Summary

- Asian stocks suffered losses in February as escalating Russia-Ukraine tensions culminated in an invasion of Ukraine by Russia. Lingering concerns over inflation also weighed on the equities markets. For the month, the MSCI AC Asia ex Japan Index fell by 2.3% in US dollar (USD) terms.

- India and China were the biggest decliners. India underperformed on the back of higher inflation and a surge in oil prices. Chinese stocks retreated despite various measures by the central bank to bolster economic growth.

- The ASEAN markets generally outperformed the broader index, partly due to positive GDP growth within the region.

- Despite the gloomy reality of a war in Eastern Europe, in our view Asian economies are more than strong enough to withstand commodity price hikes even at their current elevated levels. We are optimistic on structural areas with policy support such as domestic Asian consumption, innovative healthcare, environment and areas of industrial technology. We believe that these are areas which will be shielded fairly well from the fallout of the ongoing geopolitical conflict.

Market review

Regional equities fall in February

Asian stocks suffered losses in February as escalating Russia-Ukraine tensions culminated in an invasion of Ukraine by Russia. Lingering concerns over inflation also weighed on the equities markets as the US consumer price index (CPI) accelerated to 7.5% in January 2022, hitting a 40-year high.

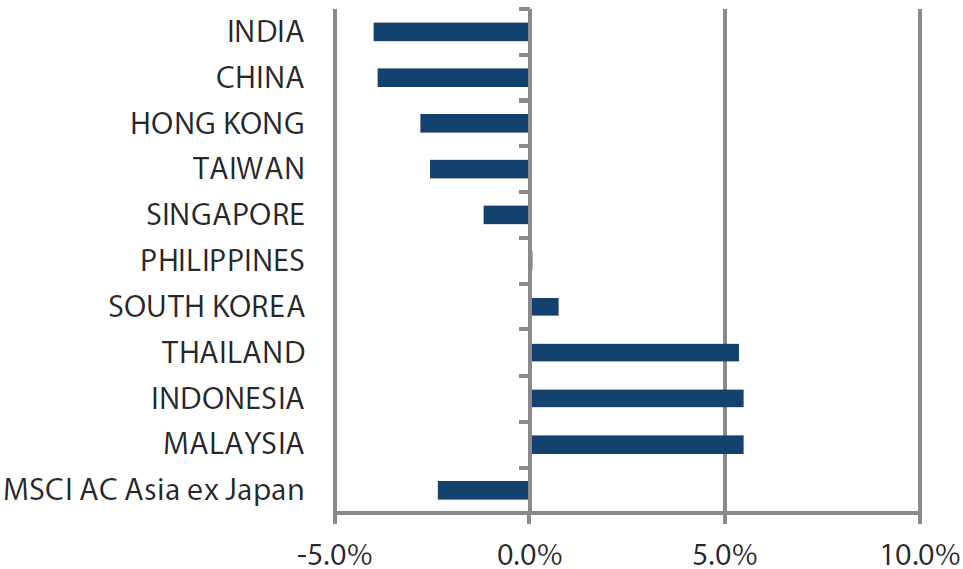

For the month, the MSCI AC Asia ex Japan Index returned -2.3% in US dollar (USD) terms. Within the region, Malaysia and Indonesia were the best performers (as measured by the MSCI indices in USD terms), while India and China were the biggest decliners.

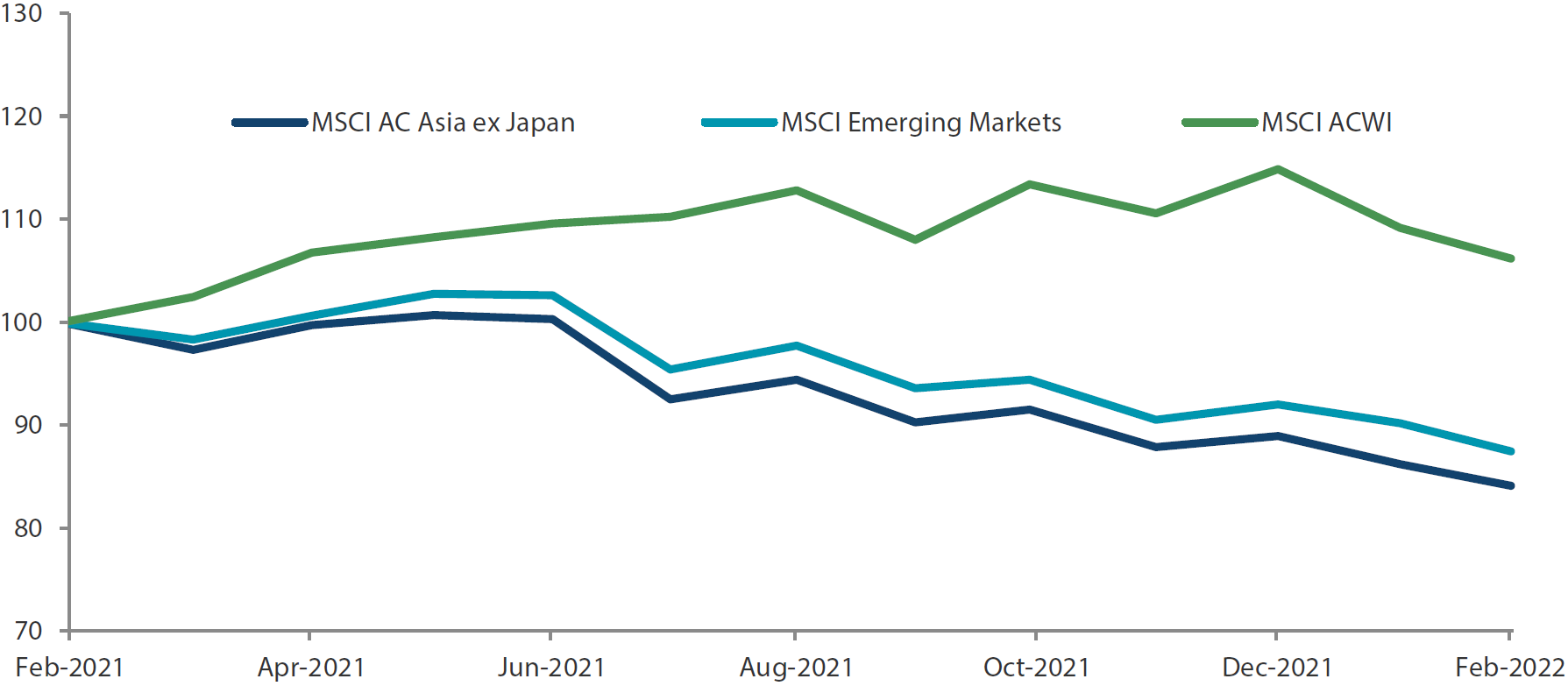

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 28 February 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 28 February 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

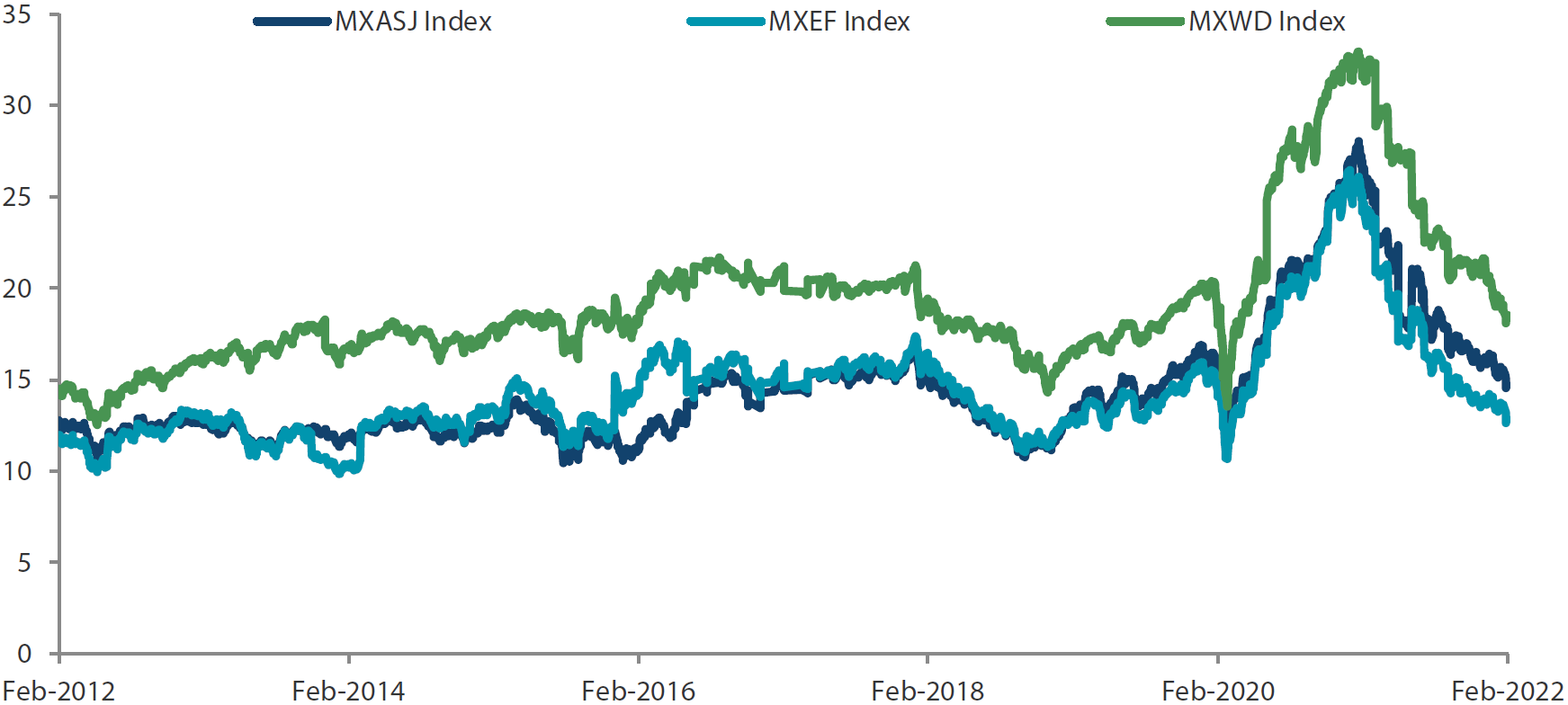

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 28 February 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 28 February 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Indian stocks decline

Indian stocks fell by 4.0% in USD terms, buffeted by weaknesses in global markets and inflation. India’s CPI climbed to 6.01% in January, driven by rising prices of food and manufactured items. Market sentiment was also dampened as oil prices surged above USD 100 per barrel for the first time since 2014 and widened the country's current account deficit. The Reserve Bank of India kept repo and reverse repo rates unchanged at 4.00% and 3.35%, respectively, to support economic recovery.

China retreats, but rest of North Asia fare better

China (-3.9% in USD terms) retreated despite various measures by the country’s central bank to bolster economic growth. The People’s Bank of China injected 300 billion yuan through medium-term loans into the financial system while keeping interest rates unchanged. China also introduced measures to reignite demand and ease the liquidity crunch in the property sector. The measures included allowing smaller down payments, lowering mortgage rates and cutting the deed tax.

The rest of the North Asian markets performed relatively better. South Korea eked out a gain of 0.7% as its central bank retained its benchmark rate at a pre-pandemic level of 1.25% to restrain inflation and household debt growth. Taiwan (-2.5%) saw exports rise for the 19th straight month in January due to robust global demand for its technology while Hong Kong (-2.8%) announced a budget of HKD 170 billion to offset the effects of pandemic-induced restrictions on households and businesses and to boost the economy.

ASEAN markets outpace the broader index

The ASEAN markets outpaced the broader regional index, partly due to positive GDP growth within the region. Malaysia (5.5%) and the Philippines (0.1%) both reported GDP growth of 3.6% and 7.7%, respectively, in the fourth quarter of 2021. The central banks of both Thailand (5.3%) and Indonesia (5.5%) kept interest rates unchanged. In Thailand, market sentiment was lifted by news that the country has commenced discussions on travel bubbles with Malaysia and China. Indonesia announced it will keep policy rates unchanged until inflation exceeds its target band of 2-4%. Conversely, Singapore closed marginally lower (-1.2%) as its core inflation in January rose to 2.4% on a year-on-year basis, the highest level in more than nine years. Singapore’s central bank also moved to tighten monetary policy to counter rising prices.

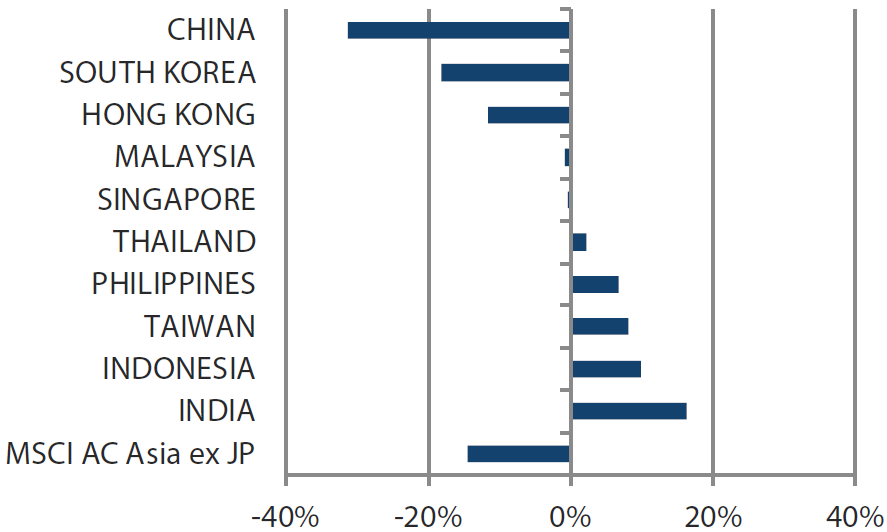

Chart 3: MSCI AC Asia ex Japan Index¹

| For the month ending 28 February 2022 | For the year ending 28 February 2022 | |

|

|

Source: Bloomberg, 28 February 2022.

¹Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Leaning on disciplined stock picking approach to navigate uncertain conditions

The escalation of the Russia-Ukraine conflict is a fast-developing and unpredictable geopolitical crisis, and our hearts go out to the people most affected by the conflict. Whilst direct impact is limited in Asia with most of the region having <10% sales or capacity direct exposure to Russia or Ukraine, there is potential indirect impact through commodities such as wheat, barley, palladium, oil, gas, coal, platinum, nickel and aluminium. Despite the gloomy reality of a war in Eastern Europe, it is important to note that Asian economies are overall more than strong enough to withstand commodity price hikes even at their current elevated levels.

Our bottom-up approach has primarily been focused on seeking out companies undergoing significant positive fundamental changes that can deliver strong sustainable returns in the future. We continue to favour structural areas with policy support such as domestic Asian consumption, innovative healthcare, environment and areas of industrial technology. These are areas which will be shielded fairly well from the fallout of the ongoing geopolitical conflict, in our view.

Constructive on renewable energy investments in North Asia

In the medium term, Europe could beef up its energy security and reduce its dependence on Russian energy supply. We may expect large scale European investments in alternative energy sources and in particular an acceleration in renewables investments—especially if energy prices remain persistently high. We believe that renewable energy supply chains across North Asian economies such as Taiwan, South Korea and China could be major beneficiaries.

Alignment with Chinese policy priorities

Further, China is also expected to spend heavily on renewables as part of its fiscal stimulus to support growth this year. A combination of fiscal and monetary easing will be required to prop up employment in a country that has seen growth declining. The easing of financial conditions in China is especially salient when juxtaposed against a tightening environment in the rest of the world. With Chinese President Xi Jinping expected to take the reins for his third term later this year, it is paramount for 2022 to be a year of “stability” for China. We continue to monitor Chinese policy priorities including those in the areas of industrial technology, artificial intelligence (AI) software, semiconductors, renewables and electric vehicles.

Higher commodity prices opportunities for ASEAN

As a major supplier of upstream commodities and agriculture produce, ASEAN could emerge as a beneficiary of higher commodity prices. For example, Indonesia could see its terms of trade improve through its exports of coal and nickel. Nickel prices, in particular, have already moved higher on the back of a shortage in class 1 nickel even before the discounting of higher geopolitical risk premium on Russian production sanctions. Elsewhere, Malaysia, as an oil producer, is another country that could prominently benefit from higher oil prices.

Selective in India

While we are optimistic about the opportunities in Asia, we are also cognisant of the markets that are vulnerable to upstream disruptions. To that end, energy importers such as India could be subjected to some downward pressure especially as valuations remain stretched in pockets of the market. Over the last few months, Indian stocks saw unattractive valuations as positive changes were realised and discounted into their share prices. That said, we remain very constructive on India’s longer-term growth on the back of its significant reform momentum over the last few years. As such, we continue to find opportunities in areas that enjoy structural growth and where valuation still offers upside. These include real estate, private banks, new economy and healthcare.

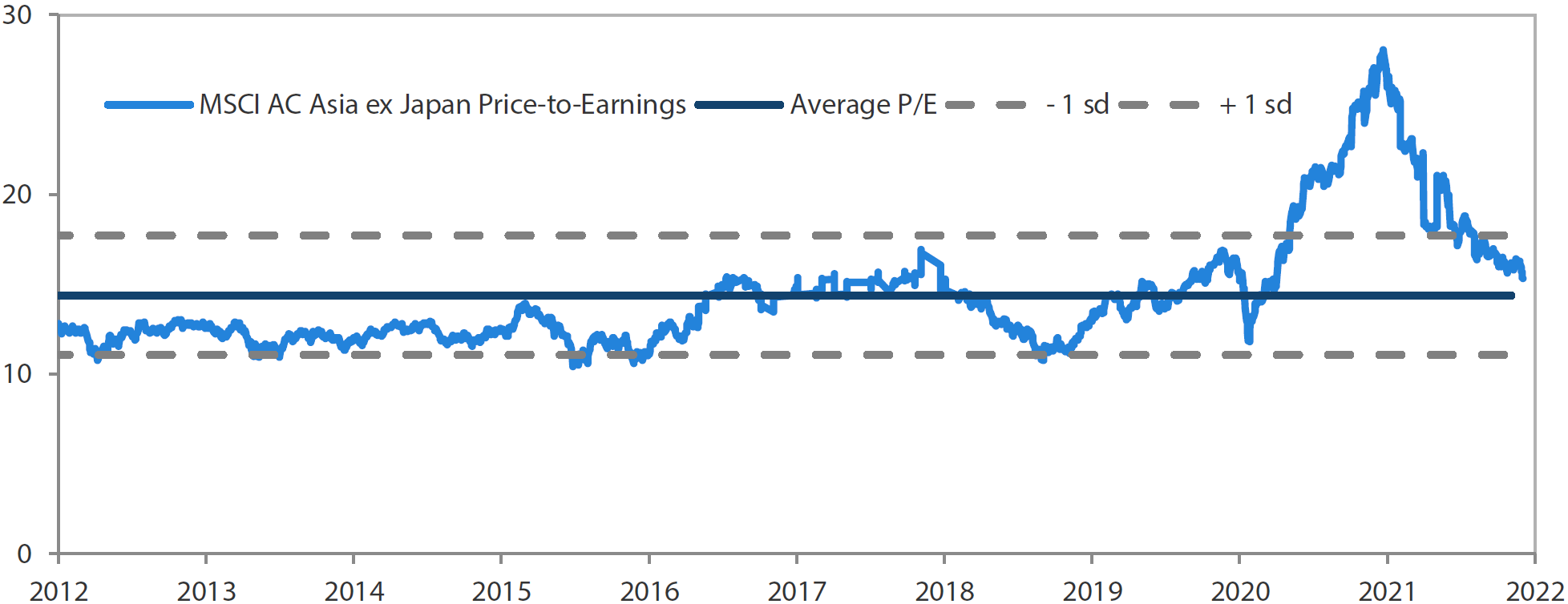

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 28 February 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 28 February 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

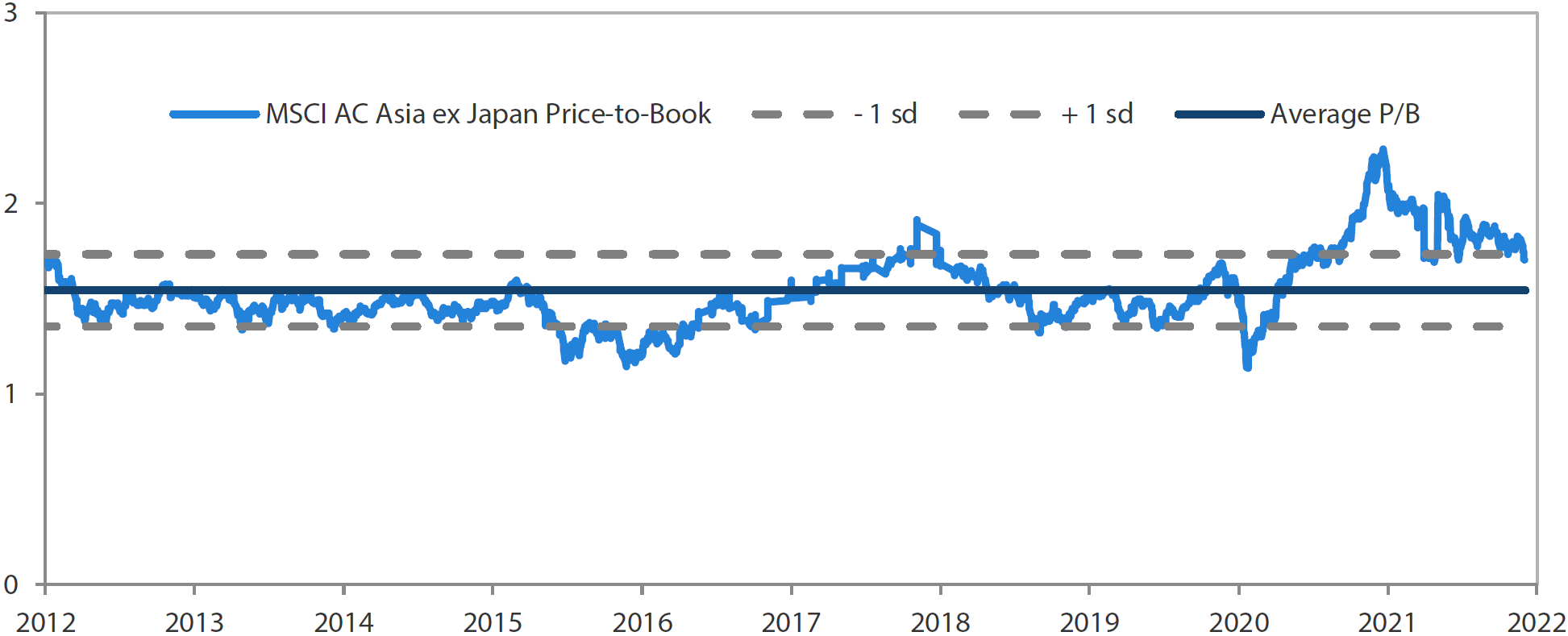

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 28 February 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 28 February 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.