Summary

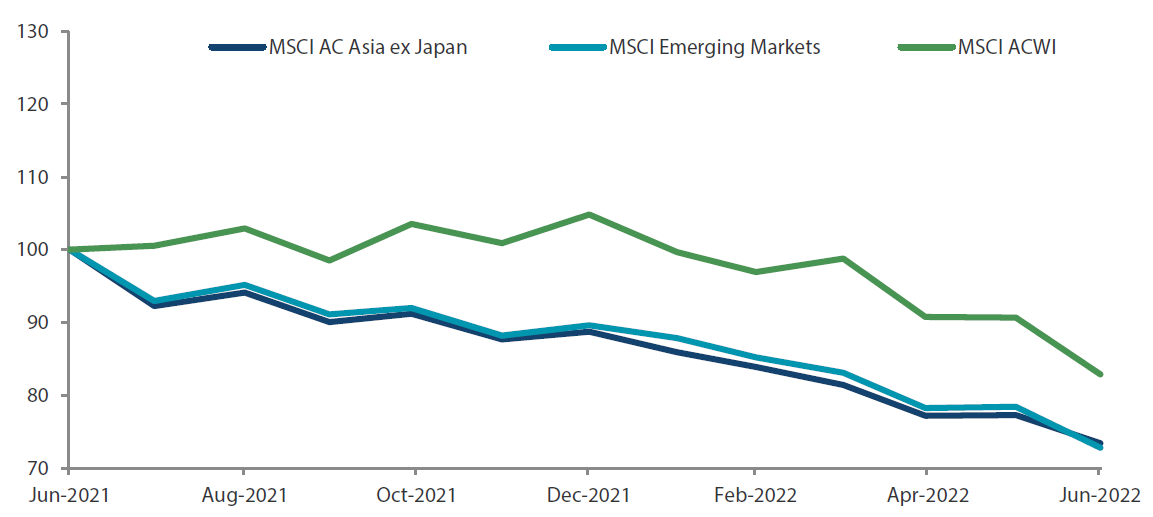

- Fears of a recession and the US CPI hitting a four-decade high of 8.6% year-on-year (YoY) in May rippled through various economies. Asian markets took heed from the multiple headwinds in the US, with inflation being a common theme across the region. For the month, the MSCI AC Asia ex Japan Index fell by 4.5% in US dollar (USD) terms.

- Despite this tough external environment, Chinese and Hong Kong stocks gained in absolute terms over the month. Chinese stocks made headway as China halved the quarantine period for inbound travellers. Hong Kong also outperformed, with market sentiment seemingly unaffected by the rise in interest rates and Macau’s closure of most business due to a COVID-19 outbreak.

- The rest of the region was impacted by foreign currency effects, with all countries retreating. Inflation was also a concern across these markets.

- While the global backdrop remains challenging, some incremental positives in pockets of the market could be emerging. In Asia, inflationary pressures have not been as intense and China, the largest economy in the region and an increasingly important driver for the region’s growth, is cautiously stimulating its economy.

Market review

Regional equities rise in June

Fears of a recession and the US CPI hitting a four-decade high of 8.6% YoY in May rippled through various economies. The US Federal Reserve (Fed) reacted to the elevated CPI by raising interest rates by 75 basis points (bps), the largest hike in 25 years, whilst preparing the markets for another hike of 50 bps or 75 bps. Asian markets took heed from the multiple headwinds in the US, with inflation being a common theme across the region. The MSCI Asia ex Japan Index fell by 4.5% in USD terms. Despite this tough external environment, Chinese and Hong Kong stocks gained in absolute terms over the month whilst the rest of the region was impacted by foreign currency effects.

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 30 June 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 June 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

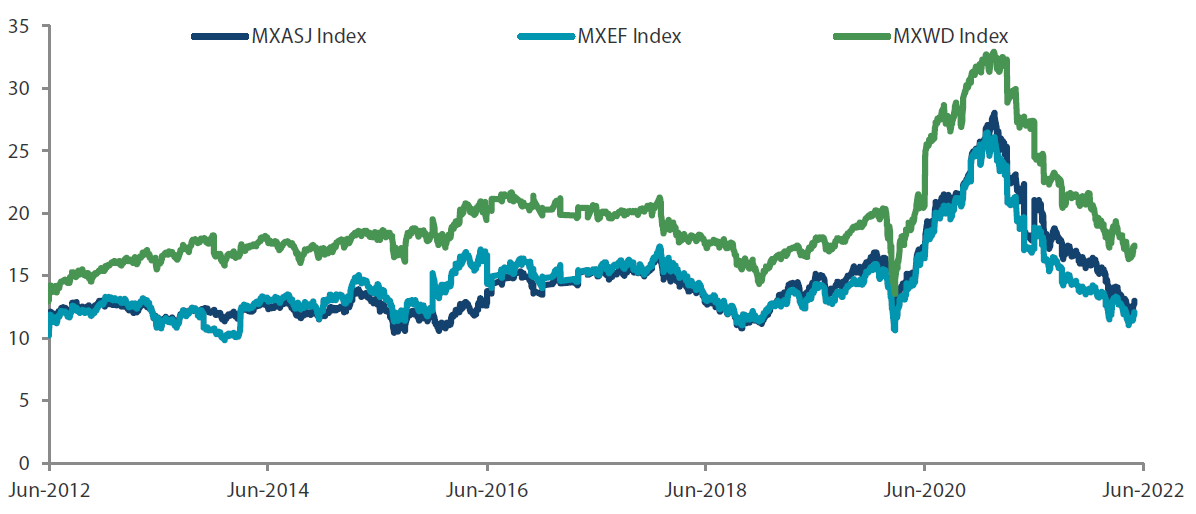

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 30 June 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 June 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

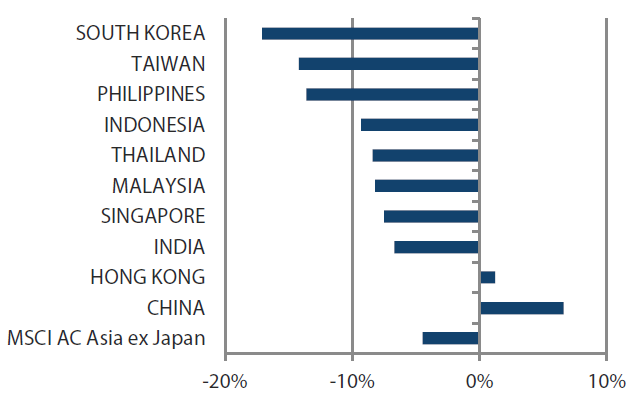

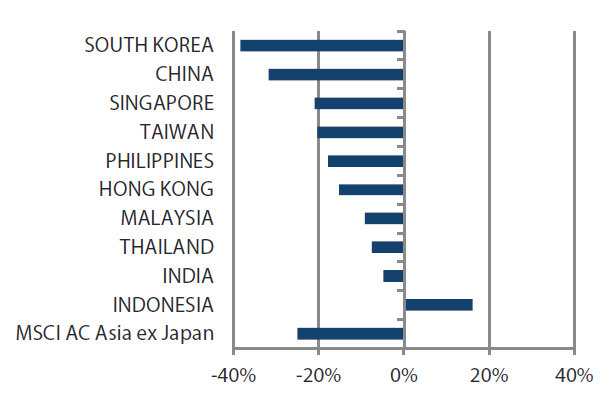

Indian stocks underperform

Indian stocks fell 6.7% in June. The Reserve Bank of India raised its key interest rate by 50 bps to combat inflation as CPI and wholesale prices in May climbed 7.04% YoY and 15.88% YoY, respectively. India’s merchandise trade deficit also ballooned to more than USD 23 billion due to rising commodity and fuel prices.

North Asia mixed

Chinese stocks advanced, returning 6.6% in USD terms, as China halved the quarantine period for inbound travellers. Its reopening earlier in the month allowed factories to ramp up production and eased snags in supply chains. China also stood pat on its benchmark lending rates again and announced its intention to make port operations more efficient to boost trade. Hong Kong also outperformed, rising 1.2%, even as the Hong Kong Monetary Authority raised its base rate by 75 bps. Market sentiment was seemingly unaffected even as most businesses in Macau were closed due to a COVID-19 outbreak, with the city opting to adhere to China’s zero-COVID policy. Taiwan (-14.2%) and South Korea (-17.1%) fell on the back of inflationary concerns and drops in demand; declines in sales and orders of chips, notebooks and smartphones also weighed.

ASEAN markets retreat

The entire ASEAN region retreated in the wake of rising inflation. The Philippines fell by 13.6% as its central bank hiked policy rates by 25 bps and indicated the likelihood of an increase of the same magnitude in August to combat inflation, with the CPI increasing 5.4% YoY in May. Malaysia shed 8.2% as the country’s food inflation reached the highest level since 2017 in May; the government, apart from providing cash handouts to lower-income earners, curbed food exports to secure local supplies and cap costs. Indonesia retreated 9.3%; the country’s CPI rose 3.55% YoY in May, reaching the upper limit of Bank Indonesia’s 2–4% target range. Singapore (-7.5%) introduced a support package exceeding USD 1 billion for lower-income groups to mitigate higher costs and inflation, which in May rose 3.6% YoY on a core inflation basis. Thailand fell 8.4% as its May CPI jumped 7.1% YoY, and as its central bank, which held its key rate at a record low for now, warned that delaying rate hikes would be detrimental.

Chart 3: MSCI AC Asia ex Japan Index1

| For the month ending 30 June 2022 | For the year ending 30 June 2022 | |

|

|

Source: Bloomberg, 30 June 2022.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

After a correction, valuations in Asia at attractive levels

While the global backdrop remains challenging, we may be starting to see some incremental positives in some areas of the market. The Fed’s ultra-hawkish tone is starting to be reflected in asset markets with deepening corrections in US equities, crypto currencies and private markets. Furthermore, key inflationary pressure points in supply chains and upstream materials prices are easing. Inflationary pressures have not been as intense in Asia; and China, the largest economy in the region and an increasingly important driver for the region’s growth, is cautiously stimulating its economy. Enthusiasm for China may still need to be tempered given Beijing’s ardent adherence to dynamic zero-COVID policies. But at the margin, Asia currently has more policy support than developed markets. Valuations too have corrected to much more attractive levels in Asia. It is also worth noting that MSCI China rose in USD terms during the month.

Policy support picking up in China as normalisation gets underway

Notwithstanding one of the toughest quarters China’s economy has had to endure in the COVID era, policy support has picked up, companies are restarting operations and some normalisation is underway. However, what keeps us from becoming more bullish on China the absence of a clear exit plan from its zero-COVID approach—without which the risk of more limited mobility remains elevated. The move to reduce quarantine periods, in our view, is the first step in any form of COVID policy easing and is likely aimed at improving confidence rather than having larger economic implications. Nevertheless, with cheap valuations and the government’s easing endeavour in mind, we have been increasing our favourable view toward select areas within China, including healthcare, software and companies well placed to take part in future opportunities in renewables and energy security.

Potential opportunities in South Korea and Taiwan

Elsewhere in North Asia we find the other two export and technology sector-dependent economies of South Korea and Taiwan under increasing pressure as demand in developed markets, particularly on the consumer side, weakens. While we are constructive on the longer-term trend of increased digitisation of all aspects of life, the shorter-term outlook for the tech sector is likely to remain more suppressed with inventories set to rise, despite supply chain and material input price pressures receding. To that end, we have a positive, albeit selective, view of stocks with improving or more resilient fundamentals. In June we witnessed broad selling pressure in these markets, and we expect further opportunities to arise.

ASEAN attracts foreign investments; region’s trade balance improves on commodity exporters

Parts of ASEAN remain in healthier in relative terms. Commodity exporters such as Indonesia and Malaysia continue to enjoy significantly improved trade balances on the back of higher commodity and agricultural product prices. The region also continues to see meaningful foreign investments in its manufacturing sector thanks to the diversification of global supply chains. Reopening has kept consumer confidence elevated in some parts. We retain a positive view toward renewable energy companies, miners geared towards transport electrification and energy storage in addition to digitisation/financial inclusion beneficiaries.

Actively monitoring India for opportunities

India remains one of the best long-term structural opportunities in the Asia region, in our view. In the short term, however, persistently higher energy prices, a tightening of domestic and overseas monetary policies and liquidity positions will likely continue to dampen the still buoyant mood of domestic investors which pushed valuations across some parts to very rich levels. We have been aware of this dynamic for some time. We have, however, noted that drawdowns in several areas of the local market are well underway and foreign allocations reduced significantly over the last 12 months. We are actively monitoring a number of exciting new ideas in the country, but for the time being we continue to focus on larger capitalisation companies who will continue to gain market share and retain pricing power even under more challenging economic conditions.

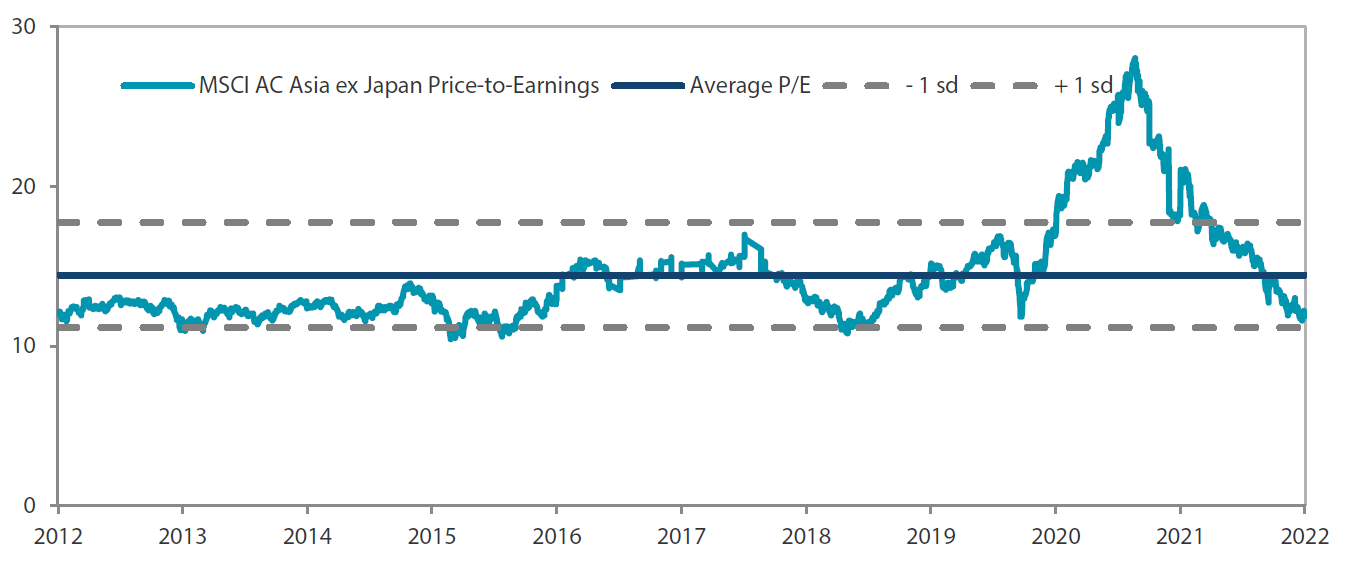

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 30 June 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

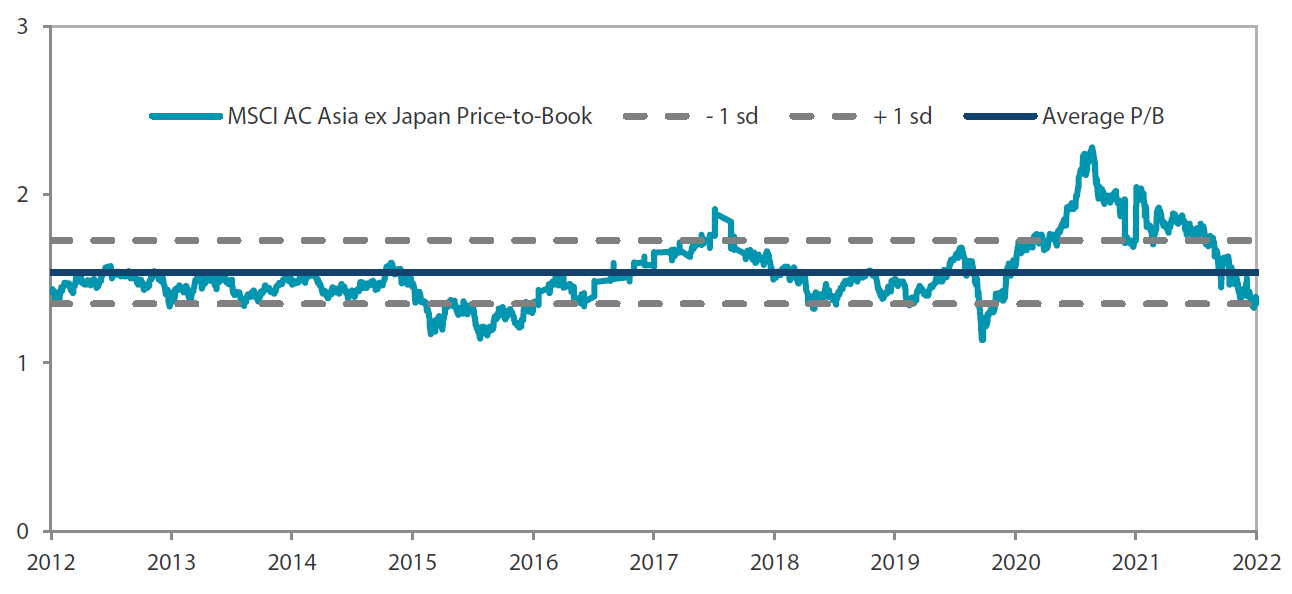

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 30 June 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.