Global equity investment philosophy

Our philosophy is centred on the search for "Future Quality" in a company. Future Quality companies are those that we believe will attain and sustain high returns on investment. ESG considerations are integral to Future Quality investing as good companies make for good investments.

The four pillars we use to assess the Future Quality characteristics of an investment are:

Franchise—does the company have a sustainable competitive advantage?

Management—does the company make sound strategic and capital allocation decisions?

Balance Sheet—is growth appropriately financed?

Valuation—are the company’s prospects under-appreciated by the market?

We believe that investing in Future Quality companies will lead to outperformance over the full market cycle. Our strategy is based on fundamental, bottom-up research therefore sector and country allocations are a function of stock selection. The Global Equity strategy is a concentrated, high conviction portfolio with a high active share ratio.

Market outlook

Equity investors have continued re-emerging from the “caves” they were sheltering in at the end of March. A measure of confidence has been created by a sound that has become very familiar in recent years: the printing presses of Central Banks creating abundant liquidity. To some extent it seems these measures have succeeded—credit spreads continue to normalise and consumer and business confidence levels have ticked higher. As a result, we believe we’ve seen the worst of the short-term impacts of the coronavirus and the associated economic shutdowns. What is less clear, however, is how soon economic growth can return to normal.

With macroeconomics and geopolitics looking as confusing as ever, and the coronavirus continuing to add another layer of uncertainty, investors will be particularly keen to hear from company management teams. We suspect, however, that the upcoming management reports will not shed much light. Whilst Chinese economic data has continued to improve steadily, the jump in new cases as some US states eased their lockdowns has probably given some pause for thought.

To some extent, 2020 is already being treated as a lost year for corporate earnings. If the resurgence in cases means that some of the social distancing measures introduced to slow the spread drag into next year, then we are likely to see another round of earnings downgrades, particularly for services companies. With valuations having moved higher in recent months, helped by monetary policy, this could provide a challenge for further market gains in the second half of this year.

We do remain constructive on a medium-term view, particularly for companies that have managed to keep investing in innovation throughout recent, challenging times. Even amongst these companies, however, the need for careful selectivity remains. Whatever historical precedent you prefer—be the “nifty-fifty” of the early 1970s or the Tech Boom of the late 1990s—valuations are nearing levels that have warranted caution in the past. This is particularly true of the information technology sector, but the price paid for innovation is high across the market. We remain particularly watchful where these valuations are not supported by cash flow generation.

At some stage, we believe there will be a re-evaluation of some of today’s apparent truths. It remains unclear what this will be the nature of the (likely macroeconomic) shock that causes this reassessment, and how it will dictate market leadership at that point. The coronavirus looks as likely a source of this resolution as any in the near-term. If one of the hundred plus vaccines currently in clinical development are demonstrated to be effective as well as safe, and the new normal looks a lot like the old normal (just with a lot more liquidity in the system), then returning consumer spending and inflation could necessitate rising interest rates. This would likely nudge higher the historically low discount rates that support the frothiest parts of the market, favouring more cyclical companies.

If, on the other hand, these vaccines fail to confer a lasting immunity to the virus, and social distancing continues to severely handicap employment and growth, recent gains in equity markets could be reversed and defensive sectors could reassert their leadership.

Whichever of these two paths that we might eventually be forced to follow, we are confident that the core characteristics of “Future Quality” will be a useful guide.

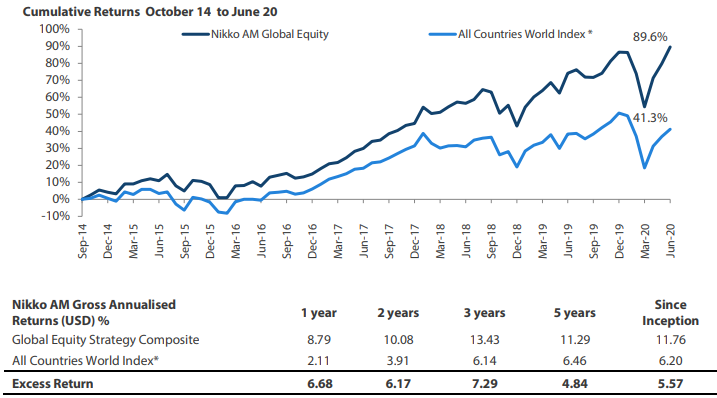

Global Equity Strategy Composite Performance to Q2 2020

*The benchmark for this composite is MSCI All Countries World Index. The benchmark was the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Source: MSCI. Returns are based on Nikko AM Global’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. The Firm claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS. Returns for periods in excess of 1 year are annualized. Returns are AUD based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Past performance does not guarantee future returns. Data as of 30 June 2020.

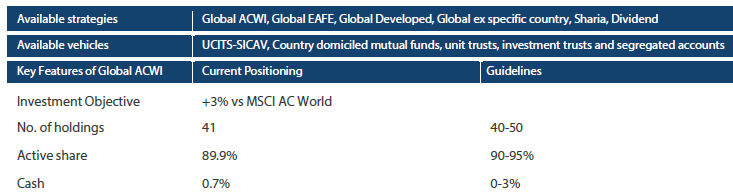

Nikko AM Global Equity: Capability profile and available funds (as at 30 June 2020)

Past performance is not indicative of future performance.

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

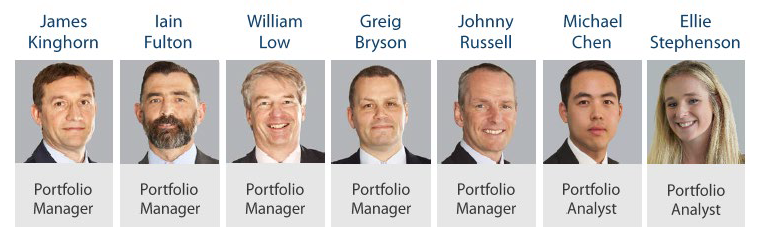

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 23 years’ industry experience and have worked together as a Global Equity team for eight years. Two portfolio analysts, Michael Chen (joined in February 2019) and Ellie Stephenson (joined in September 2019) are the first in a new generation of talent on the path to becoming portfolio managers. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of Future Quality companies will lead to outperformance over the long term. They define Future Quality as a business that can generate sustained growth in cash flow and improving returns on investment. They believe the rewards are greatest where these qualities are sustainable and the valuation is attractive. This concept underpins everything the team does.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 235.4 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 30 June 2020.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.