Summary

- The sharp decline in US Treasury (UST) bond yields observed since mid-October reversed in January as investors adjusted their expectations of an early pivot by the US Federal Reserve (Fed), after the central bank pushed back on immediate rate cuts. At the end of January, the benchmark 2-year and 10-year UST yields settled at 4.21% and 3.91%, respectively, 4.2 basis points (bps) lower and 3.3 bps higher compared to end-December.

- We maintain our positive outlook for Asian local government bonds, expecting higher returns and lower volatility in 2024. The anticipated decrease in yields in developed bond markets, as major central banks, including the Fed, pivot towards rate cuts amid easing inflationary pressures, coupled with enhanced foreign inflows, is expected to bolster demand for Asian bonds.

- Asian credits achieved marginal positive returns in January, primarily driven by gains in Chinese property credits and strong returns in Indian high-yield (HY) credit. Asian investment-grade (IG) credit retreated 0.12% as spreads widened about 2 bps, while Asian HY credit gained 2.67% as spreads tightened about 64 bps.

- Technically, Asia credit is expected to remain well supported with subdued net new supply as issuers continue to access cheaper onshore funding. Although fund flows into emerging market hard currency funds have remained weak, demand remains robust from regional institutional investors looking to lock in attractive yields. Nevertheless, the materialisation of some negative risk factors such as a weaker-thanexpected global economy, local political uncertainties and geopolitical tensions may exert some widening pressure on Asia credit spreads, particularly the IG segment.

Asian rates and FX

Market review

UST yields rise on the longer end of the curve in January

The sharp decline by UST bond yields observed since mid-October reversed in January as investors adjusted their expectations of an early pivot by the Fed. Central bank statements pushing back on the timing of rate cuts, coupled with stronger-than-expected US economic data and concerns about supply chain disruptions from incidents in the Red Sea (which could potentially lead to higher commodity prices), were pivotal factors leading to upward pressure on yields. Subsequently, investors closely monitored guidance from major central banks. The Bank of Japan (BOJ) retained its easing bias even as Governor Kazuo Ueda suggested that an end to negative interest rates was nearing. The European Central Bank (ECB) maintained its current stance while providing a neutral, data-dependent outlook for future actions. At the close of the month, the Fed held rates steady but signalled that a rate cut was not on the immediate horizon. At end-January, the benchmark 2-year and 10-year UST yields settled at 4.21% and 3.91%, respectively, 4.2 bps lower and 3.3 bps higher compared to end-December.

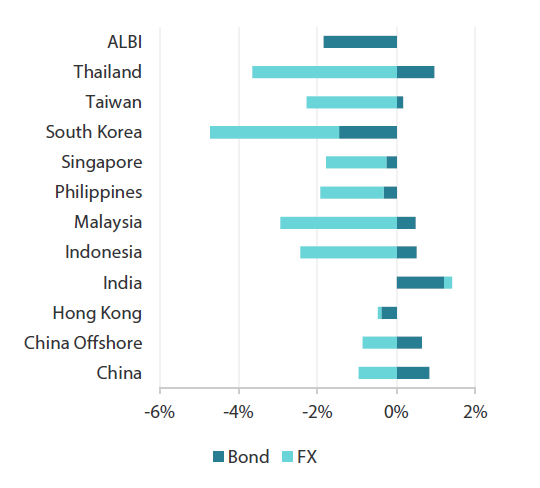

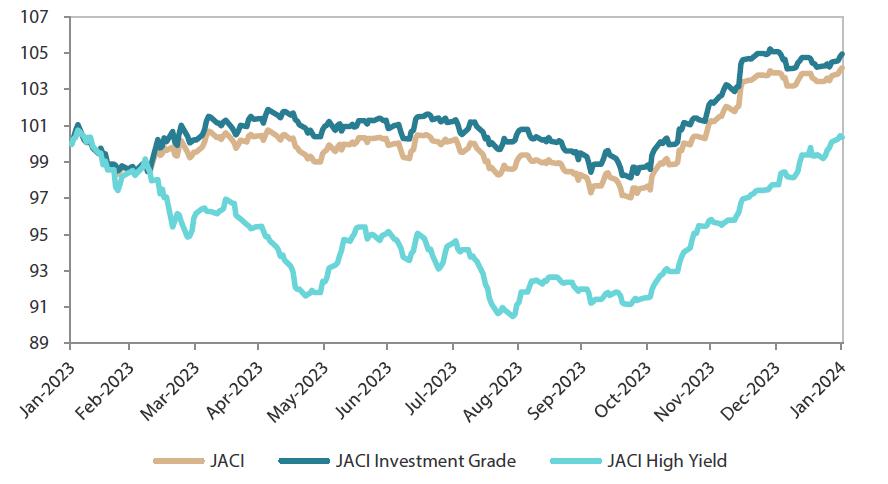

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

|

For the month ending 31 January 2024

|

For the year ending 31 January 2024

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 January 2024

Central banks in South Korea, Malaysia and Indonesia leave policy rates unchanged

The Bank of Korea (BOK) kept its policy rate unchanged at 3.5%, with Governor Rhee Chang-yong emphasising the intent to uphold restrictive policy for an extended period. Bank Negara Malaysia (BNM) maintained its overnight policy rate at 3.0%, stressing that the current monetary policy stance continues to support the economy. BNM is optimistic about potential economic improvement in 2024, driven by factors including an export rebound, resilient domestic expenditure, sustained employment and wage growth, and increased tourism spending. Malaysia’s headline inflation is expected to stay modest throughout 2024. In Indonesia, the central bank kept its benchmark rate at 6.0%, projecting 2024 growth within the range of 4.7–5.5%. Bank Indonesia (BI) targets inflation at a range of 1.5–3.5% in 2024. BI Governor Perry Warjiyo expects the rupiah to remain stable and potentially strengthen, supported by factors such as easing global uncertainty, a downward trend in developed countries’ bond yields and a likely depreciation of the US dollar. In Singapore, the Monetary Authority of Singapore (MAS) retained the prevailing rate of appreciation for the Singapore Dollar Nominal Effective Exchange Rate (SGDNEER) policy band in its first decision following the transition to a quarterly schedule. MAS expects the economy to strengthen in 2024, characterised by more broad-based growth. While MAS’s 2024 core inflation projection remains at 2.5–3.5%, the full-year headline inflation forecast was revised down to the same range, due to larger Certificate of Entitlement (a quota licence for vehicle ownership in Singapore) premiums compared to the previous year.

December headline CPI prints mostly moderate

In Thailand, the headline consumer price index (CPI) dropped by 0.83% year-on-year (YoY) in December, marking the eighth consecutive month below the central bank’s target and the third consecutive month of decline. Core CPI remained unchanged at 0.58%, maintaining November’s levels. In Indonesia, the headline inflation rate decreased to 2.61% YoY in December from 2.86% in November, falling within the central bank’s 2023 inflation target of 2–4%. The moderation was partly attributed to lower food and utilities inflation. Core inflation also decelerated, dropping to 1.80% YoY from 1.87% in November. Inflation also eased in the Philippines, primarily due to slower increases in utility expenses and essential food prices. Malaysia’s headline CPI remained stable at 1.5% YoY in December, unchanged from November. Singapore’s headline CPI increased to 3.7% in December, reflecting a faster rise in transport costs and a pickup in core inflation. The annual inflation rate in India edged up to 5.69% in December from 5.55% in November.

Countries register decent growth in the fourth quarter of 2023

China’s economy expanded by 5.2% in the fourth quarter; it also grew by 5.2% for the full year in 2023. However, concerns about growth momentum persisted as December’s activity data showed mixed results. In Singapore, advance estimates showed that the economy expanded 2.8% YoY in the fourth quarter of 2023, surpassing the downwardly revised growth of 1.0% recorded in the July to September period. For the whole of 2023, the economy grew by 1.2%, marking a slower pace compared to the growth of 3.6% experienced in 2022. Preliminary estimates showed that Malaysia’s economy grew by 3.4% YoY in the fourth quarter of 2023, with full-year growth reaching 3.8%, slightly below the central bank’s initial projection of 4%. In the Philippines, fourth quarter economic growth decelerated to 5.6% YoY from an upwardly revised growth of 6.0% marked in the July to September period. Full-year growth for 2023 also registered at 5.6%, falling short of the government’s target range of 6.0–7.0%; this also represented a deceleration from the 7.6% rise recorded in 2022.

Chinese policymakers move to bolster economy anew

Chinese policymakers addressed the decline in the domestic stock market and supported the overall economy. To stimulate bank lending to households and businesses, the People’s Bank of China (PBOC) lowered the reserve requirement ratio for most banks by 50 bps, effective 5 February. Additionally, the National Financial Regulatory Administration announced a policy change allowing commercial banks to extend new loans to developers, using their commercial property assets as collateral, not just for operational necessities but also for repaying loans and maturing bonds.

Market outlook

Positive on India, Indonesia and Philippine bonds

We maintain our positive outlook for Asian local government bonds, expecting higher returns and lower volatility in 2024. The anticipated decrease in yields in developed bond markets, as major central banks, including the Fed, pivot towards rate cuts amid easing inflationary pressures, coupled with enhanced foreign inflows, is expected to bolster demand for Asian bonds.

We anticipate the disinflation trend in India, Indonesia and the Philippines to persist. In our view, this should provide the Reserve Bank of India, BI and Bangko Sentral ng Pilipinas with the flexibility to shift towards rate cuts later in the year. We see the backdrop of a slow but steady easing of monetary policy, coupled with reasonable growth, supporting India, Indonesia and Philippine local currency bonds. Additionally, the attractive real yields of these bonds relative to their regional peers could further support demand.

Asian credits

Market review

Asian credit spreads tighten in January

Asian credits achieved marginal positive returns in January, primarily driven by gains in Chinese property credits and strong returns in Indian HY credit. Credit spreads tightened about 6 bps, while UST yields moved slightly higher. Asian IG credit retreated 0.12% as spreads widened about 2 bps, while Asian HY credit gained 2.67% as spreads tightened about 64 bps.

Following strong gains since November, Asian credits remained relatively stable in the first month of 2024 as investors adjusted their expectations of an early pivot by the Fed. However, Chinese policymakers’ resolve to address the decline in the domestic stock market and support the overall economy led to a rally in Chinese credits, particularly in the real estate sector. To stimulate bank lending to households and businesses, PBOC announced that reserve ratio requirements for banks will be cut by 50 bps from 5 February. Additionally, the National Financial Regulatory Administration announced a policy change allowing commercial banks to extend new loans to developers, using their commercial property assets as collateral, not just for operational necessities but also for repaying loans and maturing bonds. Meanwhile, GDP growth in China expanded 5.2% in the fourth quarter and for the whole of 2023, although concerns about growth momentum persisted due to mixed activity data in December. In the rest of Asia, countries reported decent growths in the last quarter of 2023. Overall, spreads of all major country segments—save for Indonesia, Malaysia and the Philippines—tightened. Taiwan’s closely-watched election turned out to be a non-event, where the ruling Democratic Progressive Party secured a third presidential term with no major changes expected in its economic policies. Taiwan credits were little affected by the election, and in fact, benefited more from the positive narrative around the semiconductor cycle upturn. Indonesia’s sovereign spreads widened slightly, as the government launched a new US dollar multi-tranche bond issue, and as concerns grew around potential resignations in President Joko Widodo’s government.

The steep decline in UST bond yields observed since mid-October reversed in January. Central bank statements pushing back on the timing of rate cuts and stronger-than-expected US economic data were pivotal factors causing upward pressure on yields. In addition, attacks in the Red Sea have caused significant supply chain disruptions and higher shipping costs, fuelling concerns of a new inflationary surge. Subsequently, investors closely monitored guidance from major central banks. The BOJ retained its easing bias even as Governor Ueda suggested that an end to negative interest rates was nearing. The ECB maintained its current stance while providing a neutral, data-dependent outlook for future actions. At the close of the month, the Fed held rates steady but hinted that a rate cut was not imminent.

Primary market activity picks up in January

There was a significant pick-up in primary market activity at the start of 2024, with issuers raising USD 20.19 billion from 39 issues. The IG space saw 33 new issues amounting to USD 18.80 billion, with quasi-financials and quasi-corporate entities in China and South Korea dominating, along with a USD 2.05 billion sovereign issue from Indonesia. Meanwhile, activity within the HY space continued to be muted, with just six new issues amounting to USD 1.39 billion.

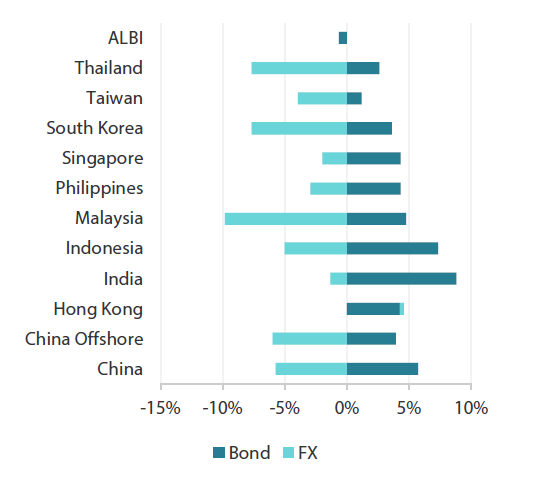

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 January 2023

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 January 2024.

Market outlook

Supportive Asia credit fundamentals and strong technicals, but tight valuation calls for cautious positioning

The fundamentals backdrop for Asian credit remains supportive. In China, the recent step-up in fiscal measures suggests that policymakers are aware of the challenging environment. This further supports expectations for Chinese policymakers to deliver additional measures to help revive confidence in the economy and broaden out the recovery in 2024. Meanwhile, macro and corporate credit fundamentals across Asia ex-China are expected to stay resilient with a recovery in exports growth potentially offsetting softer domestic conditions. While non-financial corporates may experience a slight weakening in leverage and interest coverage ratios stemming from lower earnings growth and incrementally higher funding costs, we believe there is adequate ratings buffer for most, especially the IG corporates. Asian banking systems remain robust, with a stable deposit base, robust capitalisation and strong pre-provision profitability providing buffers against moderately higher credit costs ahead.

Technically, Asia credit is expected to remain well supported with subdued net new supply as issuers continue to access cheaper onshore funding. Although fund flows into emerging market hard currency funds have remained weak, demand remains robust from regional institutional investors looking to lock in attractive yields. Nevertheless, following the sharp rally in recent months, these positive factors have been largely priced in, and the materialisation of some negative risk factors such as a weaker-than-expected global economy, as well as local political uncertainties and geopolitical tensions, may exert some widening pressure Asia credit spreads, particularly the IG segment.