|

Inflation is on everyone’s mind. From central bankers to bakers, it is one of the biggest topics of discussion. The prices of many commodities are rising sharply. The reasons vary. Supply constraints, sharp rise in demand or bad weather—take your pick. Latin America sits at the nexus of many of the sources of inflation. Latin American countries are major global suppliers of staples such as coffee, sugar, soybeans and beef as well as materials like iron ore, copper and lithium—inputs for traditional industries and new net-zero carbon industries. The prices of all of these commodities are up sharply as current and expected demand have outstripped supply. China is a major trade partner to the Latin American countries and a large importer of many of these raw materials. |

China now imports 43% of global iron ore production to feed its mammoth steel industry |

|

China: Major importer of raw materialsIron ore is the main input for making steel. Brazil is the second largest iron ore producer in the world. In first place is Australia, which produces twice as much iron ore as Brazil. China is third, producing 40% less than Brazil. The iron ore market is an effective global oligopoly dominated by a handful of players consisting of Vale (Brazil), Rio Tinto, BHP and Fortescue (Australia) and Anglo American (South Africa). Vale has one of the largest mine outputs and the lowest cost of production. It is also aggressive on pricing, effectively making it the Saudi Arabia of the iron ore market. Vale’s biggest trading partner is China. Chinese steel production has kept growing and now accounts for more than half of global output. Yet it lacks enough iron ore, the raw material for steel. New iron ore supply comes mostly from Australia and Brazil, and iron ore production in both countries dwarf that of China’s. Australia produces 2.5 times more iron ore than China, and Brazil’s iron production exceeds China’s output by 40%. The result is that China now imports 43% of global iron ore production to feed its mammoth steel industry. China’s iron ore imports have doubled in the last 10 years. The drive to support the economy through infrastructure spending and lack of new supply have driven iron ore prices to all-time highs. Copper has a similar tale, but one that involves different Latin American countries. Replace Brazil with Chile and Peru and add socialist governments in both countries looking to raise revenue through potential rises in mineral extraction taxes. The volumes are similar, but copper has higher costs. China’s role stays the same as a big importer (40% plus of global production) and a small producer. Lithium—wash, rinse, repeat. Lithium is the new metal getting on this Latin America-to-China treadmill. It is the metal that will help us electrify our cars. It is the main ingredient for batteries used in everything from smartphones, laptops to electric vehicles. The production tables for lithium by country look like those for iron ore: Australia comes first, Chile second and China third. Future supply growth is to be found in Australia and Chile while China accounts for most of future demand growth. Two companies produce 30% of the global lithium supply, with one US-based and the other in Chile. China produces most of the world’s electric vehicle batteries and it comes as no surprise that lithium is in short supply. It’s like watching a replay of a movie you have seen many times before. |

||

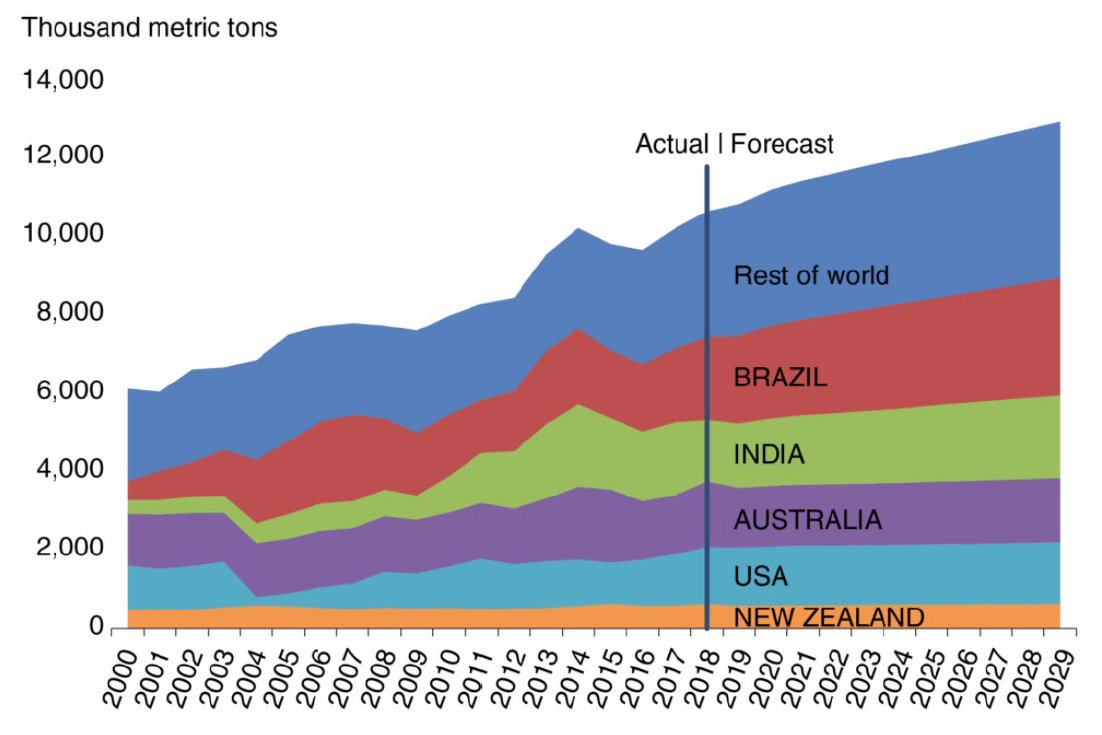

Climate change a consequence of food productionThe story is no different in raw materials for food inputs. Soybeans are a vegetable source of protein used in cooking and in animal feed. Brazil produces 37% of the world’s soybeans, making it the largest producer of the crop. The US is a close second. On the other hand, China accounts for 5% of global production and imports 60% of soybeans produced around the world. As for other food sources, beef is finding new and rising demand. Brazil produces 17% of global beef, with most of it exported. According to the US Department of Agriculture, Brazil’s beef exports are expected to outpace those of all other countries in the next 10 years. China imports just 3% of global beef, but Chinese appetite for beef is only at the early stages of growth. As the wealth of the Chinese increases and their tastes broaden, expect their beef imports to be much higher five years from now. Chart 1: Brazil projected to outpace other top beef exporting countries

The consequence of the growth in demand for beef is the unprecedented destruction of the Brazilian rainforest. |

||

|

A few facts on the rainforest: it is close in size to the US and is the biggest rainforest in the world. It is home to 3,000 species of fish, 40,000 types of plants and 2.5 million insect varieties. New species are being discovered every year. The Amazon rainforest is referred to as the lungs of the earth as it produces of over 20% of the world’s oxygen. Pastureland for beef is the largest source of legal and illegal destruction of the rainforest. As reported by the Guardian (14 July 2021), a recent study showed that for the first time the Amazon rainforest emitted more carbon dioxide than it could absorb. The continued loss of the rainforest will be a huge blow to the efforts to slow global warming and climate change. China’s growing appetite for protein-rich foods, pork and beef need to be satiated and Brazil again sits as the main supplier of the commodities. The effects of climate change are showing up on the supermarket shelves and your local coffee shop. Severe droughts in the western hemisphere have hit the coffee crop for this year and are expected to reduce output next year. The result is that raw coffee bean prices are up almost 60% year-to-date. We would be remiss not to mention politics. Brazil, Peru and Chile have all been making headlines. Brazil’s president Jair Bolsonaro has done a poor job of managing the pandemic, Peru just concluded a messy presidential election that resulted with a socialist in power and Chile is debating reforms to their mineral tax laws to increase taxes. The political volatility makes investment for new supply less certain. Government-supported Chinese companies have been investing in Latin America for years to secure supply. The initial wave of investments went unnoticed but as these countries wake up to their importance in the global supply chain, expect tougher negotiations and higher prices. |

The effects of climate change are showing up on the supermarket shelves and your local coffee shop. |

|

ConclusionInvestors had relegated Latin American countries to the back of the queue as these commodity-heavy emerging markets were expected to be replaced by the new digital and consumer growth engines of China, ASEAN and India. But the mineral and agricultural riches of Latin America, the stars of yesteryear, have become the key to tomorrow’s future. Latin American countries are well-placed as the key suppliers to the journey towards net-zero carbon and the growing appetites of Asia’s wealthier and consumption-hungry population of almost three billion. |

||

Source: USDA, Economic Research Service, Baseline Projections to 2028 data.

Source: USDA, Economic Research Service, Baseline Projections to 2028 data.