Introduction

Following a tumultuous 2020 marked by the COVID-19 pandemic, global growth in 2021 is expected to improve on the back of positive vaccine developments and continued government measures. However, the pace of recovery is likely to be uneven among economies and fears of a resurgence of COVID-19 linger. It would be presumptuous to say that we are finally out of the woods.

But there is a silver lining: China has emerged from the pandemic stronger and more resilient. In this article we will outline our case on why China’s current macroeconomic backdrop of recovery presents a favourable opportunity to invest in China bonds—in particular China government bonds and China policy bank bonds. We will also discuss the attractiveness of these bonds.

Section 1: China’s macroeconomic backdrop of recovery is a sweet spot

China’s economic recovery strong, sequential momentum likely to moderate

China was the first country to bear the brunt of the COVID-19 pandemic but also among the first to recover. China was the only major economy to avoid a contraction in 2020, with its full-year GDP expanding 2.3%. The country’s recovery is expected to continue, although the pace of growth is likely slow on a quarter-on-quarter basis.

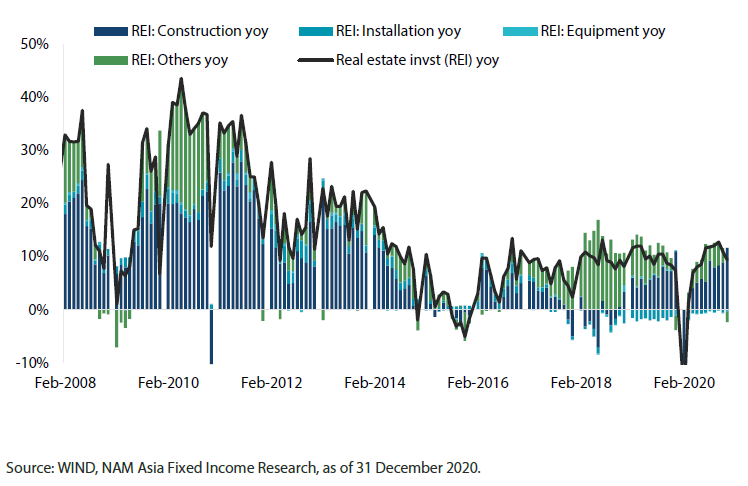

Real estate investment in China has returned to pre-COVID-19 levels (Chart 1) and we expect growth to moderate to between 8 to10 % year-on-year (YoY). Infrastructure investment has also rebounded from the lows marked during the pandemic, with the sector receiving continued moderate fiscal support from the government. More importantly, manufacturing investment is expected to remain strong, supported by healthy export growth. Credit continues to flow into the manufacturing sector. Travel restrictions during this year’s Lunar New Year prevented a portion of workers from returning home for the holidays and kept them in operation as a result. In a reflation year, manufacturing investment may peak in the first quarter of 2021 (off a low base in the first quarter of 2020), but we do not expect subsequent moderation to be too sharp.

Chart 1: Year-on-year (YoY) real estate investment growth

Gradual tightening could moderate recovery and provide support for bonds

China’s macroeconomic indicators have been largely positive but we remain cautiously optimistic on its economic recovery. We see risk from tightening measures as the People’s Bank of China (PBOC) continues to express concern over asset “bubbles”. However, compared to last year, tightening this year is expected to come in the form of tighter credit supply rather than higher interest rates, which is supportive of China government and policy bank bonds.

Last year, the PBOC was concerned with financial and interbank leverage and surprised markets by tightening interbank liquidity, which caused rates bonds (government bonds, local government bonds and policy bank bonds) and credit bonds to sell off. The PBOC was able to carry out this tightening without fear of overturning the cart, as growth momentum was only beginning to pick up at the time.

This year, the PBOC is expected to tighten credit supply. One risk is that weaker corporates might be unable to refinance themselves, resulting in defaults that could push up credit bond yields. Such a scenario would be negative for rates bonds too. But as with last year, this may provide good entry points into the relatively safer China government and policy bank bonds, should the PBOC step in to help soothe the market.

We do not expect the PBOC to tighten too fast or too soon, a scenario that would affect China government and policy bank bonds. The recently concluded annual parliament meeting reaffirmed that Beijing would not make sharp policy reversals. One may even argue that PBOC’s intervention would be unnecessary. Credit growth has already been slowing since November last year, suggesting that banks now have higher excess reserves, which can be channelled towards interbank liquidity and in turn support China government and policy bank bonds.

Lastly, the lag effect of tightening credit is expected to be around six months. The moderation in sequential growth in the interim, while not favourable for credit bonds which risk default, would be supportive for rates bonds as well.

Section 2: China policy banks

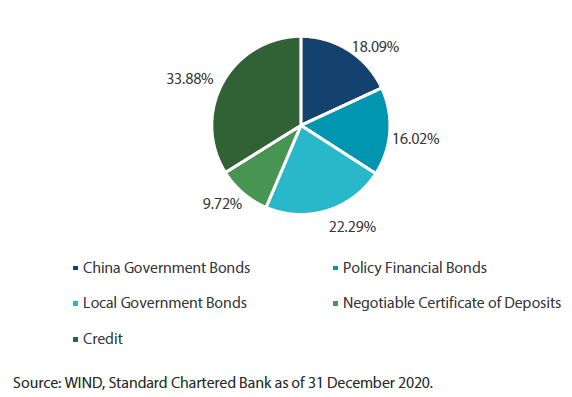

China’s three policy banks are the China Development Bank, the Agricultural Development Bank of China and the Export-Import Bank of China. The trio is distinct from China’s listed, state-owned commercial lenders. The policy banks help channel public sector funding and resources into important areas such as trade, infrastructure, and agriculture—in many instances to complement commercial lenders and private investors. The policy banks have a strong policy role set by the China State Council and enjoy implicit sovereign guarantee. They are assigned a “zero-risk weighting”; therefore, they are rated as high as government bonds and treated as such by onshore investors. Together with China government bonds, they form 34% of the onshore bond market (Chart 2).

Policy banks are a common feature in many major economies. The US, UK, Japan and India’s export-import banks focus on providing trade-related funding. Japan’s export-import bank is integrated within the Japan Bank for International Cooperation (JBIC), which funds areas ranging from international aid to the protection of the global environment. The China Development Bank and Agricultural Development Bank of China are equivalent to the US government’s International Development Finance Corporation (DFC) and India’s National Bank for Agriculture and Rural Development (NABARD).

Chart 2: Breakdown of the China onshore bond market by bond type

Section 3: “Free Lunch” from the yield pick-up on China policy bank bonds

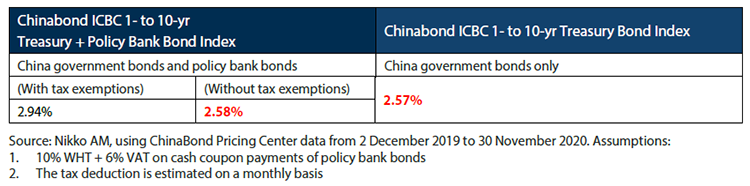

China policy bank bonds currently trade at a 30-50 basis points (bps) spread above China government bonds (Table A). This is despite a similar credit rating of A1/A+ by international credit rating agencies Moody’s, Fitch and S&P, and offers a “free lunch” for investors due to the yield pick-up.

The higher yield is often attributed to a withholding tax and value added tax applicable to certain onshore investors. However, for foreign investors, there is a 3-year tax exemption (7 November 2018 to 6 November 2021) on the cash coupon payments by policy bank bonds. The exemption is widely expected to be rolled over after 6 November 2021. Without tax exemptions, we estimate the 1-year return of the Chinabond ICBC 1- to 10-year treasury + policy bank bond index at 2.58%, which is almost the same as the yield on a pure treasury bond index. This is consistent with our understanding that onshore investors view China policy bank bonds on par with China government bonds and see little need for them to be rated.

Table A: Comparison of 1-year returns for the Chinabond ICBC 1- to 10-year Index with and without tax exemptions

Section 4: The total return perspective—yields, price, and currency

It is important to approach China government and policy bank bonds from a total return perspective.

Historically, China government and policy bank bond yields have ranged between 2 to 5%; we expect the yields to remain steady at around 3% or 4%. This presents an attractive carry compared to major economies such as the US, Germany, Australia and Japan, with the highest 10-year government bond yield among them barely reaching 2%.

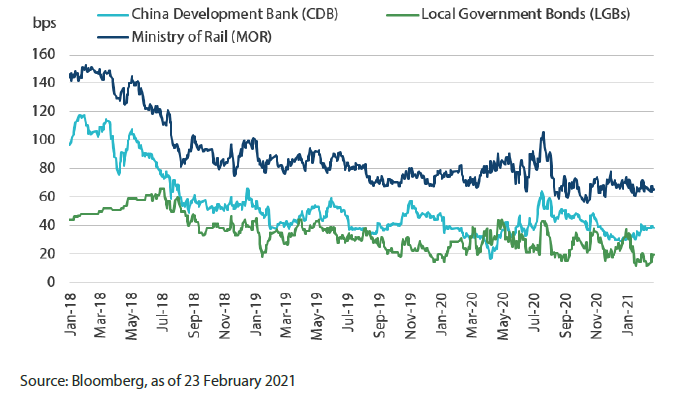

From a price perspective, onshore policy bank bond spreads have tightened and remained fairly stable between 30 to 60 bps over the past 3 years, constrained by Ministry of Rail bonds at the top and local government bonds (LGBs) at the bottom (Chart 3). Ministry of Rail bonds are issued by the China State Railway Group to support the country's railway construction. The group is viewed as a quasi-sovereign and the risk premium for its bonds have been declining steadily over the past decade. At the same time, policy bank bond spreads are unlikely to trade below those of LGBs. China banks would still favour LGBs as they are tax exempt, hoping that local governments would place deposits with them and thus provide a cheap source of funding. This is despite LGBs having almost no liquidity since they are often held by banks until maturity. Thus, China policy bank bonds offer good value, in our view, because they are held up by stable market technicals.

Chart 3: 5-year spreads relative to China government bonds

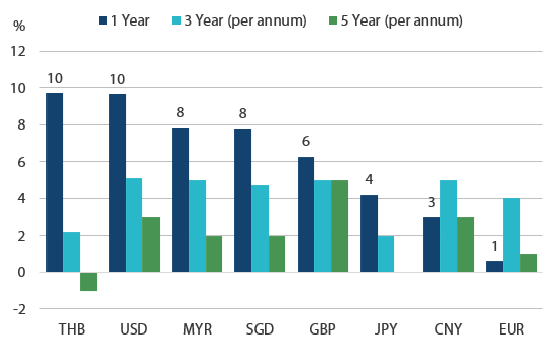

From a currency perspective, we expect the Renminbi’s (RMB) foreign exchange movements to add meaningful variability to the total return. The RMB saw exceptional strength in 2020—returning as much as 10% in Singapore dollar (SGD), Thai baht (THB) and Malaysian ringgit (MYR) terms. Admittedly, some of the RMB strength came from concerns over the US dollar (USD). That said, we observe that the returns from China bonds have been cyclical and tend to average out over time. This is evident in the annualised returns on China government and policy bank bonds across major and selected Asian currencies (Chart 4); compared to the higher annualised returns at 1-year, the 3-year and 5-year annualised returns are more moderate at under 2 to 5%.

RMB volatility is likely to persist as China’s exchange rate regime becomes more market oriented. However, the RMB will also become better regulated as policymakers discuss the possible adoption of a band and slope construct similar to Singapore’s SGD Nominal Effective Exchange Rate (SGD NEER).

Chart 4: Annualised index returns of ChinaBond ICBC 1-10 year treasury and policy bank bond index (%)

Note: Official Index returns are in CNY. WMR 4pm London fx rates are used for conversion to other currencies.

Source: Nikko Asset Management Asia, ChinaBond Pricing Center as of 31 December 2020. Performance of the index presented here is not exactly the same as that of the corresponding or related ETFs. Index performance does not factor in any management fee, transaction costs or fund expenses of an ETF. Past performance is not necessarily indicative of the future performance.

Conclusion

China has emerged from the pandemic stronger and more resilient. As the country enters into a measured tightening cycle, the China sovereign and policy bank bond market presents a quality investment opportunity for investors.