Summary

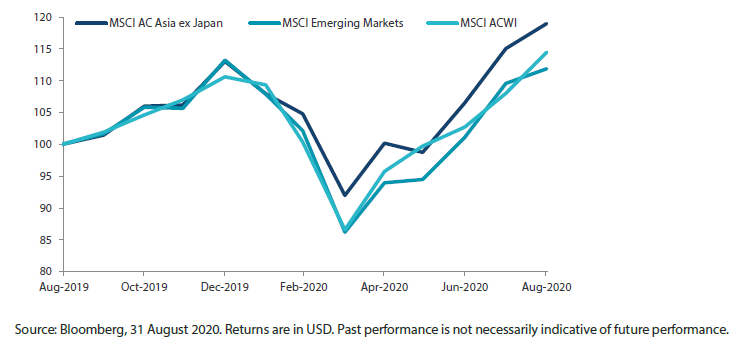

- Asian stocks posted gains for the third consecutive month, boosted by positive COVID-19 vaccine developments around the world, the persistently weak US dollar (USD) and resilient Chinese economic data. The MSCI AC Asia ex Japan Index gained 3.5% in US dollar (USD) terms over the month.

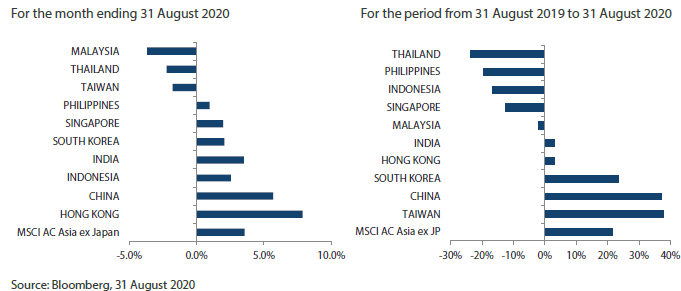

- Hong Kong and China were the best-performing markets, surging 7.9% and 5.7%, respectively, in USD terms in August after the US and China reaffirmed their commitment to the "Phase One" trade deal. Market sentiment was also supported by upbeat Chinese economic data and Beijing's latest reforms to bolster its capital markets.

- Conversely, Taiwanese stocks sank 1.8% in USD terms. Shares of its chip makers slumped on the back of fresh US sanctions against Chinese telecom giant Huawei. In the ASEAN region, stock markets saw mixed returns. Indonesia and Singapore were the best performing ASEAN markets, while Malaysia and Thailand lagged.

- We continue to find evidence that Asia has, in general, handled the COVID-19 pandemic relatively well, whilst using less fiscal and monetary support than Western developed and emerging markets. We think this paves the way for continued structural growth across Asia. We continue to favour structural beneficiaries including software, healthcare, financial inclusion, industrial automation and renewables, while being mindful of valuations.

Market review

Regional stocks surge, outpacing gains of global equities

Asian stocks continued their winning streak in August, turning in strong gains for the third consecutive month, boosted by positive COVID-19 vaccine developments around the world, the persistently weak US dollar (USD) and resilient Chinese economic data.

Shrugging off the escalating US-China tensions and the resurgence of COVID-19 cases in the region, the MSCI AC Asia ex Japan Index rose 3.5% in USD terms in August. Within the region, Hong Kong and China were the month's best performing markets (as measured by the MSCI indices in USD terms), while Malaysia, Thailand and Taiwan were the worst performers.

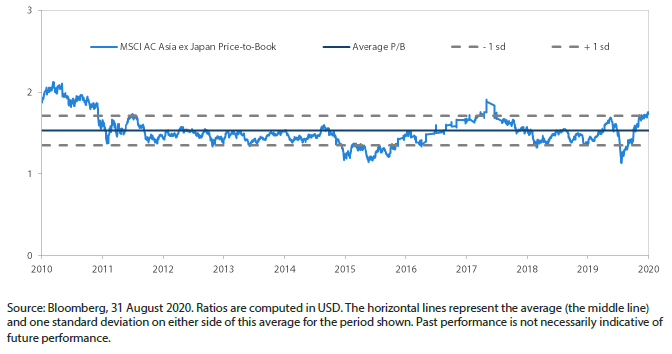

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Hong Kong and China outperform

In Hong Kong and China, stocks surged 7.9% and 5.7%, respectively, in USD terms for the month after the US and China reaffirmed their commitment to the "Phase One" trade deal. Market sentiment was also supported by Beijing's latest reforms to bolster its capital markets, with new reforms introduced by the Shenzhen Stock Exchange, and upbeat Chinese economic data, especially the Caixin China General Manufacturing Purchasing Managers Index, which rose to 53.1 in August from July's 52.8.

India and South Korea see positive returns; Taiwan dip

In India, notwithstanding the country's rising coronavirus cases, stocks still managed to climb 3.5% in USD terms in August, buoyed by better-than-expected 2Q20 corporate results. Although India reported dismal 2Q20 GDP numbers, which contracted 23.9% year-on-year (YoY), investors were optimistic that the worst was over, as there were incremental improvements in India's economic data.

In South Korea, despite a fresh outbreak of domestic COVID-19 cases, stocks turned in USD gains of 2.1% for the month, supported by the strong performance of technology, electric vehicle-related and biopharmaceutical stocks. Taiwanese stocks, on the other hand, sank 1.8% in USD terms for the month, weighed down by the slump in shares of Mediatek and other Taiwanese chip makers, all of which will no longer be able to supply chips (using US technology) to Huawei from mid-September due to fresh US sanctions against the Chinese telecom giant.

Mixed returns for ASEAN markets

In the ASEAN region, stock markets saw mixed returns in August. Indonesia (+2.5% in USD terms) and Singapore (+2.0%) were the best performing ASEAN markets; the Philippines eked out gains of 1.0%; while Malaysia (-3.5%) and Thailand (-2.2%) were the worst performers. During the month, Bank Indonesia announced additional macro measures to support the country's economic recovery, while the Singapore government announced an additional SGD 8 billion of fiscal support measures to preserve and create jobs. Elsewhere, Thailand experienced street protests against its government and the monarchy, with students and protesters calling for systemic democratic reforms.

Chart 3: MSCI AC Asia ex Japan Index1

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market Outlook

Investing in structural beneficiaries

We continue to find evidence that Asia has, in general, handled the COVID-19 pandemic relatively well, whilst using less fiscal and monetary support than Western developed and emerging markets. We think this paves the way for continued structural growth across Asia, which is also seeing ongoing reforms in key markets. External factors such as rising geopolitical tension ahead of US elections, the ultra-loose global liquidity environment and the prospect of vaccines are important drivers to monitor and have implications for both sector and stock selection going forward. In such an environment, we continue to favour structural beneficiaries including software, healthcare, financial inclusion, industrial automation and renewables, while being mindful of valuation.

Finding opportunities in software, automation, healthcare and insurance

China's continued commitment to quality over quantity was exemplified by its support measures in the wake of COVID-19, focusing on areas of strategic investment for the future. This is a big positive change versus the response post the Global Financial Crisis (GFC); so much so that concerns have shifted to when the local market liquidity may be withdrawn. US anti-China rhetoric and policy action, with a focus on the technology and digital sectors, will likely ratchet up as we approach the US presidential election. As tensions surrounding Hong Kong die down, we look for evidence of virus containment and a re-opening of the border with China. We remain focused on identifying stocks with mispriced sustainable returns and undergoing positive change. We currently find such opportunities in software, automation, healthcare and insurance.

Constructive on India’s long-term outlook, selective in ASEAN

India, the world's largest democracy, is likely to continue to grapple with COVID-19, with the seasonal boost from monsoons likely to be "watered down" this year. Still, we are seeing incremental improvement in a number of areas. Despite the short-term economic pain, we remain constructive on India's longer-term outlook premised on the benefits accruing from reforms instituted over the past two years and indeed during the pandemic-response period. We remain constructive on private banks, digital services, logistics and select consumer subsectors.

Similar to India, ASEAN markets have been hit hard by COVID-19 but are gradually recovering from the harsh disruption. Parts of the region, like Vietnam, have emerged from the crisis with a new found reputation for resilience and stability, which augur well for investments relating to the reconfiguration of global supply chains. There are, however, also countries where inadequacy of infrastructure implies a slow road to recovery, while highlighting the opportunities if they can address these shortcomings. The ever-changing political environment and a general lack of structural reforms also restrict our positioning in these markets currently.

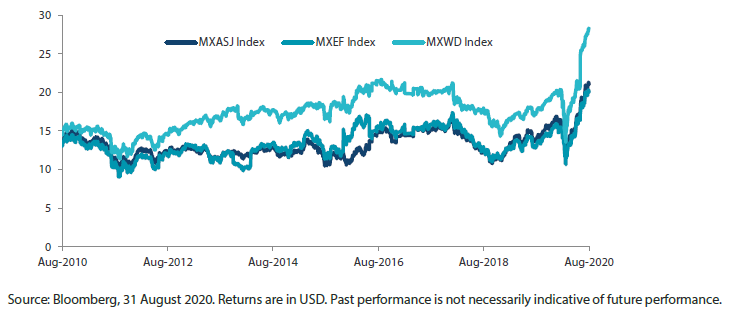

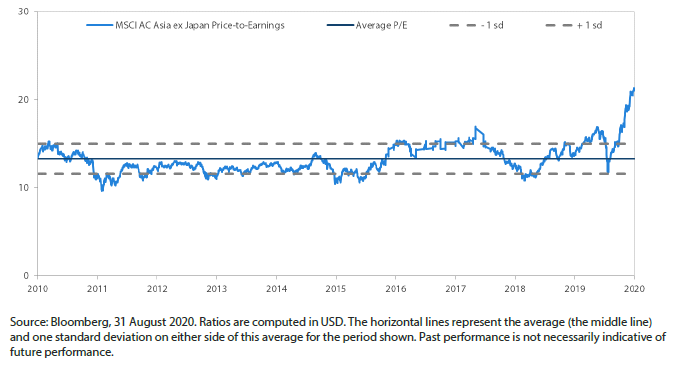

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Chart 5: MSCI AC Asia ex Japan price-to-book