that there are very few pure EV players in the US and Europe, with the majority being Chinese. Whilst the performance of the sector has taken a hit in the last year, the future growth of this industry should not be underestimated. Cheaper valuations now allow for a better entry point, in our view.

Chart 5: Performance of China EV vs Global EV

Source: Bloomberg as at 14 June 2022

Source: Bloomberg as at 14 June 2022

We believe that the next decade will bring extraordinary progress in EV acceptance. The attraction and development of cost-efficient cars, infrastructure and technology will only further fuel the growth of this industry. As investors continue to recognise this important space in the market, the attraction of including this theme in an investment portfolio increases. China is not losing any momentum on its journey to become the leader of the EV space and with some relatively cheaper valuations, China remains our favourite region to be focussed on in this sector.

Reference to individual stocks is purely for illustrative purpose and does not constitute a recommendation to buy, sell or hold any securities or to be relied upon as financial advice in any way.