Summary

- Asian markets were downcast in April as investors were concerned about inflation and the likelihood of a larger-than-expected rate hike by the US Federal Reserve (Fed). For the month, the MSCI AC Asia ex Japan Index fell by 5.2% in US dollar (USD) terms.

- Taiwan and the Philippines saw the biggest declines. Taiwanese stocks underperformed amid a surge in local COVID-19 cases. Philippine stocks retreated on the back of skyrocketing oil and food prices which fuelled inflation.

- Indonesia, the sole positive returner in the region, climbed as S&P Global Ratings revised up the country’s credit ratings outlook to "stable" due to its economic recovery from the pandemic and better terms of trade.

- Increasingly hawkish comments from the Fed continue to drive yields up and raise risk premia globally. Coupled with persistently high inflation, asset values are likely to fluctuate and cause volatility. We remain focused on enduring shifts such as localisation and digitisation, greater focus on health and wellbeing, and the environment.

Market review

Regional equities fall in April

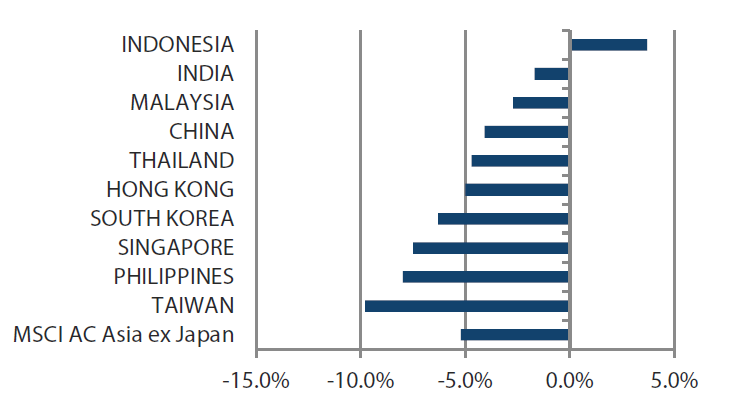

Asian markets were downcast after monthly US consumer price index (CPI) data showed a rise of 1.2% in March—the biggest monthly gain since September 2005—and Fed indicated that it was preparing a 50 basis points interest rate hike at its meeting in May. Prices of commodities, in particular energy, remained high as effects from the Russia-Ukraine war rippled through the global economy. For the month, the MSCI AC Asia ex Japan Index returned -5.2% in USD terms. Indonesia, India and Malaysia were the month’s best performers, while Taiwan and the Philippines lagged.

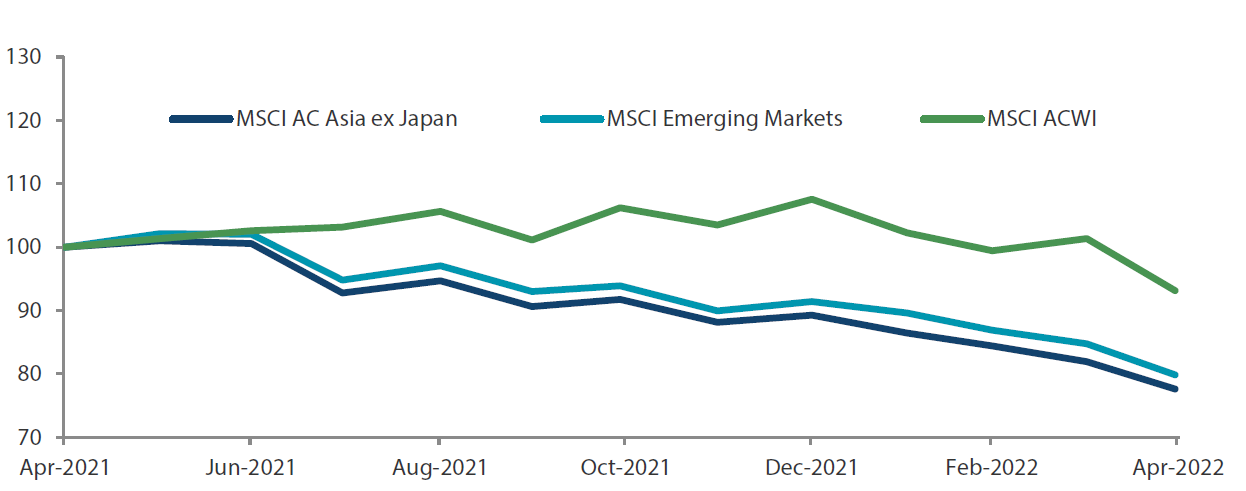

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 30 April 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 April 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

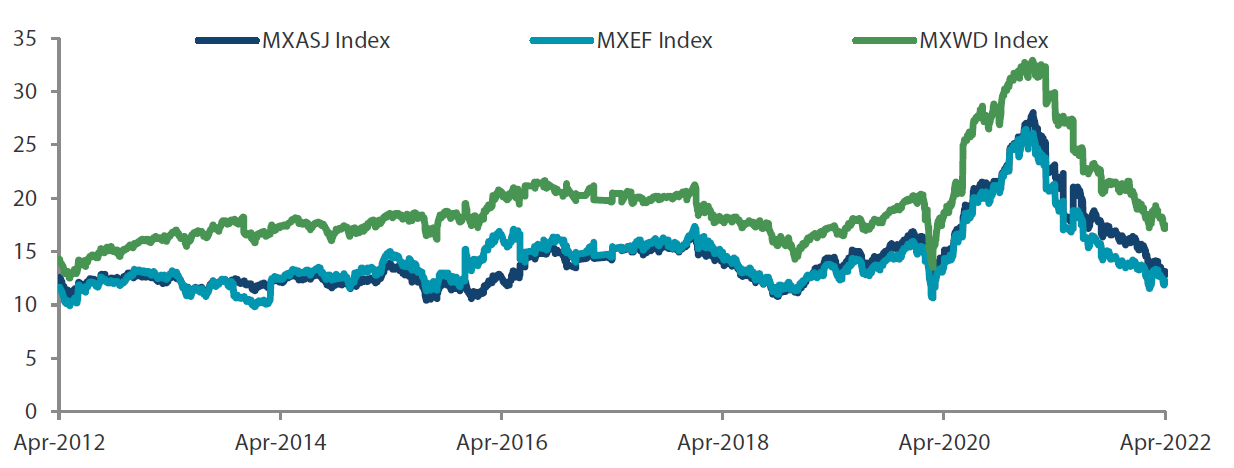

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 30 April 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 April 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Indian stocks relatively resilient in the region

India (-1.7% in USD terms) fell marginally on the back of inflation data—retail inflation accelerated to near 7% year-on-year, and annual wholesale inflation rose to 14.55% in March due to rising costs. The Reserve Bank of India also announced that that it would prioritise tackling inflation over supporting economic growth and its accommodative policy stance.

ASEAN markets mixed

Indonesia (+3.7%), which was also the sole positive returner in the region, climbed as S&P Global Ratings revised up the country’s credit ratings outlook to "stable" due to its economic recovery from the pandemic and better terms of trade. The rest of the ASEAN region fared less positively. Malaysia fell by 2.7% on the back of a rise in CPI of 2.2% in March. Thailand (-4.7%) slipped as its finance ministry revised its 2022 economic growth forecast downwards due to the impact of the Russia-Ukraine war on global growth and inflation. In Singapore (-7.5%), the Monetary Authority of Singapore tightened its monetary policy again as Singapore's economic momentum waned over the first quarter. The Philippines (-8.0%) also retreated as the Philippine Statistics Authority reported that inflation rose to 4% in March, due to skyrocketing oil price and food inflation.

North Asia retreats

In the North Asian region, China was the best performing country, despite losing 4.1%. China’s economy slowed in March as consumption, real estate and trade were affected due to COVID-19 curbs and weakened domestic demand. The Chinese government’s relentless pursuit to shore up the economy continues, with steps such as a 0.25% cut to the reserve requirement ratio. Nearby in Hong Kong (-5.0%), incumbent Chief Executive Carrie Lam chose not to run for a second term. South Korean stocks dived 6.3% as the central bank raised the benchmark rate by 0.25% to 1.50%, the highest since August 2019, to combat inflation. Taiwan (-9.8%) was the worst performer in the region as it battled a surge in local COVID-19 cases, sustaining losses although its exports rose for a 21st straight month in March thanks to continued strong tech demand.

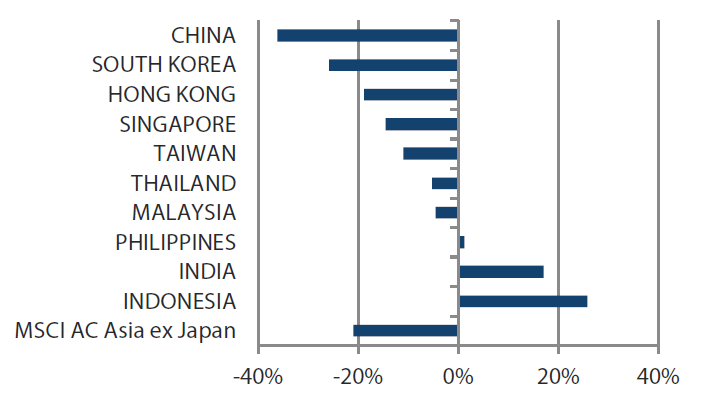

Chart 3: MSCI AC Asia ex Japan Index¹

| For the month ending 30 April 2022 | For the year ending 30 April 2022 | |

|

|

Source: Bloomberg, 30 April 2022.

¹Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Remaining focused on enduring shifts

Increasingly hawkish commentary from senior Fed officials continues to drive yields up, in turn raising risk premia globally. In an ironic twist, “lower for longer” is now seeing greater usage in the context of economic growth, rather than interest rates. The worry is that persistently high inflation will dampen consumption and investment, hurting economic growth in most countries. Unfortunately, this has come at a time when countries are still assessing the negative fallout of the Russia-Ukraine war, not just on Ukraine but on their own economies as supply chains, particularly in energy and agricultural products, are upended. Backwardation in oil futures perhaps reflects the hope (that undying human emotion) that current problems will find some resolution in the coming months. The flip side is that any disappointment on this front will likely further weigh on economic growth, and consequently, on asset values. As sentiments yo-yo between hope and despair, with risk premia following suit, asset values are likely to fluctuate between being overvalued and undervalued, making for volatile financial markets. In such times, we hope to remain focused on enduring shifts such as localisation and digitisation, growing focus on health and wellbeing and environmental issues.

Continued alignment with Chinese policy priorities

China’s reluctance to abandon its zero-COVID stance will likely hurt growth, and this realisation has seemingly prompted easing by the government. At first glance, efforts to stimulate the economy via infrastructure stimulus might appear like a return to the old playbook. However, this time, these efforts are focused on new areas such as industrial automation, the environment and semiconductors. Thus, we continue to favour these new areas, particularly in companies with strong fundamentals that have been mispriced down in the broad sell down.

Finding opportunities in India and North Asia

Valuations in India remain, by and large, rich as a steady inflow of domestic money continues to offset foreign portfolio outflows. Notwithstanding attractive longer-term growth opportunities, higher energy prices are headwinds. The relatively balanced risk-reward trade-off has drawn our attention to interest rate beneficiaries, namely financials and property.

The ever-increasing digitisation of all aspects of life—managing household devices remotely, wearables, and the metaverse in a few years—will require ever more sophisticated chips, and Taiwan and South Korea remain leaders in this space globally. However, localisation of critical components of supply chains, particularly in high technology, is increasingly becoming more important. We believe the tussle between these two trends will affect different companies differently—identifying winners will require a fundamental bottom-up approach. We are selective in our view of these markets.

Keeping watch on ASEAN

Despite ASEAN being a meaningful beneficiary of higher commodity and agricultural product prices on account of being a net exporter, murky politics and lackadaisical policymaking leave us on the sidelines in most of the region’s markets. We remain positive towards Indonesian miners exporting commodities critical to transport electrification and energy storage. Consistent with the same theme, we favour opportunities in the Philippines that are focused on renewable energy, digitisation/financial inclusion and beneficiaries.

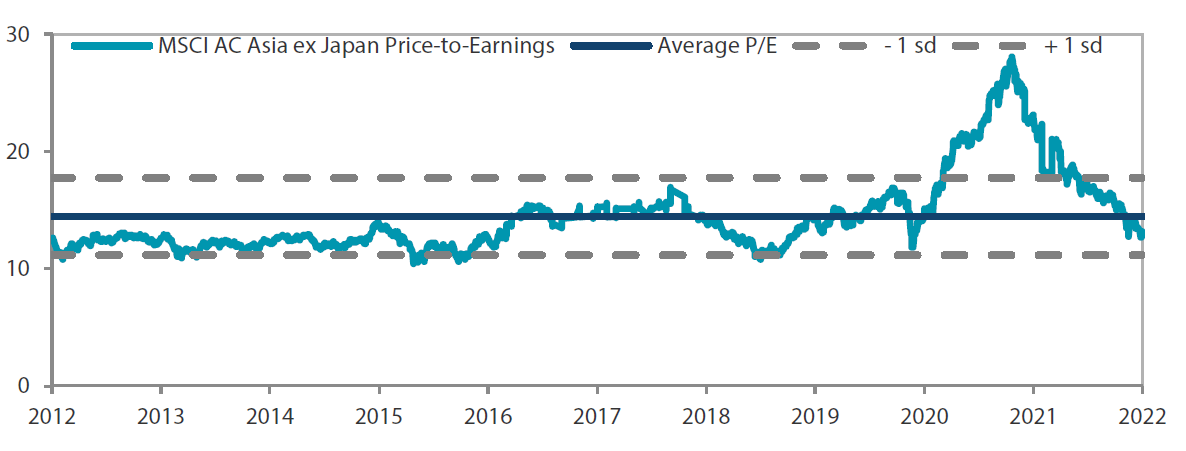

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 30 April 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 April 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

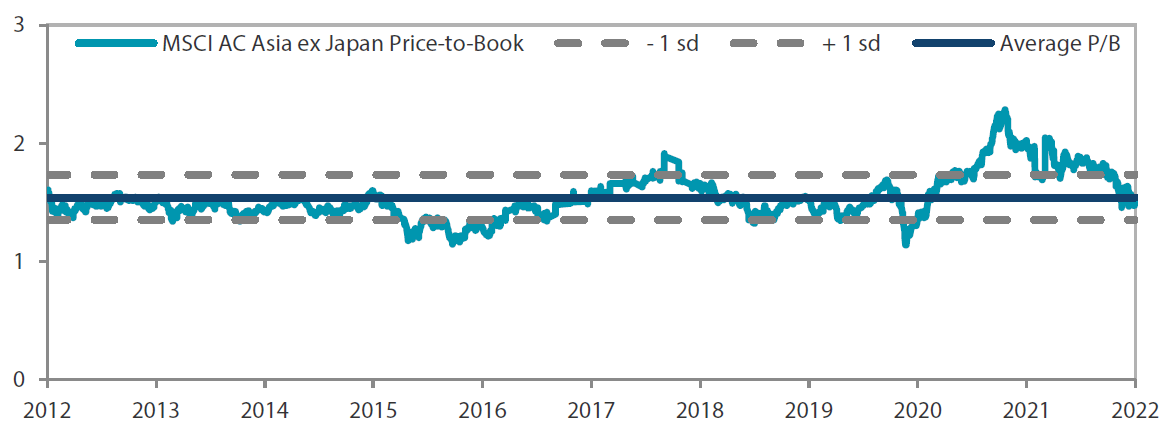

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 30 April 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 April 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.