Summary

- The US Treasury (UST) yield curve steepened in September as yields continued rising. Persistent inflation concerns amid rising oil prices, together with a prolonged period of high interest rates, were the primary drivers of UST weakness. At the end of September, the 2-year and 10-year yields settled at 5.05% and 4.57%, respectively, 18.1 basis points (bps) and 46.3 bps higher compared to end-August.

- Amid the current rise in oil prices, global central banks have become more vigilant against inflation, becoming increasingly wary of risks occasioned by a potentially premature end to their rate hiking cycles. Consequently, we deem it prudent to be more cautious on duration. We therefore have a largely neutral view on duration for most countries in the region. As for currencies, we prefer the Chinese renminbi and Philippine peso, while we are cautious on the South Korean won and Thai baht.

- Asian credits retreated 0.96% in September, despite credit spreads tightening by about 11 bps as UST yields rose. Asian high-grade (HG) credit lost 1.24%, while Asian high-yield (HY) credit gained 0.79%.

- We expect macro and corporate credit fundamentals across Asia ex-China to stay resilient, although slower economic growth appears to loom over the horizon. Asian banking systems remain strong, with their stable deposit base, robust capitalisation and strong pre-provision profitability providing buffers against moderately higher credit costs ahead. However, given the slightly weaker macroeconomic backdrop and uncertainties ahead, coupled with geopolitical tensions and the US Federal Reserve’s (Fed) policy path, in our view the valuation of Asia HG credit looks slightly stretched compared to both historical levels and developed market spreads.

Asian rates and FX

Market review

USTs weaken in September

The UST yield curve steepened in September as yields continued rising. Persistent inflation concerns amid rising oil prices, together with a prolonged period of high interest rates, were the primary drivers of UST weakness. In early September, Russia and Saudi Arabia announced they were extending voluntary oil supply cuts to the end of the year. In addition to triggering a jump in global oil prices, worries about the impact tighter oil supply could have on inflation and economic policies of major countries also weighed on overall risk sentiment and pushed UST yields higher. Mid-month, the Fed left its benchmark Federal Funds Rate steady at a target range of 5.25–5.50% but sent a hawkish signal through the dot plot. The accompanying Summary of Economic Projections (SEP) revealed concerns among Fed officials that firmer economic activity and rising oil prices could derail recent progress on inflation; hence, a majority of officials continue to expect another hike this year and have pencilled in fewer rate cuts for 2024 and 2025 than they did in the June 2023 SEP. That said, Fed Chair Jerome Powell offered a less hawkish outlook during the press conference following the decision, reiterating that the central bank will proceed “carefully” in any further move. At the end of September, the benchmark 2-year and 10-year yields settled at 5.05% and 4.57%, respectively, 18.1 bps and 46.3 bps higher compared to end-August.

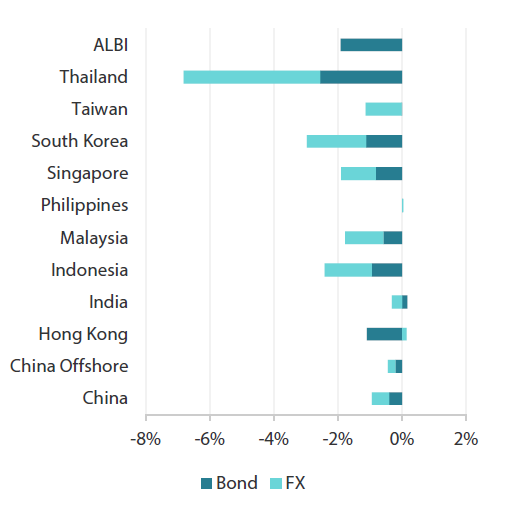

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 30 September 2023 | For the year ending 30 September 2023 | |

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 September 2023.

Bank of Thailand raises rates; other central banks leave policy rates unchanged

The Bank of Thailand (BOT) tightened its monetary policy further in September, raising its one-day repurchase rate by 25 bps to 2.50%, declaring that the policy rate is now at a neutral level. That said, the central bank will be monitoring upside risks to growth and inflation from government economic policies, taking this into consideration when deliberating policy going forward. The BOT substantially lowered its 2023 GDP growth and headline inflation forecasts to 2.8% (from 3.6%) and 1.6% (from 2.5%), respectively, citing slower external demand as one of the factors contributing to the softer growth forecast. In contrast, it raised the GDP growth outlook for 2024 significantly higher—to 4.4% from 3.8%—seeing growth driven by “domestic demand, underpinned by a steady tourism recovery and a turnaround in merchandise exports, with additional support from government policies”. Meanwhile, Bank Indonesia stood pat, keeping the benchmark seven-day reverse repo rate at 5.75%, reiterating that it remains focused on “strengthening rupiah stability to anticipate the contagion effect of global financial market uncertainty”. Bangko Sentral ng Pilipinas (BSP) maintained its current policy stance despite the recent rise in inflation, with BSP Governor Eli Remolona Jr. declaring that a rate hike was “on the table in November”, although the final decision would depend on available data. Elsewhere, Bank Negara Malaysia left its overnight policy rate unchanged at 3%. According to the central bank, the risks of weaker-than-expected external demand could affect the country’s growth prospects. Nonetheless, higher tourism activity, a recovery in the electrical and electronics goods sector together with faster implementation of existing and new projects could provide an offset.

Headline consumer price index (CPI) prints mostly accelerate in August

Consumer prices in Thailand rose by the highest pace in four months in August, owing largely to increasing energy prices. The headline print climbed 0.88% year-on-year (YoY) in August, quickening from the 0.38% increase in July. However, underlying inflation, as measured by core inflation, actually eased over the same period. Similarly, overall inflation in Indonesia accelerated to 3.27% YoY in August from 3.08% in July. However, excluding prices of food and energy, core inflation decelerated to 2.18% from 2.43%. In the Philippines, an uptick in food and transport costs led inflation to unexpectedly quicken for the first time in seven months. The headline CPI rose 5.3% YoY in August from July’s 4.7% while the rise in core inflation eased to 6.1% from 6.7% over the same period. Meanwhile, inflation returned to China in August. Consumer prices rose 0.1% YoY in the month, after falling 0.3% in July, driven largely by firmer prices of services as well as a low base. In contrast, overall and core inflation in Singapore both inched lower in August. Overall inflation eased to 4.0% YoY from 4.1%, reflecting a drop in accommodation inflation, along with a lower core inflation, which more than offset the rise in private transport inflation.

PBOC lowers banks’ RRR; Chinese data suggests some stabilisation in the economy

During the month, the People’s Bank of China (PBOC) announced a 25-bps reduction in banks’ reserve requirement ratio (RRR). The cut, which only applies to banks with reserve ratios above 5%, took effect on 15 September. Separately, Chinese high-frequency activity data in August proved to be relatively benign following months of disappointments. Although the overall improvement was modest, it suggested that the economy was showing signs of stabilising. China’s industrial production and retail sales improved, while fixed asset and property investments remained weak despite Beijing’s efforts to rekindle growth. Meanwhile, the overall urban unemployment rate edged down, and the September official manufacturing purchasing managers index bounced back into expansion territory for the first time in six months. Meanwhile, credit growth picked up in August. Banks issued Chinese yuan (CNY) 1.36 trillion of new loans in August, up from CNY 346 billion in July. The rise in corporate loans—albeit mainly from short-term bills—was the major contributor to the increase. Aggregate financing, which includes both bank and non-bank credit, was also sharply higher in August at CNY 3.12 trillion, up from CNY 536 billion in July.

India government bonds added to JP Morgan’s Bond Index

Towards month-end, international index manager JP Morgan announced the inclusion of India government bonds in the widely tracked Global Bond Index—Emerging Markets (GBI-EM) family of indices. According to JP Morgan, the bonds will be included in the indices over a period of 10 months starting from June 2024, with 1% weigh being added per month.

Market outlook

Moving to a neutral duration stance; prefer Indian bonds

UST yields are being lifted by rising oil prices and increasing expectations that interest rates will remain elevated for longer than previously anticipated. Amid rising oil prices, global central banks have become more vigilant against inflation, becoming increasingly wary of risks occasioned by a potentially premature end to their rate hiking cycles. Consequently, we deem it prudent to be more cautious on duration at this point. We therefore have a largely neutral view on duration for most countries in the region.

India government bonds will be officially included in JP Morgan’s GBI-EM Index and will be the second biggest Emerging Market country in the index by April 2025. This should provide solid support for India government bonds vis-à-vis regional peers over the short and medium term as foreign interest in the market increases. In contrast, Thai government bonds are likely to succumb to further selling pressure on concerns around the size of the new government’s spending.

Chinese renminbi and Philippine peso preferred

The higher-for-longer US rates narrative has prompted another round of broad-based US dollar strength. Within the region, we prefer the Chinese renminbi and Philippine peso, and we are cautious on the South Korean won and Thai baht. Support from the PBOC should be positive for the renminbi, while demand for the peso in the coming months could be underpinned by a seasonal boost. Meanwhile, we expect higher oil prices to be most negative for the current account balances of South Korea and Thailand, negatively affecting demand for their currencies.

Asian credits

Market review

Asian credits retreat in September

Asian credits retreated 0.96% in September, despite credit spreads tightening by about 11 bps as UST yields rose. Asian HG credit underperformed its HY counterpart, returning -1.24% despite spreads narrowing by about 4 bps. In contrast, Asian HY credit gained 0.79%, with spreads tightening 72 bps, owing largely to a rebound in Chinese property credits.

Asian credit spreads stayed largely range-bound in September. Hopes that Chinese policymakers would implement more growth-stabilisation policies prompted an initial tightening in credit spreads. That said, the marked rebound in Chinese HY property credits was driven mainly by positive idiosyncratic headlines within the sector. Mid-month, the PBOC announced a 25-bps reduction in banks’ reserve requirement. Meanwhile, Chinese high-frequency activity data improved slightly, and the country’s credit growth showed some recovery—particularly in new loan creation. Although the overall improvement was underwhelming for the most part, the suggestion that some green shoots of recovery may be evident supported the positive risk tone. However, this was partly offset by concerns around persistent inflation as oil prices surged. Thereafter, Asian credit spreads moved steadily higher as market focus stayed principally on weakness in US rates after the Fed left its benchmark Federal Funds Rate steady at a target range of 5.25–5.50% but sent a hawkish signal through the dot plot. Overall, spreads of all major country segments—save for South Korea, Indonesia and the Philippines—tightened. Notably, higher UST yields weighed heavily on Indonesia sovereign and quasi-sovereign, given their long durations. In contrast, Indian credits were buoyed by JP Morgan’s announcement that India government bonds will now be included in its widely tracked GBI-EM family of indices.

Over the month, UST yields were lifted by rising oil prices and increasing expectations that interest rates will remain elevated for longer than previously anticipated. In early September, Russia and Saudi Arabia announced they were extending voluntary oil supply cuts to the end of the year. In addition to causing a jump in global oil prices, worries about the impact tighter oil supply could have on inflation and economic policies of major countries weighed on overall risk sentiment and pushed UST yields higher. Subsequently, although the Fed stood pat and left its policy rates unchanged, the accompanying SEP revealed concern among its officials that firmer economic activity and rising oil prices could derail recent progress on inflation. Hence, a majority of officials continue to expect another hike this year and have pencilled in fewer rate cuts for 2024 and 2025 than they did in the June 2023 SEP. This higher-for-longer rates narrative sparked another move higher in US rates and broad-based US dollar strength. At the end of September, the benchmark 10-year yield settled at 4.57%, 46.3 bps higher compared to end-August.

Primary market sees some pick-up in activity in September

Calmer investor sentiment, particularly in the first half of the month, prompted a pick-up in primary market activity, with USD 10.42 billion being raised in September. The HG space saw 16 new issues amounting to USD 9.35 billion, including the USD 1.0 billion two-tranche issue from LG Energy Solution and USD 2.0 billion three-tranche issue from Export-Import Bank Korea. Meanwhile, the HY space had eight new issues amounting to USD 1.07 billion.

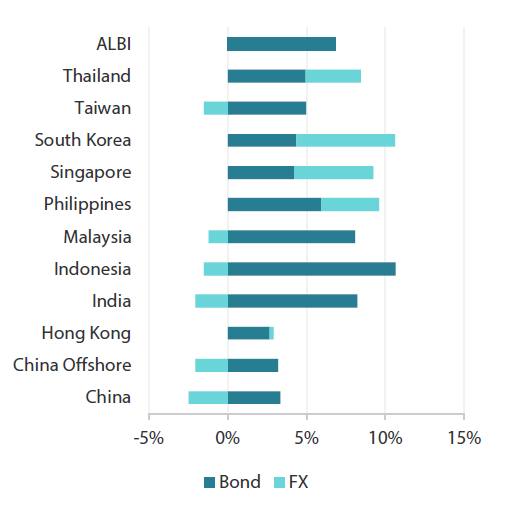

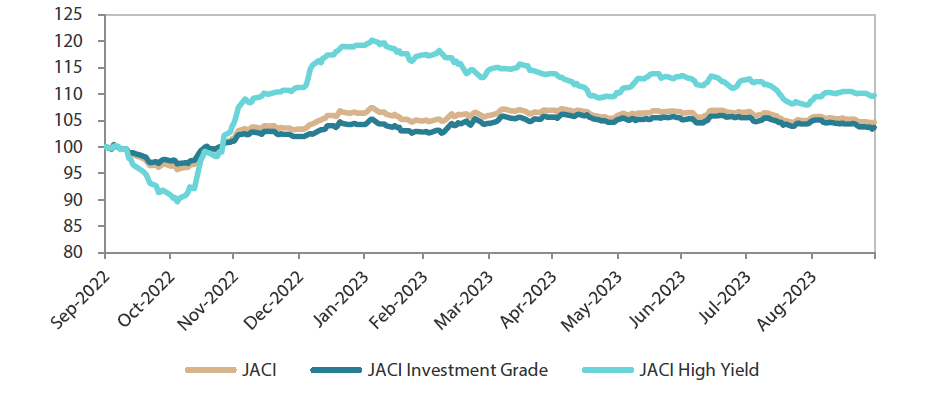

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 September 2022

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 September 2023.

Market outlook

Valuations remain stretched with Asia macro and corporate credit fundamentals offering a buffer

The recent step-up in Chinese property easing measures could stabilise near-term sentiments as the nationwide policy measures mark a positive step in the right direction. However, we expect policymakers to roll out more aggressive measures, as concerns on contracting exports, geopolitical tensions and weak confidence in the private sector may continue to weigh on the economy and the sentiment of potential home buyers. Meanwhile, macro and corporate credit fundamentals across Asia ex-China are expected to stay resilient despite slower economic growth in the second half of 2023 and the first half of 2024 as the effects of past monetary policy tightening begin to weigh and pent-up demand for services fade. While non-financial corporates may experience a slight weakening in leverage and interest coverage ratios stemming from lower earnings growth and incrementally higher funding costs, we believe there is adequate ratings buffer for most, especially the HG corporates. Asian banking systems remain strong, with a stable deposit base, robust capitalisation and strong pre-provision profitability providing buffers against moderately higher credit costs ahead.

Given the slightly weaker macroeconomic backdrop and uncertainties ahead, including geopolitical tensions and the Fed’s policy path, the valuation of Asia IG credit continues to look slightly stretched versus both historical levels as well as developed market spreads. As such, we favour a more cautious view towards risk in the near-term.