Overall evaluation: BOJ’s communication efforts pay off

In March, the BOJ took a momentous step towards normalising its monetary policy by ending negative interest rates. It also scrapped its yield curve control and ETF-purchasing policies. Considering the significance of its decision, the BOJ’s move was met with relative calm and did not cause market volatility. For this the central bank can be credited for effectively communicating its intentions to the market well in advance of its decision. Led by Governor Kazuo Ueda, the BOJ repeatedly expressed its intent to wait for a sustained rise in wages—a key factor in Japan’s exit from a low inflation environment. The “shunto” negotiations, which are wage talks between unions and large companies held every spring, resulted in the most substantial wage hike in 33 years and likely gave the BOJ enough confidence to lift rates. The central bank was also helped by stronger-than-expected Q4 2023 capital expenditure data, which resulted in an upward revision of Japan’s Q4 GDP. By this time, the central bank’s data-dependent stance had been absorbed by the markets, and the robust capex data gave participants another reason to anticipate a change in policy. All in all, the BOJ’s decision to lift rates in March could be seen as a natural progression.

More hikes on the horizon, but nominal rates likely to be kept below inflation

The BOJ’s Ueda noted that the central bank will maintain accommodative monetary conditions for the time being. Ueda essentially meant that the central bank could hike again, but that it will keep interest rates below the inflation rate, retaining a condition known as real negative interest rates. The BOJ wants to see sustainable inflation before lifting its accommodative stance, and it could take another year, possibly two, before the central bank feels that such a condition has been met. Until then, it is expected to keep interest rates below Japan’s “neutral” rate of interest. The neutral rate, also referred to as “r*”, is an in-the-middle rate where monetary policy neither stimulates nor restricts economic growth. The neutral rate is not released officially and estimates vary widely, but the current consensus appears to be around 0.7% for Japan. It is worth bearing in mind that even if inflation stabilises at around 2%, the BOJ is unlikely to immediately raise interest rates to that level when the neutral rate is taken into consideration.

Yen expected to have a greater policy impact

The yen is expected to receive more attention from the BOJ than before. Ueda stated after the March policy decision that the central bank would respond with monetary policy should currency market fluctuations significantly impact inflation. Instead of appreciating, the currency has weakened since the March rate hike on the prospect of Japan’s interest rates remaining low compared to those of other countries for the foreseeable future. Gone are the days when a weak yen was generally welcomed. The currency’s depreciation is now often blamed for increasing living costs by making imports more expensive. Some even view this trend as a national security issue as Japan faces more challenges in purchasing staples such as grains due to a weaker yen. Lawmakers are also increasingly focusing on the demerits of a weaker yen. Traditionally, the central bank has not specifically targeted currency movements when conducting monetary policy. However, it is mandated with maintaining economic stability, and its efforts to tackle higher import costs could hasten its next rate hike.

BOJ’s ETF options: several possibilities, all likely to span over the long-term

The BOJ is estimated to have accumulated approximately 70 trillion Japanese yen worth of ETFs over the past 14 years as part of its unconventional monetary policy. The BOJ is believed to hold around 80% of Japan's ETFs and 7% of its equity market. Naturally, concerns have arisen about potential negative market effects if the central bank starts to divest these assets from its balance sheet.

The primary scenario envisages the BOJ gradually selling its ETFs, essentially reversing its previous approach. This would involve selling when stock prices are high to minimise market impact. While the sale of ETFs is sure to influence the market to some degree, it could be a decade or more before the BOJ begins selling its holdings. The BOJ's unconventional monetary policy phase, during which it made substantial purchases, can be credited for aiding the equity market's recovery. The central bank may wish to proclaim its ETF operations a success. However, if the BOJ were to start selling ETFs prematurely, it could be blamed for market downturns even if the cause lies elsewhere, thereby undermining its own success.

Market speculation is currently focused on how the BOJ might sell its ETFs. One method raised as a possibility is to break down ETFs into individual shares and sell them to interested buyers. However, this strategy could be logistically challenging and may expose the BOJ to unnecessary risk, making it an unrealistic option. Another envisaged solution is the transfer of ETFs to a government-established fund. This fund could then take several decades to sell the holdings, either as indexes or as individual shares. More unconventional suggestions include offering individual investors the opportunity to purchase the ETFs at a substantial discount. While the likelihood of these aforementioned methods being implemented seems rather slim, the final approach could potentially be a combination of various ideas. This would enable the BOJ to offload its ETFs over different time frames.

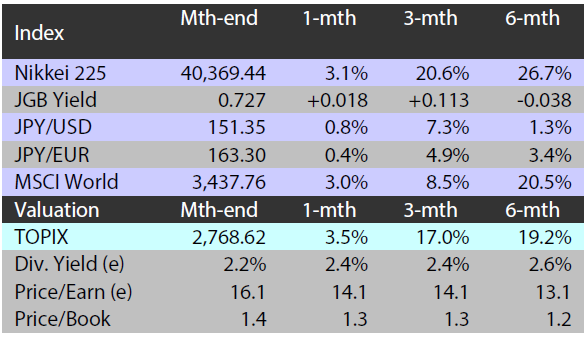

Japan equities gain in March as BOJ’s accommodative stance provides support

The Japanese equity market ended March higher with the TOPIX (w/dividends) up 4.44% on-month and the Nikkei 225 (w/dividends) rising 3.78%. In the first half of the month, stocks were weighed down by mounting expectations for the BOJ to scrap its negative interest rate policy. The BOJ did indeed eliminate its negative interest rate policy and end purchases of ETFs. However, the central bank indicated the continuation of the accommodative monetary environment for the time being and this supported equities.

Of the 33 Tokyo Stock Exchange sectors, 28 sectors rose, with Real Estate, Mining, and Oil & Coal Products posting the strongest gains. In contrast, 5 sectors declined, including Marine Transportation, Precision Instruments, and Pharmaceuticals.

Exhibit 1: Major indices

Source: Bloomberg, 29 March 2024

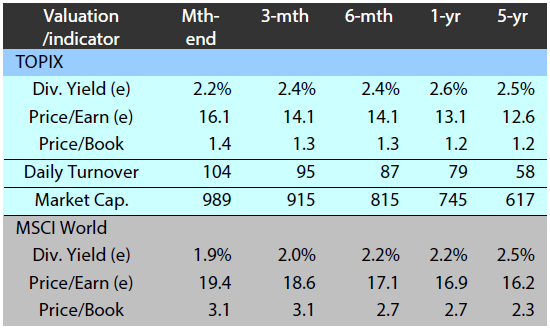

Exhibit 2: Valuation and indicators

Source: Bloomberg, 29 March 2024