This month we discuss the timing of Japan’s savings to investments push as assets held by households hit a record high; we also look at the rise in the domestic long-term yield to a 10-year peak and assess its potential impact on the equity and credit markets.

Japan seeking savings to investments push as household assets hit record high

According to recent Bank of Japan (BOJ) data, assets held by Japanese households increased 4.6% year-on-year at the end of June to hit a record Japanese yen (JPY) 2,115 trillion. This is a vast amount—approximately 14 trillion in dollar terms. Japan has been eager to tap into it by encouraging households to shift more from savings into investments under Prime Minister Fumio Kishida’s “doubling asset-based incomes plan”, which is part of a broader economic initiative to stimulate the country’s growth. The government may have good reason to do so as Japanese households are more conservative towards investments than their US and European peers. BOJ data showed that as of March-end 2023, Japanese households allocated 54.2% of their assets to currency and deposits, a much higher proportion relative to those of the US (13.7%) and the euro area (34.5%); as for equities, Japanese households allocated a modest 11% (US 39.8%, euro area 19.5%).

One may be forgiven for thinking that household assets reaching a record high is a sign that more households are finally warming towards investing. However, the biggest reason behind the record high is likely the simple fact that the stock market significantly gained year-on-year and gave equities held by households a boost. There are positive signs for the economy; Japan is slowly shaking off deflation with labour and goods shifting from a surplus to a shortage as the country continues to recover from pandemic-induced setbacks. That, however, may not be enough reason for households to begin investing more actively. What is needed for households to consider investing in assets that involve more risk are individual success stories pertaining to equities. Fortunately, there should be a number of successful investment stories as Japan’s Nikkei Stock Average has roughly quadrupled over the past decade, rising from around 8,000 to nearly 33,000. And such success stories are likely to have a favourable impression on the younger generation of individual investors who did not experience the bursting of Japan’s economic bubble in the early 1990s.

The key point, from an equity market perspective, is turning households’ interest towards investment into actual action. The scheduled 2024 renewal of Japan’s tax-free savings scheme, the Nippon Individual Savings Account (NISA), will take place at a good timing as it could serve the needs of households with a growing interest in equities. The tax-free features of current NISA plans were designed to expire after a number of years, but the new NISA will not have time limitations on tax benefits. While the timing of the NISA launch seems favourable, we do have to remember that households are likely to consider Japanese equities as just one of many options, with a significant amount of investment continuing to flow into foreign stocks. We also have to keep in mind that the cautious nature of Japanese households will not change overnight; interest may not lead to immediate action and it could take some time before they actually begin investing in domestic equities.

Assessing the impact of Japan’s long-term yield hitting 10-year highs

The benchmark 10-year Japanese government bond (JGB) yield has steadily risen throughout the year, climbing above 0.8% for the first time since 2013 early in October. The ongoing surge in US Treasury yields is of course a reason, but a more significant factor driving the rise in the benchmark JGB yield is domestic. The higher JGB yield, in significant part, reflects market expectations that the current rise in domestic wages will continue amid a persistent labour shortage. Actual data in the October-December period could be seen to back such expectations regarding wages and the JGB yield may continue rising steadily for the foreseeable future.

Financial media often portray higher yields as negative for equities, but what impact could the latest rise in the benchmark JGB yield to 10-year highs have on Japan’s stock market? In short, the nature of the current yield rise suggests the impact on equities could be neutral. As mentioned above, Japan is experiencing a labour shortage meaning that the economy is being exposed to inflationary pressures, with more firms raising wages to attract workers and also actively engaging in new capital expenditure. Under such conditions, earnings by firms could increase to a degree that more than offsets the negative effects of higher long-term yields. If the rise in wages eventually outpaces the inflation rate, as some indicators suggest, consumption will increase and further boost corporate sales. That said, higher rates and inflation are likely to inadvertently create market laggards as some firms will not be able to generate enough profit to keep up.

While not directly related to equities, higher JGB yields are expected to have a positive impact on the corporate bond market. By artificially capping the 10-year JGB yield under its yield curve control (YCC) scheme, the BOJ had previously created a kink in the yield curve and distorted pricing in the credit market, thereby hampering the ability of firms to raise funds through the issuance of bonds. The BOJ’s loosening of the YCC, which allows the 10-year yield to rise to 1.0%, enables corporate bonds to be issued at levels deemed more appropriate by the market. When yields were generally lower, issuers commonly sold debt with longer maturities than they actually desired (such as 10 years) so they could offer buyers enough returns. Some buyers, on the other hand, wanted debt with shorter maturities (such as 5 to 7 years) to curb duration risk but had to settle with 10-year debt. Such supply-demand mismatches will likely be alleviated if JGB yields continue rising and enable the issuance of bonds with higher returns and shorter maturities.

Market: Japan stocks mixed in September; weak yen, firm earnings lend support

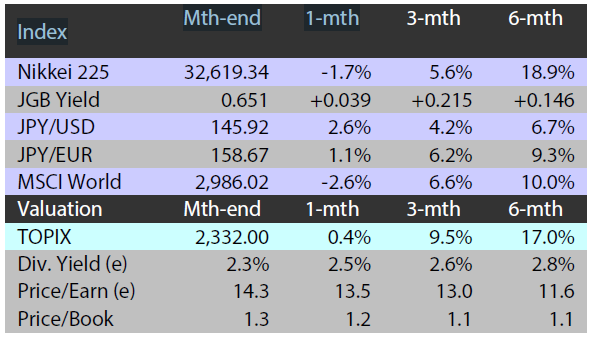

The Japanese equity market was mixed in September, dipping at times due to the rise in US long-term interest rates, but remained firm overall on the back of the weakening yen and strong corporate earnings. The TOPIX (w/dividends) rose 0.51% on-month and the Nikkei 225 (w/dividends) fell 1.65%. Shares were up in the first half of the month as additional rate hikes from the US Federal Reserve appeared less likely in the face of looser labour market conditions evidenced by an on-month increase in the unemployment rate in the latest US job report, in addition to receding concerns regarding the Chinese economy following the release of better-than-expected economic indicators. However, Japanese equities were weighed down in the latter half of the month on the view that US monetary tightening could be prolonged based on the policy rate outlook in the latest US Federal Open Market Committee (FOMC) meeting minutes.

Of the 33 Tokyo Stock Exchange sectors, 15 sectors rose, with Mining, Banks, and Oil & Coal Products posting the strongest gains. In contrast, 18 sectors declined, including Precision Instruments, Services, and Air Transportation.

Exhibit 1: Major indices

Source: Bloomberg, as at 29 September 2023

Source: Bloomberg, as at 29 September 2023

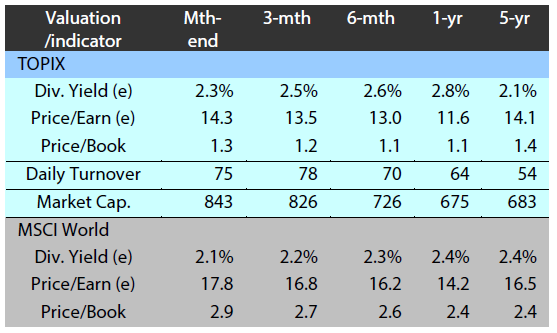

Exhibit 2: Valuation and indicators

Source: Bloomberg, as at 29 September 2023

Source: Bloomberg, as at 29 September 2023