Summary

- Asian equity markets rose marginally in May, boosted by Shanghai’s plan to lift COVID-19 restrictions, even as the US Federal Reserve (Fed) raised its benchmark overnight interest rate by 50 basis points (bps). For the month, the MSCI AC Asia ex Japan Index rose by 0.5% in US dollar (USD) terms.

- India was the biggest underperformer, following a surge in retail inflation to 7.79% in April year-on-year. Market sentiment was also weighed down by higher oil prices, and a raise in the repo rate by 40 bps to 4.40%.

- The ASEAN region saw mixed returns, mainly on the back of interest rate hikes and GDP data that exceeded expectations.

- All markets in the North Asian region rose. China and Hong Kong advanced, buoyed by Shanghai’s announcement to lift COVID-19 restrictions and measures by the government to shore up the Chinese economy. Taiwan and South Korea gained on positive export data.

- Uneasiness remains in regional markets, with inflationary pressure broadening out globally and growth showing signs of slowing from a high base. It is, however, important to note that Asia may be on a better footing in comparison to the rest of the world. There is less risk of inflation expectations moving up as Asian economies are still growing below potential, in addition to accelerating policy support and attractive valuations.

Market review

Regional equities rise in May

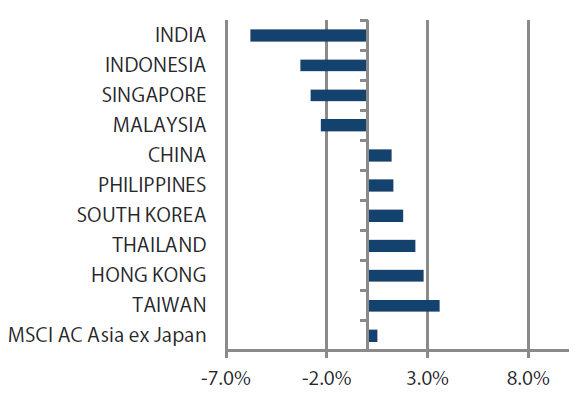

Asian equity markets rose marginally in May, boosted by Shanghai’s plan to lift of COVID-19 restrictions and easing policy measures in China, even as the Fed raised its benchmark overnight interest rate by 50 bps, the largest in 22 years. The Fed also prepared market watchers by hinting of more 50 bps rate hikes to come; it also plans to reduce its assets to control inflation. For the month, the MSCI AC Asia ex Japan Index returned 0.5% in USD terms. Local markets saw mixed returns as Hong Kong, Thailand and Taiwan were the month’s best gainers (as measured by the MSCI indices in USD terms), while India, Singapore and Indonesia underperformed.

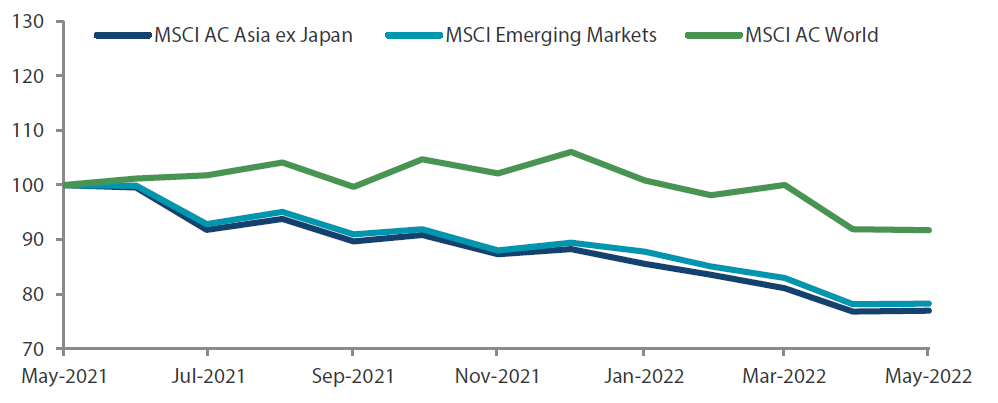

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 May 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 May 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

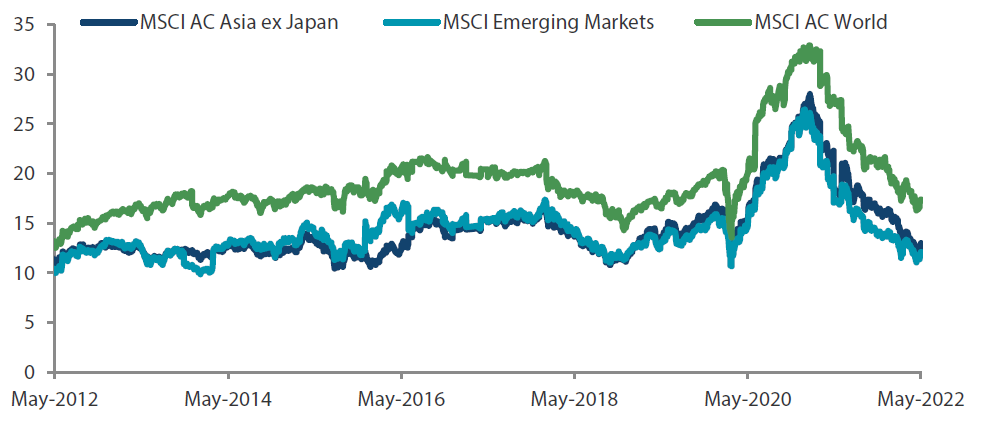

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 May 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 May 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Indian stocks underperform

India was the largest underperformer, losing 5.8% in USD terms, following a surge in retail inflation to 7.79% in April year-on-year. Market sentiment was also weighed down by higher oil prices, and as the Reserve Bank of India raised the repo rate by 40 bps to 4.40%.

ASEAN markets mixed

The ASEAN region saw mixed returns. Indonesia and Malaysia fell by 3.3% and 2.3%, respectively, as interest rates rose. Indonesia’s central bank lifted the reserve requirement ratio (RRR) for banks to 7.5% starting July and 9% in September and said it expects inflation to rise above its target band of 2% to 4%. Malaysia’s central bank raised the benchmark interest rate to 2% from 1.75%. Singapore retreated 2.8% on the back of CPI data. Singapore’s core inflation rose to 3.3% in April on a year-on-year basis, the highest since February 2012. The Philippines and Thailand gained 1.3% and 2.4%, respectively, riding on positive growth data that exceeded expectations. The Philippines’ GDP grew 8.3% year-on-year in the first quarter, and Thailand’s GDP for January to March expanded 1.1% from the previous quarter. In addition, a presidential election was held in the Philippines, with Ferdinand Marcos Jr., who pledged to rev up the economy, emerging victorious.

North Asia rises

All markets in the North Asian region rose. China and Hong Kong advanced by 1.2% and 2.8%, respectively, buoyed by Shanghai’s plan to lift COVID-19 restrictions. Coupled with the government’s measures to shore up the economy—such as cutting benchmark rate for mortgages, subsidising utility bills and voucher handouts—positive market sentiment remained strong even as export growth slowed to 3.9% in April from a year earlier. COVID-19 curbs disrupted production and demand, resulting in profits at China's industrial firms shrinking by 8.5% in April from a year earlier. Taiwan and South Korea rose 3.6% and 1.8%, respectively, thanks to strong export data. Taiwan’s exports rose for a 22nd straight month in April due to sustained demand for chips despite geopolitical uncertainties and supply chain worries, and South Korea’s exports increased 12.6% in April from a year earlier.

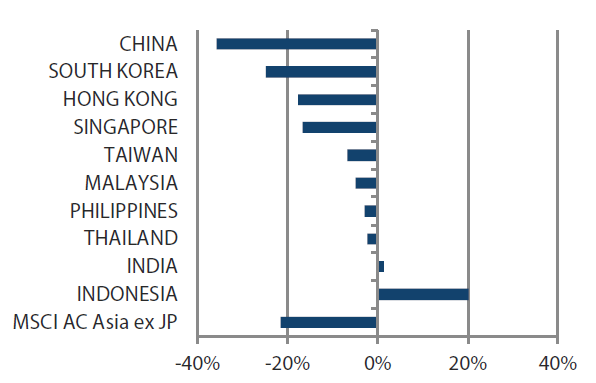

Chart 3: MSCI AC Asia ex Japan Index1

| For the month ending 31 May 2022 | For the year ending 31 May 2022 | |

|

|

Source: Bloomberg, 31 May 2022.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Signs of Inflationary pressure and slowing global growth

Uneasiness remains in regional markets, with inflationary pressure broadening out globally and growth showing signs of slowing from a high base. It is, however, important to note that Asia may be on a better footing in comparison to the rest of the world. Underpinned by strong demographics, Asia is not faced with the labour force issues plaguing the West, and there is less risk of inflation expectations expanding as Asian economies are still growing below potential. Furthermore, accelerating policy support and attractive valuations are also expected to provide firm support for the region over the next 12 months. We continue to be disciplined, sticking to our bottom-up approach, focusing on companies undergoing significant positive fundamental changes that can deliver strong sustainable returns in the future. We find these in structural areas with policy support such as domestic Asian consumption, innovative healthcare, environment, and areas of industrial technology.

Continued alignment with Chinese policy priorities

Over the past few weeks, China has been conspicuous in stepping up its policy support rhetoric, and more importantly, through its rolling out of actual policy easing details across various cities. Yet, the market remains seemingly unconvinced that policymakers are doing enough. Seemingly out of political expediency, President Xi Jinping’s regime is hitherto dogmatic in its zero-COVID approach, and policy measures will inadvertently have to do the heavy lifting to stabilise the economy. Thus, we expect the Chinese government to ramp up its easing measures over the next few quarters. However, what keeps up us from becoming more bullish is the absence of a clear exit plan from its zero-COVID approach—without which the risk of repeated lockdowns remains elevated. Nevertheless, with cheap valuations and the government’s easing endeavour in mind, we continue to favour Chinese policy priorities including those in the areas of industrial technology, software and renewables.

Higher commodity prices and foreign investments beneficial to ASEAN

ASEAN remains in a healthy position. Commodity exporters such as Indonesia and Malaysia continue to enjoy a significantly improved trade balance on the back of higher commodity and agriculture product prices. The region also continues to see meaningful foreign investments in its manufacturing sector as part of global supply chain diversification. Reopening of economies are also expected to drive the recovery of services sectors such as tourism in countries like Thailand. We remain interested in renewable energy companies, miners geared towards transport electrification and energy storage in addition to digitisation/financial inclusion beneficiaries.

Balancing short-term outlook with longer-term trends for tech markets

While we are constructive on the longer-term trend of increased digitisation of all aspects of life, the shorter-term outlook for the tech sector is slightly murkier. As the global tech cycle tails off, South Korean and Taiwanese tech companies have to now contend with higher raw material prices and supply chain disruption. To that end, we view these markets selectively as earnings momentum are now slowing while margins are increasingly challenged.

Taking a more cautious view towards India

Despite rich valuations and running a twin deficit in an inflationary environment, India has been surprisingly resilient year to date as domestic flows continue to offset foreign portfolio outflows. However, with energy and food prices expected to stay high for an extended period of time, downside risk remains in India. While we continue to be optimistic about India’s reform driven long term growth opportunities, its near-term risk-reward dynamics are no longer as attractive relative to the rest of the region. As such, we have taken a more cautious view towards the country.

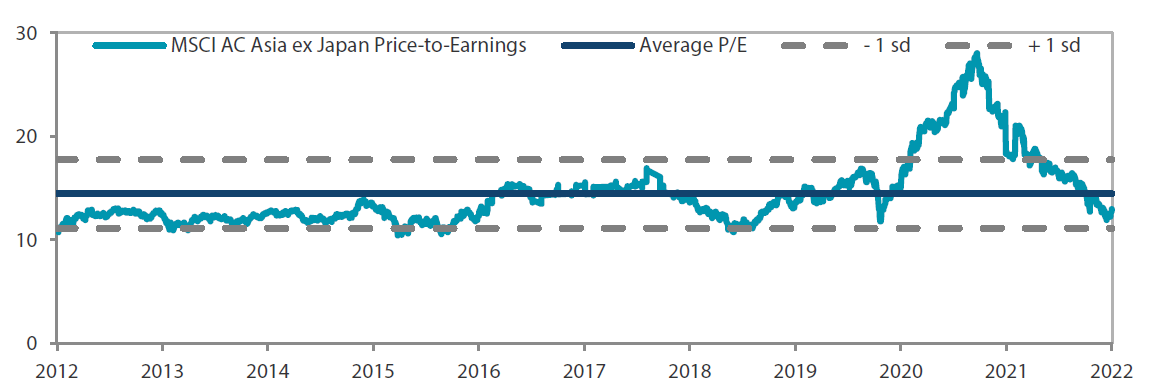

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 May 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

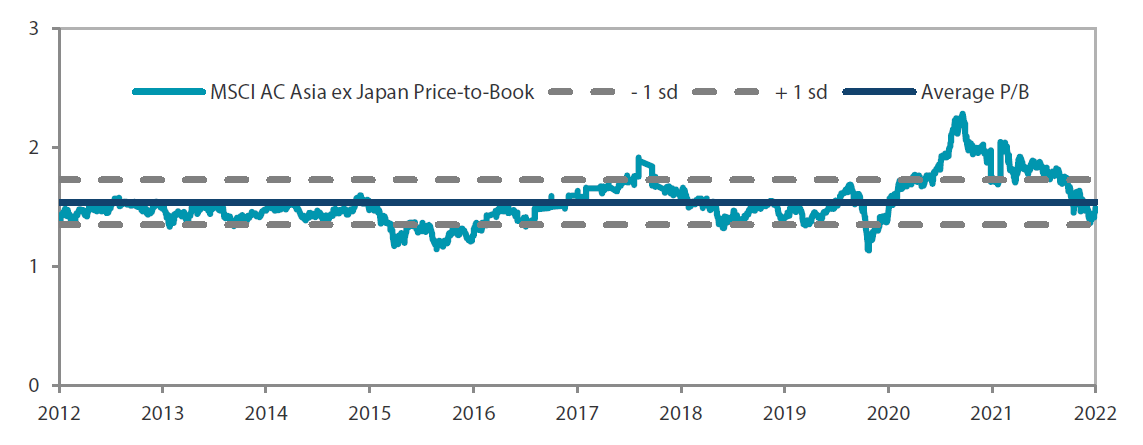

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 May 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.